Private Equity Waterfall Distribution Models

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Private Equity Fund Financial Projection Model with Distribution Waterfall

Highly versatile private equity fund financial projection model with calculations…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Fruit Processing Facility – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Auto Parts Store – 5 Year Financial Model

This Financial Model Template provides an advanced 5-year financial plan…

Trucking Company – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Cocktail Bar – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Truck Rental Company Financial Model

This detailed 10-year monthly Excel template is specifically designed to…

Private Aircraft Rental Company Financial Model

Embark on a journey to financial mastery with our Private…

Culinary Arts Academy – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Sky Diving Center – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Senior Living Development – 10 Year Financial Model

Financial model presenting a development scenario for a Senior Living…

Crypto Trading Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan of a…

Events & Weddings Venue – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Microfinance Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a…

Private Equity Fund Financial Model & Economics

Comprehensive financial model covering projections and key economics for a…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Car Rental Business Financial Model

This Car Rental Business Financial Model Template in Excel offers…

Buy Now Pay Later (BNPL) Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a…

Digital Hiring (Talent) Marketplace – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for an…

Comprehensive Merger Financial Model

Our sophisticated merger financial model is a versatile and powerful…

Online Payments Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

VOD/OTT Streaming Platform – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup…

Subscription Box Financial Model – Up to 72 Months

Test many variables in this financial model for a subscription…

Subscription Business – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup…

Crowdlending (P2P) Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Mini Football Club Financial Model – 5 Year Forecast

Financial Model providing an advanced 5-year financial plan for a…

Scaling Multiple Rental Properties: Up to 100

Configure up to 100 rental property acquisitions and view the…

Real Estate Private Equity GP Catchup Waterfall Analysis Model

Ultimate Real Estate Private Equity Financial Model Template: Preferred IRR…

Scuba Diving Center – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Padel Club Financial Model – 5 Year Forecast

Financial Model providing an advanced 5-year financial plan for a…

Condo Development Model (Build and Sell)

A financial forecasting model specifically designed for the economics of…

Yacht Marina Acquisition Financial Model

Financial model presenting an acquisition scenario of a Yacht Marina.

Real Estate PE Multiple Hurdles Waterfall Analysis Model

We proudly present our cutting-edge Real Estate Waterfall Analysis Model…

Public-Private Partnership (PPP) Financial Model

Financial Model presenting development and operating scenarios of various projects…

Real Estate Acquisition Financial Model (Commercial, Industrial, Residential)

Simple Real Estate Acquisition Financial Model suitable for Commercial, Industrial…

Cruise Line Company – Dynamic 10 Year Financial Model

Financial Model providing a dynamic 10-Year Financial Plan for a…

Oil & Gas Marketing and Distribution DCF Valuation Model with 5 Yrs Actual,1 Yr Budget & 5 Years Forecast

A detailed and user friend financial model that captures 5…

Apartment Building / Self-Storage / Multi-Family Acquisition Model: 15 Year

This real estate model works great for acquisitions of apartment…

Real Estate Development Financial Model

A professional model for real estate construction (build – hold…

Real Estate Acquisition Financial Model

A professional model for real estate acquisition (buy – hold…

Asset Management Company – Closed End Fund Model

Financial Model providing analysis of a Closed-End Fund hosted by…

Cash Flow Waterfall with GP / Sponsor Catch-up Provision

Offers logic to demonstrate the option to catch up the…

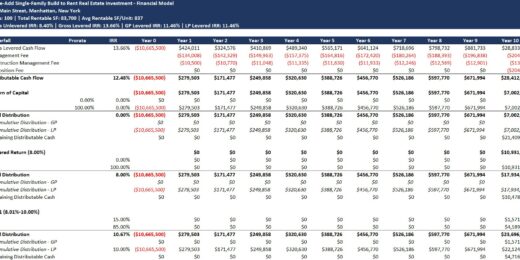

Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

A financial model to help calculate and analyze the pro…

Core Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Economic Model for Oil and Gas Extraction Feasibility

