Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery rental sector with our sophisticated 10-year monthly financial model template. Tailored specifically for the rental industry’s unique challenges and opportunities, this tool empowers you with in-depth analysis and projections, facilitating informed decision-making and strategic planning.

In the ever-evolving construction industry landscape, the demand for cutting-edge machinery meets the challenge of financial sustainability. A construction machinery rental company plays a pivotal role. It is the backbone of construction projects, providing access to high-quality equipment without the hefty price tag of ownership. However, navigating this sector’s financial complexities and uncertainties demands strategic foresight and meticulous financial planning. This is where the importance of a construction machinery rental company financial model template becomes undeniably evident.

A Construction Machinery Rental Company Financial Model Template is a navigational compass offering detailed insights into heavy machinery rental companies. This strategic tool helps identify potential financial risks and opportunities, optimize cash flow management, and facilitate informed decision-making. Projecting monthly revenues, expenses, and capital expenditures over a decade offers a comprehensive view of the company’s financial trajectory. Thus, it plays a pivotal role in securing investments, managing assets efficiently, and steering the company toward its financial goals in the ever-evolving construction industry.

Top Financial Queries for Construction Machinery Rental Services

A Construction Machinery Rental Company Financial Model Template can help answer key questions to guide financial planning and decision-making for construction machinery rental services:

- Investment Requirement: How much capital is required to start or expand the construction machinery rental business?

- Buy or Lease Strategy: Is buying the construction machinery outright financially more viable than leasing it?

- Rental Rates: What rental price points should be set for different types of construction machinery to remain competitive yet profitable?

- Operating Costs: What are the ongoing operational expenses, including maintenance, insurance, and staffing, associated with running the rental service?

- Equipment Lifetime: Over what period can each type of construction machinery be expected to generate revenue before it needs to be replaced?

- Seasonality: How do seasonal variations affect demand and revenue, and how can the business adjust to these changes?

- Cash Flow: What is the projected cash flow from operations, and how does it impact the business’s liquidity and ability to reinvest?

- Expected Monthly and Annual Revenue: What are the expected monthly and annual revenues from renting out the construction machinery?

- Fleet Expansion: Based on projected demand and financial health, when and how should the business plan to expand its fleet?

- Debt Schedule: What is the debt repayment schedule for any borrowed funds, and how does this affect the business’s financial planning?

- Return on Equity: What is the expected return on equity for the owners or investors in the construction machinery rental business?

These questions are crucial for understanding the financial viability and strategic planning required to successfully operate and grow a construction machinery rental company.

Maximizing Return of Heavy Machinery Rental Companies

Several key profit margin drivers significantly influence the performance of heavy machinery rental companies. Each plays a crucial role in revenue generation and cost control, directly impacting operational efficiency and profitability. By meticulously analyzing and optimizing these factors, businesses can unlock significant gains in efficiency and customer satisfaction.

- Fleet Size: A larger fleet size enables a construction machinery rental company to serve more customers simultaneously, potentially increasing revenue.

- Fleet Mix: The composition of the fleet (types and models of equipment) affects the company’s ability to meet diverse customer needs and impacts rental rates and utilization.

- Rental Duration: Longer rental durations on construction machinery for rent can ensure steady income streams, improve asset utilization, and reduce the loss associated with frequent turnovers and vacancies.

- Rental Rates: Setting competitive rental rates can attract more customers, balancing demand and profitability to impact the bottom line positively.

- Cost Structure: The proportion of fixed to variable costs influences the company’s flexibility in pricing and profitability under different levels of business activity.

- Occupancy Rate: Higher occupancy rates of construction machinery for rent typically indicate efficient utilization of assets, leading to increased revenue and improved business performance.

- Pricing Strategy: Effective pricing strategies balance demand, market conditions, and operational costs to ensure competitive positioning and profitability.

- Seasonal Demand: Seasonal demand fluctuations can affect equipment utilization rates and pricing, requiring strategic planning to optimize profits year-round.

- Upsells: Offering additional services or products (upsells) to rental customers can generate higher revenue from existing transactions, boosting overall financial health.

- Equipment Financing: Favorable financing terms for purchasing equipment can reduce monthly costs and improve profit margins through lower interest expenses.

- Bank Loans: The terms and interest rates of bank loans for business operations can significantly impact the company’s cost structure and net profitability.

Together, these drivers provide a comprehensive framework for understanding heavy machinery rental companies’ financial health and strategic direction.

Strategies to Elevate Your Construction Machinery Rental Company

Exploring financing scenarios for the growth of your construction machinery rental company is pivotal in navigating the competitive landscape and capitalizing on market opportunities.

