Development

Listed here are financial model templates designed for the real estate industry, specifically, the development business model and its related sectors.

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

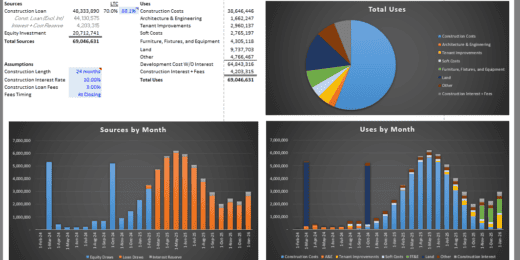

Construction Draw Schedule & Gantt (New Development Cost/Sources & Uses Model)

Elevate your construction project planning with our Construction Draw Schedule…

Industrial Warehouse Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Student Accommodation Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Care Home Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a multi…

Real Estate Proforma – Value-Add Apartment Acquisition Model

This multifamily apartment value-added real estate model is a sophisticated…

Senior Living Development – 10 Year Financial Model

Financial model presenting a development scenario for a Senior Living…

Student Accommodation / Village Development Model – 20 years

This Student Accommodation 20-year Development Model (hold and lease) will…

Real Estate – Fix and Flip Pro-forma

This meticulously crafted Financial Model for Analyzing Fix and Flip…

Self-Storage Park Development Model

This Self-Storage Park development model will produce 20 years of…

Financial Model for a Smart City Project

This is a financial model to identify various components of…

Rental Property Financial Model

The Rental Property financial model template, forecasts a rental property's…

Recreation & Community Center – Dynamic 10 Year Financial Model

Financial Model presenting a development and operating scenario of a…

House Flipping – Rehab Financial Model

The house flipping financial model is a comprehensive tool designed…

Condo Development Model (Build and Sell)

A financial forecasting model specifically designed for the economics of…

Real Estate PE Multiple Hurdles Waterfall Analysis Model

We proudly present our cutting-edge Real Estate Waterfall Analysis Model…

Public-Private Partnership (PPP) Financial Model

Financial Model presenting development and operating scenarios of various projects…

PADEL Court and Club Dynamic Financial Model 10 years

Introducing the Padel Court and Club Financial Forecasting Model, a…

Real Estate – Multiphase Land Development

Raw land development projects: The model is specifically designed for…

PICKLEBALL Court and Club Development – Dynamic Financial Model (10 years)

Introducing our Pickleball and Club Financial Forecasting Model – your…

Apartment Building / Self-Storage / Multi-Family Acquisition Model: 15 Year

This real estate model works great for acquisitions of apartment…

Real Estate Development Financial Model

A professional model for real estate construction (build – hold…

Real Estate Acquisition-Rent-Sell Comprehensive Analysis Model

An integrated, dynamic and ready-to-use Real Estate Acquisition-Rent-Sell Comprehensive Analysis…

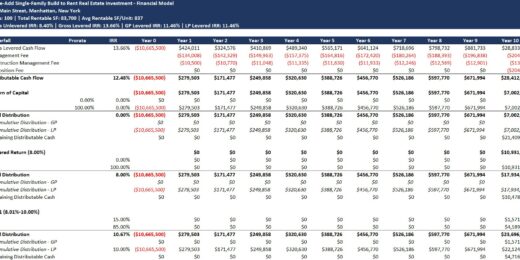

Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

A financial model to help calculate and analyze the pro…

Multi Sports Complex Financial Model – Dynamic 10 Year Forecast

Financial Model presenting a development and operating scenario of an…

Student Hostel Development – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Student Hostel…

KPI Dashboard: Quote vs Actual Gross Profit Margins

This dashboard will improve the tracking of any general contracting…

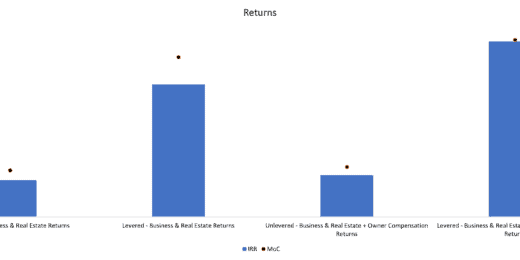

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

Single Tenant Net Lease (NNN) – Investment & Valuation Model

Financial model presenting an investment scenario for a Single Tenant…

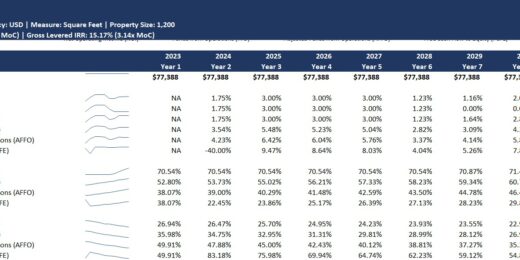

Triple Net Lease (NNN) Real Estate Investment with Returns & Waterfall

This Pro Forma Model is used to analyze the financial…

Storage Facility Development Model

The Storage Facility Development model projects annual future cash flows…

Mobile Home Park Development Model

The Mobile Home Park Development model projects annual future cash…

Retail Property Development Financial Model

A professional model for retail property construction (build – hold…

Value-Add Multi-Family (Apartment) Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Hotel Real Estate Investment Model Template

