Financial Model

At eFinancialModels.com, we're not just offering templates; we're offering a partnership in pursuit of excellence. We understand that no two businesses are the same. That's why our Excel financial model templates are tools and partners in your financial narrative. Leverage our sophisticated financial models to unlock insights, drive strategies, and propel your business toward its financial goals. Your vision, coupled with our precision, paves the way for unparalleled success.

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Custom Financial Model Design Service

Unlock the power of strategic financial planning with The Company…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Diagnostic Collection Center Financial Model

It is financial model for diagnostic collection center whose phlebotomists…

Mobile Imaging Center Financial Model

This Excel model facilitates mobile imaging services by providing equipment…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Indoor Golf Centre Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Golf…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Mobile App Development Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Mobile App…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Social Media Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Social Media…

Affiliate Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Affiliate Marketing…

Web Hosting Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking web hosting…

5 Year 3 Statement Recycling Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Recycling Centre…

5 Year 3 Statement Construction Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking construction company…

5 Year 3 Statement Solar Energy Solutions Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Solar Energy…

Digital Advertising Agency Finance Model Excel Template

A comprehensive editable 5 Year 3 Statement, MS Excel spreadsheet…

5 Year 3 Statement Virtualization Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Virtualization Software…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Graphic Design Company Finance Model Excel Spreadsheet

A comprehensive editable, MS Excel spreadsheet for tracking Graphic Design…

Private Equity Fund Financial Projection Model with Distribution Waterfall

Highly versatile private equity fund financial projection model with calculations…

5 Year 3 Statement Private Mental Health Care Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking private Mental…

5 Year 3 Statement Alpaca Farming Finance Model Excel Template

A comprehensive 3 Statement 5 Year editable, MS Excel spreadsheet…

5 Year 3 Statement Architect Company Finance Model Excel Template

A comprehensive 5 Year 3 Statement editable, MS Excel spreadsheet…

Swimming School Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Swimming School…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

3 Statement 5 Year SAAS HR Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking SAAS HR…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

Achieving Financial Success with Excel Financial Model

"Risk comes from not knowing what you're doing." - Warren Buffett. The quote underscores the importance of understanding and analysis in finance. A financial model can be crucial in reducing uncertainty and making informed decisions. It is a cornerstone of business decision-making, often capturing complex realities in a structured and quantifiable form.

Using a financial model as a tool for success isn't just about predicting the future accurately; it's about understanding the potential impacts of various decisions and strategies. It's a way to test hypotheses and scenarios in a risk-free environment. The true power of financial models lies in their ability to help users navigate through the uncertainty and complexity that characterize financial markets and business environments. They are not just tools for prediction but instruments for creating a more strategic and informed pathway to success.

What Is a Financial Model?