- Modeling up to 5 fleet expansions of construction machinery allows a focused efficiency analysis, helping users understand the financial and operational repercussions of adding or removing equipment.

- Determining the expected lifetime per construction machinery ensures accurate forecasting of replacement timing and the additional costs to be incurred.

- Deciding when to buy or lease involves analyzing the financial implications to optimize cash flow and tax benefits.

- Considering bank loans for expansion provides insight into leveraging debt for growth while managing repayment obligations.

Unveil the Blueprint of Financial Mastery with Our Construction Machinery Rental Model!

The Construction Machinery Rental Company Financial Model Template is a comprehensive tool designed to help business owners and financial analysts understand and plan the financial dynamics of a construction equipment rental business. It breaks down vital financial components, from revenue streams to budget analysis, ensuring strategic planning and decision-making.

- Instructions and Terms of Abbreviations: This section provides a guide to the template’s usage and explains the abbreviations used throughout the model for clarity.

- Assumptions: This section outlines the foundational assumptions about market conditions, pricing strategies, and operational efficiencies on which the financial model is based.

- Executive Summary: A high-level overview featuring summaries, visual charts, and schedules to quickly grasp the business’s financial health.

- Detailed Summary: The Detailed Summary in the Construction Machinery Rental Company Financial Model Template offers a granular view of the financial landscape of heavy machinery rental companies.