Pro Forma Models created this financial model to calculate and…

Residential “Build & Sell” Financial Model

A professional model for residential property construction (build & sell)

Residential “Build-Hold-Sell” Financial Model

A professional model for residential property construction (build – hold…

Condominium Development – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Condominium Units…

Real Estate – Self Storage Acquisition Model

This template is an Institutional-Quality excel-based analysis tool for a…

Real Estate – Industrial Acquisition Model

An Excel-based analysis tool for the acquisition, operation, and ultimate…

Real Estate – Simple Acquisition Model for Office, Retail Properties

This is a fully functional, institutional quality, and dynamic real…

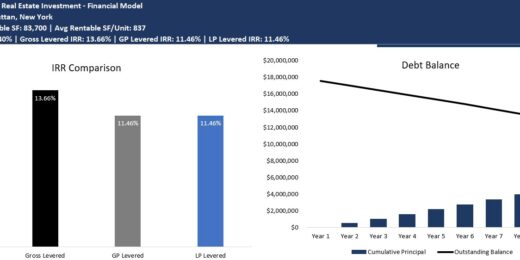

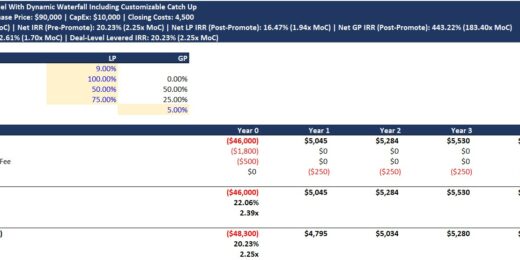

Real Estate Investment Model Template with Waterfall & Catch Up

The waterfall model includes a dynamic catch up. This model…

Real Estate – Farm Development Model

This is an Excel-based analysis tool for the ground-up development,…

Acquisition Model for Commercial Property

This is the Quintessential Commercial Property Acquisition Model that allows…

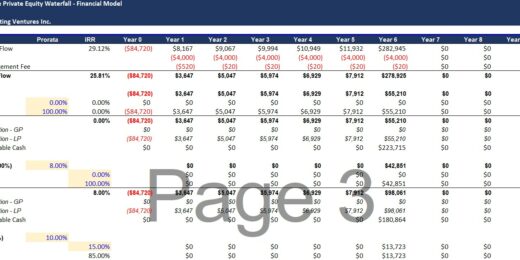

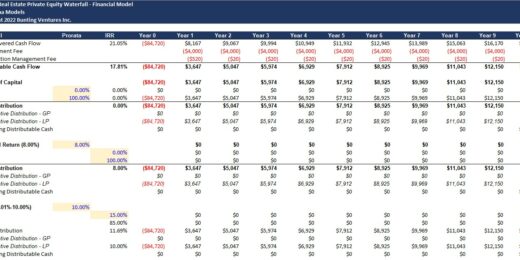

Dynamic Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity…

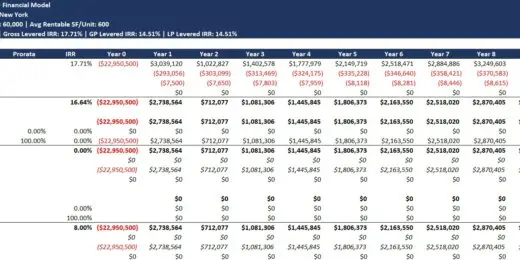

10 Year Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity…

Return Analysis Model of Real Estate with Refinancing Loan & Renovation

The objective of this model is to provide users with…

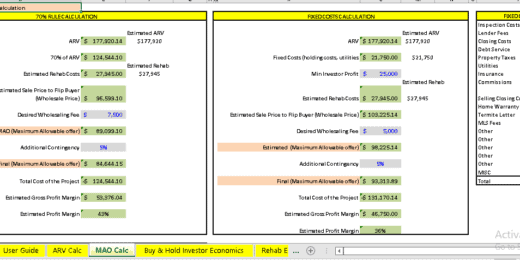

Wholesale Deal Analyzer in the Real Estate – Financial Model

This model is best for those who want a calculator…

Industrial Real Estate Development Model

An Excel-based analysis tool for the ground-up development, operation, and…

Warehouse Development Financial Model

A professional model for warehouse (industrial building) construction (build –…

Real Estate Investment Fund – Development Properties

This model projects monthly future cash flows from development properties…

Residential Investment Property Acquisition Model Template

Residential Investment Property Acquisition Model provides detailed monthly Cash Flow…

