Calculator

Our online financial calculators are designed to transform your approach to managing money, making it simpler, smarter, and more efficient. Whether you're calculating monthly mortgage payments, exploring investment options, or planning for retirement, our tools offer you the clarity and precision needed to make confident financial decisions. Dive into a world where complex calculations become effortless, and discover how you can achieve your financial goals faster.

Manufacturing KPI Management Excel Dashboard

A manufacturing key performance indicator (KPI) is a clearly defined…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

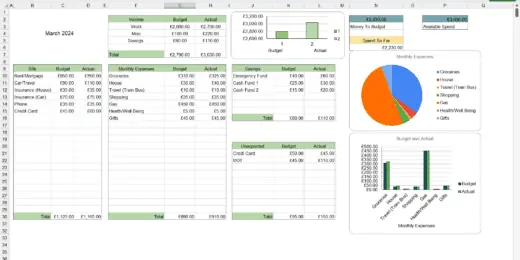

Ultimate Budget Spreadsheet, Budget Dashboard, Google Sheets, Excel

Ultimate Budget Spreadsheet, Budget Dashboard, in both Google Sheets and…

Zero Down Seller Financing Strategy for Real Estate Investment

A tool to estimate expected risk and cash flow of…

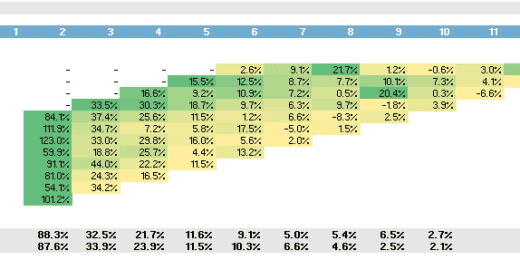

Store Vintage Analysis | Same Store Sales Analysis | Cohort Analysis

This comprehensive Excel model has been meticulously crafted to facilitate…

Multifamily Real Estate Financial Model

The Multifamily Real Estate Financial Model allows users to evaluate…

Function-as-a-Service (serverless computing) Financial Model

Create financial projections for a FaaS cloud computing services business.…

Financial Modeling Mastery Bundle: Diverse Insights for Informed Decision-Making

Unlock financial expertise with our 'Diverse Insights Bundle.' Seven meticulously…

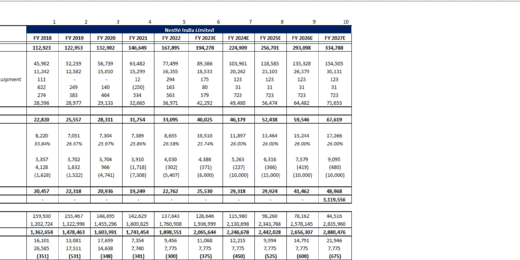

3 – Statement Financial Model – Compacted – For All Industry

Introducing the Ultimate Financial Modeling Tool for Thriving Businesses with…

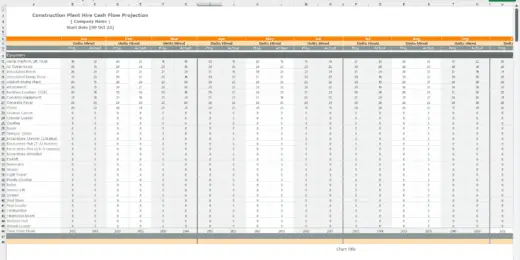

Plant Hire Business Financial Model

A comprehensive editable MS Excel spreadsheet for tracking your plant…

Side Hustle Success: 12-Month P&L Tracker for Passion Projects

Introducing the comprehensive 'Side Hustle Success' P&L Tracker, designed for…

Amortization Schedules Template (Loans, Mortgages, LC, Bonds, Leases)

User friendly template including Amortization Schedules for Loans, Mortgages, Operating…

Tenant Management: Real Estate Dashboard

Structured database with the right columns to keep track of…

Cost Segregation Study: Estimated Benefit Summary and Supporting Data

This calculator has inputs for many different asset categories and…

Simple Capitalized Earnings Business Valuation Model

This simple Capitalized Earnings Business Valuation model template offers a…

WACC Calculator and DCF Analysis with Sensitivity Tables

A simple tool that walks the user through all the…

Upstream Oil Financial Derivative Hedging Model

This model calculates financial oil derivative positions for Put Options,…

Manufacturing Sensitivity Analysis Template

Supercharge your manufacturing business with this versatile sensitivity table template:…

