LBO (Levered Buyout)

Whether you're a seasoned investor or a financial analyst, our tools equip you with the insights to assess leverage effects, optimize debt structures, and maximize returns. Dive into a seamless integration of data-driven analysis and intuitive design, all aimed at helping you make informed decisions swiftly and effectively. Start transforming complex financial data into actionable strategies today with our leading-edge LBO models.

Complete Private Equity (LBO) Financial Model

This is a professional financial model which performs a thorough…

SaaS Company Financial Model and Valuation

Discover the SaaS Company Financial Model and Valuation, an essential…

Private Equity Fund Financial Model & Economics

Comprehensive financial model covering projections and key economics for a…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Private Equity Investment Financial Model (LBO, IRR, CoC)

This model offers an understanding of potential investments from a…

Private Equity and Venture Capital Financial Model – BUNDLE DEAL

This is a Combo of Private Equity and Venture Capital…

Venture Capital Return Analysis Template (Cap Table, IRR, CoC)

Unlocking Potential Returns: Venture Capital Return Analysis Simplified - Financial…

Private Equity – Leveraged Buyout (LBO) Model and Return Analysis (IRR and MOIC)

Leveraged Buyout (LBO) model, designed to empower you with the…

Complete buy-side Telecom Tower Portfolio LBO

Complete Buy-Side Telecom Tower Portfolio LBO Model. This model allows…

Trucking / Transportation Business: Scaling Financial Model

Build assumptions around scaling deliveries. Smart logic built for truck…

Marketplace with 3 Subscription Tiers: 5 Year Financial Model

I built marketplace assumptions on to of my best subscription…

Laundromat Financial Model – 10 Year

This template allows the user to produce financial statements based…

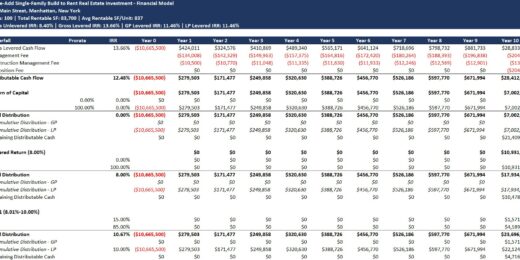

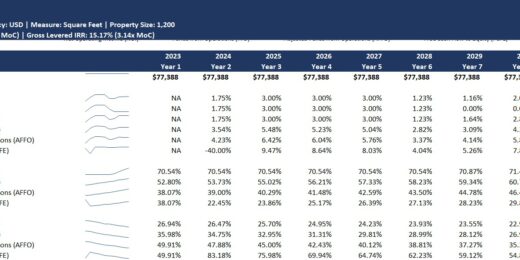

Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

A financial model to help calculate and analyze the pro…

Property Management Business Financial Model

Create a wide range of scenarios for the financial forecasting…

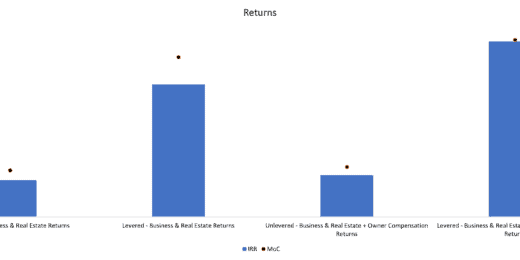

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

Dynamic Franchise Business Plan – 3 Statement Model with DCF & Returns

Pro Forma Models created this model to analyze the financial…

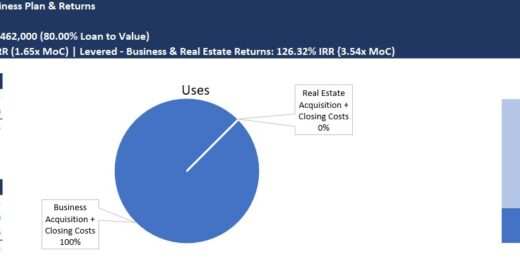

Business Acquisition (M&A) Model with Monthly Business Plan & Returns

Pro Forma Models created this model to analyze the financial return…

Sports Agency Startup 3 Statement Forecasting Template

This 10-year financial forecasting template works great for any sort…

Restaurant and Bar Financial Model Template

Financial model template for an eating establishment in which customers…

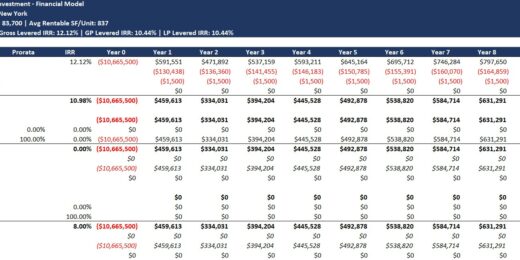

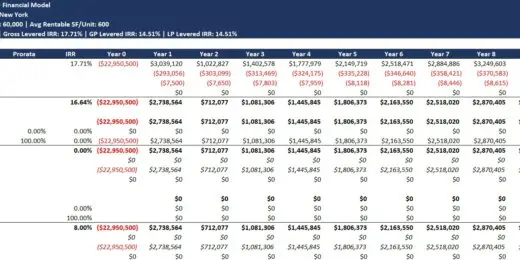

Student Housing Real Estate Investment Model with Returns & Waterfall