This model runs for 20 years and makes it easy…

General Hospital Financial Model (Development, Operation, & Valuation)

Financial Model presenting a development and operating scenario of a…

Equipment Leasing Company Financial Model – Dynamic 10 Year Forecast

Financial model providing a dynamic 10-Year Financial Plan for an…

Triple Net Lease (NNN) Real Estate Investment with Returns & Waterfall

This Pro Forma Model is used to analyze the financial…

Retail Property Development Financial Model

A professional model for retail property construction (build – hold…

All you need to know about Private Equity Waterfall Distribution Models

Private equity investments operate as partnership with a general partner (the sponsor/manager) and limited partners (the investors). These business structures describe distributions' flow to the sponsor and investor as waterfalls, with stipulations protecting investors in clawback clause while the manager is protected in catch-up provision. In some cases that the deal exceeds projection, the waterfall will reshape the timing of payment. On the other hand, investors' risk increases if the deal falls short of expected returns. Here, we will try to expound everything you need to know about private equity distribution models.

What is Distribution Waterfall

A distribution waterfall is a method in which capital gains of the fund are distributed between or among investors or partners, typically between limited partners (LPs) and general partners (GPs). The profits earned are distributed according to the cascading structure of sequential tiers with reference to waterfall. Basically, when the first tier's allocation requirement is satisfied, the excess funds will be subjected to the next tier's requirement.

Importance of the Waterfall Distribution

A distribution waterfall outlines the schemes for the distribution of profits in a private equity memorandum. Its objective is to align incentives for the sponsor and establish a payment structure for the Limited Partner (LP). Like a waterfall, when the first tier is filled to the brim, profits will flow to the next tier and continuously to the succeeding levels once the condition is fulfilled. This distribution waterfall ensures that profits are distributed in a manner both agreed by the partners. The structure of allocation protects the investors' interests while incentivizing the general partner to maximize the return of the fund.

The Agreement

In profit distribution waterfall, cash flows are distributed according to the owner's agreement. This agreement will provide all the details of how profits will be split among the partners. Though, there are some commonly used Private Equity waterfall structures, the only way to fully understand the model's specific structure is to read the agreement itself as each agreement could vary extensively.

Common Private Equity Waterfall Model Components

Below are the basic building blocks of the typical private equity waterfall model.

The Return Hurdles

The rate of return defines the distribution structure, which may elicit disproportionate profit split. The internal rate of return (IRR) is the most commonly used return hurdles. This return can be calculated from a different perspective, which should be stated in the owner's agreement.

The Preferred Return

The preferred return is the targeted return on investment in a private equity waterfall model. The preferred investors are entitled to all investment profits until the target is reached, and excess profits will be split accordingly. The preferred return could either be cumulative or non-cumulative, which is critical for those struggling with cash flows. If the preferred return is cumulative, it will be added to the investment balance for the subsequent period until the preferred return is paid. And if it is cumulative, it could be compounded or non-compounded. When the preferred return is compounded, it could be compounded at the preferred return rate as it accumulates. This provision must be explicitly stated in the owner's agreement.

The Clawback Protection Clause

The protection clause requires the limited and general partner to look back at the end of the deal to determine whether the pre-determined rate of return has been achieved. It takes into effect if the sponsor takes a performance fee while the deal eventually underperforms. The clawback feature obliges the manager to return any fees received to make up for the shortages if the deal does not reach the preferred return at the time of sale.

The Catch-Up Protection Clause

The catch-up provision requires that the sponsor or fund manager receives participation in profits should there be any delay in distribution. Once the deal reached a pre-determined milestone, the sponsor receives a share in the net proceeds retroactively. Once the manager reaches the benchmark, he is entitled to a portion of the profit as a catch-up payment.