Depreciation Recapture – Accounting Calculator

A simple calculator that displays the resulting tax basis for…

Insurance Technical Analysis Model

Financial model to compute the underwriting result / operating result…

Simple Budget Planner Template

Introducing our Budget Income Statement Template, designed to help you…

Investment Appraisal Model with Carbon Pricing

Investment appraisal excel model with carbon pricing for up to…

Property Manager Plan with Return Calculations & M&A Model

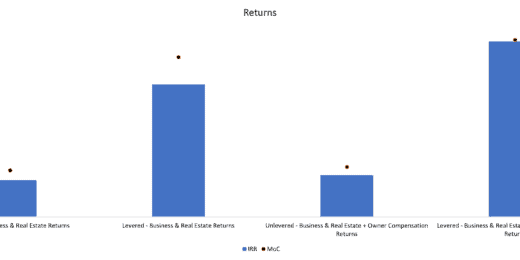

Pro Forma Models created this model to analyze the financial return…

Dynamic Franchise Business Plan – 3 Statement Model with DCF & Returns

Pro Forma Models created this model to analyze the financial…

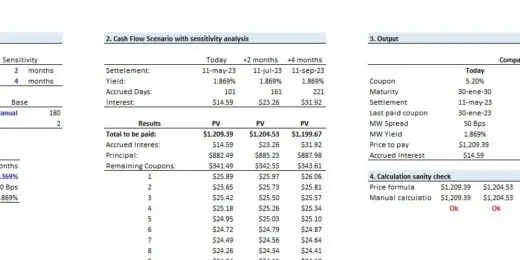

Bond, Loan or Note Make Whole Calculator

The model is designed to evaluate a make-whole calculator for…

Breakeven Analysis Template – Team Strategy FM

Our customizable breakeven template enables businesses owners to quickly and…

Crypto Currency Portfolio Investment Return Calculator

Excel model to calculate the expected value and return for…

3-in-1 Templates: Accounting System in Excel

This is an easy financial statement creator based on various…

Preferred Return – Simple Interest – Multiple Hurdles

This is not preferred equity. It is a cash flow…

Investment Fund Preferred Return Tracker: Up to 30 Members

Track preferred returns for investors in a fund with this…

Acquisition Model for Commercial Property

This is the Quintessential Commercial Property Acquisition Model that allows…

Capex & Depreciation Schedule Calculator Template

This template is to provide users with a ready-to-use depreciation…

Weighted Average Cost of Capital (WACC) Calculator Template

This Template is to provide users with a ready-to-use calculator…

Debt Service Coverage Ratio Calculator Free Template

This Template is to provide users with a ready-to-use calculator…

Consumer Lifetime Value & Client Acquisition Cost Calculator Free Template

This Template is to provide users with a ready-to-use calculator…

ROIC & Payback Period Calculator Free Template

This Template is to provide users with a ready-to-use calculator…

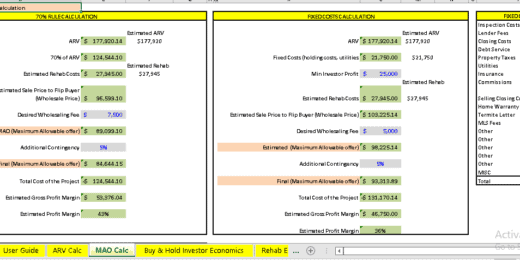

Wholesale Deal Analyzer in the Real Estate – Financial Model

This model is best for those who want a calculator…

Revolutionize Finances with Online Financial Calculators

"Numbers have life; they're not just symbols on paper." This profound statement echoes numbers' vital role in our lives, especially when managing our finances. In today's fast-paced world, where financial literacy is as crucial as ever, the advent of online financial calculators has been nothing short of revolutionary. These powerful tools are not just about crunching numbers; they embody the seamless integration of technology and finance, designed to simplify complex calculations and make financial planning accessible to everyone.

Online financial calculators have transformed the way we approach budgeting and financial planning. By inputting a few key details, individuals can instantly receive insights that would otherwise require hours of manual calculations or the expertise of a financial advisor. From creating a monthly budget to planning for retirement, saving for a child's education, or figuring out mortgage payments, these calculators offer personalized solutions tailored to individual financial situations and goals. Let us make them work for us as efficiently and effectively as possible.

What is an Online Finance Calculator?