Pro Forma Models created this financial model to calculate and…

Triple Net Lease (NNN) Real Estate Investment with Returns & Waterfall

This Pro Forma Model is used to analyze the financial…

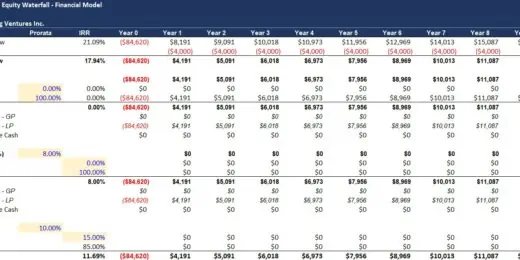

Dynamic Annual Private Equity Waterfall Cash Flow Distribution Financial Model

Pro Forma Models created this model for private equity professionals…

Hotel Real Estate Investment Model Template

Pro Forma Models created this financial model to calculate and…

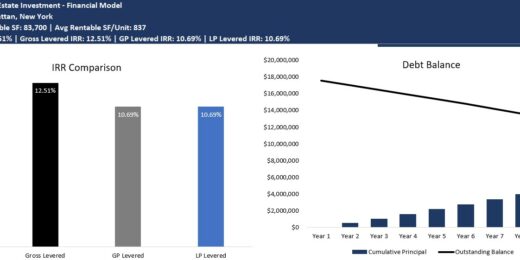

Core Multi-Family (Apartment) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Management Buyout (MBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes…

Detailed Leveraged Buyout (LBO) Financial Model Template and Presentation

This is a detailed and easy-to-use Leveraged Buyout (LBO) financial…

Leverage Buyout Real Case Study Model Template

This provides an LBO (Leveraged Buyout) real case study model.

LBO Simple & Quick Analysis Model – Ready to Use Dynamic and Suitable for all sectors

This is a simple, ready-to-use, and highly dynamic LBO simple…

Purchase Price Allocation Simple Guidance + Goodwill & Consolidated Balance Sheet Template

This is a simple excel explanation model of Purchase Price…

Start-Up Business 3 Statement Model with Returns Calculation

This model can be used to analyze the financial return…

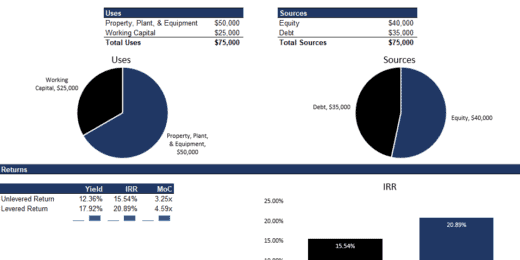

Investment Financial Models – All-in-One Bundle (5 Templates)

A collection of templates suitable for investment decisions in various…

6 Different Financial Modeling Assessments/Tests for Investment Banking

6 different Financial Model Tests with one coming with a…

Leveraged Buyout (LBO) Financial Model

Advanced Financial Model presenting a potential acquisition of a public…

Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset…

Due Diligence P&L – Exhaustive Revenue and Costs Analysis Template

Model for in depth understanding of high level profit and…

Leveraged Buyout (LBO) Model Template

The Leveraged Buyout (LBO) Model provides a business valuation of…

BAKERY – 3 Statement Financial Model with 5 Years Monthly Projection

This Bakery FM is a perfect tool for financial feasibility…

Juice Bar- 3 Statement Financial Model with 5 years Monthly Projection and Valuation

This Juice bar FM is a perfect tool for financial…

Pizzeria – 3 Statement Financial Model with 5 years Monthly Projection and Valuation

The Pizzeria FM is a perfect tool for financial feasibility…

Mobile Application (APP) – 3 Statement Financial Model with 5 years Monthly Projection

This Mobile App Business Plan Model is a perfect tool…

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns…

LBO Financial Model (Detailed)

A comprehensive LBO (Leveraged buyout) financial model to analyze investor…

Private Equity – Leveraged Buyout Model

The Private Equity Leveraged Buyout Model offers a simple template…

How Does a Leveraged Buyout Work?

