Hotel

Listed here are Valuation Models and Financial Model Templates for the Hotel Industry and its related sectors. Owning a hotel is the dream of many in the hospitality sector, but better to carefully plan how the financial performance might turn out.

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

Hotel Reservation Excel Template and Dashboard

Elevate Your Hotel Management: Streamlined Booking and Availability Tracking.

Hotel Complex – Financial Model (5 Yrs. DCF and Valuation)

The Hotel Complex financial model is a comprehensive tool designed…

Financial Modeling Mastery Bundle: Diverse Insights for Informed Decision-Making

Unlock financial expertise with our 'Diverse Insights Bundle.' Seven meticulously…

Tour Operator Financial Model – 5 Year Financial Plan

Financial Model providing an advanced 5-year financial plan for a…

Quick Coherent HOTEL / GUESTHOUSE Valuation and Financial Model 20 years

This quick and coherent Valuation and Financial model (20 years)…

Student Hostel Development – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Student Hostel…

AIRBNB Financial Model 20 years – Three Statement Analysis, and Valuations

This Airbnb acquisition and financial forecasting model will provide you…

Hostel Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Airbnb Marketplace Financial Model Excel Template

Airbnb Marketplace Budget Template Solid package of print-ready reports: P&L…

Hotel Real Estate Investment Model Template

Pro Forma Models created this financial model to calculate and…

Hotel Construction and Operation Excel Modeling Template

Granular assumptions to create a financial forecast for hotel operators…

City Hotel Financial Model – Dynamic 10 Year Forecast

Financial model presenting an operating scenario of a City Hotel.

All-Inclusive Resort Financial Model – Dynamic 10 Year Forecast

Financial model presenting an operating scenario of an All-Inclusive Resort

REIT Financial Model –NAV (Net Asset Value) & DCF Valuation Analysis Model

This is a REIT (Real Estate Investment Trust) financial model…

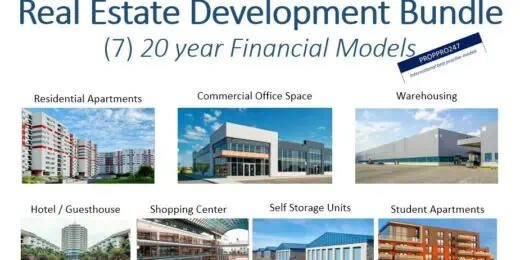

Real Estate Development Financial Models Bundle

A collection of seven Real Estate Development Financial Models offered…

Real Estate Acquisition Financial Models Bundle

A collection of six Real Estate Development Financial Models offered…

Hotel Portfolio – 20-year Financial Analysis and Valuations

This 20-year Hotel Valuation Model and Portfolio of 20 Hotels…

Hotel/Guesthouse/Resort Development Model and Valuation – 20 year Three Statement Analysis

This Hotel / Holiday Resort Development Model will take you…

ALL IN ONE Boutique Hotel Integrated 5-Year DCF Financial Model (Scenarios & Seasonality Based Forecast)

This is a real case-based advanced DCF model of a…

Pet Hotel Financial Model Excel Template

Pet Hotel Budget Template Allows you to start planning with…

Short Term Rentals (Airbnb) Financial Model – Dynamic 10 Year Forecast

Financial model presenting a Short Term Rental (Airbnb) business scenario.

AirBnB, Boutique Hotel, and Bed and Breakfast Investment Model

This investment model can be used to analyze a potential…

Theme Park & Hotel Financial Model (Construction, Operation & Valuation)

Financial model presenting a development scenario for a Theme Park…

Hotel Acquisition and Renovation – Pro Forma Real Estate

The Hotel Acquisition & Renovation Pro-form is an excel-based tool…

Pet Hotel Financial Model – Dynamic 10 Year Forecast

Financial Model providing a dynamic up to 10-year financial forecast…

Boutique Hotel Financial Model Template in Excel

The Boutique Hotel Financial Model provides a 5-year annual forecast…

Hotel Development Financial Model (Construction, Operation, & Valuation)

Financial model presenting a development scenario for a Hotel including…

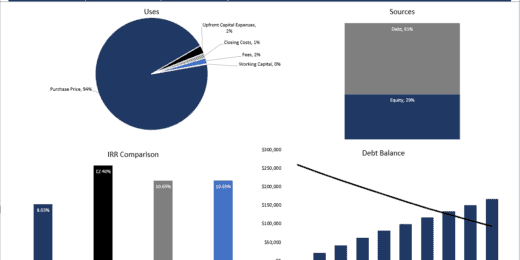

Hotel Acquisition Financial Model

Advanced financial model presenting a potential Hotel acquisition.

