Budgeting

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Sales and Revenue Dashboard Excel Template

Empowers your business with real-time revenue and profit insights to…

Online Store Sales Dashboard Excel Template

Equips businesses with actionable insights for optimizing sales strategies tailored…

CEO Dashboard KPI Excel Template

Our CEO Dashboard Excel Template provides a comprehensive overview of…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Cash Runway Calculation Template

Discover our Cash Runway Calculation Template, a user-friendly tool that…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

3 Statement Van Hire Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking van hire…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

Fruit Processing Facility – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Brewery Financial Model and Budget Control

This Excel model is an advanced, user-friendly financial planning tool…

Gym Financial Model and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Surfboard Rental Business Financial Model

Surfing is not just a sport—it's a lifestyle booming globally.…

Ultimate Budget Spreadsheet, Budget Dashboard, Google Sheets, Excel

Ultimate Budget Spreadsheet, Budget Dashboard, in both Google Sheets and…

Actual vs. Budget Variance Analysis Template

Excel model and dashboard for the preparation of a monthly…

Real Estate – Multi Family Acquisition Pro-forma

This Excel template is an intuitive and comprehensive solution tailored…

Real Estate – Single Family Rental Pro-Forma Template

This real estate financial model is a dynamic tool designed…

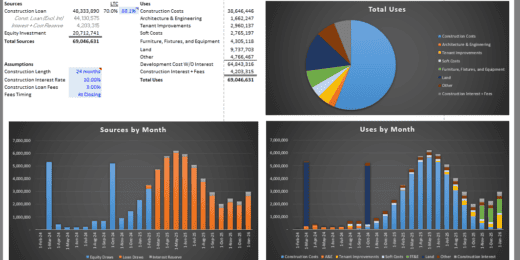

Construction Draw Schedule & Gantt (New Development Cost/Sources & Uses Model)

Elevate your construction project planning with our Construction Draw Schedule…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Trucking Company – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Pet Grooming Business Dynamic Financial Model 2024

Tailored for pet grooming businesses, this dynamic financial model streamlines…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Ship Management Business 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a startup…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Industrial Warehouse Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Cleaning Service Pro Forma Template (Commercial / Residential)

A pro forma template for any home service or general…

All About Corporate Budgeting

Budgeting is a norm in every business. The business's strategic plan is laid out to upper management to set an expectation of the company's performance in the budget year. Budgeting serves as the quantitative representation of the business plan, which is also used as a measure of performance. However, no matter how tight the budget is, there are material changes along the way that may cause huge variances between the actual and budget. For this reason, budgets are being revisited for cases that may require specific changes to ensure that desired goals are met. A budgeting template in Excel is proven to be the most useful tool in budgeting given its flexibility and user-friendliness.

Preparing a Budget Report in a Comprehensive Budgeting Worksheet

Financial statements are just pieces of the business equation but in reality, the budget provides critical context by providing a base or goal in which performance could be measured. When budgeting, it is essential to pinpoint where you are strong and where you are entirely off the rails.

Building a budget report is about more than repeating numbers. Managers are interested in how the budget applies to them. They want to know how real numbers pile up against budgeted numbers and how functional areas address this matter. Budget planning can be a little too overwhelming. It's no doubt that you may find it challenging to predict operating costs over a year. We do not know chances in the future. But the safest way to do your budget is by using your previous financial year figures as a base while adding inflation, expected expenditures, and providing a cushion for the unforeseen financial burden that may arise. It is also best to create this in a comprehensive budgeting worksheet that allows flexibility and full functionality as you go through the entire budgeting process.

Translating objectives into budgets using a budgeting template in Excel

In order for a strategy to become effective, it must be quantifiable and measurable. There is plenty of budgeting template in Excel available online that will ease your way in quantifying these objectives. Meanwhile, here are the four elements to ponder in translating top-tier strategies to budgets.

- Set the business's goals or objectives. Setting an objective on what you want to achieve in a given year will steer your direction. Say your goal is a 35% increase in monthly sales.

- Develop tactics or strategies that will complement your goal. Technically, if you plan to achieve something bigger, you need to make ways to make it happen. Meaning, you should consider changing your marketing strategy, expand product selection, increasing sales incentive or any decisive maneuver that will make this goal feasible.

- Evaluate the effectiveness of the developed strategy using appropriate measures like the percentage of sales growth. It will help you assess whether your strategy is working or not.