Real Estate Development: A Comprehensive Guide for Aspiring Developers

Real Estate Development, commonly known as "property development, " drives economic growth and creates jobs. It is a complex and challenging industry but also one of the most rewarding. Real estate developers transform ideas into reality, shaping our communities and building the infrastructure we rely on daily.

China Evergrande Group, the largest real estate developer in the world, is a testament to the power and potential of this industry. In 2022, Evergrande had total assets of over $300 billion (source: swfinstitute.org) and revenue of over $100 billion. It employs over 200,000 people and operates in over 280 cities in China.

But real estate development is not just about big numbers and ambitious projects. It is also about creating homes and businesses where people can live, work, and thrive. For example, the Knowledge Economic City in Saudi Arabia is a master-planned real estate development home to many educational and research institutions, as well as businesses and industries related to knowledge and innovation.

Real estate development is also essential for addressing the challenges of urbanization and climate change. For example, The Line, an under-construction linear city in Saudi Arabia, is designed to be sustainable and livable, with no cars and a focus on walkability and public transportation.

Whether you are an aspiring real estate developer, a seasoned professional, or an investor, understanding the financial aspects of real estate development is essential. Financial modeling provides a structured, quantitative framework for assessing project viability, mitigating risks, and optimizing returns.

In this article, we will explore the basics of real estate or property development finance and discuss how specialized financial models can help you achieve success in this competitive industry.

The Importance of the Real Estate Development Industry

The real estate development industry is often viewed through the lens of profit and investment returns. However, its significance extends far beyond financial metrics. Real estate development plays a pivotal role in shaping the economic, social, and infrastructural fabric of society.

Why is this Industry Important?

Economic Impact

The real estate industry plays a pivotal role in shaping the economic landscape of a nation. Its influence extends beyond mere property transactions, having profound implications for job creation, GDP growth, and investment opportunities. Let's delve deeper into the economic impact of this industry.

Job Creation: Real estate development is a major driver of employment, creating real estate development jobs across various sectors including construction, architecture, engineering, and real estate brokerage. These jobs not only provide livelihoods but also contribute to the overall economic growth.

GDP Contribution: The global real estate market holds a pivotal position in the world's economy. According to the Global Real Estate Market Report 2023, the industry was valued at $3694.47 billion 2022 and grew to $3976.18 billion 2023. With a projected Compound Annual Growth Rate (CAGR) of 7.0%, the market is anticipated to reach a staggering $5209.84 billion by 2027. This consistent upward trajectory underscores the industry's resilience and its indispensable role in driving global economic stability.

Investment Opportunities: Real estate often serves as a lucrative investment avenue, attracting both individual and institutional investors. The industry's ability to generate consistent returns makes it a cornerstone of economic stability.

Social Contributions

The social impact of the real estate industry is often overshadowed by its economic contributions. However, it plays a crucial role in community development, urbanization, and enhancing the quality of life.

Community Development: Real estate projects often lead to the development of communities, providing people with homes, and creating spaces for social interaction.

Urbanization: As populations grow, the need for organized living spaces becomes crucial. Real estate development facilitates urbanization, transforming rural areas into developed towns and cities.

Quality of Life: By providing amenities like parks, schools, and healthcare facilities, real estate development directly impacts the quality of life.

Infrastructure Development

Infrastructure development is another critical area where the real estate industry leaves its mark. From transportation and utilities to sustainable real estate development, the sector plays a vital role in shaping the physical landscape of a community.

Transportation: Many real estate projects include the development of roads, bridges, and public transport facilities, improving connectivity.

Utilities: From electricity and water supply to waste management, real estate development often involves setting up essential utilities.

Sustainable Development: With growing awareness of environmental issues, sustainable real estate development is becoming increasingly important, incorporating eco-friendly materials and energy-efficient designs.

The real estate industry is a cornerstone of economic and social prosperity. Its contributions extend far beyond property transactions, influencing job markets, GDP, investment landscapes, community development, urbanization, and infrastructure. It is an industry that not only builds properties but also shapes the future of nations.

