Financial Planning

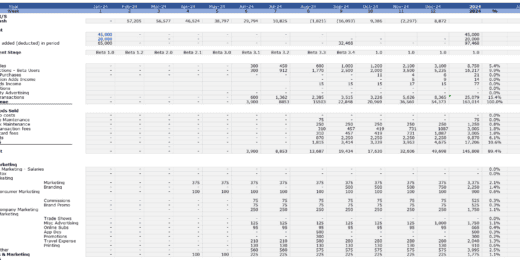

Manufacturing KPI Management Excel Dashboard

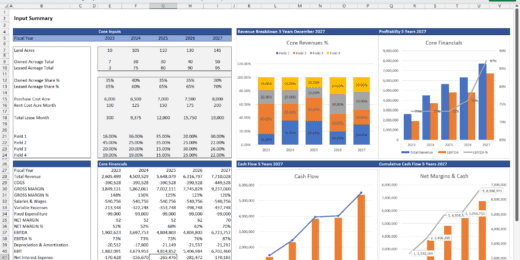

A manufacturing key performance indicator (KPI) is a clearly defined…

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

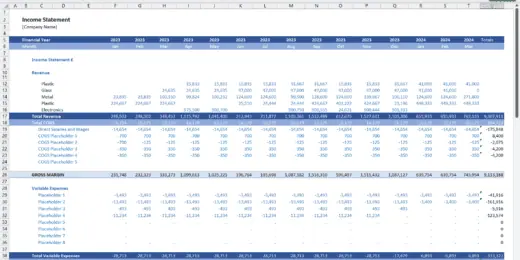

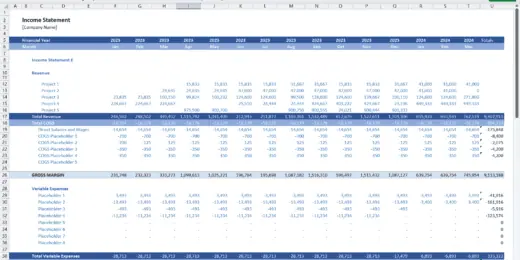

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

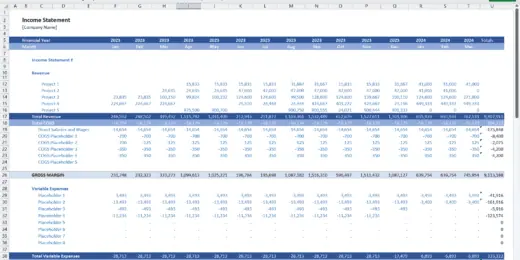

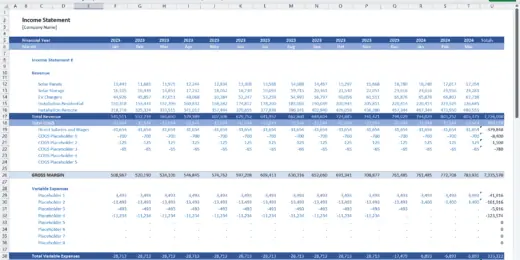

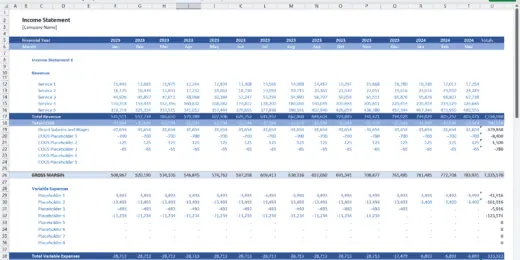

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

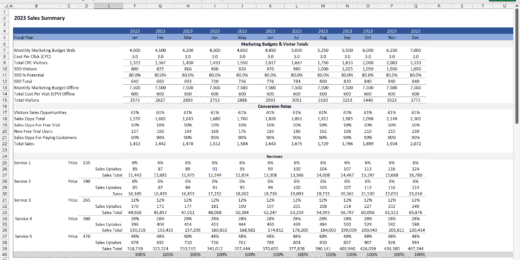

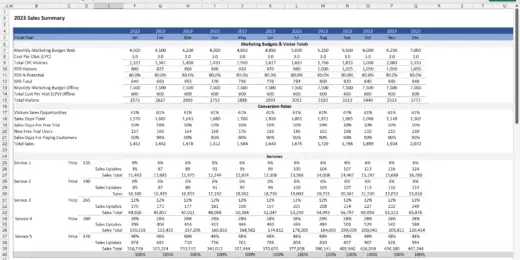

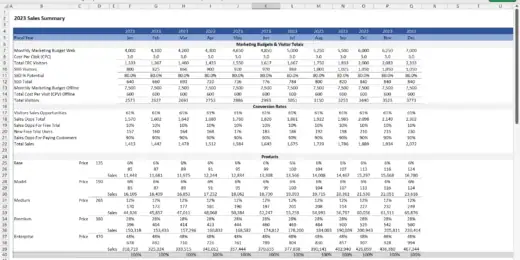

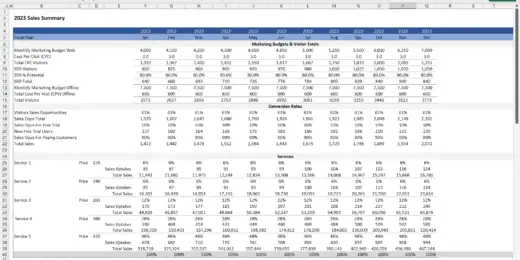

Online Store Sales Dashboard Excel Template

Equips businesses with actionable insights for optimizing sales strategies tailored…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Diagnostic Collection Center Financial Model

It is financial model for diagnostic collection center whose phlebotomists…

Mobile Imaging Center Financial Model

This Excel model facilitates mobile imaging services by providing equipment…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

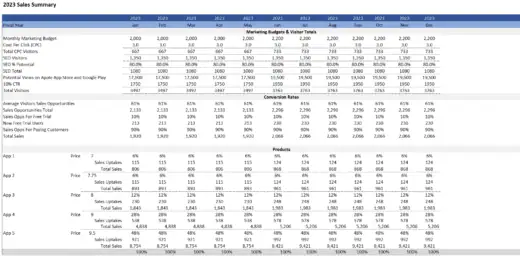

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Indoor Golf Centre Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Golf…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Mobile App Development Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Mobile App…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Social Media Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Social Media…

Affiliate Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Affiliate Marketing…

Web Hosting Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking web hosting…