- Set the target you would like to accomplish in a given period. The target should be quantifiable and time-bound i.e, an increase in the product sold in a given period.

These targets translated from your objective will now be the base of your budget. Once the budget is implemented, a monthly or quarterly visit is conducted to see whether these figures are achievable or otherwise revise the budget as the case may be. The business budget template passes several revisions to complement the complexity of the budget requirement of the company.

Objective of Budgeting

Budgeting is a vital process for any business. As we know, there's always a chance that the budget will differ from the actuals. As managers go through the process, they understand that various conditions may affect their budget, thereby allowing them to counter whatever inconvenience the situation has given. Budgeting also supports managers in building relationships among other members of the organization and interacting on how they could support each other towards achieving a common goal. It also challenges individuals or managers to strive further in achieving this goal by linking compensation or incentive relative to the budget. Most companies provide certain incentives once the budget has been met. The budget will determine whether a department, individual, or company has raised all the efforts to meet this goal. In a budgeting Template in Excel, the managers will be able to see their actual spending over budget, allowing them to control financial activities. Moreover, this business budget template conveniently allows the manager to be assessed or evaluated based on their performance.

Budget to Actual Variance Analysis in a Business Budget Template

An essential function for finance professionals is to perform budget to actual variance analysis. A budget to actual variance analysis is a budgeting method by which a company's budget is compared to actual events and interprets the variance. Ideally, business organizations perform this analysis in detail periodically (i.e, monthly, quarterly, annually) to allow managers to understand their business occurrence. The variance analysis is intended to answer the main question of what caused the variance? The variance could either be favorable or unfavorable variance. The difference is whether the actuals came in better or worse than the measure it is compared to. The variance should not be material enough unless an unexpected event occurred. But if actuals deviate immensely from your budget, take a harder look at the numbers to uncover fact from fiction. Below are some points to consider when performing budget to actual variance analysis.

- Review which business activities didn't go as planned. There may be occurrences beyond our control like this pandemic which strike the global economy gradually.

- Noting variances allows you to be more aware of what to look for. Take time reviewing your budget and actuals. Sooner or later, you'll find little to no difference in variance analysis as you become better at predicting your expenses.

- Use a business budget template that you're most comfortable with. It's generally easier to use a consistent format that allows flexibility and functionality throughout your budget analysis.

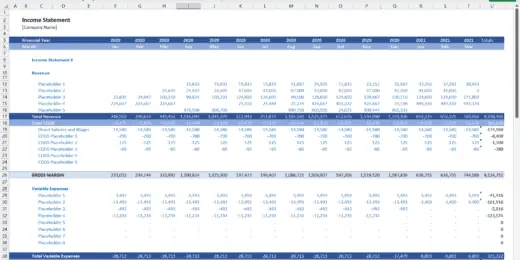

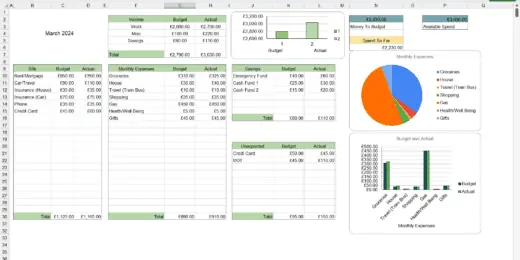

To illustrate it further, here’s a sample of a budgeting template for better appreciation. This template shows a monthly and YTD budget to actual variance analysis which also comes in percentages.

What causes the variances?

This is the question that will finance analyst have to answer the management when the report is shown. If the variances noted are significant, the analysts should be able to investigate what causes it. For example, repairs and maintenance resulted in a significant negative variance; the facilities manager then answered the reason for this variance. There may be a major repair in the production machine which was not predicted, thus resulted in a negative variance. Another example is material expense variance which is caused by a shortage of supply and drives the purchasing department to purchase a more expensive alternative; otherwise, production will stop. These are just some of the reasons why variances occur. The financial analyst will only have to pinpoint what goes wrong and eventually require department managers to uncover reasons for the variances. If the variance is expected to be repetitive, then it is best to adjust the budget accordingly. A few modifications could help bring the budget to actual analysis in line.

