Solar

At eFinancialModels.com, we understand the dynamic and promising world of solar energy investments. Our meticulously crafted Solar Investment Financial Model Templates are the perfect tools for entrepreneurs, investors, and financial experts aiming to navigate this flourishing sector. With a focus on clarity and precision, these templates provide a comprehensive framework for analyzing solar projects, ensuring you make informed, data-driven decisions.

Each template is tailored to the unique needs of solar energy investments. Whether you're evaluating the feasibility of new solar projects, analyzing return on investment, or preparing detailed financial projections for stakeholders, our models offer unparalleled depth and flexibility. They are designed to adapt to various scenarios, from small-scale installations to large solar farms.

Explore our Solar Investment Financial Model Templates and take the first step towards optimizing your solar energy ventures.

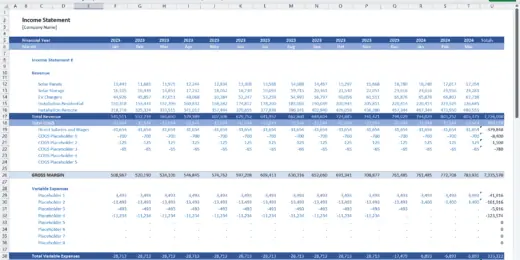

5 Year 3 Statement Solar Energy Solutions Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Solar Energy…

Renewable Energy Financial Model

Comprehensive financial model designed for analyzing renewable energy projects, such…

Solar Farm (PV) Tax Equity – Fixed Partnership US

PV farm Tax Equity partnership in the US is designed…

Green Ammonia from Renewable Energy Financial Model

This comprehensive 40-year tool aid investors in evaluating potential risks…

Wind/Solar Power Generation (Renewable Energy) Financial Model

Financial Model to calculate Profit/Loss, accurately forecast financial statements and…

Green Hydrogen (Electrolysis) Production Financial Model

This green hydrogen financial model template builds a multi-year financial…

Yellow Hydrogen from Solar Energy Financial Model

Deciding whether to invest or not in producing yellow hydrogen…

Green Hydrogen Project Financial Model (Electrolysis & Onsite Solar Plant)

A Project-Level Financial Model to assess the financial feasibility of…

Investment in an Operating Solar (PV) Power Plant

Investment in an Operating Solar (PV) Power Plant is a…

Solar Farm Business Financial Projection 3 Statement Model

3-Statement rolling projection model for startup or existing business developing…

Renewable Energy Financial Models Bundle

A collection of user-friendly Project Finance Models in the Renewable…

Solar (PV) Power Plant – Project Finance Model

Project Finance Model providing forecast and profitability analysis for a…

Renewable Energy Project Finance Model Template

The Renewable Energy Project Finance model is used to provide…

Solar Panel Manufacturing Plant Business Plan Financial Model Excel Template

Get the Best Solar Panel Manufacturing Plant Financial Model. Spend…

Abacus Solar & Wind Debt Sculpting Financial Model

Abacus is a bankable, easy-to-use, debt-sculpting financial model for use…

Renewable Energy Financial Model Template Bundle

Take this opportunity and get a discount by getting the…

Project Feasibility Template – Solar Rooftop

Solar Rooftop FM is a Project Finance Model for construction…

Solar PV Project Finance Model Template

Financial model for a typical project finance solar project.

Solar PV Plant 3 Statements Financial Model Template

Solar Park FM is a Project Finance Model for construction…

Start Up Solar Farm Excel Model and Valuation

Start Up Solar Farm Excel Model presents the business case…

Renewable Energy Financial Model Bundle

This is a collection of financial model templates for projects…

Solar Energy Financial Model

The Solar Energy Financial Model Excel template forecasts the expected…

10 Reasons to Invest in Solar Power

Solar power has emerged as a pivotal renewable energy source due to environmental, technological, economic, and policy factors. These aspects have been instrumental in driving the growth and adoption of solar energy globally. There is a growing need for sustainable energy sources. Solar-powered projects, being both renewable and abundant, are well-positioned to meet this demand. However, for businesses and entrepreneurs, strategic planning in capitalizing on emerging opportunities in the green economy is crucial. As such, they need to understand the why and how of investing in a solar powered project.

Solar-Powered Projects 101

Solar-powered projects involve converting solar radiation into electricity, harnessing a sustainable and renewable energy source. These projects are typically designed to reduce reliance on fossil fuels, lower greenhouse gas emissions, and provide a cost-effective energy solution over time, contributing to a cleaner and more sustainable energy future. Two leading solar energy technologies are prominent in this arena: solar photovoltaic power generation (PV) systems and concentrating solar-thermal power systems (CSP). Understanding the workings of these systems is essential for anyone interested in renewable energy, sustainability, or technology.

Solar Photovoltaic Power Generation Systems (PV)

Solar photovoltaic power generation systems (PV) consist of solar panels equipped with photovoltaic cells that convert sunlight directly into electricity. These systems are scalable, ranging from small rooftop installations for individual homes to large, utility-scale solar farms, and they offer a clean, renewable energy source that significantly reduces carbon emissions and dependence on fossil fuels.