Definition and Types of Real Estate Development

Real estate development involves the purchase, ownership, planning, and eventual sale or lease of real estate properties. It's a process that transforms raw land or renovates existing structures into habitable, commercial, or industrial spaces. Each type of development has its own set of rules, market demands, and financial considerations.

Residential Development: involves the creation of living spaces such as houses, apartments, and condominiums. These projects can range from single-family homes to large apartment complexes.

Zoning Laws: Residential developments often have specific zoning requirements that dictate the density and type of housing that can be built.

Market Demand: Understanding the housing needs of the target market is crucial for the project's success.

Financing: Residential projects often require different financing structures, such as construction loans that convert to traditional mortgages.

Commercial Development: focuses on creating spaces for businesses, including offices, retail stores, and shopping centers.

Location: The success of commercial properties often hinges on location and accessibility.

Regulations: Commercial developments may require additional permits and adhere to different building codes.

Tenant Mix: For multi-tenant properties like shopping centers, the mix of tenants can significantly impact the project's success.

Industrial Development: Industrial real estate development includes the construction of factories, warehouses, and other facilities used primarily for production, storage, and distribution.

Infrastructure: Industrial developments often require robust infrastructure, including transportation and utilities.

Environmental Regulations: These projects usually undergo rigorous environmental assessments.

Long-term Leases: Industrial spaces often involve longer lease agreements, affecting the investment's liquidity.

Land Development: Land Development involves the subdivision and improvement of raw land into parcels for other types of real estate development.

Land Use Planning: Deciding the best use for the land—whether residential, commercial, or industrial—is crucial.

Utilities and Infrastructure: Developers must consider the cost and logistics of bringing utilities to the site.

Zoning and Permits: Obtaining the necessary approvals can be a lengthy process, affecting project timelines.

Gated Communities: Gated communities are a specialized form of residential development, offering secure, exclusive living spaces, often with shared amenities like swimming pools and gyms.

Security: One of the main selling points, and thus a key consideration in planning.

Amenities: The quality and variety of amenities can significantly impact the project's attractiveness.

Homeowners Associations: These often play a significant role in the ongoing management of the community.

Real estate development is a complex field with various sub-disciplines, each presenting its own set of challenges and opportunities. From residential and commercial to industrial developments, understanding the nuances of each type is crucial for success.

How to Start in Real Estate Development

Embarking on a career in real estate development is a journey that combines education, practical experience, and strategic networking. This multifaceted field offers a unique blend of creativity and financial insight, allowing you to transform landscapes while generating value. Whether you're interested in residential, commercial, or mixed-use properties, the path to becoming a successful developer is paved with informed decisions and calculated risks. Read on to discover the essential steps to launch your real estate development career with confidence and expertise.

Real Estate Development Process

Navigating the complexities of real estate development requires a foundational understanding of its various components. This section aims to serve as a comprehensive guide for understanding the basics of real estate development, from the development process and key stakeholders to the types of real estate and the development lifecycle.

How Does Real Estate Development Work?

Real estate development is a multi-step process that begins with the identification of a viable project and culminates in the sale or leasing of developed properties. This intricate journey navigates through stages of architectural planning, land acquisition, financial modeling, phased execution, regulatory compliance, risk mitigation, and market positioning.

1) The Master Plan: Architectural Design and Planning

The journey begins with a well-thought-out plan. This involves hiring an architect or urban planner to create a master plan that outlines the design, layout, and other critical elements of the project.

2) Land Acquisition: The Foundation of Your Project

The next step is securing the land where the development will take place. This could involve purchasing the land outright or securing a long-term lease. Due diligence is crucial at this stage to ensure the land is free from legal issues.

3) Financial Feasibility Analysis: The Numbers Game

Before proceeding further, a thorough financial feasibility analysis is essential. This involves calculating the expected investment costs, projected income, operational costs, and potential profits. Financial modeling tools can be invaluable at this stage.

4) Time and Phasing Plan: The Roadmap

Once the financials are clear, a detailed time plan or phasing plan is developed. This serves as the project's roadmap, outlining the timeline for each phase, from land acquisition to construction and eventual sale or leasing.

5) Regulatory Approvals: Navigating the Legal Maze

With a plan and timeline in place, the next step is to secure all necessary approvals from local and federal authorities. This could include zoning approvals, environmental clearances, and construction permits.

6) Pre-Selling: Risk Mitigation and Capital Generation

In some cases, especially for large-scale residential projects, pre-selling some of the real estate is advisable. This not only generates capital but also serves as a market validation tool.