Different kinds of budget

Ideally, budgets are typically represented in a budgeted income statement, balance sheet, and cash flow. However, most of us do not know that this three statement has been built part by part by a different department within the organization. A sound budget structure is developed around a master budget, including operating budget, capital expenditure budget, and cash budget, and built-in a comprehensive budgeting worksheet.

Operational Budget

The operational budget is about the day-to-day activities of the business. It represents the income-generating activities of the business i.e. sales, production, and inventory. Building an operating budget is a collaborative exercise of executives and managers. The following or essential component of the operational budget.

Revenue Budget

Initially, they assess the coming year's revenue by referencing historical performance and market variables such as changes in the economy, new company or product launching, seasonal change, etc.

Production Budget

This budget allows the business to see how many units or hours to produce to meet the sales budget and required ending inventory.

Direct Material Purchases Budget

This budget provides the cost of each raw material needed in the production process.

Direct Labor Budget

It manifests the cost of total direct labor and labor hours needed in the production process. It allows managers and executives to plan their labor force demands.

Overhead Budget

It contains all manufacturing costs other than direct labor and material.

It may either be variable costs which are directly attributable to the sales or fixed costs, which includes all cost that the business regularly incurs with or without sales. Examples include utilities, insurance, and rentals.

Ending Finished Goods Inventory Budget

It provides the business the value of each unit produced based on raw materials, direct labor, and overhead.

Cost of Goods Sold Budget

It is the cost of production for the units sold. Essentially, the cost of goods sold can be calculated if the beginning inventory, direct material purchase budget, direct labor, and overhead.

Selling and Administrative Budget

The indirect cost of the operational budget includes selling and administrative expenses. It consists of all costs of non-manufacturing or non-production departments like accounting, engineering, IT, human resource, and so on.

Budgeted Income Statement

Once these budgets are completed, all the information needed to supply the income statement is ready; therefore, a budgeted income statement will be available until the operating income.

Capital Budget

Capital budgets include long-term capital investments that are favorable for the business in the long-run but may require significant demand on the business cash flow. These may include purchasing a new building, machinery, and equipment, IT or software systems, etc.

What does Capital Budgeting mean?

Capital budgeting is a means of determining the business's long-term investments that are worth pursuing. Since it involves a material cash outlay, this decision must be studied carefully, whereas benefits shall essentially exceed its cost.

How does Capital Budgeting Works?

The business must consider the most appropriate capital budgeting techniques such as Internal Rate of Return(IRR), Net Present Value(NPV), Payback Period, etc., in determining the project to be accepted. Ideally, the IRR of the project must be higher than the weighted average cost of capital(WACC) to be considered a sound investment. This analysis involves estimating cash flows that the project will generate throughout the economic life of the project. Most business budget template includes calculation of these capital budgeting metrics, which are also available in our website.

Cash Budget

The cash budget depicts the business's future cash flows in a given period. It basically ties up the operational and capital budgeting and considers the timing of receipt and payment. It assesses the expected cash receipts and future cash disbursement in a particular budget period. Nonetheless, the cash position must be ascertained more frequently to keep track of the budget. The cash budget may also dictate the next step the company would take. It allows management to strategize further should an unpleasant situation arise. The management may boost their collection, increase bank borrowing, cost-cutting, or negotiate for vendor payments as the case may be.

Using Budget Template in Excel

Are you planning to create a budget plan but don't know where to start? Are you running a business and want to manage your finances to help you get by and get the opportunity to succeed financially? Are you looking for a convenient tool to serve as a template to build your budget plan out of? If you are, then we recommend for you to check our various budget templates in Excel listed above.

From Personal Financial Plan Template, Budgeting Worksheets, Budgeting Templates to Business Budget Template, you can choose whichever fits the criteria you're looking for. Start budgeting now and take advantage of these very convenient Excel budgeting templates for you to use as a base when creating a budget plan for yourself or your business.

Conclusion: Budgeting saves businesses from financial distress

Budgeting is never easy, especially if you are constraints with adequate funding to support your expenses. However, keeping your budget handy will surely save your business from financial distress in the future. Discovering why your actuals exceed your budgets is not always simple. But once you understand what went wrong, you could start making necessary adjustments and become a better forecaster. Additionally, performing variance analysis regularly will uncover trends that could have been ignored. This analysis will also help business owners make informed decisions addressing matters in a timely and effective manner with the aid of financial analysis and budget reports.