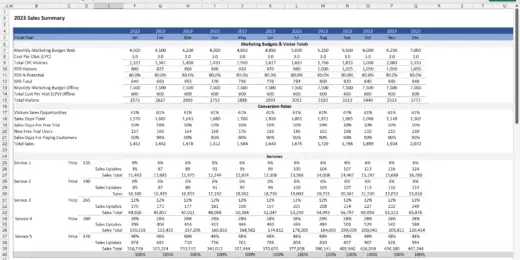

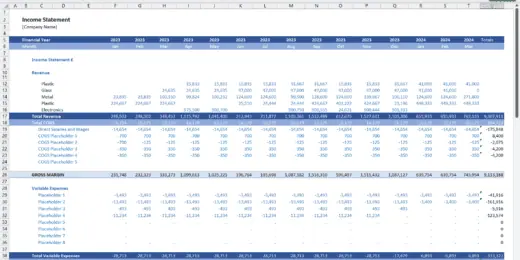

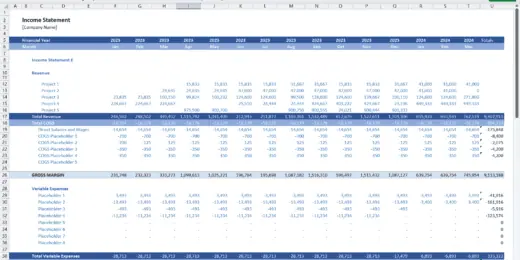

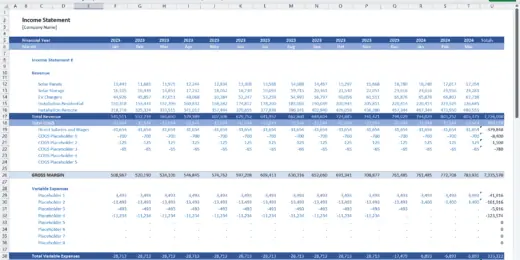

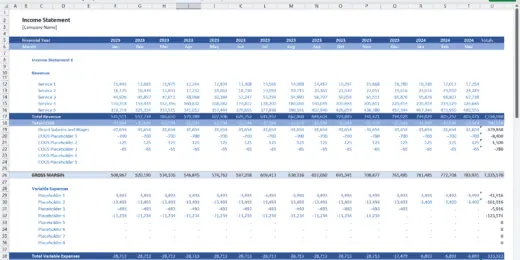

A financial model is a tool designed to forecast the financial performance of a business, project, or any financial asset over a specific period. It represents all aspects of the company's operations, financial statements, and market conditions. A financial model is typically constructed in Microsoft Excel due to its robust features and widespread use among finance professionals. Excel offers the flexibility and computational power to handle complex financial forecasting and analysis.

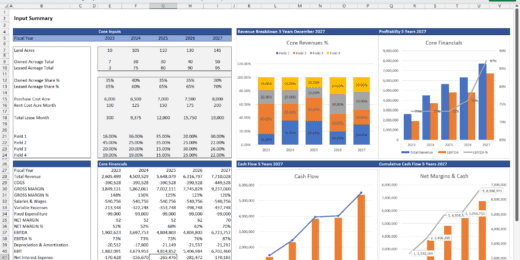

Excel financial models often project future revenues, expenses, and capital costs. They help in budgeting and planning for upcoming financial periods. They support business decisions such as expansions, acquisitions, or new projects by predicting outcomes and assessing risks. Furthermore, they are critical in determining the value of a business or an asset, instrumental during fundraising, selling a business, or mergers and acquisitions.

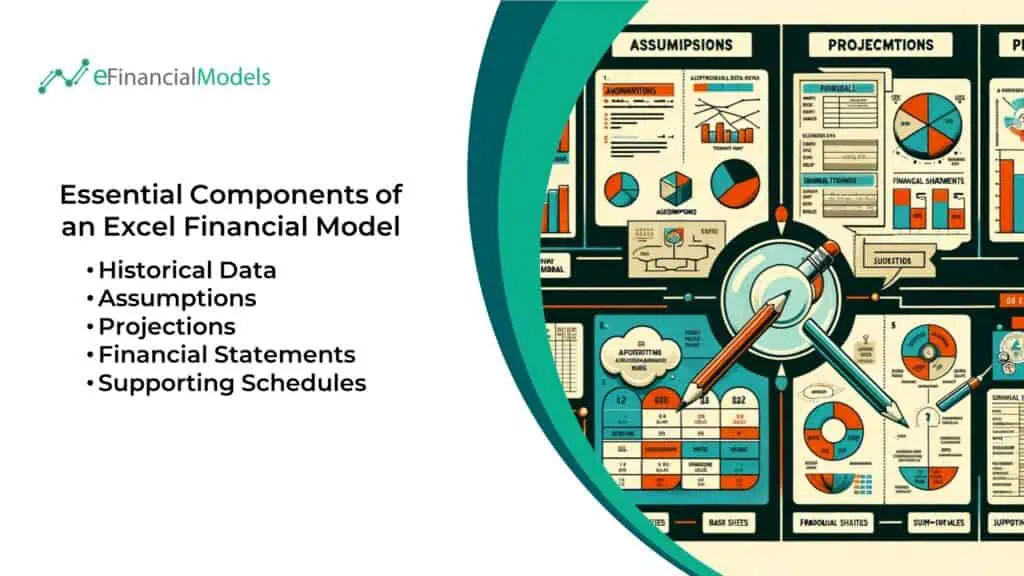

Essential Components of an Excel Financial Model

- Historical Data: Typically, a financial model starts with historical financial information of the business, such as income statements, balance sheets, and cash flow statements.

- Assumptions: These are the building blocks of a financial model. Assumptions about future performance include growth rates, profit margins, inflation rates, and other factors influencing the business.

- Projections: Based on historical data and assumptions, the model forecasts future income, expenses, cash flow, and other financial metrics.

- Financial Statements: These include forecasted income statements, balance sheets, and cash flow statements.

- Supporting Schedules: These might include depreciation schedules, debt schedules, and tax schedules, which feed into the primary financial statements.

