Discount Rate

Moreover, we will delve into different discount rates in varying contexts. Likewise, this will help you on how you can easily determine the type of discount rate to be used in a business valuation or analysis. This will give you an idea of how to calculate discount rates in excel following the step-by-step process provided on the lower portion of this page.

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

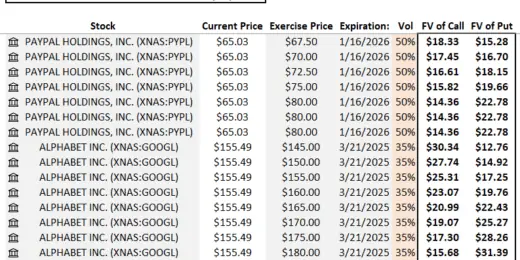

Equity Options Fair Value Calculator (Black-Scholes)

The Equity Options Fair Value Calculator (Black-Scholes) is your go-to…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Surfboard Rental Business Financial Model

Surfing is not just a sport—it's a lifestyle booming globally.…

Motorboat Rental Business Financial Model

Dive into the heart of financial planning with our Motorboat…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

Crypto Token Valuation Model

A cutting-edge crypto token valuation model, designed to provide comprehensive…

Complete Private Equity (LBO) Financial Model

This is a professional financial model which performs a thorough…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Online Tutoring Services Financial Model (10+ Yrs DCF and Valuation)

The Online Tutoring Services Financial Model is a comprehensive tool…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Cleaning Service Pro Forma Template (Commercial / Residential)

A pro forma template for any home service or general…

Oil & Gas Financial Model – DCF and NAV Valuation (5+ Yrs.)

The Oil and Gas financial model with DCF (Discounted Cash…

CPG Company Financial Model and Valuation

Discover the CPG Company Financial Model and Valuation, an essential…

SaaS Company Financial Model and Valuation

Discover the SaaS Company Financial Model and Valuation, an essential…

Dog Grooming Services Financial Model (10+ Yrs DCF and Valuation)

The Dog Grooming Services financial model is a comprehensive tool…

Zero Down Seller Financing Strategy for Real Estate Investment

A tool to estimate expected risk and cash flow of…

Buy Now Pay Later DCF Model & Valuation (10 Year DCF Model)

The Buy Now Pay Later (BNPL) Company financial model is…

Rental Property (Airbnb – Real Estate) Financial Model

Powerful Real Estate Rental Property Financial Model for Informed Decision-Making,…

Hotel Complex – Financial Model (5 Yrs. DCF and Valuation)

The Hotel Complex financial model is a comprehensive tool designed…

Function-as-a-Service (serverless computing) Financial Model

Create financial projections for a FaaS cloud computing services business.…

Data-as-a-Service Financial Feasibility Study

This model is built for data-as-a-service startups. If you have…

EV Battery Recycling Plant Financial Model (10+ Yrs DCF and Valuation)

The EV Battery Recycling Plant financial model is a comprehensive…

Tennis Court and Club Development – 10-year Financial Forecasting Model

Introducing our Tennis Courts and Club Financial Forecasting Model –…

Dental Clinic Financial Model and Budget Control Template

This financial model serves as a tool for owners and…

Educational Courses: Financial Feasibility and Capacity Model

Model up to 3 course types that have scaling logic…

Student Accommodation / Village Development Model – 20 years

This Student Accommodation 20-year Development Model (hold and lease) will…

Catering Services Business Financial Model (10+ Yrs DCF and Valuation)

The catering services business financial model is a comprehensive tool…

Real Estate – Fix and Flip Pro-forma

This meticulously crafted Financial Model for Analyzing Fix and Flip…

Moving Services Business Financial Model (10+ Yrs DCF and Valuation)

The moving services business financial model is a comprehensive tool…

Online Travel Agency Financial Feasibility Model

Create up to 72 months of financial projections based on…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Discounted Cash Flow (DCF) Financial Model

Discounted Cash Flow (DCF) Financial Model with 5-year projections and…

IT/Tech Service Provider 5-Year Financial Projection Model

5 year rolling financial projection Excel model for an IT…

Private Equity and Venture Capital Financial Model – BUNDLE DEAL

This is a Combo of Private Equity and Venture Capital…

Badminton Court and Club Dynamic Financial Model 10-years

Introducing the Badminton Court and Club Forecasting Model, a visionary…

Vending Machine Business 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a vending…

Financial Advisor / Financial Planner Financial Projection Model

5-Year 3-Statement Excel projection model for Financial Advisor / Financial…

Comprehensive Logistics Company Financial Model and Valuation

Discover the Comprehensive Logistics Company Financial Model and Valuation, an…

Car Repair Shop Financial Model (10+ Yrs DCF and Valuation)

The Car Repair Shop Fin. Model (DCF and Valuation) is…

How to Calculate Discount Rate?