Hotel Lease Financial Model – 10 Year Forecast

Highly-sophisticated and user-friendly financial model providing 10-Year Financial Plan for…

Vacation Rentals Hotel Financial Model Excel Template

Discover Vacation Rentals Hotel Pro Forma Projection. Use this Excel…

Spa Hotel Financial Model Excel Template

Buy Spa Hotel Financial Model Template. This well-tested, robust, and…

Ski Resort Hotel Financial Model Excel Template

Buy Ski Resort Hotel Financial Model Template. There's power in…

Private Island Financial Model Excel Template

Get Your Private Island Financial Model Template. Fortunately, you can…

Floating hotel Financial Model Excel Template

Discover Floating hotel Pro Forma Projection. Creates a financial summary…

Eco Hotel Financial Model Excel Template

Get Your Eco Hotel Financial Projection. Excel template - robust…

Condo Hotel Financial Model Excel Template

Check Condo Hotel Financial Projection. Spend less time on Cash…

Casino Hotel Financial Model Excel Template

Download Casino Hotel Financial Projection Template. Fortunately, you can solve…

Beach Hotel Financial Model Excel Template

Try Beach Hotel Financial Model. Enhance your pitch decks and…

Banquet Hall Financial Model Excel Template

Buy Banquet Hall Financial Model. Excel template - robust and…

Hotel Development REIT Financial Model Excel Template

Get the Best Hotel Development REIT Financial Model. Excel Template…

Hotel Development Financial Model

Hotel Development Financial Model presents the case where an hotel…

Resort/Hotel Project Valuation – Construction and Operation Phase with NPV & IRR calculations

Hotel - Construction and Operations FM is a project finance…

Bed And Breakfast Financial Model Excel Template

Buy Bed And Breakfast Financial Projection Template. This well-tested, robust,…

Resort Financial Model Excel Template

Order Resort Financial Model. Excel template - robust and powerful.…

Hotel Startup/Existing Business Financial Projection 3 Statement Excel Model

User-friendly 3 Statement 5 year rolling financial projection Excel model…

Hostel Financial Model Excel Template

Check Hostel Financial Plan. Requesting a loan without a financial…

Motel Financial Model Excel Template

Discover Motel Financial Model Template. With this Excel you get…

Financial Analysis for Hotel Investment and Valuation: A Comprehensive Guide to Hotel Financing

In the world of investments, the hotel industry stands as a lucrative yet complex venture. The success of a hotel investment is not solely determined by its location or services but is deeply rooted in meticulous financial planning and analysis. Financial analysis serves as the backbone of any hotel investment, offering insights into profitability, cash flow, and valuation. It enables investors to make informed decisions, mitigate risks, and maximize returns. According to Statista, in 2023, the global hotel industry was valued at approximately $1.21 trillion, emphasizing the need for robust financial strategies to tap into this market.

This article aims to provide a comprehensive guide on the financial aspects of hotel investment and valuation. While there are various other factors, like legal considerations and market trends, that impact hotel investments, our focus will remain strictly on the financial elements. We will delve into the costs involved in hotel construction financing, the down payment requirements, and how financial planning can set the stage for a successful hotel venture.

Starting A Hotel: Financial Considerations

How Much Does It Cost to Start a Hotel?

Starting a hotel is a capital-intensive endeavor that involves various financial components. The initial investment can range from a few hundred thousand to several million dollars, depending on the scale and location of the hotel. Here are some key financial elements to consider:

- Land Acquisition: The cost of land is often the most significant expenditure, especially in prime locations.

- Construction and Renovation: Building from scratch or renovating an existing structure involves considerable costs.

- Licenses and Permits: Regulatory approvals come with their own set of fees.

- Operational Costs: Staff salaries, utilities, and maintenance are recurring expenses that need to be factored in.