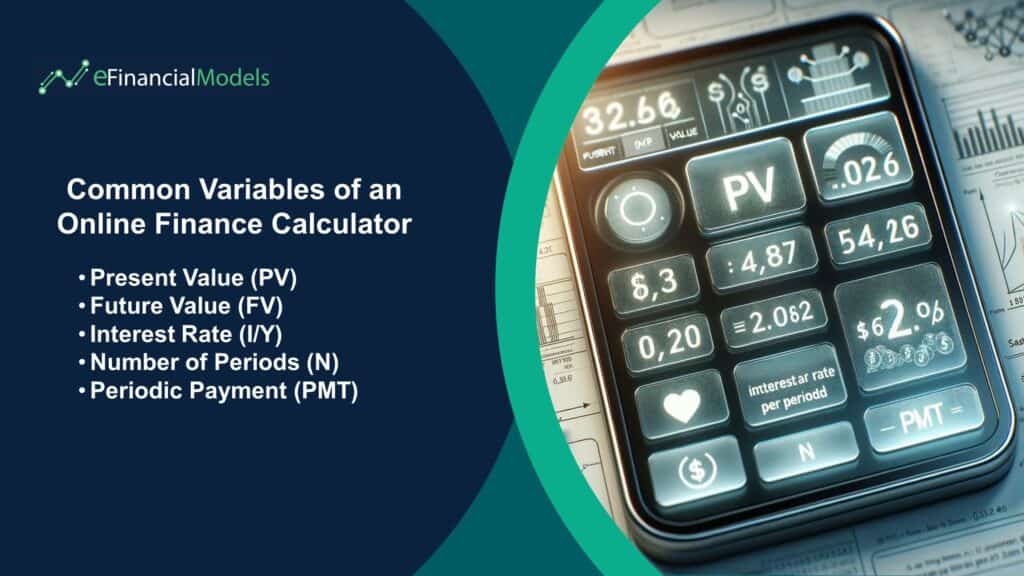

An Online Finance Calculator is a digital tool designed to simplify complex financial calculations frequently encountered in business and commerce. It operates electronically, accessible via the internet, to perform a variety of financial functions without the need for manual computations or traditional calculators. One of the key areas where online finance calculators are particularly useful is calculating the time value of money (TVM). The concept of TVM is foundational in finance, reflecting the principle that the value of money changes over time due to the potential earning capacity of that money. It can involve calculations related to several variables, including:

- Present Value (PV): The current value of a future amount of money or stream of cash flows, given a specified rate of return.

- Future Value (FV): The value of an investment at a specific date in the future, based on a certain rate of interest or return.

- Interest Rate (I/Y): The percentage rate of return expected from an investment or the interest rate per period.

- Number of Periods (N): The number of time periods over which the investment or loan will be compounded or paid.

- Additionally, Periodic Payment (PMT) is another variable that an online finance calculator can calculate, though it's only sometimes required. PMT refers to the payments that occur at regular intervals in an annuity or other structured payment plan.

The advantage of using an online finance calculator is its ability to quickly and accurately compute these variables, saving users a significant amount of time and reducing the potential for error. Whether you're calculating loan payments, investment returns, savings growth, or comparing financial options, an online finance calculator can provide instant insights and help make informed financial decisions.

Practical Use of Financial Calculator

Online financial calculators are invaluable tools for both personal and professional finance management, allowing users to make informed decisions based on precise calculations. They are designed to handle a variety of financial functions, providing clarity and assistance in financial planning and analysis. The practical use of financial calculator coincides with its purpose or type:

- Amortization Calculator: This helps users understand the repayment schedule of a loan over time, breaking down payments into principal and interest components, which is essential for managing loans efficiently and planning for debt repayment.

- Annuity Calculator: Assists in calculating the future value of an annuity, which is helpful for retirement planning, helping individuals estimate how much they will receive from an annuity investment.

- Annuity Payout Calculator: Used to determine the amount of regular payments from an annuity, given a specific principal and interest rate, aiding retirees and investors in budgeting their income.

- Auto Loan Calculator: Helps prospective car buyers determine their monthly car loan payments, considering the loan amount, term, and interest rate, which aids in financial planning and assessing affordability.

- Budget Calculator: Assists individuals in managing their finances by helping them track income and expenses, thus facilitating a better understanding of their financial health and areas for improvement.

- Credit Card Calculator: This helps users understand the implications of credit card payments and interest, which is crucial for managing credit card debt and planning payoff strategies.

- Compound Interest Calculator: Allows individuals to calculate the interest earned on an investment or paid on a loan, considering the compounding effect, which is vital for investment planning and understanding loan costs.

- Currency Calculator: Useful for travelers and international traders, it converts values between different currencies based on current or historical exchange rates, aiding in financial planning and cross-border transactions.