For people who are new to business and finance, and to those who are in the field but have a hard time distinguishing what discount rate is, let me tell you that you are not the only one. Most of the time we encounter a discount rate in a DCF Valuation model wherein we use the WACC (Weighted Cost of Capital) as the discount rate to determine the present value of future cash flows. But in the finance industry, the discount rate is not always the WACC. You will get the bigger picture of discount rates in varying contexts, their purpose, and how to calculate discount rates.

Discount Rate Definition

The discount rate may have a varying definition based on the context that you are referring to.

Here are some of the definitions you might consider when determining the discount rate:

Discount Rate Federal Reserve

Discount Rate Federal Reserve- The first discount rate definition is about the discount rate federal reserve is the interest rate set by the Federal Reserve on loans made to commercial banks by the central bank. This is used when a qualified enterprise or institution borrows funds directly from the FED. The main purpose of this discount rate is to control the supply of available funds. The more money available, the greater the likelihood of inflation. Raising the rate makes borrowing from the Fed more expensive. This reduces the available money supply, which results in an increase in short-term interest rates. Reduced interest rates have the opposite effect, lowering short-term interest rates. The discount rate is an important indicator of an economy's credit situation. A change in the discount rate affects banks' rate of borrowing and thus the interest rates they charge on loans. A change in the discount rate also serves as a means to prevent and tackle recession or inflation. The discount rate is also used to deal with balance-of-payments deficits, which means balancing the cash flows.

Discount Rate NPV - The second discount rate definition is one of the key components in a DCF valuation model. DCF model is one of the known valuation models used to determine the intrinsic value of a company or a business. Likewise, it is used to estimate the value of a project or investment on its future cash flows. The discount rate NPV is used to assess the feasibility of a project and its income-generating power by determining the present value of its future cash flows. The discount rate in the context of DCF analysis refers to the interest rate used to calculate the present value.

Calculating the Discount rate: How to determine which Discount rate to use?

In calculating the Discount rate, we must bear in mind that it is not always the WACC in each calculation. It may vary in different calculations. It really depends on what type of cash flow stream you are referring to.

It is vital to define Free Cash Flow (FCF) before comparing Free Cash Flow to Firm (FCFF) and Free Cash Flow to Equity (FCFE). The amount of cash that a company or corporation incurs after non-cash expenses, changes in net working capital, taxes, and capital expenditures are referred to as free cash flow.

Let us look at the two types of cash flow streams:

Free Cash Flow to Firm (FCFF)

Free Cash Flow to Firm refers to the Unlevered Free Cash Flows (UFCF). It is the cash that remains to a business or a company after the taxes, depreciation, amortization, capital expenditures, and investments. This type of cash flow stream determines the performance and operations of a company. All cash inflows in the form of revenues, all-cash outflows in the form of expenses, and all cash invested to grow the firm is taken into account by FCFF. A company's Free Cash Flow to the firm is the money left over after all these activities have been completed.

Remember that a positive FCFF is a measure that a company still has a good amount of money after all the expenditures. On the other hand, if the FCFF has a negative value, it means that the company has not able to produce enough cash to suffice its daily operational activities.

Free Cash Flow to Equity (FCFE)

Free Cash Flow to Equity refers to the Levered Free Cash Flows (LFCF). Unlike the FCFF which aims is to generate money for the firm, FCFE refers to the amount of cash available which will be given to the equity shareholders after all the debts, taxes, capital expenditures, investments are paid.

Now that you know the difference between the two cash flow streams, the real question is how to find the discount rate based on these two cash flow streams?

When doing a Discounted Cash Flow (DCF) Valuation using the Free Cash Flow to Firm (FCFF), we usually use the Weighted Average Cost of Capital as the discount rate WACC. We discount the annual free cash flows using the discount rate WACC to determine the Enterprise Value (EV) of the company. Hence, when using the Free Cash Flow to Equity (FCFE) in a DCF valuation, we use the cost of equity as the discount rate. The cost of equity is used to keep free cash flow available only to equity stockholders.

Discount Rate NPV: Purpose of Discount Rate in determining the Net Present Value (NPV) in a DCF Valuation

The discount rate is one of the key components in a DCF valuation model wherein it is used to compute for the Net Present Value (NPV) by discounting the annual free cash flows. Aside from this objective, the discount rate is also employed to:

- Recognizes the risks of investment: The company or business must take into account the risks of a project or investment. No one can really say that a business or a venture has no risks. Remember that the amount that a company or a business has today may not be at risk but the money that will be generated in the future is uncertain.

