Break-Even

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

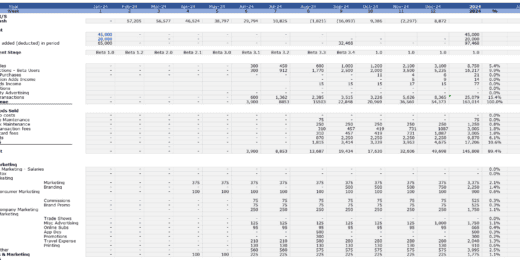

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

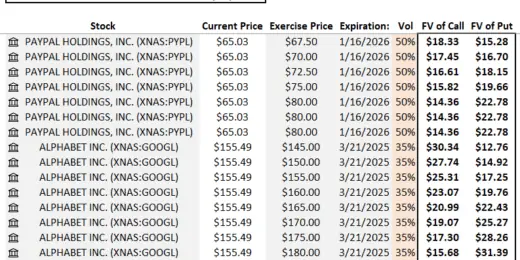

Equity Options Fair Value Calculator (Black-Scholes)

The Equity Options Fair Value Calculator (Black-Scholes) is your go-to…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Fruit Processing Facility – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Auto Parts Store – 5 Year Financial Model

This Financial Model Template provides an advanced 5-year financial plan…

Brewery Financial Model and Budget Control

This Excel model is an advanced, user-friendly financial planning tool…

Surfboard Rental Business Financial Model

Surfing is not just a sport—it's a lifestyle booming globally.…

Motorboat Rental Business Financial Model

Dive into the heart of financial planning with our Motorboat…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

Crypto Token Valuation Model

A cutting-edge crypto token valuation model, designed to provide comprehensive…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Trucking Company – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Pet Grooming Business Dynamic Financial Model 2024

Tailored for pet grooming businesses, this dynamic financial model streamlines…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Ship Management Business 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a startup…

Online Tutoring Services Financial Model (10+ Yrs DCF and Valuation)

The Online Tutoring Services Financial Model is a comprehensive tool…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Cocktail Bar – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Self Storage Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Truck Rental Company Financial Model

This detailed 10-year monthly Excel template is specifically designed to…

Private Aircraft Rental Company Financial Model

Embark on a journey to financial mastery with our Private…

Webinar Organizer Business Plan Template

Discover the key to financial success in your webinar ventures…

Party Planning Business Financial Model

Introducing the Party Planning Business Financial Model – Your Ultimate…

Culinary Arts Academy – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Dog Grooming Services Financial Model (10+ Yrs DCF and Valuation)

The Dog Grooming Services financial model is a comprehensive tool…

Ship-to-Ship Fuel Bunkering 5-Year 3 Statement Financial Projection Model

5-year rolling 3 statement financial projection with a monthly timeline…

Student Accommodation Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Care Home Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a multi…

Event Organizer Business Model Template

Elevate your event planning business to new heights with our…

Sailboat Rental Business Financial Model

This comprehensive 10-year monthly Excel template offers an ideal basis…

Rental Property (Airbnb – Real Estate) Financial Model

Powerful Real Estate Rental Property Financial Model for Informed Decision-Making,…

Sky Diving Center – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Financial Modeling Mastery Bundle: Diverse Insights for Informed Decision-Making

Unlock financial expertise with our 'Diverse Insights Bundle.' Seven meticulously…

Crypto Trading Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan of a…

Events & Weddings Venue – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

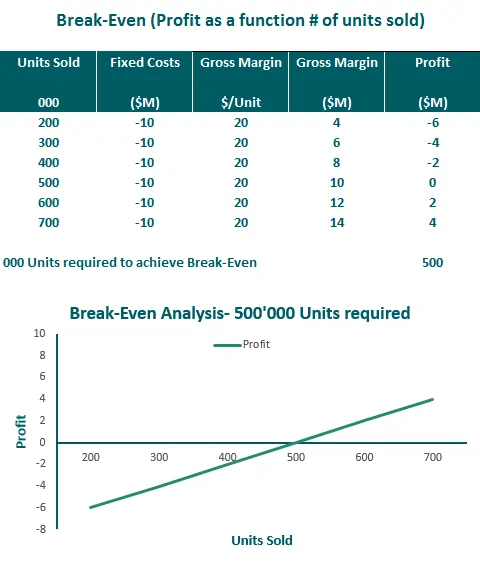

What is Break-Even Analysis

A break-even analysis involves the calculation and the evaluation of a project’s feasibility by determining which month or year from now a business becomes profitable or able to at least cover the costs incurred. Basically, once you've reached the break-even point, you are neither losing money nor making money but all your costs have been covered. In finance, calculating the break-even point does not include the cost of working capital since it only considers the expended costs for the benefit of the project or investment and other costs required to develop a project or investment.

Break-even analysis is a useful tool as a metric to calculate the level of fixed costs relative to the profit earned by the project. Thus, if a project has a lower fixed cost, it will tend to have a lower break-even point. Since the break-even point is the point at which the cost or expenses and revenue are equal, there is no net loss or gain. It is considered as such, although the opportunity costs have been paid and the capital has received the risk-adjusted, expected return. This means that the break-even point is the point in which the total revenue of a business exceeds its total costs and then the business is able to create wealth instead of expending it.

