Real Estate Bundle 2 (6 models)

Planning to start a real estate endeavor but don’t know the financial implications of your investment? Why don’t you use our real estate bundle with 6 templates as a base to start with and check your potential returns?

This is a collection of selected financial model templates for projects or ventures in the Real Estate Industry and its related sectors. These templates are specially designed for businesses that operate in the real estate field who need help to forecast the financial statements as well as to possibly conduct a valuation. Not only will you save time from having to purchase these templates separately, but you will also get a discount when getting this bundle!

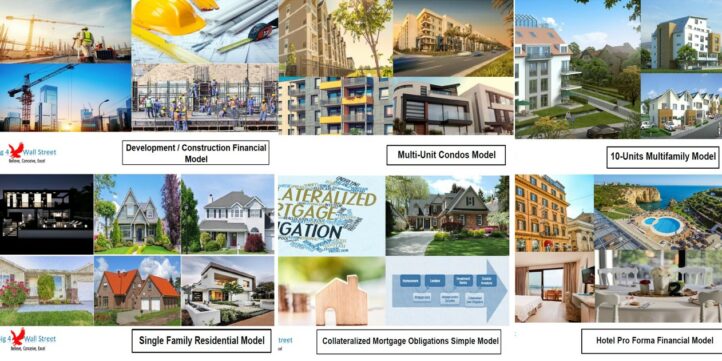

The bundle includes the following templates:

Construction / Development Financial Model: Development & Construction Model presents the case where a property with multiple residential units is constructed and subsequently rented for several years before the property is sold. The model generates cash flows on a project and equity basis and calculates the relevant metrics (cash on cash, Internal Rate of Return, net present value, loan to value, debt yield, coverage ratio, and DSCR).

Multi-Family Residential Model: 10-Units Multifamily Model presents the case where a property with multiple residential units is purchased and subsequently rented for several years before the property is sold. The model generates cash flows on a project and equity basis and calculates the relevant metrics (cash on cash, Internal Rate of Return, net present value, loan to value, debt yield, coverage ratio, and DSCR).

Single Family Residential Model: Single Family Residential Model presents the case where a property is purchased and subsequently rented for several years before the property is sold. The model generates cash flows and a project and equity basis and calculates the relevant metrics (cash on cash, Internal Rate of Return, net present value, loan to value, debt yield, coverage ratio, and DSCR).

Hotel Development Financial Model: Hotel Development Financial Model presents the case where a hotel is constructed with the intention to operate it and potentially sell it after a few years. The model generates cash flows on a project and equity basis and calculates the relevant metrics (cash on cash, Internal Rate of Return, net present value, loan to value, debt yield, coverage ratio, and DSCR).

Multi-Unit Condos Model: Multi-Unit Condos Model presents the business case where a property with multiple residential units or apartments is financed, constructed, and subsequently sold. The model generates cash flows on a project and equity basis and calculates the relevant metrics (Unlevered and Levered IRR, Equity Return Multiple, Levered Peak Equity, and Payback Period).

Collateralized Mortgage Obligations Model: Collateralized Mortgage Obligations Model presents a simple model where mortgage-backed securities are used as collateral. Mortgages are pooled and interests in these pools are sold to investors in classes or tranches. Bondholders buy into these tranches and receive cash flows. The payments are prioritized according to their class. Some bondholders receive cash flows automatically while others choose to defer cash flows based upon a future higher return or some other greater return. Deferring the payments may yield a greater return but this is in exchange for a greater risk taken by the tranche’s holders.

All finance models above come as Excel Files, and you can also check out the detailed description of each financial model template by viewing the individual product.

Similar Products

Other customers were also interested in...

Real Estate Development Bundle

This Real Estate Development Bundle is a collection of real estate calculators or tools in MS Excel ... Read more

Condo Hotel Financial Model Excel Template

Check Condo Hotel Financial Projection. Spend less time on Cash Flow forecasting and more time on yo... Read more

Multi – Unit Condos Model Template

Multi-Unit Condos Model presents the business case where a property with multiple residential units ... Read more

Construction / Development Financial Model

Development & Construction Model presents the case where a property with multiple residential un... Read more

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

Real Estate Acquisition-Rent-Sell Comprehensive An...

An integrated, dynamic and ready-to-use Real Estate Acquisition-Rent-Sell Comprehensive Analysis Mod... Read more

Real Estate Multi-Family Development Excel Model

Real Estate Financial Model to evaluate a development project, with Equity Waterfall and Advanced Sc... Read more

Hotel/Guesthouse/Resort Development Model and Valu...

This Hotel / Holiday Resort Development Model will take you through a 20-year period of Three Statem... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Condominium Development – Dynamic 10 Year Fi...

A condominium (or condo for short) is a building structure divided into several units that are each ... Read more

You must log in to submit a review.