- Acknowledges the Time Value of Money: “A dollar today, is not worth a dollar tomorrow.” We often hear this saying and that is something that a company or business should consider. Money invested today can gain more interest rather than in the future as there are underlying factors that may affect the value of money. Note that the future cash flows are discounted using the discount rate. Thus, the higher the discount rate the lower the present value of the future cash flows. Likewise, a reduced discount rate has a higher present value. This means that when the discount rate is higher, the money in the future will have a lower value than the amount of money today.

Discount Rate Formula

The Discount rate calculation depends on the type of cash flow stream in a given calculation. There are two discount rate formulas that you can use in calculating the discount rate:

The first discount rate formula centers on the Weighted Average Cost of Capital (WACC) as the discount rate.

The WACC formula for discount rate is as follows:

WACC = (E/V x Re) + (D/V x Rd) x (1 – T)

E =is the firm's equity market value.

D =is the market value of the company's debt.

V=total capital value

E/V = equity as a percentage of total capital.

D/V= denotes the debt-to-capital ratio.

Re= denotes the cost of equity (required rate of return)

Rd= denotes the cost of debt (yield to maturity on existing debt)

T= is the tax rate.

The second discount rate formula is the Cost of Equity as the Discount Rate

Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return – Risk-Free Rate of Return)

Discount Rate Excel: Step-by-Step Process in Calculating the Discount Rate in MS Excel

In this excel example, we will examine how we will combine these two components debt and equity to determine and portray in excel the discount rate calculation.

How to find the Discount Rate?

Finding out which discount rate to use in a particular calculation is crucial in doing business valuation. When calculating the net present value of a project, the Weighted Average Cost of Capital is employed as a discount rate. As a result, WACC indicates the long-term estimated cost of capital. It can be calculated by multiplying the cost of each type of capital by its share in the capital structure of the company.

There are ways in how a company can fund its day-to-day operations, business ventures, projects. Funds may come from debt or equity. Debt refers to the borrowed money of the company while equity means the money of the company’s shareholders.

We will get the detailed steps on how to calculate discount rate using these components:

Cost of Equity Calculation

1. The very first step in calculating the WACC as the discount rate is to weigh the value of Equity and debt of a company. Weighing the value of equity and debt will help you determine how much of the company’s capital is composed of equity and debt.

Note that all values in blue fonts are forecast and the values in black fonts are the calculations. Since we have the value for the weight of equity, we calculate the weight of debt using the formula in the image above.

2. Next is to calculate the Cost of Equity. Cost of Equity is used to discount investor cash flows and any type of cash flows going to Equity shareholders. In calculating the Cost of Equity, you must consider the key metrics to be able to calculate it:

The risk-Free rate refers to a theoretical rate of return an investor expects from a zero-risk investment. A risk-free rate is a theoretical number since technically all investments carry some form of risk

Beta measures a stock’s return. By calculating beta, you can determine the stock's volatility and risk. A positive beta value suggests that equities and the market generally move in the same direction, and vice versa.

A measure of market risk is levered beta also known as simply beta or equity beta. When determining a company's risk profile, debt and equity are taken into account. On the other hand, Unlevered beta removes the debt component from the equation, leaving only the risk associated with the company's assets.

In the illustration below, the value for the unlevered beta is given while the value for levered beta is the first thing that we need to calculate. To get the levered beta, we need to multiply the unlevered beta to 1 plus the company’s debt-to-equity ratio.

3. Risky financial movements may appear to most people to be a poor decision, but there are instances when there is more to gain if you are ready to take a chance. This is what a Market risk premium highlights as there is a possibility of a high rate of return from a risky investment. The value for Market risk premium USA, which is the average risk rate in the United States, and country spread are already provided in our Discount rate excel example.

Another risk premium that compensates investors for a high-risk offshore venture is the country spread. However, in our example, the country spread value is 0, indicating that the project or investment is just for a single country. Also, when the country risk premium is zero, it means that the country has a developed economy. To compute the Market risk premium, we must first add the market risk premium for the United States and the country spread.

4. Next thing that we should know is the Equity Risk Premium. The equity risk premium is the additional return provided by a particular stock or market over and above the risk-free rate of return.

The premium amount is determined by the level of risk taken on, and the higher the risk, the larger the premium. Additionally, this risk premium fluctuates in response to market fluctuations. In our example, we get the value of equity risk premium by multiplying the levered beta, and the market risk premium.

5. Now to be able to calculate the Equity Discount rate, we must sum up all the risk premiums and the risk-free interest rate. Equity Discount Rate represents the cost of equity capital that the shareholders invested in a business or project.

Cost of Debt Excel Calculation

Another way for a company to sustain its operations and business ventures is through debt. Cost of debt is the average rate of return that the company will pay for its current liabilities such as loans and bonds.

6. Since some of the values given and calculated from the cost of equity are also part of the cost of debt calculation, the next value that we are going to calculate is the value of the pre-tax cost of debt.