In other words, the break-even point is reached once the generated revenue equals the total costs accumulated until the period of profit generation. By conducting a break-even analysis, the business will be able to set a solid business plan to which they can ensure a steady stream of revenue and maintain profitably.

How to Calculate the Break-even Point – Using the Break-even Analysis Calculator

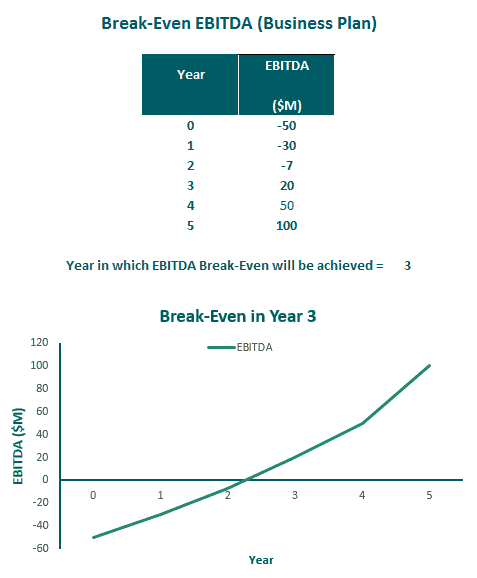

There are a few basic calculation methods to which you can determine a business’ break-even point. The first one is based on the number of units of products sold, next is based on the earnings before interest, taxes, depreciation, and amortization (EBITDA) for a business plan, and then the other is based on the point in sales dollars.

The formulas to calculate the break-even point is as follows:

Calculating Break-Even Point based on Units: You first need to divide the fixed costs by the revenue per unit sold and then subtracted by the variable cost per unit. The fixed costs are those expenses that do not change, thus the term “fixed”, no matter how many products get sold. Then the revenue is what you consider as the price for which you are selling the products deducted by the expenses incurred to create the product, like labor, materials, etc. This can be better expressed by the following formula:

Break-even Point (Units) = Fixed Costs / ( Revenue per Unit – Variable Cost per Unit )

Example:

This is an operational view to get the pricing right and figure out how many quantities you need to achieve break-even.

Calculating Break-Even Point based on EBITDA: EBITDA is “Earnings Before Interest, Taxes, Depreciation and Amortization” and is a standard indicator of financial performance. It can be used to determine the break-even point of a business by simply calculating the EBITDA and once you arrived at a positive cash flow, then that will be the estimated break-even point. The EBITDA can be calculated by the following formula:

EBITDA = ( Revenue - Expenses ) + Depreciation + Amortization

Example: A high-level view of the business plan overall.

Calculating Break-Even Point based on Sales Dollars: You first need to divide the fixed costs by the contribution margin ratio which you can determine by calculating the contribution margin per unit divided by the sale price. The contribution margin is the excess between the selling price of the unit and the total variable costs. To better understand how to calculate it, refer to the following formula:

Break-even Point (Sales Dollars) = Fixed Cost / Contribution Margin Ratio

where:

Contribution Margin Ratio = Contribution Margin per Unit / Sales Price

For a more detailed look at the formula, we’ll list what each entails:

- Fixed Costs – The expenses incurred which are fixed and unaffected by the number of items sold. E.g. rent, interests, equipment and software, fees paid for services, etc.

- Variable Costs – The expenses that increase with the production of units, products, or services. E.g. raw materials, distribution expenses, packaging, labor, etc.

- Contribution Margin – As mentioned above, it is the excess between the selling price of the good and total variable costs. So, if the price of the unit is $100 and the materials + labor is $50, then the contribution margin is $50. The contribution margin is then used to cover the fixed costs where the excess after that will be considered as the net profit.

- Contribution Margin Ratio – Usually expressed as a percentage, it is calculated by simply subtracting your fixed costs from your contribution margin. Then after, you will be able to determine the factors to reach break-even, such as cutting production costs, raising prices, etc.

- Profit after Break-even Point – Once your revenue equals your fixed and variable costs, you have reached the break-even point. A report will then show a net profit or loss of $0. Beyond that point, it will all contribute to your net profit.

To help you calculate the break-even point, you can also refer to tools such as a break-even analysis calculator. Basically, a break-even analysis calculator will provide you with a tool to easily calculate the break-even point of a business by simply inputting the required variables for calculation. The break-even analysis calculator is usually included in a financial model which you can build to evaluate a business' or project's financial feasibility.

Break-Even Analysis Example Models

Usually, when conducting a break-even analysis, one would create a complete financial model instead and included the break-even analysis to further provide data about the evaluation of a business or project. A financial model is a great tool to assess an entity’s financial feasibility as well as providing a comprehensive financial report regarding an entity’s value or financial position. Thus, including the break-even analysis is an important component to showcase the break-even point of an entity.

Listed above are break-even analysis example models which you can use to create your very own financial models with break-even analysis included. These break-even analysis example models are ready-made by financial modeling experts with vast experience and industry know-how. So, you won’t have to build a model from scratch to be able to evaluate the financial feasibility of a project. Depending on your requirements, the break-even analysis example models come in Excel, so it wouldn’t be that hard to adjust it according to your preference.