0 ITEMS

Insurance

In the intricate world of insurance, the robustness of financial models and insurance business plans is the cornerstone of strategic planning and risk management. These models, designed with precision, not only forecast potential revenue streams and liabilities but also scrutinize market conditions to predict future trends effectively.

As insurers grapple with uncertainties—from climatic shifts to economic upheavals—these models provide a framework for assessing risks, optimizing resource allocation, and ensuring financial stability. Consequently, they enable insurers to devise competitively priced products while maintaining a buffer against potential losses, ensuring the business remains resilient in the face of unforeseen challenges.

As insurers grapple with uncertainties—from climatic shifts to economic upheavals—these models provide a framework for assessing risks, optimizing resource allocation, and ensuring financial stability. Consequently, they enable insurers to devise competitively priced products while maintaining a buffer against potential losses, ensuring the business remains resilient in the face of unforeseen challenges.

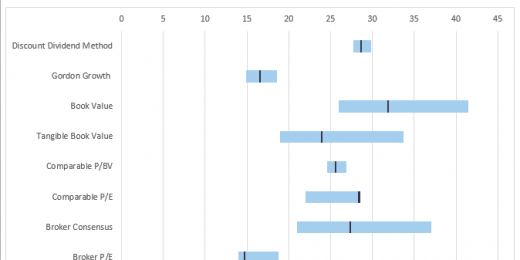

Insurance Company Financial Model – 5YR DCF & Valuation

The insurance financial model is a comprehensive tool designed to…

IFRS 17 GMM Insurance Financial Projection Model

IFRS 17 General Measurement Model (GMM) Insurance 5 year quarterly…

Insurance Technical Analysis Model

Financial model to compute the underwriting result / operating result…

Insurance Company Financial Model – Dynamic 10 Year Forecast

Financial Model providing a dynamic up to 10-year financial forecast…

General Insurance Company Financial Projection 3 Statement Model

User-friendly Excel model for the preparation a of 5-year rolling…

Insurance Managing General Agent (MGA) Financial Projection 3 Statement Model

Insurance Managing General Agent (MGA) 3 statement 5 year rolling…

Insurance Broker Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model for…

Legal Services Financial Model Excel Template

Buy Legal Services Financial Plan. Based on years of experience…

Insurance Agency Financial Model Excel Template

Shop Insurance Agency Financial Plan. Fortunately, you can solve Cash…

Business Planning Essentials for Today’s Insurance Companies

Insurance companies' unique business model involves transforming risk management into a profitable venture. By collecting premiums from policyholders, insurers create a pool of funds to invest in diverse assets, earning income from both premiums and investments. This dual income stream allows insurance companies to thrive financially, even in volatile markets.

However, the path to profitability is fraught with challenges. Insurance companies face various obstacles, ranging from catastrophic events to economic instability and inflation. The inherent unpredictability of claims, competitive pressures, and changing consumer expectations further complicate their operational landscape. These challenges necessitate robust strategic planning and risk assessment to maintain financial stability and market competitiveness.

It is where insurance business plans become critical. Effective business planning, underpinned by sophisticated financial modeling, is not just a tool but a strategic imperative. Financial models provide the analytical backbone for strategic decisions, from pricing policies to investment strategies. They help forecast future revenue, assess risk exposure, and determine capital adequacy.

In essence, rigorous business planning facilitated by advanced financial modeling ensures that insurance companies can not only navigate but also capitalize on the complexities of today's market, securing their growth and sustainability in an unpredictable world.

Insights Into the Insurance Sector

The insurance sector comprises different types of insurance companies whose primary service is risk management through insurance contracts. These contracts, fundamentally, are agreements where the insurer promises to compensate the insured for specific potential losses in exchange for premiums paid by the insured. This system of transferring and distributing risk enables individuals and businesses to safeguard themselves against financial losses due to unforeseen events. The versatility of insurance products ranges from health, life, and auto insurance to complex coverages for corporate risks and natural disasters, illustrating the sector's crucial role in both personal and economic stability.

Historically, the insurance industry has been perceived as a slow-growing yet stable haven for investors, particularly when compared to the more volatile realms of the financial sector. While the explosive growth seen in the 1970s and 1980s has moderated, the industry remains a comparatively safe bet in today's investment landscape. This enduring perception of stability stems from the industry's conservative management of vast pools of capital and the predictability of long-term liabilities, which in many cases allows for steady if unspectacular, financial performance.