- Debt Payoff Calculator: Assists in creating a strategy for paying off debt by calculating how long it will take to pay off a debt with a specific payment plan, which is essential for debt management and financial freedom.

- Depreciation Calculator: Used by businesses to calculate the depreciation of assets over time, which is essential for tax purposes, financial reporting, and asset management.

- Estate Tax Calculator: Helps individuals or estate planners estimate potential estate taxes based on the current tax laws, aiding in estate planning and ensuring compliance with tax obligations.

- Home Affordability Calculator: Helps prospective home buyers determine how much house they can afford based on their income, debt, and current mortgage rates, which is crucial for making informed home-buying decisions.

- Income Tax Calculator: This allows individuals to estimate their income tax liabilities based on their income, deductions, and the prevailing tax rates, which is essential for tax planning and financial management.

- Inflation Calculator: This helps users understand the impact of inflation on the purchasing power of money over time, which is critical for long-term financial planning and investment decisions.

- Investment Calculator: Assists in estimating the future value of investments based on the initial investment, rate of return, and compounding intervals, which is vital for planning and assessing investment strategies.

- Mortgage Calculators: A broad category that includes tools for calculating monthly mortgage payments, comparing different mortgage options, and understanding the impacts of extra fees on the loan’s lifetime, crucial for mortgage planning and management.

- Mortgage Payoff Calculator: Helps homeowners plan for early mortgage payoff by calculating the impact of additional payments on the loan term and interest savings, which is beneficial for financial planning and debt reduction.

- Rental Property Calculator: Assists real estate investors in evaluating the profitability of rental properties, considering expenses, rental income, and potential returns, which is crucial for investment decisions.

- ROI Calculator: Used to calculate the Return on Investment (ROI) for various investments, helping investors assess the efficiency and profitability of their investments, which is essential for portfolio management.

- Sales Tax Calculator: Helps individuals and businesses calculate the total cost of purchases after sales tax, which is necessary for budgeting and financial planning.

The practical use of financial calculator provides specific insights and data to guide financial decisions, making them indispensable tools for personal finance, investment analysis, and business planning.

How to Use Financial Calculators

Learning how to use financial calculators is straightforward. Here's a simplified guide to getting you started:

- Familiarize Yourself with the Calculator: Get to know where the standard functions are, such as the numeric keypad, the function keys, and any special buttons. Most of them come with a manual or online resources to guide you on how to use financial calculators. If your calculator allows for updates or has programmable functions, ensure it's up to date to utilize the latest financial models and calculations. These resources can be beneficial for understanding specific functions and features.

- Input Basic Financial Variables: Financial calculations often involve critical variables like the initial amount of money, interest rate, number of periods (years, months, etc.), and the payment amount per period. Always start by clearing previous entries to avoid errors. Then, enter your data carefully.

- Solve for the Unknown Variable: After inputting the necessary variables, you can solve for the unknown variable. For example, if you're solving for FV, you would input N, I/Y, PV, and PMT, then press the FV button. Some online finance calculators also offer advanced functions to calculate the internal rate of return (IRR), net present value (NPV), payback period (PBP), etc.

Once you learn how to use financial calculators, remember that financial calculations can be highly sensitive to small changes in input values, especially over long periods. If your calculator allows for updates or has programmable functions, ensure it's up to date to utilize the latest financial models and calculations. By following these steps and practicing regularly, you'll become proficient in using an online finance calculator, making it a valuable tool for financial planning and decision-making.

Utilize Online Financial Calculators to Make Smart Decisions

Online financial calculators are digital tools designed to assist individuals in managing various aspects of their personal and business finances. These calculators can be found on numerous financial websites and apps, offering functionalities ranging from budgeting, loan comparisons, investment analysis, and retirement planning. They are engineered to provide quick, detailed calculations that would otherwise be time-consuming and complex to perform manually. Users can obtain precise estimates and projections that aid in making informed financial decisions by inputting specific financial information, such as income, expenses, interest rates, and investment amounts.

Using online financial calculators can revolutionize how individuals and businesses approach their finances. These tools make it significantly easier to understand the implications of financial decisions before committing to them. For example, using a loan calculator, one can determine the total cost of a loan after interest, helping to choose the most cost-effective borrowing option. Investment calculators enable users to project the growth of their investments over time, facilitating more strategic investment planning. Furthermore, retirement calculators can help users plan their savings to ensure a comfortable retirement. Overall, online financial calculators empower users to take control of their financial future, enabling smarter, data-driven decisions that can lead to more excellent financial stability and growth.