How Photovoltaic Power Generation Works

Solar photovoltaic (PV) panels work on the principle of converting sunlight directly into electricity. This process is known as the photovoltaic effect. A PV cell typically consists of semiconductor material, usually silicon, doped with specific chemicals to create layers with different electrical properties. These layers include a positively charged layer (p-type) and a negatively charged layer (n-type). When sunlight hits the PV cell, it energizes the electrons in the semiconductor material. This energy boost allows electrons to break free from their atoms. The freed electrons move toward the n-type layer, while the holes they leave behind move toward the p-type layer. This movement creates an electrical imbalance between the two sides, generating an electric current. Metal contacts on the top and bottom of the PV cell captured the current and made it available for electrical power needs. The efficiency of PV panels can vary based on factors like the type of semiconductor material, the configuration of the solar cells, and environmental conditions such as temperature and the amount of sunlight.

Concentrating Solar-Thermal Power Systems

Concentrating solar-thermal power systems (CSP) are a form of solar energy technology that utilizes mirrors or lenses to concentrate a large area of sunlight onto a small area, generating high temperatures. This concentrated heat is then used to produce steam, which drives a turbine to generate electricity.

How CSP Works

Unlike PV systems, CSP systems use mirrors or lenses to concentrate a large area of sunlight, or solar thermal energy, onto a small area. The concentrated light is converted to heat, which then heats a fluid. This fluid can be water to create steam or a heat-transfer fluid to produce steam. The steam powers a turbine, which generates electricity similar to traditional power generation methods. There are several types of CSP systems, including parabolic troughs, dishirling systems, concentrated linear Fresnel reflectors, and solar power towers. Each has a unique way of harnessing sunlight and converting it to thermal energy. An advantage of CSP systems over PV systems is their ability to store the collected energy as heat. They can continue producing electricity even when the sun isn't shining, typically using molten salts as a storage medium. Yet, concentrating solar-thermal power systems require more space compared to PV systems.

Why Invest in Solar Power?

Investing in solar power represents a forward-thinking and strategic decision, aligning with environmental sustainability and financial prudence. As the world increasingly focuses on renewable energy sources to mitigate the impacts of climate change, solar power stands out due to its abundance, accessibility, and technological advancements. For investors, this sector offers a pathway to contribute positively to environmental sustainability and presents substantial economic opportunities. The steady decrease in the cost of solar technology, combined with supportive government policies and growing public awareness, has led to a significant expansion of the solar market. By investing in solar power, individuals and businesses can anticipate potentially attractive returns and position themselves at the forefront of a critical and rapidly evolving energy transition.

Decrease Business Expenses

Investing in solar power is a financially astute decision for businesses looking to reduce expenses, primarily through significant reductions in energy costs. By generating their own electricity, businesses can markedly decrease their reliance on the grid, leading to lower monthly utility bills. This investment ensures predictability in energy expenses, essential for financial planning, and enhances a business's sustainability profile, potentially boosting its brand value.

Ease of Maintenance

Solar-powered projects are easy to maintain, enhancing their long-term cost-effectiveness and reliability. Solar power systems, notably photovoltaic (PV) panels, have minimal moving parts, reducing the risk of wear and tear and the need for frequent repairs. This inherent simplicity translates to lower ongoing maintenance costs than traditional energy sources. The low maintenance aspect of solar power not only diminishes operational disruptions but also contributes to a more predictable financial performance, making it an attractive option for businesses and investors seeking sustainable and cost-efficient energy solutions.

Environmental Leadership

Investing in solar power is a compelling decision for environmental leadership due to its profound impact on reducing carbon emissions and fostering sustainable energy practices. Solar power harnesses the abundant energy of the sun, a renewable resource, to generate electricity, thus significantly curtailing reliance on fossil fuels, which are a significant contributor to greenhouse gas emissions. This shift not only combats climate change but also reduces air pollution, improving overall environmental quality. Furthermore, solar-powered projects support a greener economy by creating jobs in clean energy sectors, encouraging technological innovation, and promoting energy independence. This commitment to solar energy resonates strongly with increasing environmental awareness and the global demand for cleaner, more sustainable energy solutions, positioning investors as financial beneficiaries and leaders in environmental stewardship and responsible, forward-thinking business practices.

Flexible Financing Options

Solar-powered projects have become increasingly attractive due to flexible financing options, making them a compelling choice for entrepreneurs, business owners, and investors. The growth of innovative financing models like Power Purchase Agreements (PPAs), solar leases, and attractive loan options has significantly reduced the financial barriers to solar investment. These models allow for either low or no upfront cost, spreading the expense over time and aligning it with the energy savings generated. The ability to leverage these financing models, coupled with solar power's environmental and economic benefits, positions it as a strategic investment for businesses and individuals seeking sustainable growth and long-term financial savings.

Improved Green Credentials

Investing in solar power is increasingly compelling due to enhanced green credentials, positioning it as a vital component of sustainable business practices. Solar energy, a clean, renewable resource, significantly reduces carbon footprints, aligning investments with global environmental goals and appealing to a growing eco-conscious market. This alignment fosters a positive public image and anticipates future regulatory changes favoring green energy, providing a strategic advantage. Hence, investing in solar power represents a forward-thinking approach, combining environmental responsibility with economic prudence and aligning with the broader shift towards sustainable energy solutions.