Moreover, different types of insurance companies are diverse, with various players operating across different segments. These range from multinational giants offering a wide array of insurance products across numerous geographies to niche firms specializing in specific types of insurance such as maritime, earthquake, or cyber insurance. Additionally, reinsurance companies provide insurance to other insurance companies to help spread the risk. This diversification within the industry helps spread financial risks and cater to the unique demands of different clients, thereby enhancing the industry's overall resilience and adaptability to market changes.

Different Types of Insurance Companies

Different types of insurance companies are broadly classified into three main categories: life, general, and business insurers, each serving distinct needs and markets. Life insurance companies focus on policies that provide financial security for beneficiaries upon the policyholder’s death, while general insurers cover non-life risks such as automobiles and homes. Business insurers specialize in protecting companies against operational and professional risks.

Life Insurance Companies

Life insurance companies offer products that provide financial security to the policy beneficiaries in the event of the policyholder's death. These companies typically offer several types of policies:

- Term Life Insurance provides coverage for a specific period. The beneficiaries receive the death benefit if the insured dies within this term.

- Whole Life Insurance covers the insured for their entire life and pays a death benefit upon their passing. It also includes a savings component, which builds cash value.

- Universal Life Insurance is similar to whole life insurance but with more flexibility in premiums and the potential to adjust the death benefit.

Specialized life insurance products include:

- Child Life Insurance ensures the life of a child, offering financial support for parents in case of the child's death.

- Disability Insurance provides income if the policyholder cannot work due to disability.

- Endowment Policies are savings plans paying a lump sum after a specific term (on its 'maturity') or on death.

- Pensions and Annuities are designed to serve as a retirement income source. These policies pay out a fixed sum at regular intervals.

General Insurance Companies

General insurance refers to all types of insurance except life insurance. These policies are typically short-term, generally lasting for one year, and must be renewed. Key categories include:

- Automobile Insurance covers damage to vehicles and liability for vehicle accidents.

- Health Insurance covers medical expenses incurred due to illnesses and injuries.

- Fire Insurance provides coverage for damage caused to property by fire.

- Property Insurance covers damage or loss to an owner's property due to various risks, such as fire, theft, and natural disasters.

- Travel Insurance covers losses incurred while traveling, such as trip cancellation and medical emergencies abroad.

- Reinsurance companies provide insurance to other insurance companies. This helps insurance companies manage risk and stabilize their operations by spreading the risk of losses. Reinsurers can be crucial in catastrophic situations, allowing primary insurers to offer coverage amounts that would otherwise be infeasible.

Business Insurance Companies

These companies offer products specifically designed for business needs, protecting businesses against specific risks associated with their operations. Types include:

- Casualty Insurance covers losses and liabilities resulting from accidents, not necessarily tied to a specific property.

- Errors and Omissions (E&O) Insurance protects companies and professionals against claims of inadequate work or negligent actions.

- Liability Insurance protects against claims resulting from injuries and damage to people or property.

- Workers' Compensation provides wage replacement and medical benefits to employees injured during employment.

Each type of insurance company plays a specific role in the financial industry by managing different types of risks. These companies allow individuals and businesses to transfer the financial risks of loss to an insurer in exchange for a premium.

How Do Insurance Companies Work?

So, how do insurance companies work? Insurance operates on a fundamental principle: One party, known as the insurer, promises to compensate for specific potential losses in the future. In return, another party, the insured or policyholder, makes regular payments called premiums to the insurer. This exchange offers the insured financial security and peace of mind against unforeseen events.

Here's a step-by-step guide on how insurance companies work:

Actuarial Analysis

The first step in the insurance process is actuarial analysis. Actuaries use mathematical and statistical methods to assess risk and determine the likelihood of various events. Based on this data, they calculate the premiums that must be charged to cover these risks adequately. This analysis helps insurance companies set fair yet sufficient prices to cover the anticipated claims and administrative costs.

Insurance Underwriting

Insurance underwriting is the process by which insurers select the risks they are willing to insure and decide the terms of the coverage. Underwriters review applications, determine the risk associated with an applicant and set the premium accordingly. They may also choose to exclude certain conditions from coverage or impose higher premiums on higher-risk applicants to balance the risk for the insurance company.

Evaluating the insured is a critical step in the insurance process, where the insurer assesses the applicant's risk profile. This assessment helps determine whether the applicant should be covered, the extent of coverage, and the premium that should be charged. During this evaluation, insurers look at various factors, including the applicant's age, health, lifestyle, occupation, and financial history. For example, a younger, healthier individual might pay lower health insurance premiums than an older person with health issues. Similarly, a person working in a high-risk job might face higher premiums for life insurance. This thorough evaluation helps insurers price the risk appropriately to cover claims while remaining financially viable.

