Public-Private Partnership (PPP) Financial Model

Financial Model presenting development and operating scenarios of various projects under a Public-Private Partnership (PPP) agreement.

Financial Model presenting the development and operating scenarios of various projects under a Public-Private Partnership (PPP) agreement. The model currently includes 4 different types of projects (Toll Road, Hospital, Commercial Building, and School) but is suitable for other types of projects as well (Airports, Ports, etc.)

The main purpose of the model is to enable users to get a solid understanding of the financial feasibility of each Development project and to evaluate the return to Private Partners.

The model includes the following PPP modes allowing the user to select the contract type of the project:

• Build-Operate-Transfer (BOT): Under a BOT contract, government grants a concession to a private company to finance, build, and operate a project for a period of 20 to 30 years. After that period, the project is returned to the public entity that originally granted the concession.

• Build-Own-Operate (BOO): Under a BOO contract, the government allows a private company to finance, build, and operate infrastructure over a specified period, and the private company retains ownership of the infrastructure in perpetuity.

Model Structure:

General & Projects Assumptions:

• PPP Contract: Contract type (BOT or BOO), Contract length (up to 30 years), Development & Operations Periods assumptions

• Development Costs & Revenue Assumptions for each project

• Uses & Sources of Cash and Capital Structure Assumptions

• Project Financing (Debt & Equity)

• Annual Operating Expenses and Capital Expenditures Assumptions

• Value for Money Analysis Assumptions: Interest During Construction (IDC), Construction & OpEx over-runs, Revenue Collection Pilferage

• Private Partnership Equity Contribution Assumptions (GP & LP)

• Project Valuation Assumptions including WACC calculation and Exit multiples

Output Reports:

• Project Cash Flows incl. before & after Tax Net Cash flows calculations and supporting schedules for PP&E, Debt & Debt Service, Reserve Accounts, Tax Schedule

• Value for Money (VfM) Analysis, including a comparison of Nominal and Real Projects Costs

• Project Returns incl. Project’s Terminal Value, Unlevered & Levered Cash Flows & Project Return Metrics (IRR, MOIC)

• Investor Distributions & Returns Waterfall Model

• Project’s Executive Summary

Help & Support

Committed to high quality and customer satisfaction, all our templates follow best-practice financial modeling principles and are thoughtfully and carefully designed, keeping the user’s needs and comfort in mind.

Whether you have no experience or are well-versed in finance, accounting, and the use of Microsoft Excel, our professional financial models are the right tools to boost your business operations!

If you experience any difficulty while using this template and cannot find the appropriate guidance in the provided instructions, please feel free to contact us for assistance.

If you need a template customized for your business requirements, please e-mail us and explain your specific needs briefly.

Similar Products

Other customers were also interested in...

Senior Living Development – 10 Year Financial Mo...

Senior living apartments are just that – apartments (townhouses and condos may also fall in this c... Read more

Industrial Building Development Financial Model (C...

Financial model presenting a development scenario for an Industrial Building including construction,... Read more

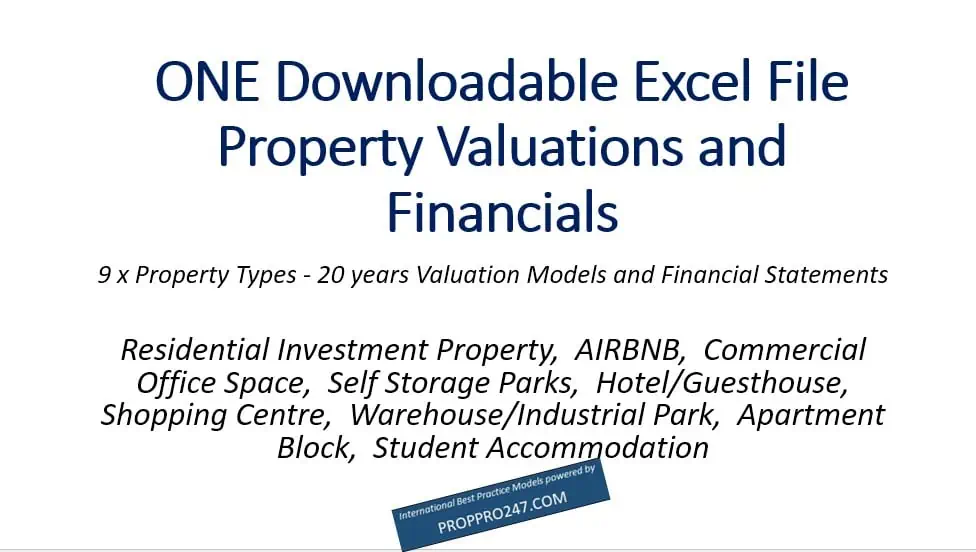

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

Construction / Development Financial Model

Development & Construction Model presents the case where a property with multiple residential un... Read more

House Flipping – Rehab Financial Model

The house flipping financial model is a comprehensive tool designed to analyze the financial aspects... Read more

Student Accommodation Business 10-Year 3 Statement...

10 year rolling financial projection Excel model for a startup or existing business developing and o... Read more

Real Estate Financial Model Template Bundle

This Real Estate Financial Model Template Bundle is best for those who are real estate professionals... Read more

Yacht Marina Acquisition Financial Model

Financial model presenting an investment scenario of a Yacht Marina, from the acquisition of the pro... Read more

Multi Sports Complex Financial Model – Dynam...

Financial Model presenting a development and operating scenario of an Indoor Multi-Sports & Fitn... Read more

Recreation & Community Center – Dynamic 10 Y...

Financial Model presenting a development and operating scenario of a Recreation & Community Cent... Read more

You must log in to submit a review.