HR Expense Control Excel Template and Dashboard

Human Resources Expenses spreadsheet is a vital tool for effectively…

5 Year 3 Statement Recycling Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Recycling Centre…

5 Year 3 Statement Construction Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking construction company…

5 Year 3 Statement Solar Energy Solutions Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Solar Energy…

Digital Advertising Agency Finance Model Excel Template

A comprehensive editable 5 Year 3 Statement, MS Excel spreadsheet…

5 Year 3 Statement Virtualization Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Virtualization Software…

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Graphic Design Company Finance Model Excel Spreadsheet

A comprehensive editable, MS Excel spreadsheet for tracking Graphic Design…

5 Year 3 Statement Private Mental Health Care Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking private Mental…

5 Year 3 Statement Alpaca Farming Finance Model Excel Template

A comprehensive 3 Statement 5 Year editable, MS Excel spreadsheet…

5 Year 3 Statement Architect Company Finance Model Excel Template

A comprehensive 5 Year 3 Statement editable, MS Excel spreadsheet…

Swimming School Finance Model Excel Template

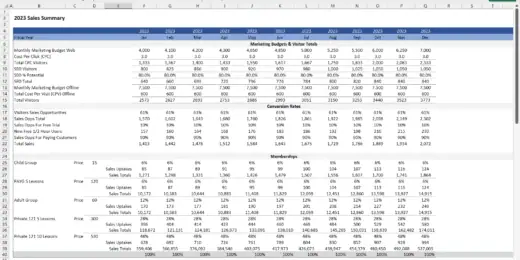

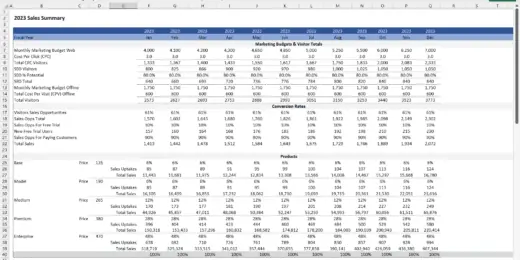

A comprehensive editable, MS Excel spreadsheet for tracking Swimming School…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

3 Statement 5 Year SAAS HR Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking SAAS HR…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

The Essentials of Financial Planning

“Most people don’t plan to fail; they fail to plan.” – John L. Beckley, the first librarian of the U.S. Congress.