What is a leveraged buyout? It might sound like complex financial jargon, but it's a fascinating and powerful strategy in the business world. At its core, a leveraged buyout model involves one company acquiring another using a significant amount of borrowed money to meet the purchase price. The assets of the company being acquired are typically used as collateral for the loans and the acquiring company's assets. This bold move can be a game-changer, allowing companies to make significant acquisitions without tying up a lot of capital upfront.

But how does a leveraged buyout work? In an LBO, the acquiring firm, often a private equity firm, uses the combination of equity and high debt levels to buy a target company. Once the acquisition is complete, the focus shifts to improving the acquired company's profitability and cash flow to pay down the debt over time. It's a high-stakes strategy that involves careful financial planning and a clear vision for enhancing the value of the acquired assets, paving the way for substantial returns on investment. However, the high leverage involved also introduces significant risks, highlighting why an LBO isn't just a financial decision—it's a strategic one.

What is a Leveraged Buyout?

A leveraged buyout (LBO) is a financial transaction in which a company is purchased with a combination of equity and significant amounts of borrowed money. The transaction is structured so that the acquired company's cash flow or assets are used to secure and repay the borrowed money. The assets of the two companies often serve as collateral for the loans. This strategy allows the acquiring entity to make large purchases without committing substantial capital expenditures. In a leveraged buyout (LBO), the acquiring company aims to purchase the target company using significant financial leverage provided by lenders who supply the necessary debt financing.

What is a leveraged buyout involving private equity? A leveraged buyout model involves three key components: significant financial leverage through private equity firms, active management of the acquired company, and a clear exit strategy.

- Firstly, a substantial portion of the purchase price is funded through debt. The private equity firm secures financing from banks, enabling it to magnify its returns—a process known as "leveraging" its investment. This financial structure allows private equity firms to maximize potential returns while minimizing initial capital outlay.

- Secondly, the debt is transferred to the acquired company's balance sheet post-acquisition. The private equity firm actively manages the company to improve operational efficiencies, boost profitability, and increase cash flows, ensuring the debt can be serviced and gradually paid down.

- Lastly, the private equity firm plans for a strategic exit at a higher value than the purchase price to realize a significant return on investment.

So, what is a leveraged buyout? A leveraged buyout model presents both high risks and potentially high returns. The primary risk stems from the significant use of debt, which can burden the acquired company with substantial interest payments. If the company's post-acquisition performance does not improve as expected, or if market conditions deteriorate, it may struggle to service its debt, leading to financial distress or even bankruptcy. On the return side, if the LBO is successful, using debt can dramatically increase the equity return to the investors. Even minor performance improvements can lead to significant returns relative to the equity invested, a phenomenon known as financial leverage.

Historical Leveraged Buyouts (LBOs)

The first recorded leveraged buyout (LBO) is generally considered the purchase of Orkin Exterminating Company by Rollins Broadcasting in 1964. This transaction is often cited as the earliest example of an actual leveraged buyout, where the acquisition of a company is made utilizing a substantial amount of borrowed funds (debt) to cover the acquisition cost. The Rollins family, which owned Rollins Broadcasting, used the assets of Orkin as collateral to secure the necessary debt financing, effectively pioneering the LBO technique that would become much more common in corporate finance and private equity decades later. The acquisition is distinguished not only by its success but also by its demonstration of how leveraged buyouts can be used to expand and transform a company's portfolio, even across vastly different industries. This transaction is often cited as an early example of the effective use of leveraged buyouts to drive corporate growth and diversification.

Nabisco's leveraged buyout (LBO) 1989 is one of the most famous LBOs in corporate history. Nabisco was a large company involved in the manufacture of cookies and tobacco through its parent company, RJR Nabisco. It was one of the largest consumer goods companies in the world during the 80's. In 1989, Kohlberg Kravis Roberts & Co. (KKR) acquired Nabisco for a whooping USD 25 Billion, making it the largest LBO during that time. KKR used a combination of high-yield junk bonds, traditional bank financing, and its own funds to finance the purchase. This transaction became a landmark event in the financial world, drawing widespread attention and leading to the publication of the book "Barbarians at the Gate," which chronicled the intense negotiations and strategic maneuvers involved.