- Marketing and Branding: A substantial budget is often required for marketing campaigns and branding initiatives.

What Is the Down Payment on a Hotel?

Typically, commercial lenders may require a down payment ranging from 20% to 40% of the total property value. For instance, for a hotel valued at $1 million, an estimated down payment could be between $200,000 to $400,000. However, it's important to understand that these numbers can vary based on multiple factors, such as the lender's policies, the investor's creditworthiness, and market conditions. The down payment serves as a risk mitigation strategy for lenders and also influences the loan terms and interest rates.

How Can I Start My Own Hotel with Financial Planning?

Financial planning is the cornerstone of a successful hotel investment. Here are some steps to guide you:

1) Feasibility Study: Conduct a thorough financial feasibility study to assess the viability of your hotel project.

2) Budgeting and Forecasting: Create detailed financial models to project revenues, expenses, and cash flows.

3) Funding Options: Explore various financing options such as bank loans, investor funding, or public offerings.

4) Risk Assessment: Identify potential financial risks and develop strategies to mitigate them.

5) Performance Metrics: Establish key performance indicators (KPIs) to monitor the financial health of your hotel.

6) Regular Audits: Periodic financial audits can help in identifying areas for improvement and optimizing returns.

By adhering to these financial planning steps, you can navigate the complexities of hotel investing and position your venture for long-term success.

Financing A Hotel: A Comprehensive Guide to Hotel Construction Financing

The hotel industry offers many opportunities for investors looking to diversify their portfolios. However, the financial intricacies involved in financing and buying a hotel can be overwhelming. This article aims to demystify these complexities, focusing solely on the financial aspects crucial for making a sound hotel investment. Whether considering a hospitality loan, an SBA hotel financing, or pondering over hotel franchises, this guide covers you.

How Do Hotels Get Financed?

A hotel is financed through a diverse procedure that combines debt and equity financing. Here are some common methods:

- Bank Loans: Traditional bank loans are often the first choice for many investors. These loans are usually long-term and require a substantial down payment.

- Investor Funding: Private investors or venture capitalists may offer to finance in exchange for equity shares in the hotel.

- Crowdfunding: Online platforms allow multiple investors to contribute smaller amounts, pooling resources to finance the hotel.

- Real Estate Investment Trusts (REITs): These trusts offer a way to invest in real estate, including hotels, without buying and managing the property yourself.

What Is a Hospitality Loan?

A hospitality loan is a specialized financial product designed explicitly for businesses in the hotel industry, including hotels, motels, and resorts. These loans are customized to meet the unique needs and challenges of the sector, offering flexible repayment terms and competitive interest rates.

Can You Get an SBA Loan to Buy a Hotel?

Yes, the Small Business Administration (SBA) offers SBA hotel financing options. SBA loans are particularly beneficial for small to medium-sized enterprises as they come with lower down payments and longer repayment terms. However, securing an SBA loan requires a rigorous application process and a strong business plan.

How to Finance a Hotel Franchise?

Financing a hotel franchise involves a different set of considerations compared to an independent hotel. Franchisors often have partnerships with lenders, making it easier to secure loans. Additionally, the franchise model may offer lower risks, making it more attractive to investors and financial institutions.

Who Are the Funders of Hotels?

The primary funders of hotels include:

1) Banks and Financial Institutions: Offer traditional loans and lines of credit.

2) Private Investors: High-net-worth individuals looking for equity ownership.

3) Crowdfunding Platforms: Pool resources from multiple small investors.

How Do You Buy a Hotel with Financial Prudence?

Financial prudence is key when buying a hotel. Here are some steps to ensure you make a financially sound hotel investment:

1) Due Diligence: Conduct a comprehensive financial analysis to assess the hotel's profitability and growth prospects.

2) Budget Allocation: Determine how much you can invest without jeopardizing your financial stability.

3) Negotiation: Use financial data to negotiate the best possible deal.

4) Financing: Choose the most suitable financing option based on your investment strategy and risk tolerance.

What Are the Examples of Hotel Financing?

1) Debt Financing: Taking a loan from a bank or financial institution.

2) Equity Financing: Selling shares of the hotel to private investors.

