DCF Model

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Diagnostic Collection Center Financial Model

It is financial model for diagnostic collection center whose phlebotomists…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

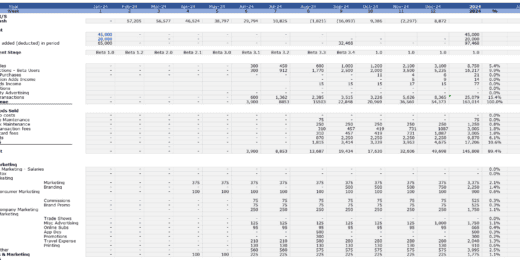

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Gym Financial Model and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Healthcare – Hospital – Financial Model and Valuation (10-year Forecast)

Welcome to the Healthcare (Hospital) Company Financial Model and Valuation,…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

Crypto Token Valuation Model

A cutting-edge crypto token valuation model, designed to provide comprehensive…

Complete Private Equity (LBO) Financial Model

This is a professional financial model which performs a thorough…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Online Tutoring Services Financial Model (10+ Yrs DCF and Valuation)

The Online Tutoring Services Financial Model is a comprehensive tool…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Industrial Warehouse Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Cleaning Service Pro Forma Template (Commercial / Residential)

A pro forma template for any home service or general…

Oil & Gas Financial Model – DCF and NAV Valuation (5+ Yrs.)

The Oil and Gas financial model with DCF (Discounted Cash…

CPG Company Financial Model and Valuation

Discover the CPG Company Financial Model and Valuation, an essential…

eCommerce | Online Retail Financial Model and Valuation

Discover the eCommerce - Online Retail Company Financial Model and…

SaaS Company Financial Model and Valuation

Discover the SaaS Company Financial Model and Valuation, an essential…

Culinary Arts Academy – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Dog Grooming Services Financial Model (10+ Yrs DCF and Valuation)

The Dog Grooming Services financial model is a comprehensive tool…

Zero Down Seller Financing Strategy for Real Estate Investment

A tool to estimate expected risk and cash flow of…

Catering and Ballroom Rental Financial Model

This Excel model is a highly adaptable and user-friendly tool…

Student Accommodation Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Buy Now Pay Later DCF Model & Valuation (10 Year DCF Model)

The Buy Now Pay Later (BNPL) Company financial model is…

Care Home Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a multi…

Real Estate Proforma – Value-Add Apartment Acquisition Model

This multifamily apartment value-added real estate model is a sophisticated…

Rental Property (Airbnb – Real Estate) Financial Model

Powerful Real Estate Rental Property Financial Model for Informed Decision-Making,…

Hotel Complex – Financial Model (5 Yrs. DCF and Valuation)

The Hotel Complex financial model is a comprehensive tool designed…

Comprehensive Oil & Gas Financial Model

Comprehensive financial model for an oil & gas company. Flexible…

Multifamily Real Estate Financial Model

The Multifamily Real Estate Financial Model allows users to evaluate…

Start-up Manufacturing Financial Projection and Budget Control – Excel & Google Sheets

The financial model is an essential tool that enables owners…

Function-as-a-Service (serverless computing) Financial Model

Create financial projections for a FaaS cloud computing services business.…

Financial Modeling Mastery Bundle: Diverse Insights for Informed Decision-Making

Unlock financial expertise with our 'Diverse Insights Bundle.' Seven meticulously…

Crypto Trading Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan of a…

Discounted Cash Flow Valuation Model (DCF Model)

Discounted cash flow (DCF) is a commonly used valuation method which is used to estimate the value of a business or an asset based on its future cash flows. By creating an excel discounted cash flow valuation model, you will see how attractive the investment opportunity is since it focuses on cash and not on accounting profits, thus, it considers any factors that might create an impact regarding the cash position of a business or the asset. This clearly shows why the excel discounted cash flow valuation model is highly regarded as most solid valuation methods to value a business or an asset.

Advantages

- Captures the underlying fundamental drivers of a business (e.g. cost of equity, weighted average cost of capital, growth rate, re-investment rate, etc.)