Starting a business is always complex. Problems requiring specific solutions may emerge during the various phases. So, to achieve your business goals, financial planning is the key. A financial plan in business determines if your investments would yield higher returns. It helps you better understand how your money will work and builds a roadmap to a profitable business.

On this page, we would like to clarify and explain certain things when it comes to how to do financial planning in business:

- What is Financial Planning?

- The Need for a Financial Plan

- Steps in Financial Planning

- Common Pitfalls of Financial Planning

- Summary

Life's already complicated, so make sure your investment is sound. Solid investments start investing with clever ideas like financial planning tools. Today, using tools for financial planning like excel templates, finance models, and online calculators can help you better achieve, manage, and plan your business goals. They can help you build business solutions by better understanding them.

What is Financial Planning?

Before laying down the financial planning concept, let us highlight that it is not a product. Instead, it is a PROCESS. As such, financial planning is a long-term strategy for wisely managing business funds and resources to achieve goals and objectives while overcoming the financial obstacles that invariably appear at every stage of operation.

The scope of financial planning typically covers three to five years, as, during this time, it's easier to make an educated prediction compared to longer planning horizons of 10 to 30 years. The objective of financial planning includes ensuring that a business can be run profitably (which is a requirement for any business to sustain in the long-term and ensuring sufficient funding availability in case significant investments or growth is required. Financial planning also includes ensuring that all lenders can be repaid and the projected financial ratios align with a solid business's standards.

Financial planning and analysis go hand in hand. Both include framing policies in fund administration, budgeting, and procurement. They involve a quantitative and qualitative review of every facet of a company’s operations to map out future goals and growth.

The Need for a Financial Plan

A financial plan is a comprehensive picture of your capital, cash flow, and expenses budgeting to achieve specific financial goals of financial planning during the course of multiple years into the future. Such a plan should state the main assumptions used to build such a plan and provide transparency on how financial projections were calculated.

Preparing a financial plan at this quality level typically offers deep insights into a business model. The requirement is a careful analysis of your expected profits, investments, net working capital requirements, cash flows, debt schedule, taxes, financial ratios, metrics, break-even point, and many other elements of a solid financial strategy.

Financial planning is used to back up a business strategy and translates objectives and management actions into quantifiable goals related to the expected financial performance and positions to achieve.

A good financial plan allows you to make the most of your assets and provides you the confidence to grow them. As it sets expectations for what may happen, you can translate business strategies to achieve your financial goals.

Every business needs a financial plan as it is one of the essential tools for financial planning and analysis. It involves a comprehensive examination of your income and expenses. It helps you understand your goals and how to achieve them. Better yet, a financial plan keeps you from stress and trouble as it clarifies your actions in reducing debts and saving for emergencies.

Typically, a business will need a financial plan for the following:

- Asset acquisition, investment, and project allocation

- Budgeting and cash flow management

- Measuring business growth and progress

- Prioritizing expenditures to conserve and maximize financial resources

- Setting targets based on quantifiable industry benchmarks

Difference Between a Business Plan & Financial Plan

On many occasions, financial plans go side by side with business plans. That is because a financial plan is integral to a business plan. Yet there is a big difference between the two. A business plan covers the distribution of products and services, market positioning strategies, team roles, and what makes a company unique. It tells how the company will operate and how the team will work. In contrast, a financial plan covers numbers and projections. As such, banks and investors are more interested in a financial plan.

Who Prepares a Financial Plan?

Sound financial planning starts with establishing goals and then continues implementing and monitoring their progress. That’s why there is a need to create a financial plan. Now, the question is, do you need financial planning certification to prepare one?

Generally, business owners, CEOs, CFOs, investors, the management team, or startup founders prepare the financial plan. However, it requires financial expertise and industry know-how. So, they will need assistance from financial advisors, consultants, modelers, investment bankers, or wealth managers. Their knowledge of financial modeling allows them to customize what is a financial model that the business may need.

Always remember financial planning continues beyond preparing a financial plan. It is as good as the team committed to delivering the goals and strategies within it. Every financial plan is only helpful with capable people implement it.