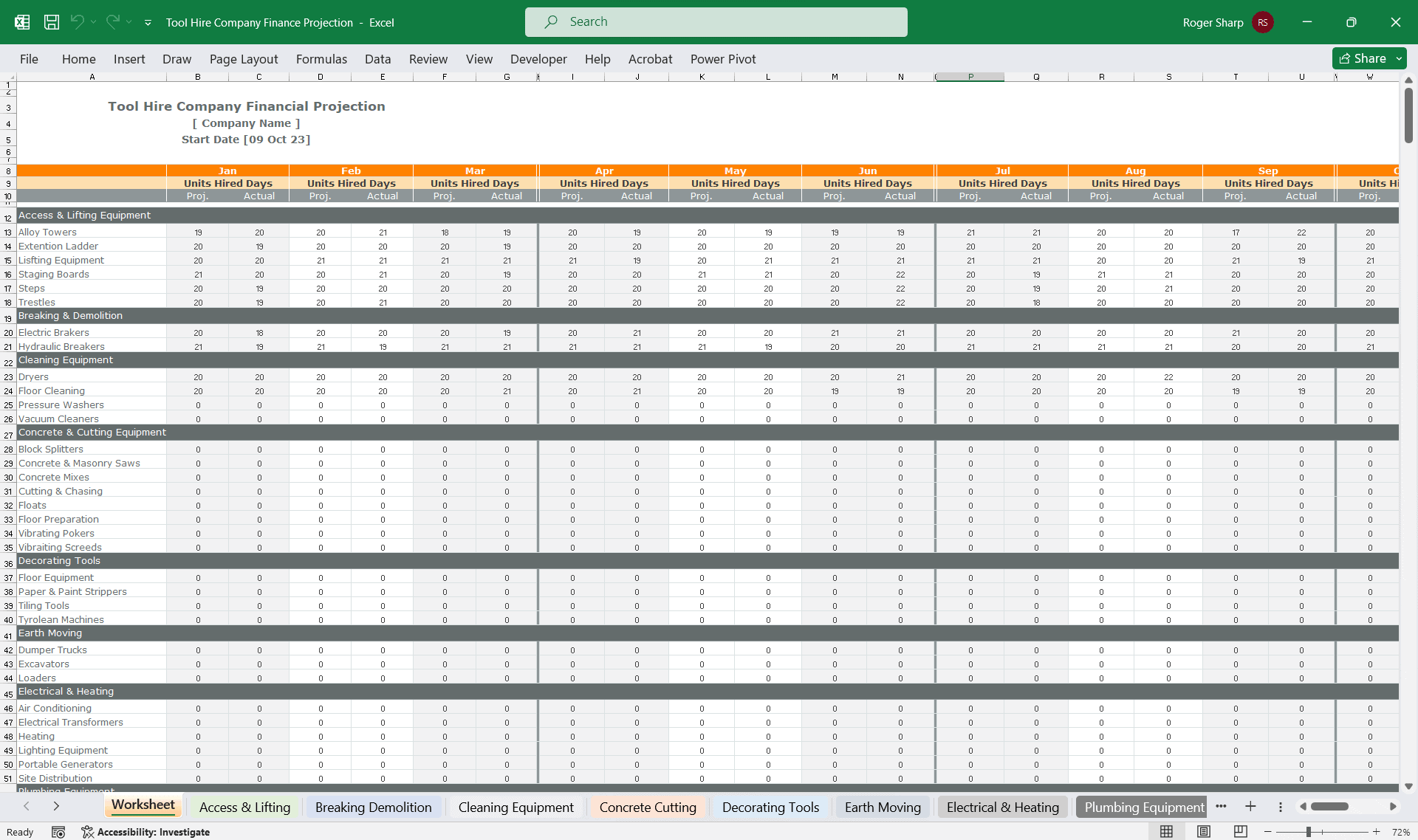

- Construction Machinery Fleet Schedule: Lists the inventory of equipment available for rent, including availability periods.

- Construction Machinery Rental Ownership: Compares the financial impact of purchasing versus leasing equipment.

- Construction Machinery Resale After Utilization Period: This projection shows the potential gains or losses from selling used equipment after its rental life.

- Revenue Model: Describes how the company generates income from renting construction machinery.

- Revenue Seasonality: Analyze how income fluctuates with seasons or market conditions.

- Land & Building Costs: Details expenses related to property acquisition or rental for operations.

- Cost Assumptions: Lists all operational and overhead cost assumptions used in the model.

- Budget Analysis: A detailed review of expected versus actual expenditures is provided to help manage finances effectively.

- Break-Even Analysis: Calculates the point at which the company will start generating profit, considering all costs and revenues.

- Financial Calculations: The financial calculations section of the Construction Machinery Rental Company Financial Model Template offers detailed projections to evaluate the company’s financial performance and health.

- Financial Statement Projections: This section offers detailed monthly and annual projections for the income statements, balance sheets, and cash flow statements.

- Forecasted Business Valuation: Estimates the future value of the business based on financial performance.

- Free Cash Flow Projections: Projects cash available to the company after accounting for operational expenses and investments.

- Funding Sources and Uses: Details how raised funds will be utilized and the sources of these funds.

- Financial Metrics: Provides key financial ratios and metrics to assess the company’s performance and health, including the Internal Rate of Return (IRR), Net Present Value (NPV), Cash on Cash Yield, and Payback Period.

Start Paving Your Road to Financial Success

Our Construction Machinery Rental Company Financial Model Template is meticulously designed to navigate the complexities of heavy machinery rental companies, ensuring financial clarity and strategic foresight. This template empowers businesses to make informed decisions, optimize operations, and drive sustainable growth by providing detailed insights into revenue streams, cost management, and profitability forecasts.

The financial model is an indispensable tool for construction machinery rental services aiming to achieve financial resilience, adapt to market dynamics, and secure a competitive edge in a challenging industry.

Let this template be the cornerstone of your financial planning as you pave the way toward a prosperous and robust future.

Disclaimer:

Please note that the Construction Machinery Rental Company Financial Model is the same template as the Car Rental Business Financial Model but has been tailored with labels and assumptions to illustrate its applicable use case for Construction Equipment Rentals.

The fully editable Excel model is currently at Version 2.3. A free downloadable PDF demo version is available to help you understand the model structure.

File Types:

.xlsx (MS Excel)

.pdf (Adobe Acrobat Reader)

Similar Products

Other customers were also interested in...

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with our Crane Truck Rental Company Financial M... Read more

Equipment Leasing Company Financial Model – Dyna...

Financial model presenting a business scenario of an Equipment Leasing Company, which offers Monthly... Read more

Equipment Rental Subscription Financial Model Exce...

Order Equipment Rental Subscription Budget Template. This well-tested, robust, and powerful template... Read more

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

Equipment Rental Business Financial Model – ...

The equipment rental financial model is a comprehensive tool designed to assist business owners and ... Read more

Bundle – Business Financial Forecasting Mode...

The purpose of this Bundle of Business Forecasting and Financial Models is to assist Business Owners... Read more

Mopeds Rental Financial Model Excel Template

Impress bankers and investors with a proven, solid Mopeds Rental Pro Forma Projection. Five-year mop... Read more

Car Rental Business Financial Model

This Car Rental Business Financial Model Template in Excel offers an ideal basis for developing a bu... Read more

Crane Rental Company Financial Model

Dive into the financial planning of your Crane Rental Company with our comprehensive 10-year monthly... Read more

Private Aircraft Rental Company Financial Model

Embark on a journey to financial mastery with our Private Aircraft Rental Company Financial Model, w... Read more

You must log in to submit a review.