3) Mezzanine Financing: A combination of debt and equity, offering lenders the option to convert their debt into equity in case of default.

4) Lease Agreements: Leasing the property for a fixed period, often with the opportunity to buy later.

Profitability and Investment in Hotel Financing

Investing in the hotel industry can be both rewarding and challenging. This article aims to provide an in-depth financial perspective on hotel investments, covering everything from profitability and investment needs to risks and key financial metrics related to hotel financing.

Is Hotel Investment a Good Investment?

From a financial standpoint, hotel investments can offer substantial returns, especially when managed effectively. Hotels have multiple revenue streams, including room bookings, food and beverage services, and event hosting, which can contribute to a diversified and robust income. However, the profitability of a hotel investment largely depends on factors like location, market demand, and effective financial management.

How Do Hotel Investors Make Money?

Hotel investors primarily make money through:

1) Capital Appreciation: The increase in the property's value over time.

2) Operational Profits: Revenue generated from hotel operations minus the operating expenses.

3) Dividends: Investors may receive dividends if the hotel is part of a larger chain or a Real Estate Investment Trust (REIT).

What Is the Average Return on Hotel Investment?

The average return on hotel investment can vary widely depending on the type and location of the hotel. However, it's not uncommon for well-managed hotels in prime locations to yield annual returns of 10-15%. It's crucial to conduct a thorough financial analysis to project potential returns accurately, especially when considering hotel construction financing.

How Much Do You Need to Invest in a Hotel?

The initial investment in a hotel can range from a few hundred thousand dollars for small boutique hotels to several million for luxury hotels in prime locations. This includes land acquisition, construction, licensing, and initial operational expenses, all critical aspects of condo hotel financing.

Risks and Safety in Hotel Investment

Are Hotels Risky Investments?

Like any investment, hotels come with their own set of financial risks, including market volatility, high operational costs, and economic downturns. However, these risks can be managed effectively with thorough financial planning and risk mitigation strategies, especially when you know how to invest in a hotel.

What Are the Risks of Owning a Hotel?

Financial risks in hotel investment include:

1) Market Fluctuations: Changes in tourism and business travel can impact revenue.

2) High Operating Costs: Hotels have high fixed and variable costs, affecting profitability.

3) Economic Downturns: A recession can significantly impact occupancy rates and revenue.

Are Hotels a Safe Investment?

While no investment is entirely risk-free, hotels can be considered safe if they are well-managed, situated in a prime location, and have a solid financial plan in place, making them a potentially good choice for hotel investing.

Revenue Generation and Financial Metrics

How Do Hotel Owners Make Money?

Hotel owners generate revenue through various streams:

1) Room Revenue: The primary source of income generated through room bookings.

2) Ancillary Revenue: Additional services like restaurants, spas, and event spaces.

3) Franchise Fees: If the hotel is a franchise, fees may be collected from franchisees.

Revenue Per Available Room (RevPAR)

RevPAR is a crucial financial metric that measures the average revenue generated per available room over a specific period. The formula for calculating RevPAR is:

RevPAR = Total Room Revenue / Total Number of Available Rooms

- Total Room Revenue: The total income generated from room bookings.

- Total Number of Available Rooms: The total number of rooms available for booking, whether occupied or not.

Gross Operating Profit Per Available Room (GOPPAR)

GOPPAR measures the gross operating profit made per available room and is essential for assessing a hotel's operational efficiency. The formula for calculating GOPPAR is:

GOPPAR = Total Number of Available Rooms / Gross Operating Profit

- Gross Operating Profit: The profit made from the hotel's operations after deducting all operating expenses before interest, taxes, depreciation, and amortization.

- Total Number of Available Rooms: The total number of rooms available for booking, whether occupied or not.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

EBITDA provides an overview of a hotel's operational profitability by considering earnings before deducting interest, taxes, depreciation, and amortization. EBITDA is calculated using the following formula:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

- Net Income: The total revenue minus all expenses, including operating expenses, interest, taxes, depreciation, and amortization.

- Interest: The interest expenses incurred on loans or other financial obligations.

- Taxes: The total amount of taxes paid.

- Depreciation: The reduction in the value of assets over time.

- Amortization: The gradual reduction of a debt over a specified period.

