Breaking Through Your Break-Even Point

Every business will gain a profit once it reaches a break-even point. So, anyone interested in running a successful business should learn to do a break-even analysis. It provides crucial pricing, profits, and cash flow insights for better investment decisions.

Yet, breaking down this concept into actionable steps can take time and effort. In this article, we’ll look at a break-even analysis and why it’s so crucial for any business looking to succeed. We’ll also walk you through all the steps to break through your break-even point.

What is Meant by Break-Even Point?

The break-even point is when the total revenue a business earns equals the total costs it incurred. At this point, the company is neither making a profit nor incurring a loss. In other words, the break-even point is the sales volume level a business must achieve to cover all its fixed and variable costs. Beyond the break-even point, the company begins to generate profits, while below the break-even point, it incurs losses.

The break-even point is a crucial financial metric for businesses because it helps them determine the minimum sales they need to generate to cover their costs and make a profit. Once a company knows its break-even point, it can use this information to make strategic pricing, production volume, and cost management decisions.

Breaking even means that a business has reached a point where its total revenue equals its total expenses, resulting in a net profit of zero. In other words, the company has neither made a profit nor incurred a loss.

When a business breaks even, it has covered all its costs. At this point, any additional revenue the company generates will result in a profit.

It is an essential milestone for businesses, as it indicates that they have achieved financial stability and can continue to operate without incurring additional debt or expenses. It also provides a benchmark for companies to evaluate their performance and make strategic decisions about pricing, marketing, and other areas of operations.

Why Perform a Break-Even Point Calculation?

Calculating the break-even point is an essential financial analysis tool that helps businesses determine the minimum level of sales required to cover all their expenses and make a profit. Here are some situations where a break-even point calculation can be helpful:

- Starting a New Business: A break-even analysis can help determine the minimum sales needed to cover the startup costs of a new business.

- New investment, Product, or Service: A break-even analysis can help determine if the product is viable and profitable before launching a new product or service. A break-even point calculation can also help businesses assess the risk of a new project or investment. If the break-even point is too high, it may not be worth pursuing the opportunity, as the risk of failure may be too great.

- Evaluating Pricing Strategies: A break-even analysis can help determine the minimum price that should be charged to cover the costs of producing a product or service. By knowing the break-even point, businesses can make informed decisions about pricing strategies, cost management, and overall profitability. This information can be used to optimize operations and make the best use of resources.

- Future Planning: By understanding the break-even point, businesses can plan for future growth and expansion. This information can be used to set realistic sales goals and to make strategic decisions about marketing and other growth-related initiatives.

- Changes in Cost Structure: A break-even analysis can help determine the impact of changes in costs, such as increases in labor or material costs, on the profitability of a business.

How is the Break-Even Point is Calculated

The widely-used break-even point formula is:

Where:

- The price per unit refers to the selling price of each product or service.

- Fixed costs refer to expenses that do not vary with the level of production or sales. They may include rent, salaries, insurance, interest, depreciation, etc.

- Variable costs are costs that vary with the level of output. These expenses are dependent on the increase or decrease in production and sales. They may include raw materials, labor, packaging, shipping, sales commissions, etc.

Sample Calculation:

Scenario No. 1

Let us say a small bakery sells cupcakes at $5/piece. The cost to manufacture each cupcake (variable cost) is $2. At the same time, its fixed cost for rent, utilities, and employee salaries is $1,200 per month. Using the simple break-even point formula, we can calculate the number of cupcakes the bakery needs to sell in a month to break even:

Break-even point = $1,200 ÷ ($5 – $2) = $1,200 ÷ $3 = 400 cupcakes

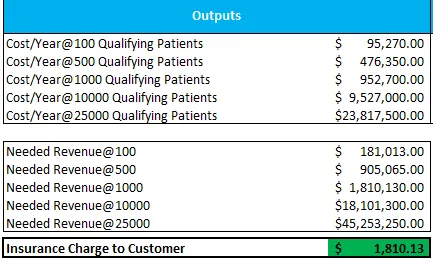

It means the bakery needs to sell 400 cupcakes monthly to break even and cover all the costs. Any cupcakes sold beyond this point will generate profit for the business. Please note that the difference between the price and variable cost per unit is called the contribution margin. So, a more straightforward break-even point formula is dividing the fixed costs over the contribution margin. Here is a sample of how the break-even point is calculated (monthly and annually) using a break-even analysis Excel template.

The break-even point calculation shows that the bakery needs to sell 400 pieces of cupcakes to break even. That is equivalent to a sale of $2,000. Of course, this is just a simplified example, and many other factors could affect the break-even point, such as competition, marketing, and pricing strategies. However, this should give a general idea of how the break-even point is calculated.

How To Do a Break-Even Analysis

A break-even analysis determines the point at which the total revenue received equals the total costs associated with producing or selling a product or service. It helps in understanding the minimum amount of sales needed to cover all expenses and reach a point of zero profit or loss, often referred to as the “break-even point.”

The best way how to do a break-even analysis is first to gather the relevant cost and pricing information. These include the fixed and variable costs and the product’s selling price per unit. How to do a break-even analysis starts the calculation of the contribution margin. Then, you can calculate the break-even point by dividing the fixed cost by the contribution margin.

Once the break-even point is determined, a business can analyze the potential profitability at different sales volume levels. By comparing the break-even point to projected sales, the company can assess its risk and make informed decisions regarding pricing, cost control, and overall business strategy.

Scenario No. 2

In Scenario No. 2, let us use the same assumptions as Scenario No. 1. The only difference will be an increase in the selling price to $8 per cupcake.

The break-even point calculation shows that the bakery only needs to sell 200 pieces of cupcakes to break even. In this scenario, Rule No. 1 of the break-even guideline shows that any increase in selling price lowers the break-even sales.