Savings & Investing

Once premiums are collected, they must be managed effectively to ensure enough funds are available to pay future claims. Insurance companies invest these premiums in various financial instruments, such as bonds, stocks, and real estate, to generate returns. These investments must be carefully balanced to achieve sufficient liquidity to cover claims while seeking a good return on investment.

Reinsurance

Reinsurance is insurance for insurance companies. It helps insurers manage risk by spreading the exposure to significant or catastrophic losses across multiple companies. By transferring portions of risk to other insurers, a company can take on more policyholders without exceeding its loss reserves. This practice stabilizes the insurance market and keeps insurance companies from going bankrupt in case of major disasters.

The intricate steps involved in how do insurance companies work underscore the necessity for meticulous business planning and rigorous financial analysis. Each step requires a deep understanding of risk, financial markets, and strategic asset allocation to ensure that premiums are priced correctly, claims can be paid promptly, and the company remains solvent despite unexpected events. This careful orchestration of how do insurance companies work ensures they can fulfill their promises to policyholders, making them reliable pillars in the financial security of individuals and businesses.

Core Challenges of Insurance Companies

Insurance companies face various core challenges that significantly impact their operations and profitability.

Climatic Shifts

Climatic shifts refer to long-term changes in weather patterns, including global warming and increased frequency and severity of natural disasters (e.g., hurricanes, wildfires, floods). These shifts pose substantial risks to insurance companies because they can cause significant, unpredictable losses. As climate-related disasters increase in frequency and intensity, insurers face the challenge of reassessing risk models, pricing policies more accurately, and sometimes even deciding to withdraw insurance coverage from high-risk areas. It affects the financial stability of these companies and pressures them to innovate in their approach to risk management.

Competition

Competition in the insurance industry comes from both within the sector and external sources, such as technology-driven firms entering the market. Increased competition can lead to price wars, which may reduce profit margins. Additionally, competitors might offer more innovative or cost-effective solutions, which can attract customers away from traditional insurance providers. Insurance companies must invest in technological advancements, improve customer service, and diversify their product offerings to meet changing consumer demands and remain competitive.

Economic Instability

Economic instability, such as recessions or fluctuations in financial markets, directly impacts insurance companies. During economic downturns, the demand for certain types of insurance might decrease as individuals and businesses cut costs. Economic instability can also affect insurance companies' investment portfolios, which are typically heavily invested in the financial markets. The volatility can lead to lower returns or losses, affecting the companies' financial health.

Inflation

Inflation affects insurance companies by increasing the cost of claims and operating expenses. As the general price level rises, the costs associated with settling claims (like repair costs for homes and vehicles) also increase. Additionally, inflation can erode profit margins if it is not accurately predicted and incorporated into premium pricing. Insurance companies must constantly adjust their premiums and reassess their reserves to manage inflation's impact effectively.

Mismanagement

Mismanagement can occur within insurance companies, including poor financial oversight, inadequate risk assessment, failure to innovate, or even ethical breaches. Such management failures can lead to significant financial losses, regulatory penalties, and company reputation damage. Effective management is crucial for maintaining operational efficiency, compliance with regulations, and the trust of policyholders.

Trust Issues

Trust issues arise when consumers lack confidence in insurance companies' ability to handle claims and disputes fairly and promptly. This mistrust can be fueled by past experiences of perceived unfair practices, such as denying legitimate claims or complicating the claims process unnecessarily. Building and maintaining trust is essential for insurance companies, as a lack of trust can deter potential customers and damage existing customer relationships. Transparency, effective communication, and fair claims handling are key strategies to overcome these trust issues.

Each of these challenges requires strategic planning and proactive management to ensure the resilience and growth of insurance companies in a complex and evolving marketplace.

Secure Success With Insurance Business Plans

In conclusion, the different insurance companies operate in a dynamic environment where profitability is closely tied to managing various challenges effectively. These challenges range from climatic shifts and market competition to mismanagement and trust issues. Addressing these issues proactively is crucial for maintaining financial stability and fostering growth.

Thus, the sector must prioritize developing and implementing robust insurance business plans to secure success in this competitive landscape. These insurance business plans should incorporate strategic goals, risk management strategies, and innovative solutions that leverage technology to enhance operational efficiency and customer service. By doing so, insurance companies can not only navigate the industry's complexities but also position themselves for sustainable long-term success.