The largest leveraged buyout (LBO) in history is the acquisition of the energy company TXU Corp. (now known as Energy Future Holdings) in 2007 valued at approximately $45 billion, including debt. The buyout was led by a consortium of private equity firms, including KKR & Co., TPG Capital, and Goldman Sachs Capital Partners. The massive size of the deal was notable not just for its financial scale but also for its timing, occurring just before the global financial crisis of 2008, which significantly impacted the deal's subsequent performance and the company's financial stability.

The leveraged buyouts (LBOs) of Orkin, Nabisco, and TXU highlight the strategic use of high debt levels to acquire companies across diverse industries, from pest control to snacks and energy. These transactions underscore the transformative impact LBOs can have on companies' growth and operations and reflect the varying degrees of financial success and challenges that can follow such high-stakes deals.

Key Characteristics of a Leveraged Buyout Model

Here are some key characteristics of what is a leveraged buyout model:

Criticism and Controversy

Leveraged buyouts (LBOs) often attract criticism and controversy due to their heavy reliance on debt and the associated business and social implications. Critics argue that the substantial debt levels imposed on target companies can significantly lead to severe financial distress, including cutbacks, layoffs, and even bankruptcy if economic or business conditions deteriorate post-acquisition. This debt burden can also force companies to prioritize short-term financial performance over long-term strategic investments and innovation, potentially stunting growth and affecting product or service quality.

Furthermore, LBOs are sometimes viewed as mechanisms for substantial wealth transfer to private equity managers and investors at the expense of other stakeholders, including employees and creditors. The aggressive nature of these transactions and their impact on employees and communities fuels the debate over their ethical and economic implications, making them a subject of public scrutiny and regulatory interest.

High Debt-to-Equity Ratio

The debt-to-equity ratio is a financial ratio that measures the proportion of a company's debt to its equity. In a leveraged buyout model, the high debt-to-equity ratio, often around 90% debt to 10% equity, is fundamental to the financing structure, introducing significant financial risk. This substantial leverage amplifies the potential returns to the equity holders if the company performs well post-acquisition; however, it also significantly increases the risk of default.

High Risks and Returns

Leveraged buyouts (LBOs) involve distinctive risks and return characteristics primarily influenced by their heavy reliance on loans and debts. LBOs allow investors to make significant acquisitions without committing much capital. Small equity contributions can be leveraged into substantial returns if the acquired company performs well. Conversely, if the company underperforms, the high debt can lead to financial distress or bankruptcy.

Well-Defined Exit Strategy

Leveraged buyouts (LBOs) typically involve well-defined exit strategies primarily because the private equity funding behind these transactions seeks to realize significant investment returns within a set timeframe, usually four to seven years. These exit strategies are crucial for converting enhanced company values into liquid financial returns. This approach allows private equity firms to return capital to their investors, satisfying the finite lifecycle of their investment funds and facilitating the repayment of substantial debts incurred during the initial buyout.

In general, what is a leveraged buyout equates to a financial transaction where a company is acquired using a significant amount of borrowed money, with the assets of the acquired company often serving as collateral for the loans. This high leverage amplifies potential returns but increases financial risk, typically prompting private equity firms to implement aggressive management strategies and plan exit strategies within a few years to realize gains.

A Detailed Breakdown of the Leveraged Buyout Model

A leveraged buyout (LBO) model offers a fascinating glimpse into the high-stakes world of finance, where investors use borrowed funds to acquire companies, betting on future profitability. Here's a detailed breakdown that unpacks the mechanics behind LBOs, revealing how they can transform debts into lucrative investments through strategic restructuring and management.

Target Selection

The initial phase in implementing a leveraged buyout model involves selecting an appropriate target company. The selection process involves rigorous industry evaluation to identify companies that can generate enough cash flow to service the debt incurred during the buyout. To qualify as an ideal candidate for an LBO, a company should exhibit several critical financial and operational characteristics:

- Consistent Cash Flows: A company suited for an LBO must have consistent cash flows. This predictability in cash inflows ensures that the company can consistently cover debt payments and operational costs, which is crucial when servicing the significant debt levels typically involved in LBOs.

- Low Existing Debts: A company with minimal existing debt is preferable because it allows room for additional leverage. When a company already has high levels of debt, it becomes riskier and potentially less attractive to lenders and investors, as the additional debt taken on to finance the LBO could strain the company's financial stability.