Basic Waterfall Distribution Example

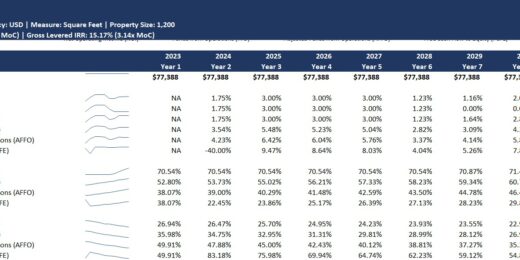

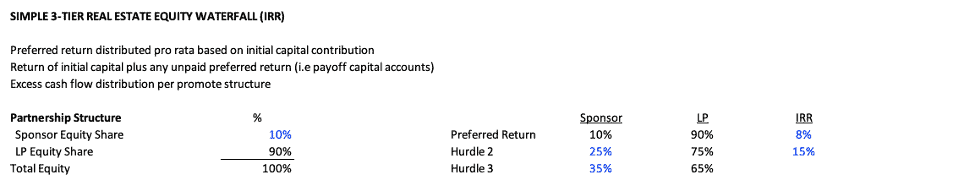

In private equity waterfall model, the initial step is to define the partnership structure which could be best executed in a waterfall model template. In this case, let us assume the following;

- A preferred return paid to the partners pro-rata based on initial capital contribution

- Return of initial capital contributions plus any unpaid preferred return

- Excess cash flows leftover will be disproportionately distributed based on the promote structure.

As illustrated here, these are the three hurdles that we should follow in this distribution waterfall. The first tier is the 8% preferred return, which is distributed according to initial capital contribution. The second hurdle is 15%, which will be split in 75:25 ratio between the LP and sponsor, respectively. The third hurdle being the promote is any excess over 15% that will be distributed to LP at 65% and to the sponsor at 35%.

In this private equity waterfall model, we will take the property levered cash flow and distribute the same to the partners based on whatever structure the partners agreed to. Levered cash flow means the amount left after paying all financial obligations related to the deal. In this case, the required capital contribution is 1,000,000, in which the LP will contribute 90%. Then, some cash flow of 150,000 was earned in Year 1, and grows at 5% each year thereafter. Finally, in Year 5, the property has been sold at 2,000,000.

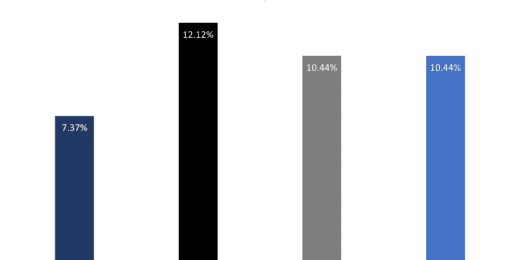

Based on the result of IRR at the property level at 27.7%, we expect that the sponsor's IRR will be greater than the overall deal's IRR, and LP's cash flow will be less because our hurdles are less than the property level IRR.

In this waterfall, the first hurdle is the preferred return and return of capital. To understand it better, let's define each of these labels one by one.

- Beginning Balance (LP) – is the ending balance from the previous period.

- LP's Required Return – is equal to the beginning balance multiplied by the hurdle rate in a particular period, in this case at 8%.

- Contributions from LP – is the minimum of the available cash flow or zero multiply by the partner's share.

- Distribution to LP at Hurdle 1 – is the lesser of the total positive cash flow to distribute in this period multiply by the LP's distribution share or the total amount required to distribute to pay off the capital account and cover the hurdle.

- Ending Balance (LP) – is equal to the beginning balance plus LP's required return plus any contribution minus distributions.

- Contribution from the sponsor – is the minimum of the available cash flow or zero multiplied by the sponsor share.

- Distributions to Sponsor Hurdle 1 – is the exact amount distributed divided by the LP's share multiply by the sponsor's share.

- Total Distribution – is the total amount distributed between the LP and sponsor.