Utilizing Financial Model for Hotel Investment: A Guide on How to Invest in a Hotel with Informed Decision-Making

The hotel industry is a complex yet rewarding investment landscape, offering multiple avenues for revenue generation. However, effective financial planning and analysis are the keys to unlocking its full potential. One of the most powerful tools in this regard is financial modeling. This article sheds light on the importance of a financial model for hotel investment, focusing on key components such as revenue forecasts, expense forecasts, and cash flow analysis.

Importance of Financial Modeling in Investment Decision-making

Financial modeling serves as the linchpin in the investment decision-making process. It provides a quantitative framework that allows investors to simulate different financial scenarios and assess the potential risks and returns. Here's why financial modeling is indispensable:

- Risk Assessment: Financial models help identify and quantify potential risks, enabling investors to develop mitigation strategies.

- Investment Viability: Through financial modeling, investors can determine whether the hotel investment aligns with their financial goals and risk tolerance.

- Strategic Planning: Financial models offer insights that can be invaluable for long-term planning, such as expansion or diversification.

- Funding and Capital Allocation: A well-crafted financial model can be a persuasive tool when seeking hotel financing from banks or investors.

Key Components of a Hotel Investment Financial Model

Revenue Forecast

The revenue forecast is a critical component of any hotel financial model investment. It provides an estimate of the potential income generated from various revenue streams, such as:

1) Room Bookings: The primary source of revenue is often influenced by factors like location, seasonality, and marketing efforts.

2) Food and Beverage: Revenue generated from in-house restaurants, bars, and room service.

3) Ancillary Services: Additional services like spa treatments, event hosting, and other amenities.

Expense Forecast

Understanding the cost structure is equally important for a successful hotel investment. The expense forecast outlines all the costs associated with running the hotel, including:

1) Operational Costs: These are the day-to-day expenses like staff salaries, utilities, and maintenance.

2) Marketing and Advertising: Budget allocated for promotional activities to attract guests.

3) Capital Expenditure: Long-term investments such as renovations or expansions.

Cash Flow Analysis

Cash flow analysis is the cornerstone of any hotel financial model, providing a snapshot of the hotel's financial health. It considers both the revenue and expenses to show how much cash the business generates or consumes over a specific period. A positive cash flow indicates a profitable operation, while a negative cash flow may signal financial troubles.

Financial modeling is an essential tool for anyone looking to invest in the hotel industry. It offers a structured approach to evaluate the financial viability of the investment, assess risks, and plan strategically for the future.

Conclusion – The Imperative of Financial Analysis in Hotel Investment and Valuation

In the intricate landscape of hotel investment, the role of financial analysis and modeling cannot be overstated. From assessing the initial investment requirements to evaluating long-term profitability, a robust financial framework serves as the backbone of any successful hotel venture. It equips investors with the quantitative insights needed to make informed decisions, whether it's choosing the right hotel financing options, allocating capital efficiently, or identifying potential risks and mitigation strategies.

Financial models, particularly those tailored for the hotel industry, offer a comprehensive view of various financial metrics such as Revenue Per Available Room (RevPAR), Gross Operating Profit Per Available Room (GOPPAR), and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). These metrics serve as key performance indicators, helping investors gauge a hotel's financial health and investment potential. Moreover, these models provide a dynamic platform to simulate different scenarios, thereby allowing investors to prepare for market fluctuations and economic downturns.

The importance of financial analysis extends beyond mere number-crunching. It provides a strategic roadmap for long-term planning, expansion, diversification, or exit strategies. Furthermore, a well-crafted financial model for a hotel can be invaluable when seeking funding, offering lenders or investors a transparent and credible overview of the hotel's financial prospects.

For those seeking specialized financial models to navigate the complexities of hotel investing, eFinancialModels stands as a reliable platform. Offering a range of expertly designed hotel financial model templates, we aim to simplify the financial planning process, making it accessible and efficient.

In conclusion, financial analysis is not just an optional tool but an imperative in the realm of hotel investment and valuation. It provides the analytical rigor and strategic insights needed to navigate the complexities of the industry. By investing time and resources in thorough financial planning, investors not only mitigate risks but also set the stage for a profitable and sustainable hotel business.