Scenario No. 3

In Scenario No. 3, we will use the same assumptions as Scenario No. 1, except that the fixed cost will increase to $1,500 monthly.

The break-even point calculation shows that the bakery only needs to sell 500 pieces of cupcakes to break even. In this scenario, Rule No. 2 of the break-even guideline shows that if the fixed or variable cost increases, the break-even sale also increases.

It’s important to note that break-even analysis provides a static snapshot of a business’s financial situation based on assumptions about costs, pricing, and sales volume. It is a valuable tool for decision-making, especially in areas like pricing strategy, cost management, and forecasting. Still, it has limitations and should be used with other financial analysis methods.

Factors that Impact Break-Even Analysis

Break-even analysis is a financial tool that helps businesses determine when they will break even or start making a profit. The following are some of the factors that can impact break-even analysis:

- Selling Price: The selling price of a product or service is also a critical factor in break-even analysis. The higher the selling price, the fewer units a business needs to sell to break even. However, if the selling price is too high, it may affect demand, leading to lower sales volume.

- Fixed Costs: They are also referred to as overhead costs. These are expenses that remain constant regardless of the amount of business activity. Knowing your fixed costs helps you ensure that your business can stay operational in the long run and keep fixed costs from eating into profits when sales are low. The higher the selling price of a product or service, the lower the number of units required to break even. The higher the fixed costs, the higher the break-even point.

- Variable Costs: Variable costs are expenses that increase or decrease with the level of production or sales. Knowing your variable costs helps you ensure that variable costs are within sales revenue, leading to losses when sales are low. A higher variable cost per unit will also increase the break-even point.

- Sales Volume: The number of sales a business generates is a significant factor that impacts break-even analysis. The higher the sales volume, the more revenue a company develops, and the faster it can break even.

- Operating Leverage: Operating leverage is the degree to which a company uses fixed costs in its operations. A high degree of operating leverage means that a company has a relatively high proportion of fixed costs compared to variable costs. It can lead to a lower break-even point if sales increase but also increase the risk of losses if sales decrease.

- Competition: Competition can affect the sales price, volume, and variable costs, impacting the break-even point. If many competitors sell similar products or services, achieving the sales volume needed to break even may take a lot of work.

- Economic Conditions: Economic conditions, such as inflation, interest rates, and consumer confidence, can impact the break-even point by affecting the sales volume and costs. A weak economy may reduce demand for a product or service, making breaking even harder.

- Market Demand: The level of demand for a product or service can impact the break-even point. If there is high demand, a business can charge higher prices and sell more units, reducing the break-even point. If the market demand is low, achieving the sales volume needed to break even may take longer.

- Technological Advancements: New technology can increase efficiency and reduce costs, lowering the break-even point.

Limitations of Break-Even Analysis

While break-even analysis can be a valuable tool for businesses, there are several common mistakes to avoid. One mistake is failing to account for all costs, including both fixed and variable costs. Another mistake is assuming that sales will remain constant, which may not be the case. Additionally, failing to update the break-even analysis regularly can result in inaccurate information. Furthermore, a break-even analysis does have its limitations. Therefore, you must consider them carefully before relying solely on these results.

- Assumes Linear Relationships: Break-even analysis assumes that the relationship between costs, sales volume, and profits is linear. However, in reality, the connections can be complex and non-linear. Furthermore, it assumes that sales prices and costs remain constant regardless of the output level. However, changes in the output level can result in changes in the cost structure and sales prices.

- Does Not Consider the Time Value of Money: Break-even analysis does not consider the time value of money, which means that it does not consider the impact of inflation, interest rates, and the time required to recover costs.

- Ignores Non-Financial Factors: Break-even analysis only looks at current sales levels, ignoring any assets or liabilities that may come into play at a future date. These additional expenditures can significantly impact the number of products you need to sell to remain profitable over the long term. It also does not consider non-financial factors such as market trends, consumer preferences, and competition. These factors can significantly impact the sales volume required to break even.

- Limited to a Single Product: Break-even analysis is designed to analyze a single product or service. If a business offers multiple products or services, it can be challenging to use break-even analysis to determine the profitability of each product or service.

- Overlook Other Expenses: Break-even analysis ignores other costs outside of raw materials and labor, including taxes, shipping fees, administrative charges, and so forth. These expenses are unpredictable and can significantly affect your overall bottom line.

- Sensitive to Price Fluctuations: Due to their unpredictable nature, market prices and macroeconomic trends can drastically change the number of products that need to be sold to break even. If the average price per product drops, you must sell more products than initially predicted to achieve profitability.

For these reasons, taking a comprehensive view when performing break-even analysis is essential, and ensuring that all expenses have been considered before relying too heavily on the results. It should also be used with other financial and non-financial metrics, like the internal rate of return (IRR), to provide a more comprehensive picture of the business’s financial health.

Leveraging a Financial Model for Break-Even Point Analysis

All in all, break-even analysis is a handy tool for any business in helping to identify the break-even point and make better business decisions. It allows you to accurately identify your fixed costs, variable costs, and pricing variables to determine how much money you need to make to break even. By understanding the break-even point in your business, you can make more informed decisions about pricing, sales goals, and budgeting. Understanding and analyzing your break-even point can help you maximize profits and minimize losses in your business.

Financial modeling is the easiest way how to do a break-even analysis. It will help determine the sales needed to reach the break-even point. Equipped with a profitability analysis, it can compare the break-even point to the projected sales volume to determine the business’s profitability. Using a break-even analysis template quickly and easily calculates the break-even point to gain valuable insights into a business’s financial health. This information can be used to make informed decisions and improve profitability.