- Relies on Free Cash Flows which eliminates subjectivity in the reported earnings

- Allows key changes in the business plan

- Predicts the best possible intrinsic value

- Checks if the business is over-valued or under-valued

- Simple to understand and apply

- Resulting value is straightforward; positive = good investment , negative = bad investment

Disadvantages

- Demands a set of forward-looking assumptions which are subjective

- Extremely sensitive to assumptions related to the perpetual growth rate and discount rate

- Only works best is the business plan will work and the future free cash flows are accurate, otherwise, the model will be susceptible to errors and uncertainty

- Terminal value comprises too much of the total value (65-75%)

- Minor variations in the assumptions on the terminal year will greatly impact the final valuation

- Needs constant vigilance and modification

- Not suited for short-term investment

Despite the advantages and its disadvantages, as long as the DCF model template is done correctly with solid inputs and business plan, the resulting DCF model template will lead to the best tool to value an investment.

How to Calculate the DCF Value

So, you plan to save money and start venturing opportunities for your future but don’t know how to ensure that you will make smart decisions? While there will always be an element of risk when it comes to investments, you can make more informed choices with some simple statistical techniques and tools to evaluate opportunities and get the most value out of it. By simply conducting a DCF analysis or creating a DCF model, you will be able to determine how attractive an investment opportunity is.

The DCF Templates Model analyzes the future cash flows and then discounts them with the required annual rate to determine the present estimated value of an investment. The resulting value is then used to evaluate if the investment is potentially profitable and feasible.

There are three elements that you need to calculate the DCF value:

- Period of time used for the valuation (time period)

- Accurate estimation of the annual cash flows (projected cash flows)

- Amount of money that could be earned if invested to something of equivalent risk (WACC or discount rate)

After realizing the elements that you needed to calculate the DCF value, next would be to apply it to the DCF formula. The DCF formula is equal to the sum of annual cash flows which is then divided by one plus the discount rate (WACC) raised to the power of the time period.

DCF = [CF1 / (1+r)1] + [CF2 / (1+r)2] + ... + [CFn / (1+r)n]

CF = Cash Flow

n = year

r= discount rate (Weighted Average Cost of Capital)

The discount rate is typically the weighted average cost of capital of a business or an asset since it represents the required expected rate of returns for the investors. Here are some of the variables that needed to be discounted when assessing the annual cash flow or basically what counts to be as the WACC of a business or an asset:

