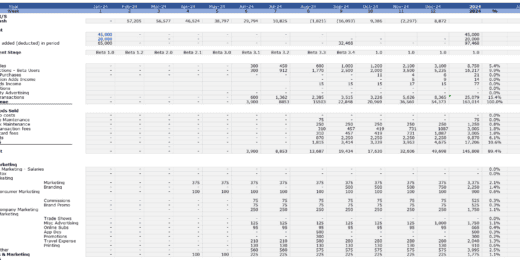

Cash Flow Projections

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

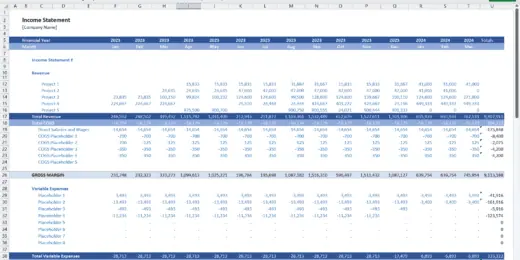

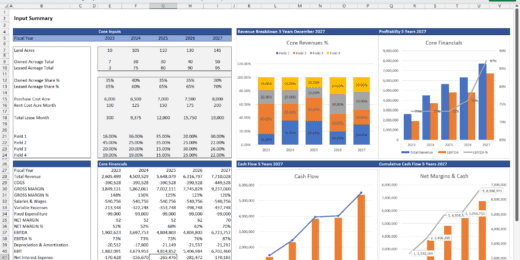

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

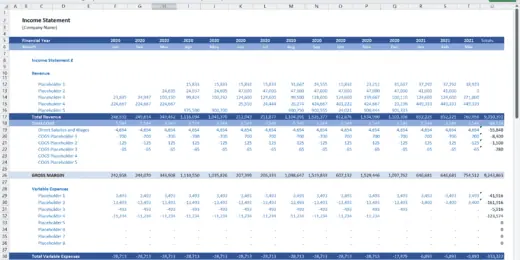

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Diagnostic Collection Center Financial Model

It is financial model for diagnostic collection center whose phlebotomists…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

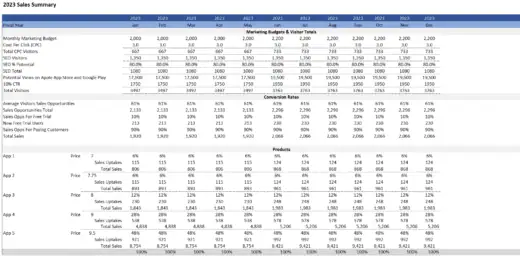

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Indoor Golf Centre Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Golf…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Mobile App Development Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Mobile App…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Social Media Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Social Media…

Affiliate Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Affiliate Marketing…

Web Hosting Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking web hosting…

5 Year 3 Statement Recycling Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Recycling Centre…

5 Year 3 Statement Construction Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking construction company…

5 Year 3 Statement Solar Energy Solutions Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Solar Energy…

Digital Advertising Agency Finance Model Excel Template

A comprehensive editable 5 Year 3 Statement, MS Excel spreadsheet…

5 Year 3 Statement Virtualization Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Virtualization Software…

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Graphic Design Company Finance Model Excel Spreadsheet

A comprehensive editable, MS Excel spreadsheet for tracking Graphic Design…

5 Year 3 Statement Private Mental Health Care Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking private Mental…

5 Year 3 Statement Alpaca Farming Finance Model Excel Template

A comprehensive 3 Statement 5 Year editable, MS Excel spreadsheet…

5 Year 3 Statement Architect Company Finance Model Excel Template

A comprehensive 5 Year 3 Statement editable, MS Excel spreadsheet…

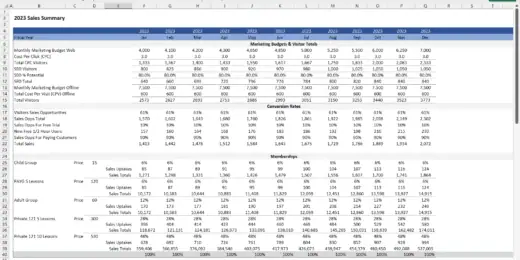

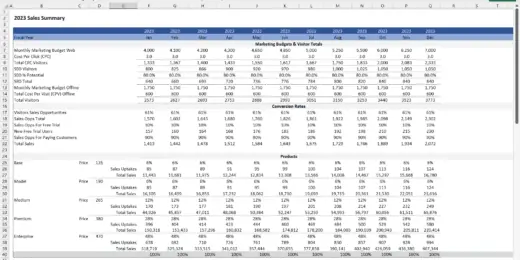

Swimming School Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Swimming School…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