- Cash Flow Remaining – is any positive cash flow minus cash flow distributed. None is remaining in the first four years because all of that will cover the hurdle and payoff initial capital, and in the last period, there is a capital event and more cash flow to go into the next hurdle.

Notice that there's less cash flow distributed to the LP than is available to distribute, and that means that there is excess cash that will flow into the next hurdle.

The second hurdle is at 15%. Basically, we will repeat the process in the first hurdle, but in this case, we now have prior distribution and some changes in the formula for distributions and cash flow remaining.

- Prior Distribution (LP) – is the amount distributed to the LP in the first hurdle.

- Distributions to LP at Hurdle 2 – is the lesser of the total cash flow remaining from the first hurdle multiplied by the partner's share in this hurdle or the total amount to hit the hurdle, in this case the beginning balance plus LP's required return minus prior distribution.

- Cash Flow Remaining is the cash flow from the previous hurdle minus total distributions, which will flow to the next hurdle.

Notice in hurdle 3, only distributions to partners are required because, in our waterfall structure, any amount above 15% will be distributed on a 65:35 ratio between the LP and sponsor. The remaining cash flow from the previous hurdle will be distributed according to the partner's respective share in this tier.

Now, let's just summarized each partner's total distributions based on the waterfall hurdles. In most cases, the IRR to LP is lesser than the overall deal's IRR, and greater to sponsor than the percentage of ownership, which also applies in this example. Giving away a fair chunk of proceeds as the deal moves up does not impact LP's so much. But, as for the sponsor, this percentage could multiply their contribution up to nth time and hence, a win-win situation for both parties. This waterfall structure and the "management promote" can be a robust means to incentivize the management team if adequately executed.

Private Equity Waterfall Profit Sharing

Generally, there are two types of waterfall structure, the European Waterfall and American Waterfall.

The European Waterfall Structure

The European Waterfall structure provides investors 100% of investment profits until the preferred return is attained plus 100% of their investment capital. The fund is distributed on a pro-rated structure determined by the level of the investor's contribution.

The sponsor participates in profit sharing only after the preferred return and capital investment have been returned to the investors. However, the manager could receive a management fee as part of the investment's operating expenses.

The American Waterfall Structure

The American Waterfall structure returns 100% of investment profits to the investors up to the preferred return but does not require full repayment of investor's capital before the manager share in the profit distribution. This structure favors the sponsor, which allows them to participate in the distribution during the cash flow cycle rather than delaying their share in profits until the capital event.

Though the manager can participate in distributions earlier, the deal must consistently meet or exceed expected performance levels to qualify in the distribution. Its objective is to limit the investor's risk while incentivizing the sponsor to work hard to maximize the return on investment.

Private Equity Waterfall Model Templates

There are plenty of ready-to-use private equity waterfall Excel (.xls) models are available for download immediately which would permit the user to allocate profits between or among the partners accurately and conveniently.

Ideally, the profit waterfall distribution can be found in Private Placement Memorandum (PPM) which dictates the structures and may contain any of the following:

- Return of Investment + Preferred to LP & GP, Distribution of Excess Profits

- Return of Investment + Preferred to LP, Catch up for GP, Distribution of Excess Profits

- Return of Investment to LP, Return of Investment to GP, Preferred Return to LP, Catch up for GP, Distribution of Excess Profits.

Aside from these tools, we have bunch of other useful finance templates published at eFinancialModels built by finance industry experts. Should you need a custom built template, feel free to drop us a message.

The Bottomline: Private Equity Waterfalls determine the distribution of profits

The private equity waterfall model structure is complex in nature, investors should analyze the terms of any agreement carefully. The profit distribution waterfall structure must be appropriately designed to address the needs and maximize the interest of the parties involved. A well-designed Private Equity waterfall model template shall create a strong alignment and adequately incentivize the sponsor to optimize investment returns. Thus, when the fund is operating efficiently, the sponsor reaps the benefits together with its investors. However, if the deal does not perform as intended, the clawback provision will take place to protect the interest of the investor.