- Net income after tax

- Depreciation

- Working capital

- Capital expenditures

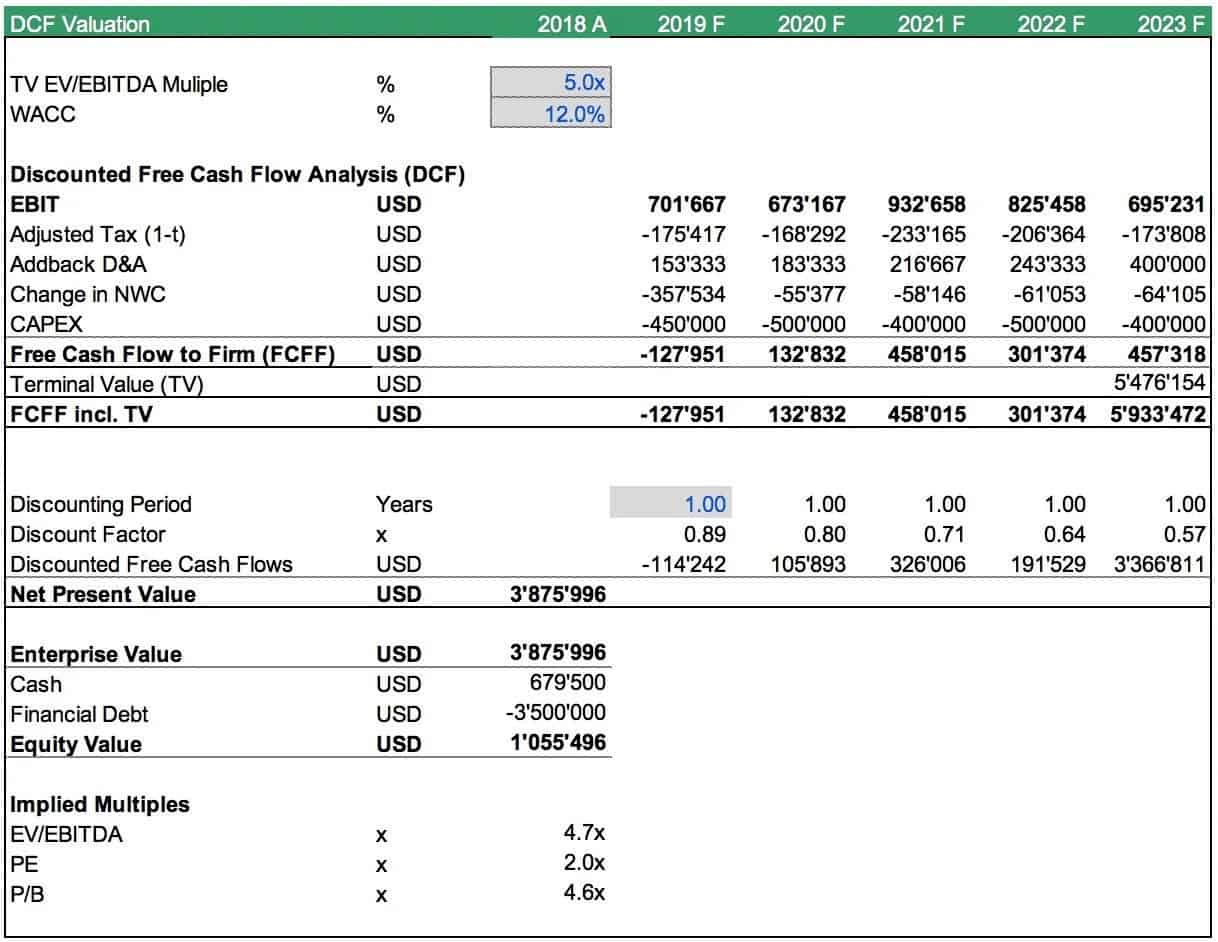

To further understand how it is calculated, see below illustration as an example.

The DCF formula is applicable not only for valuing a business or an asset, but it can also be used in cases such as valuing the entire business as a whole or separately, valuing a project or investment, valuing a bond or shares in a company, valuing a commercial property, etc.

Example Illustration of a DCF Valuation

So here’s a better illustration of a DCF Valuation Model. By simply following the formula mentioned above we can calculate the Discounted Free Cash Flows as well as NPV of the business or its enterprise value.

This valuation basically helps business owners and managers see whether pursuing a business investment it worth the shot just by looking at the probable cash flows of the firm for the next consecutive years.

How the DCF Model Works – DCF Model Templates

To make the process of building a DCF Templates Model easier, using discounted cash flow model templates is the answer. The DCF model templates will serve as the basis and the foundation of your model so you don’t have to spend a lot of time on creating from scratch. You also don’t have to spend a high amount of fees to ask a professional to build a completely new DCF model for you. If you are looking to acquire discounted cash flow model templates, you can check out our list above and choose which DCF model templates you need. You might be wondering, how does the DCF model work?

The DCF model templates are usually in Excel and require at least a minimum of 5 years of Cash Flow stream. Since the DCF model is normally done by forecasting the financial statements of a business, the templates are also included with the three statement model which you can then calculate the Cash Flow to Firm over the next years by adding up the following:

- Earnings before Interest and Taxes (EBIT)

- Adjusted Taxes which is the applicable income tax rate applied to EBIT

- Non-cash expenses are added back e.g. Depreciation and Amortization

- Adjustment for changes in Net Working Capital

- Deduction of CAPEX

After realizing the factors above, a discount rate is then calculated to discount the future cash flows to its present value. The discount rate or the Weighted Average Cost of Capital (WACC) should reflect the business’ or an asset’s risks. After calculating the discount rate, it will then be applied to the free cash flows to firm to get the present value which should be equal to the Enterprise Value. To arrive at the final Equity Value, the net debt (business’ financial debt) is deducted and then the business’ cash is added. The equity value will be the end result of the DCF valuation model.

Feel free to check out our discounted cash flow model templates to use as a starting point to start building your very own DCF model. No more wasting time building from the beginning. Just simply input and replace the line items with more detailed calculations referring to your business’ financial specifications. The DCF model template should work as long as the figures you inputted are correctly flowing in the to Free Cash Flow to Firm!