Good Return on Investment

Solar power investment presents a compelling opportunity for robust returns on investment (ROI). Firstly, solar energy reduces reliance on traditional energy sources, leading to significant savings on utility bills over time. Secondly, the cost of solar technology has dramatically decreased in recent years, making initial investments more affordable and increasing the potential for higher returns. Furthermore, many governments offer tax incentives, rebates, and grants for solar installations, which can further improve ROI. Its long lifespan and low maintenance requirements ensure a steady, long-term income stream, making it a desirable option for investors seeking sustainable and stable returns.

Long-Term Investment

Investing in solar power is a prudent long-term investment primarily due to solar systems' impressive lifespan and durability. Typically, solar panels are designed to last for 25 to 30 years, often exceeding this with proper maintenance, ensuring a prolonged period of energy generation. This longevity translates into decades of reduced or eliminated electricity bills, offering a return on investment that continues to accrue long after the initial payback period. The long lifespan of these systems, combined with continuous advancements in solar technology, means that investors can enjoy a stable and sustainable energy source, aligning with environmental goals while securing financial returns over an extended period.

Raise Property Valuation

Solar installations reduce utility costs through clean, renewable energy generation and position the property as environmentally responsible, a highly valued feature in contemporary real estate markets. Solar investments increase property appeal among ecologically conscious buyers, often leading to higher resale values. Furthermore, solar power systems can generate income through surplus energy production, making them attractive to prospective buyers or tenants. Overall, incorporating solar power represents a forward-thinking approach, marrying environmental stewardship with financial prudence, thus boosting the property valuation – its marketability and long-term value.

Reliable Power Supply

Solar power investment presents a strategic opportunity due to its reliable power supply, which is particularly valuable in the current energy landscape. Unlike traditional energy sources, solar power relies on the sun, an abundant and predictable resource, eliminating the unpredictability and volatility of fossil fuels. This reliability ensures a consistent power supply and protects against fluctuating energy prices, providing a significant advantage for long-term financial planning and stability. Furthermore, advancements in solar technology and battery storage have greatly enhanced the efficiency and consistency of solar energy, making it a more dependable and viable option for individuals and businesses.

Solar Incentives

Solar incentives offer immediate financial benefits and align with long-term strategic goals for sustainable and cost-effective energy solutions. Investing in solar power has become increasingly appealing due to the availability of solar incentives, which significantly enhance the financial feasibility and return on investment of such projects. These incentives, including tax credits, rebates, and grants, lower the initial capital outlay, thus making solar installations more affordable for businesses and individuals. Moreover, they are designed to accelerate the adoption of renewable energy sources, contributing to environmental sustainability by reducing reliance on fossil fuels.

Financial Modeling: Make the Most of Your Solar Power Investment

Investing in solar power involves a range of financial considerations and requires thorough financial modeling to assess its viability and profitability. Financial modeling is a crucial tool for making the most of your investment in solar power, primarily due to its ability to provide a detailed and comprehensive analysis of the project's financial viability and potential returns. Here's how financial modeling serves this purpose:

- Cash Flow Analysis: Solar power investments involve significant upfront costs and generate returns over a long period. Financial modeling helps in analyzing & projecting cash flows, both inflows from the sale of electricity or savings from using solar power and outflows related to installation, maintenance, and operational costs. It provides a clear picture of the project's financial sustainability over time.

- Cost-Benefit Analysis: Financial models allow investors to compare the costs of investing in solar power against the benefits. This includes calculating the payback period, the time it takes for the investment to repay its initial cost, and the return on investment (ROI), which measures the efficiency of the asset.

- Energy Yield Projections: The model can integrate technical data like solar panel efficiency, sunlight hours, and expected degradation of solar panels over time to accurately forecast energy production and revenue generation.

- Financing Structure: For solar power projects, the financing structure (debt, equity, or a combination) plays a crucial role. Financial models can simulate financing scenarios to determine the most cost-effective and sustainable structure, factoring in interest rates, loan terms, and equity requirements.

- Risk Assessment and Sensitivity Analysis: Solar power investments are subject to various risks, including technological, environmental, and regulatory risks. Financial modeling can incorporate sensitivity analysis to understand how changes in key assumptions (like energy prices, government incentives, or technological efficiency) impact the project's viability. It helps in making well-informed decisions and in preparing contingency plans.

- Scenario Planning: Financial models allow for scenario planning, crucial in understanding how different market conditions or policy changes could affect the investment. It includes best-case, worst-case, and most likely scenarios.

- Tax Implications and Incentives: Many regions offer tax incentives for solar power investments, such as tax credits, rebates, and depreciation benefits. A financial model can quantify these incentives and show how they improve the project's financial performance.

A comprehensive financial model for a solar power investment should integrate all these factors to provide a realistic and robust evaluation of the project's financial viability. Investors, entrepreneurs, and finance professionals must understand these dynamics to make informed decisions and optimize the return on investment in this increasingly crucial renewable energy sector.