Steps in Financial Planning

Financial planning differs from business to business or project to project. Some may be short-term, and others may be long-term. Some focus on online marketing, while others establish distribution plots for large manufacturing sites. Yet, all in all, it is a roadmap to achieving your revenue targets. In general, here are the steps in financial planning.

Step 1 - Set Motivational Financial Goals

The first step is to set your financial goals. Make it motivational by imagining what you want in 5, 10, or 20 years. Turn them into concrete targets by laying out the complete steps to achieve them.

Step 2 - Outline a Budget Forecast

The next step is to determine your capital, income, and expenses. Forecast the money that will come in and the money that will go out. It can help you develop medium-term and long-term plans by knowing where your money will go.

Step 3 – Experiment with Different Scenarios

The best way to see if you have an effective financial plan is to simulate different downside risks and upside potentials. Such sensitivity analysis can help you better understand how the business will work in different scenarios. Most of the time, it results in revisions to address crucial assumptions.

Step 4 - Conduct a Regular Review of Your Financial Plan

Financial planning is fluid, with changing objectives and markets requiring constant review. Regular reviews ensure your plan remains on track and meets your needs and goals. They also provide a chance to reevaluate the risk tolerance of investments as they shift over time.

Common Pitfalls of Financial Planning

Knowing the common pitfalls of financial planning makes it easier to avoid them. Yet many only show up once the business starts operating. So, to help you create are robust financial plan, you need to be aware of these situations.

Undermining Cash Flows

It's simple to overspend and get into financial trouble by undermining your cash flows. Therefore, you must clearly understand money coming in and out to avoid such financial difficulties. The first thing is knowing the precise date that receivables are anticipated. Then, adhering to payment schedules of your debts and payables comes next.

Spending Too Much Money

It's easy to get carried away and let your spending habits go out of control when everything seems to be going well. Before you know it, you've brought on five extra team members, rented a new office, and purchased a brand-new vehicle. In addition, the "nice-to-have" costs, like coffee mornings or company dinners, may pile up rapidly and significantly. Small and large expenses require caution as they can dramatically impact your company's bottom line. Make sure your budget takes all of your costs into account.

Helpful Financial Planning Tools Online: A budget planner spreadsheet is one of the best tools for financial planning you can use to keep track of your cash inflows and outflows. Its visualization features make it easy for businesses to adhere to payment schedules and avoid overspending.

Poor Inventory Management

Changes in market demands may lead to inappropriate inventory levels. It leaves money on the table, resulting in a low-profit margin. So, companies should keep close tabs on their inventory levels and prepare for changes in demand. They should maintain accurate sales and purchase records to maintain adequate inventory turnover rates.

Helpful Financial Planning Tools Online: An inventory management control and tracking template can help users manage and track inventories. It provides updated real-time inventory information together with analysis and charts. Such visual representations make it an accessible dashboard for product KPIs.

Growing Too Quickly

Too many companies push their expansion plans forward before they are confident enough to do so. These may result in cash shortage and a decrease in productivity. Hence, companies should maintain a sizeable working capital reserve in case of unanticipated costs and liabilities. Adhering to your plan and growing at a modest rate is best.

Failure to Plan for Worst-Case Scenarios

Every business may experience a sudden dip in customer demands, workforce losses, or unforeseen catastrophes or events. These things happen, and failure to plan in these worst-case scenarios can lead to closure. The key is to implement contingency plans and financial buffers. These you can do by carrying out risk analysis.

Helpful Financial Planning Tools Online: One essential financial planning and analysis concept is learning to value different investments or operational projects. Determining the most profitable project or investment can help them grow modestly. A feasibility metrics excel template can help calculate IRR, NPV, and Payback to consider and rank investments. Furthermore, a risk analysis and matrix can help a business identify risks and how to treat them.

Summary

Financial planning is not an activity that should be taken lightly. To succeed, you need to have clear objectives and a strategy for managing your finances and minimizing risk.

A financial plan requires an in-depth look at the business capital, cash flow, and expenses to achieve specific financial goals. When doing so, it is best to seek help from the experts, such as financial advisors, consultants, modelers, investment bankers, or wealth managers. A team committed to delivering the goals and strategies within it is also needed.

The first step in financial planning is to identify business goals and objectives. The second step is to forecast the money that will come in and the money that will go out. Then, assessing any risks associated with achieving those goals is essential. Finally, it should be a continuous review process to ensure that plans remain on track and meets current needs and goals.