3 Statement 5 Year SAAS HR Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking SAAS HR…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

Pig Farming Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking pig farming…

3 Statement Car Hire Company Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking car hire…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

Comprehensive 3 – Statement Financial Model for a Midstream Oil and Gas (Refinery with 7- Years Forecast)

This is a 6,000bpd financial model for refinery producing Diesel…

3 Statement Self Storage Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Self Storage…

3 Statement Software Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking software development…

Renewable Energy Financial Model

Comprehensive financial model designed for analyzing renewable energy projects, such…

How to Create Accurate Cash Flow Projections

Making a sound financial plan can feel like trying to find your way through a maze in the dark. However, a simple helper can guide us through this tricky task, which many of us already know how to use: Microsoft Excel. Using an Excel cash flow projections isn't just about filling out a spreadsheet; it's like having a map for your money. This smart tool makes the scary parts of dealing with money easier to understand, helping you see where your money is coming from, where it's going, and how to plan your spending.

Whether you're a budding entrepreneur dreaming of a startup or a seasoned business owner aiming to refine your financial strategy, Excel cash flow projections are designed to streamline your financial operations, ensuring you remain on solid ground amidst the ever-shifting sands of the business landscape. Let's dive into how this template can become the cornerstone of your financial planning, turning complexity into clarity and ambition into achievement.

What are Cash Flow Projections?

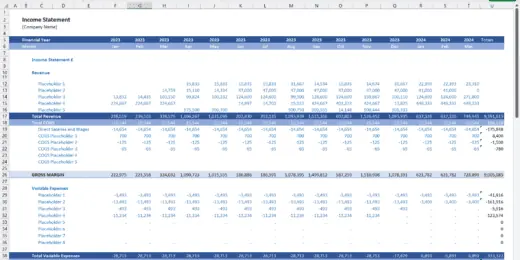

Cash flow projections are sets of financial statements designed to project the movement of cash in and out of a business. This essential financial tool helps business owners and financial managers visualize how cash is expected to flow through the company, allowing them to plan for future financial needs and assess the company's liquidity. Moreover, cash flow projections systematically organize a company's expected cash inflows and outflows over a specified period. Excel cash flow projections are typically most relevant within a 12-month budget or as part of a multi-year business plan. It enables businesses to forecast and prepare for periods of positive or negative cash flow, ensuring they have adequate funds to cover expenses, invest in growth opportunities, and manage potential financial challenges.

Cash flow projections are structured around three primary sections crucial for financial planning. It begins with "Cash at the Beginning," which indicates the initial cash balance for a specific period. Following this, the template elaborates on "Cash Inflows and Outflows," which provides a comprehensive breakdown of all anticipated cash receipts and payments, often monthly. The final section, "Net Cash Flow and Ending Cash," presents the cumulative effect of the cash inflows and outflows, culminating in the ending cash balance. This crucial figure indicates whether the business anticipates a cash surplus or deficit by the period's end. Such templates immensely benefit businesses of varying sizes, offering a transparent outlook on future cash positions. It, in turn, aids in ensuring that companies are well-equipped to fulfill their financial obligations and seize upcoming opportunities.

The Two Cash Flow Projection Models

Cash flow projection models are financial tools businesses, and financial analysts use to forecast the amount of cash flowing into and out of business over a specified period. They are crucial for understanding a company's liquidity, ensuring it has enough cash on hand to cover expenses, invest in new opportunities, and manage its financial obligations. There are two primary types of cash flow projection models: the direct cash flow method and the indirect cash flow method. Both types of cash flow projection models aim to provide an accurate picture of future cash flows but differ in their approach and the level of detail they provide.