A financial model is a sophisticated tool that requires a deep understanding of both the business being modeled and financial theory. It's a dynamic representation that evolves with the business and the market. For finance, investment, and business management professionals, the ability to build and interpret financial models is a critical skill. Whether created in Excel or any other platform, a well-constructed financial model is an invaluable asset for making informed and strategic financial decisions.

Top 10 Types of Financial Models

Financial models are sophisticated tools that are critical in financial decision-making and analysis. The types of financial models vary widely to suit different purposes, from predicting future financial performances to assessing the viability of a buyout in LBO models. Other types of financial models evaluate the financial implications of business combinations, comprehensive budgeting and forecasting, internal planning, and valuing financial derivatives. Each type is tailored to provide detailed insights, facilitate strategic planning, and support effective financial management in diverse business contexts.

- Three Statement Model: The Three Statement model is the bedrock among the types of financial models. It integrates the income statement, balance sheet, and cash flow statement into a dynamically connected financial model. In this Excel financial model, formulas ensure that the three statements flow into one another and that changes in one impact the others. This model is pivotal for various financial analyses, including historical and future performance evaluations.

- Discounted Cash Flow (DCF) Model: A DCF model estimates the value of an investment based on its expected future cash flows. The model calculates the present value of expected future cash flows using a discount rate, typically the weighted average cost of capital (WACC). In Excel, this involves forecasting free cash flows, calculating the terminal value, and discounting these to the present value.

- Merger Model (M&A): The Merger Model, or M&A model, analyzes the financial profile of two companies, the cost of the acquisition, and how the purchase is made (cash, stock, or debt). It forecasts the impact of the merger or acquisition on the combined company's earnings per share (EPS) and determines whether the transaction is accretive or dilutive. Excel is used to align the involved companies' financial statements and to simulate different scenarios.

- Initial Public Offering (IPO) Model: An IPO model forecasts the expected proceeds from an initial public offering. Such an Excel financial model is used to determine the company's implied market value and to understand how the IPO can affect existing shares. It involves calculating diluted shares outstanding, estimating the IPO price, and understanding the impact on the company's valuation.

- Leveraged Buyout (LBO) Model: An LBO model evaluates the financial feasibility of acquiring a company with a significant amount of borrowed money. The model focuses on the buyer's equity return and is built in Excel by projecting the company's cash flows and calculating the equity internal rate of return (IRR) for the investment.

- Sum of Parts Model: Sum of Parts models are the most common types of financial models used for companies with multiple business units or divisions. Each segment is valued independently, and then all are summed up to get the total enterprise value. Excel handles complex structures and interconnections between the parts, providing a detailed and comprehensive valuation.

- Consolidation Model: A Consolidation Model is an Excel financial model used to combine the financials of multiple subsidiaries or divisions into a single model. Each subsidiary is typically modeled on a separate sheet, with a consolidation sheet summing up all entities. It's crucial to create an overarching view of a group's financial performance.

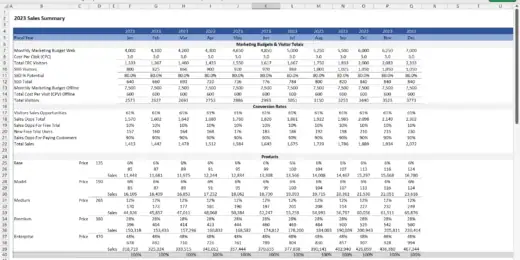

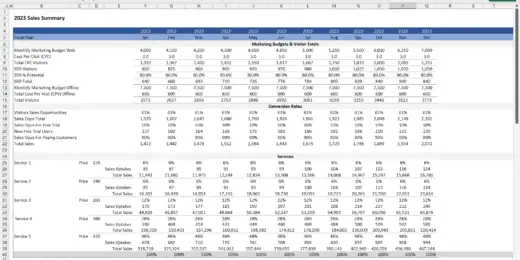

- Budget Model: Among the types of financial models, the budget model is the most used for internal planning. It involves setting expectations for revenue and expenses and comparing actual results to those expectations. This Excel financial model is used to track and analyze variances, which helps understand performance and make informed decisions.

- Forecasting Model: Forecasting models predict future financial performance based on historical data and assumptions about future conditions. These models are extensively used in departments like sales, inventory, and operations planning. Such an Excel financial model allows for detailed scenarios and sensitivity analysis, providing a range of possible outcomes.