The amount or cost that a company spends to finance its overall operations and expansion in order to produce revenue is known as the pre-tax cost of debt. It is also the company's cost of debt before taxes are taken into consideration. To be able to calculate it, the risk-free rate and debt risk premium should be summed up.

7. The interest paid on debt less any income tax savings owing to deductible interest expenditures is the after-tax cost of debt. Subtract a company's effective tax rate from 1 and multiply the difference by its cost of debt to get the after-tax cost of debt.

When striving to stay profitable, knowing the after-tax cost of the debt you are taking on is critical. The after-tax cost of debt is very crucial as it will show the income tax percentage. You can deduct interest from taxable profit, so you will pay less in income taxes. To account for this effect, we calculate the after-tax cost of debt. As a result, it will allow a company to save money on taxes. When a company borrows money, the rate of interest should be kept in mind because the company is required to pay a fixed rate of interest to an investor who has invested in their company bonds.

Discount Rate WACC Calculation

The Weighted Average Cost of Capital (WACC) is a financial metric that calculates the company or business’ cost of capital across all sources which includes equity and debt. In other words, it calculates the weight of debt and the cost of borrowing money or raising cash through equity to support purchases, ventures, and expansions depending on the current debt and equity structure of the organization. It is also the minimum average rate of return on assets wherein the return should meet the expectation and satisfaction of key investors.

In addition, WACC is also used as a discount rate. In our Discount rate excel example, the type of cash flow stream is the Free Cash Flow to Firm (FCFF) which means that the Weighted Average Cost of Capital will serve as the discount rate.

At this point, you might be wondering why we calculated the Cost of Equity and Debt. It is because, without these two components, it is impossible to calculate the WACC.

8. To calculate the WACC, we must first get to know the company’s total value of equity and debt by multiplying their cost to their designated weights. After that, we sum up the total value of equity and debt to get the Weighted Average Cost of Capital (WACC).

You must remember that the discount rate used to calculate a company's Net Present Value (NPV) is the Weighted Average Cost of Capital. It's also used to assess investment opportunities because it represents the company's opportunity cost. When considering mergers, WACC is used as a hurdle rate.

In a discounted cash flow (DCF) analysis, the discount rate is the interest rate used to calculate the present value of future cash flows. This determines if the future cash flows from a project or investment are worth more than the capital expenditure required to fund the project or investment now. Similarly, the discount rate is the amount that must meet or go above the cost of capital to meet the expectations of the investors and shareholders. Likewise, to justify the worth of a new purchase or venture.

Discount Rate on a Final Note

The discount rate may have varying definitions based on different contexts. The concept of discount rate may refer to either the interest rate charged by the Federal Reserve for the loans acquired by financial institutions or commercial banks. On the other hand, the discount rate may also refer to the interest rate when calculating the present value of cash flows.

The term discount rate can refer to either the rate at which the Federal Reserve charges banks for short-term loans or the rate at which future cash flows are discounted in discounted cash flow (DCF) analysis.

The discount rate is used to discount future cash flows, and as the discount rate rises, the present value of future cash flows falls. Oppositely, the lower the discount rate, the greater the present value of money. This means that when the discount rate is higher, money will be less valuable, or have less purchasing power, in the future than it has today.

The discount rate also emphasizes the time value of money because it determines the present value of future cash flows. As a result, the discount rate is one of the financial metrics that investors and financial analysts consider when comparing the value of future cash inflows to the cash outflows made to make the given investment.

The process on how to find the Discount rate can be determined by the type of analysis to be conducted. Take note that investors always venture in taking opportunities where their money can grow. However, we must also bear in mind that with great opportunities in business or finance, there are always risks. If the company uses the free cash flow to firm as their cash flow stream, then the Weighted Average Cost of Capital should be used as a discount rate. Moreover, if they used Free cash flow to equity as a cash flow stream, then use the cost of equity as the discount rate.

I will agree if you say that determining which discount rate to use is very confusing. The analysis and calculation require a rigorous process to ensure that values are accurate and correct. If you are seeking DCF Models and want to learn how to make your own, go to Discounted Cash Flow Models. If you want to learn more about how to utilize discount rates and how they function, we have put up a selection of discount rate example models that are tailored to certain sectors and use situations. Because it is the most common use case when computing the discount rate, these discount rate example models generally employ the weighted average cost of capital computation as the basis.

These discount rate example models have been prepared by expert financial modelers with extensive financial modeling experience and industry knowledge. As a result, the model will just require you to input values based on your data and customize the ranges or metrics to meet your needs. If you still need assistance with establishing a bespoke model with a discount rate, we can assist you with that as well. Simply provide us with your specs, and we will draft the model and offer you a proper price.