Direct Cash Flow Method

The direct cash flow method is one of the two types of cash flow projection models that involves listing all cash transactions, including cash receipts from customers and cash payments to suppliers and employees, to calculate net cash flow from operating activities directly. It offers a straightforward view of cash movements by detailing the actual cash transactions. The direct cash flow method helps stakeholders understand the company's liquidity and cash management practices by presenting specific information on how and where it receives and spends its cash. The direct cash flow method formula can be summarized as follows:

![]()

Where:

- Cash Receipts from Customers = the total amount of cash the company receives from its customers for the goods or services it sells. They are the primary source of cash inflow in business operations.

- Cash Payments to Suppliers = all cash outflows to suppliers to purchase inventory or raw materials necessary for the company to produce the goods or services it sells.

- Cash Payments to Employees = all cash payments made to employees in wages, salaries, and other compensation forms.

- Other Cash Payments = all other cash outflows related to operational activities that do not fall under payments to suppliers or employees. It can include utilities, rent, interest payments on loans specifically for operational purposes, and other expenses paid in cash.

By subtracting the total cash payments from the cash receipts, the company arrives at the Net Cash Flow from Operating Activities. This figure is crucial as it shows how much cash the company's core business activities generate. If this number is positive, the company generates more cash than it spends on its operations, which is a good sign of operational health. Conversely, a negative cash flow from operations might indicate selling, pricing, cost management, or other operational challenges.

Indirect Cash Flow Method

On the other hand, the indirect cash flow method starts with the net income from the income statement and adjusts for changes in balance sheet accounts to arrive at the net cash flow from operating activities. The indirect cash flow method includes adjustments for non-cash transactions, such as depreciation, and changes in working capital components like accounts receivable, inventory, and accounts payable. The indirect cash flow method formula is mathematically expressed as:

Where:

- Net Income = a company's profit after all expenses, taxes, and costs have been subtracted from total revenue. It's important to note that net income is calculated on an accrual basis, meaning it includes all revenues earned and expenses incurred, regardless of whether cash has been exchanged.

- Non-Cash Expenses = the expenses recorded on the income statement that does not involve cash outflow. The most common non-cash expense is depreciation, which is the gradual charging to the expense of an asset's cost over its expected useful life. Other examples include amortization and stock-based compensation. Adding back non-cash expenses is necessary because, although they reduce net Income, they do not affect the company's cash reserves.

- Changes in Working Capital = current assets minus current liabilities. It represents the short-term financial health and operational efficiency of a company.

The indirect cash flow method shows how much cash the company's operations have generated by adjusting net income for non-cash expenses and changes in working capital. Understanding the company's ability to generate cash from its regular business operations is crucial, independent of its financing or investment activities. It is often used for internal analysis and decision-making because it links the cash flow to items reported in the income statement and balance sheet, offering insights into how operations impact the company's cash position without requiring detailed transaction-level data for the direct method.

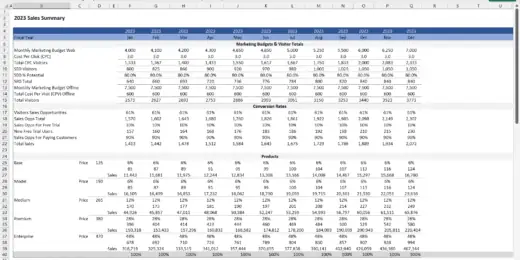

Steps to Creating Excel Cash Flow Projections

Creating Excel cash flow projections can help forecast financial health over a specific period. This process involves estimating future inflows and outflows of cash to see if you'll have enough money to operate or to identify potential shortfalls. Here's a step-by-step guide to creating Excel cash flow projections:

Step 1 – Set Up Your Spreadsheet

Begin by creating a new workbook and organizing the columns at the top to represent different periods, such as months or quarters. In the first column, enumerate various cash flow categories, including starting cash, cash inflows (sales or income), cash outflows (expenses or purchases), and ending cash. For the starting balance, input the amount of cash on hand at the start of the period into the cell beneath the first period's column, which will serve as your initial cash balance.

Step 2 – Project Cash Inflows

For each period, detail your anticipated cash receipts next, which may encompass sales, proceeds from loans, earnings from investments, or other income streams. Maintaining realism in the scheduling and estimated amounts of these cash inflows is crucial. Following this, enumerate your projected cash outflows underneath the inflows section, including all foreseeable cash expenses like rent, wages, utility bills, loan repayments, and procurement of goods or services. Similarly, a realistic approach is applied to predict the timing and magnitude of these payments.