- Option Pricing Model: An Option Pricing Model, like the Black-Scholes and Binomial models, calculates the options' theoretical value. These models consider the underlying asset's price, the option's strike price, volatility, time to expiration, and risk-free rate. In Excel, these factors are integrated into complex formulas to derive the option's price.

Excel is a powerful tool in all these types of financial models, offering flexibility, functionality, and a wide array of financial functions. These Excel financial models can be as straightforward or complex as needed, with the ability to include vast datasets, use sophisticated formulas, and create detailed charts and graphs for analysis and presentation.

How to Make a Financial Model

Creating an Excel financial model is a meticulous process that involves analyzing and synthesizing a vast array of data into a coherent and predictive framework. Here are the detailed steps on how to make a financial model:

Step 1: Collect Assumptions

The first step on how to make a financial model gather the necessary information and parameters to drive your model's projections. You can perform industry research to understand the sector dynamics, growth rates, margins, and typical capital structure. It can be done through market reports, industry analyses, or financial news. Another way to collect assumptions is through historical analysis. Review the company's past financials to identify trends, growth rates, and operational efficiencies. It will include a deep dive into income statements, balance sheets, and cash flow statements over several periods.

Step 2: Decide the Forecast Method

Establish the methodology for how revenue and expenses will be projected. It may be through a top-down or bottom-up approach. The top-down approach starts with the macro view, such as total market size and growth, then narrows down to the company's expected share. It's useful for new markets or when external factors heavily influence the business. At the same time, the bottom-up approach involves estimating potential sales and extrapolating to broader financials. It's often more accurate as it builds from the company's capabilities and resources but requires detailed operational understanding.

Step 3: Model the Financial Statements

The third step on how to make a financial model is to model the financial statements. Its purpose is to create a dynamic structure that reflects the business's financial performance over time.

- The income statement projects revenues, costs, expenses, and profit. It will involve detailed line items for each revenue stream and expense category.

- The balance sheet forecasts the company's assets, liabilities, and equity at a given point in time. Ensure the balance sheet balances through the accounting equation (Assets = Liabilities + Equity).

- The cash flow statement reflects the inflows and outflows of cash, showing how the company's operations, investments, and financing activities affect its cash position.

Step 4: Set Up Calculations of Financial Ratios

To provide metrics for evaluating the health and performance of the business, the fourth step in how to make a financial model is to set up calculations of relevant financial ratios. You can add calculations of the current ratio, debt-to-equity, gross margin, return on equity, and more. You can also set up calculations for financial metrics like the net present value or internal rate of return. You can use these ratios to compare against industry benchmarks and historical performance. Integrate them into the model to automatically update as assumptions or figures change.

Step 5: Stage Sensitivity Analysis

The last step on how to make a financial model is to stage sensitivity analysis. It aims to understand how changes in assumptions impact financial outcomes and identify risk areas. Analyze the best, worst, and most likely case scenarios to prepare for various outcomes. Here, you should identify key drivers (e.g., sales volume, price, cost of goods sold) and understand their impact on the financials. Use data tables, charts, and scenarios to visualize how changes in these drivers affect profits, cash flow, and other critical metrics.

Keep a clear record of sources and assumptions. It aids in transparency and makes updating or auditing the model easier. Review the model with stakeholders regularly and validate assumptions with market data or feedback. Understand that financial modeling is not a one-time task. It should be updated periodically as new information comes to light. By meticulously following these steps, you can create an Excel financial model that provides insight into a business's potential financial future, informs decision-making, supports strategic planning, and helps communicate the financial trajectory to stakeholders effectively.

Master Success with Excel Financial Models

Excel financial models are indispensable tools, providing insightful data and forecasts that guide entrepreneurs toward informed decisions and financial success. They transform complex financial data into clear insights, enabling a strategic approach to business challenges. With a suitable model, businesses can anticipate outcomes and strategize effectively, paving the way to financial prosperity.

Mastering an Excel financial model gives you a powerful toolset for understanding market dynamics, assessing risk, and identifying growth opportunities. It offers a dynamic platform for scenario analysis, helping you prepare for various business contingencies. By integrating financial expertise with Excel's robust capabilities, you can unlock a new level of strategic planning and business intelligence.

At eFinancialModels.com, we understand the unique challenges and opportunities your business faces. That's why we offer custom financial models tailored to your needs, empowering you to make well-informed decisions confidently. Explore our services today and elevate your financial strategy with our expertly crafted models.