- Valuable Collateral Assets: Possessing valuable assets is a significant advantage for an LBO candidate. These assets can be used as collateral to secure new debt, which is a cornerstone of the LBO financing structure. Collateral reduces the risk for lenders, potentially leading to more favorable borrowing terms.

- Stable Earnings: Similar to consistent cash flows, stable and predictable earnings are crucial. They ensure that the business can maintain profitability over time, essential for managing new debt obligations and eventually providing a return on the investment.

- Steady Business Operations: Stability in operations often indicates a mature business model, efficient management, and a solid market position, which can reassure lenders and investors about the company's ability to generate sufficient earnings before interest, taxes, depreciation, and amortization (EBITDA). This financial predictability helps structure the debt appropriately. It enhances the feasibility of achieving favorable returns on investment through operational improvements and strategic financial management during the ownership period.

Together, these factors make a company an attractive LBO candidate by minimizing financial risks and enhancing the likelihood of a successful buyout that is profitable for the investors involved. These characteristics ensure the company can handle the substantial debt it will take on to finance the buyout and can be exploited to enhance value post-acquisition.

Leveraged Buyout Valuation

A leveraged buyout valuation process involves assessing the financial viability of acquiring a company primarily using borrowed funds. Financial analysts or potential acquirers analyze the company's financial statements and forecasts to evaluate its capacity to service debt. Key metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) are scrutinized to estimate the company's available cash for debt repayment. The valuation also involves determining the amount of debt the company can handle, typically structuring the debt across senior, mezzanine, and sometimes high-yield bonds.

During a leveraged buyout valuation, the private equity firm assesses the target company's value to determine the maximum price it can pay to achieve desired returns. This involves calculating the potential return on investment under various scenarios, projecting the company's future cash flows, and determining the enterprise value at the end of the investment period, usually through a planned exit strategy like a sale or public offering. A leveraged buyout valuation typically includes sensitivity analyses to understand how economic conditions or company performance changes could affect the investment outcome. The objective is to buy the company at a price that allows for significant value creation through operational improvements, growth initiatives, or market changes.

Leveraged Buyout Financing

The third step involves arranging the necessary leveraged buyout financing. A leveraged buyout financing is typically a mix of debt and equity. Banks and institutional investors often provide the debt used in leveraged buyout financing. These may include senior bank loans, mezzanine financing, and high-yield bonds. The private equity firm conducting the buyout and other co-investors usually provide the equity. The structure of leveraged buyout financing is critical. It must align with the cash flow dynamics of the target company to ensure the debt can be serviced reliably while providing a reasonable expectation of return on invested capital.

- Private Equity Sponsors: In the context of leveraged buyout financing, private equity sponsors, usually private equity firms, play a crucial role. They provide a significant portion of the funding needed for the buyout, typically contributing 10% to 50% of the total purchase price. This contribution is made in cash and represents the equity portion of the LBO financing structure. This initial investment is crucial as it not only funds a part of the acquisition but also leverages additional debt financing by showing commitment and confidence in the success of the buyout.

- Bank Financing: Private equity sponsors often resort to bank financing to fund most of the LBO. It involves borrowing from a single bank or a syndicate of banks. The borrowed funds are usually structured as a fixed-rate business loan, which might also involve a revolving credit line. A revolving credit line is a flexible financing tool where the borrower can withdraw funds, repay them, and borrow again up to a set credit limit. This leveraged buyout funding is essential for providing the liquidity needed to complete the buyout and to support the company's ongoing capital needs.

- Bonds or Private Placements: Another method for raising funds in an LBO is issuing bonds or engaging in private placements. These are debt instruments the company, which is being acquired, can issue to raise capital. Investors purchase these bonds at their face value and receive periodic interest payments until the bond reaches its maturity or expiration date. A bond dealer, acting as an arranger, facilitates these transactions in the bond market. This component of leveraged buyout funding is crucial for providing a long-term debt component that supplements bank financing.

- Mezzanine Financing: Mezzanine financing is a hybrid form of capital that combines elements of both debt and equity. It is used in LBOs when additional funding is needed, but the company doesn't want to, or can't, provide more collateral. Mezzanine financing typically carries a higher interest rate than senior debt due to its subordinate ranking in the event of a default. Additionally, lenders may require warrants or options, which are rights to purchase equity later, adding a potential equity upside to their investment. This leveraged buyout funding is precious for bridging gaps between senior debt and equity contributions.