Step 3 – Calculate Net Cash Flow

To ascertain your net cash flow for each period, deduct the total cash outflows from the total inflows. Insert this formula right after your listed outflows for every period. The ending cash for a given period then serves as the beginning cash for the following one. To calculate this, utilize the formula = Starting Cash + Net Cash Flow and replicate it across all periods. This approach ensures the dynamic updating of the starting cash for each subsequent period, maintaining a continuous flow of your cash management.

Step 4 – Analyze and Adjust

Review your Excel cash flow projections. Look for periods where you might have shortfalls and consider how to address them (e.g., reducing expenses, securing additional funding). Adjust your projections based on new information or changes in business or financial situation.

Step 5 – Make It Visual

Consider adding charts or graphs to your Excel workbook to represent your cash flow projections visually. Excel has built-in features that make creating visual representations of your data easy.

Tips for Accurate Cash Flow Projections

Creating accurate cash flow projections is essential for any business, as it helps understand future financial positions, make informed decisions, and plan for sustainability and growth. Here's a breakdown of tips for making accurate cash flow projections, explained per paragraph:

- Distinguish Between Profits and Cash Flow: Understanding that profit does not equate to cash flow is essential. Profit includes revenues that may still need to be received in cash and expenses that need to be paid out. On the other hand, cash flow is concerned with the actual inflow and outflow of cash. This distinction is vital for accurate projections and affects how you manage your resources and obligations.

- Engage Stakeholders: Involving key stakeholders, such as employees, investors, and suppliers, in your cash flow projection process can provide additional insights and perspectives. Their input can help refine your projections, identify potential opportunities or risks, and foster a collaborative approach to managing cash flow.

- Incorporate Realistic Assumptions: When projecting your cash flow, use realistic assumptions based on past performance, industry standards, and economic conditions. More optimistic or pessimistic forecasts can lead to better strategies. Realism in your assumptions helps prepare for feasible scenarios, allowing for more effective planning and risk management.

- Keep Accurate and Up-to-date Records: The accuracy of your cash flow projection relies heavily on the quality of your financial records. Regularly updating your records ensures that your forecasts are based on current information. This practice helps identify trends, adjust, and spot potential cash flow issues before they become problems.

- Monitor and Update Regularly: A cash flow projection is not a one-time task; it's an ongoing process. Regularly monitoring and updating your projections with actual results allows for adjustments in response to the dynamic business environment. This habit also enhances the accuracy of your forecasts over time and improves your ability to make informed decisions.

- Plan for Various Scenarios: The future is uncertain, and many factors can affect your business's cash flow. It's wise to prepare for different scenarios, including best-case, worst-case, and most-likely scenarios. This approach helps you prepare for unexpected changes in the market or economy, ensuring that your business remains resilient and adaptable.

- Understand Your Business Cycle: Every business has its unique cycle, including seasonal peaks and troughs. Recognizing these patterns is crucial because they directly impact your cash flow. For instance, a retail business may see a significant increase in cash flow during the holiday season. By understanding these cycles, you can anticipate changes in your cash flow and plan accordingly.

By following these tips, businesses can enhance the accuracy of their cash flow projections, thereby improving their financial planning and decision-making processes. Accurate cash flow projections are a cornerstone of any business's financial health and strategic growth.

Cash Flow Projections Boost Business Financial Health

Excel cash flow projections are crucial financial tools designed to help businesses forecast their cash inflows and outflows over a specific period. These templates allow organizations to plan their financial operations precisely, enabling them to anticipate potential shortfalls or surpluses in cash. Their forward-looking approach is essential for maintaining liquidity, managing debts, and ensuring sufficient money to cover operational needs and investment opportunities.

Excel cash flow projections are also instrumental in enhancing businesses' financial health. They serve not only as planning tools but also as a strategic guide for decision-making. By accurately forecasting future cash positions, companies can make informed decisions regarding investments, expense management, and funding strategies.

Furthermore, well-crafted cash flow projections give stakeholders confidence in the company's financial management capabilities, fostering trust and potentially attracting more investment. In essence, leveraging cash flow projection models is a competent practice for any business aiming to strengthen its financial foundation and drive sustainable growth.