- Seller Financing: Seller financing occurs when the current owners of the company being sold provide part of the financing themselves. Instead of receiving the full payment upfront, the seller agrees to deferred payments that the new owners will pay over time. These arrangements create a debt-like obligation on the company's balance sheet, contributing to the LBO's financing structure. Seller financing can be advantageous as it helps facilitate the deal by allowing the buyer to pay over time, which can be particularly useful when other forms of funding may be insufficient or too costly.

Significant Acquisition

This phase covers the actual acquisition process. During this phase, the leveraged buyout financing structure is finalized, where the proportion of debt versus equity is determined based on risk assessments and financial projections. The financing structure usually involves various layers of debt, including senior bank loans and subordinated debt like mezzanine financing, which might also include equity-like features such as warrants or options. Negotiations with lenders and other financial institutions are critical at this stage to secure favorable terms. The deal structure must align with strategic goals, such as optimizing tax considerations and ensuring compliance with regulatory requirements.

Once financing is in place, the acquisition is executed, which might involve negotiating with the target's shareholders, mastering the art of due diligence to confirm the company's financial and operational status, and securing all necessary regulatory approvals. The legal and financial risks are thoroughly assessed to ensure the transaction can proceed smoothly without unforeseen liabilities. This phase culminates in integrating the target into the acquirer's operations, focusing on realizing synergies and implementing operational improvements to drive value creation. This step is crucial as it ensures all stakeholders are aligned.

The Exit Strategy

The final step in the leveraged buyout model is planning and executing an exit strategy. This strategy is essential for realizing the value created during the holding period. It involves different methods to conclude the investment with a profitable return. Here's a breakdown of each exit strategy:

- Strategic Sale to Another Company: In a strategic sale, the private equity firm sells the acquired company to another business that sees the target as a good fit for its strategic goals. This buyer could be looking to enter a new market, develop new technology, benefit from synergies, or eliminate a competitor. The strategic buyer is often willing to pay a premium over the market value because of the potential long-term benefits, making this exit strategy particularly lucrative.

- An Initial Public Offering (IPO): An IPO involves selling shares of a previously private company to the public on a stock exchange. This route can be very profitable but comes with higher costs and complexities, such as regulatory requirements and market risks. Before pursuing an IPO, the company must demonstrate sustained profitability and market appeal to attract potential investors. This method also allows the private equity firm to gradually exit by selling off its shares over time, potentially at increasing valuations.

- Secondary Sale to Another Private Equity: In a secondary buyout, one private equity firm sells the company to another. It often occurs when the selling firm has maximized its value creation strategies but believes further long-term value could still be realized. The buying firm typically has different capabilities, techniques, or a longer time horizon to manage the investment. Secondary buyouts can appeal if market conditions are unfavorable for an IPO or a strategic sale.

- Leveraged Recapitalization: This strategy involves the company taking on new debt to fund a hefty dividend payout to the shareholders, typically the private equity owners. It is considered once the company has paid a significant amount of the initial acquisition debt and generates stable cash flows. Leveraged recapitalization allows the private equity firm to realize an immediate return on its investment while still holding a stake in the company, which could be sold in the future. It's a way to reward investors without selling or floating the company.

The timing and method of exit depend on market conditions, the success of the operational improvements implemented, and the overall investment strategy of the private equity firm. The goal is to exit at a time that maximizes the returns on the initial investment, typically within 4 to 7 years of the acquisition.

Each of these steps shows how a leveraged buyout works. It requires detailed planning and precise execution to ensure the buyout is successful and delivers the expected financial returns to the investors involved.

Streamline Leveraged Buyouts with Expert Financial Modeling

How does a leveraged buyout work? It is a financial strategy where a company is purchased primarily through borrowed funds. These funds often comprise a significant debt, which the acquired company's assets typically secure. The main goal of an LBO is to enable investors to make large acquisitions without committing a lot of capital. Over time, the debt is repaid from the cash flows of the acquired company or through the sale of its assets, ideally leading to a substantial return on equity for the investors once the debt is fully paid off.

Expert financial modeling is indispensable to streamlining the process of leveraged buyouts. By employing sophisticated financial models, investors can better assess the viability and profitability of a potential LBO. These models help forecast future cash flows, understand the debt repayment schedule, and evaluate the target company's overall financial health. It not only aids in making informed investment decisions but also enhances the management of financial risks associated with high leverage, ensuring a smoother transition and potentially more successful outcomes in leveraged buyouts.