7) Construction: Where Plans Meet Reality

Construction is fraught with risks, from delays and cost overruns to quality issues. Effective project management is crucial to navigate these challenges successfully.

Types of Risks in Construction

- Financial Risks: Fluctuations in material costs, labor costs, etc.

- Operational Risks: Delays due to weather, labor strikes, etc.

- Quality Risks: Subpar materials, construction errors, etc.

8) Commissioning: The Final Checkpoint

Once construction is complete, the project goes through a commissioning process to ensure everything meets the specifications outlined in the master plan. Any construction mistakes must be revised at this stage.

9) Exit or Rent: The Final Decision

The last step involves deciding whether to sell the developed real estate or to hold and rent it out. This decision is often influenced by market conditions and the project's financial performance.

Each phase is a critical milestone, fortified by specialized tools and expertise, aimed at transforming a vision into a tangible, profitable reality.

Key Stakeholders in Real Estate Development

The key stakeholders in real estate development are the individuals and groups who are interested in the project's success. They may be directly involved in the development process, or they may be indirectly affected by it. Some of the most common key stakeholders in real estate development include:

- The developer: The developer is the individual or company that initiates and manages the development project. They are responsible for obtaining the land, securing financing, and overseeing construction.

- Investors: Investors provide the capital needed to finance the development project. They may be individuals, financial institutions, or other companies.

- Lenders: Lenders provide loans to finance the development project. They may be banks, credit unions, or other financial institutions.

- Contractors: Contractors are responsible for building the development project. They may be general contractors, subcontractors, or specialty contractors.

- Consultants: Consultants provide expert advice and services to the developer on various aspects of the development process. This may include architects, engineers, lawyers, and environmental consultants.

- Government agencies: Government agencies may be involved in the development process in various ways. For example, they may issue permits, approve zoning changes, or provide financial incentives.

- Community members: Community members live, work, or play in the area where the development occurs. The development may affect them in various ways, both positively and negatively.

Developers must identify and engage with their key stakeholders early in development. This will help ensure that everyone is on the same page and that the project can move forward smoothly.

Here are some additional key stakeholders that may be involved in real estate development projects:

- Tenants: The tenants will be key stakeholders if the development project includes commercial or residential space. They will be directly interested in the space's quality and functionality.

- Suppliers: Suppliers provide the materials and equipment needed for the development project. They may be local businesses or national corporations.

- Media: The media can be important in raising awareness of a development project and influencing public opinion.

- Environmental groups: Environmental groups may be concerned about the impact of the development project on the environment. They may advocate for changes to the project or even try to block it altogether.

Developers can increase their chances of success by identifying and engaging with all of their key stakeholders.

Key Players in Real Estate Development

The key players in real estate development are the individuals and groups directly involved in planning, financing, and constructing a development project. They include:

- Real estate developer: The developer is the individual or company that initiates and manages the development project. They are responsible for assembling the land, securing financing, and overseeing construction.

- Project manager: The project manager is responsible for coordinating the activities of all the different parties involved in the development project. They ensure that the project stays on schedule and within budget.

- Architect: The architect is responsible for designing the development project. They work closely with the developer to create a design that meets the needs of the project and the community.

- Engineer: The engineer is responsible for designing and overseeing the infrastructure construction for the development project. This may include roads, utilities, and drainage systems.

- General contractor: The general contractor is responsible for hiring and managing the subcontractors who will build the development project.

- Subcontractors: Subcontractors are specialized contractors who perform specific tasks on the development project, such as electrical work, plumbing, and HVAC installation.

In addition to these key players, several other professionals may be involved in a real estate development project, such as:

- Real estate attorney: The real estate attorney helps the developer with all the legal aspects of the project, such as acquiring the land and negotiating contracts.

- Environmental consultant: The environmental consultant assesses the environmental impact of the development project and recommends ways to minimize it.

- Marketing consultant: The marketing consultant helps the developer to market and sell the development project to potential buyers or tenants.

The success of a real estate development project depends on the effective collaboration of all the key players. By working together, they can create a project that benefits everyone involved.

What Are the First Steps to Becoming a Developer?

The first steps to becoming a real estate developer are to:

- Get an education: There is no specific degree required to become a real estate developer, but a bachelor's degree in a related field, such as business, finance, real estate, or construction, can be helpful. Some colleges and universities also offer specialized programs in real estate development.

- Gain experience: Once you have an education, gaining experience in the real estate industry is important. This can be done by working as a real estate agent, broker, or appraiser. You can also gain experience by working for a real estate development company.

- Build a network: Networking is essential for the real estate development industry's success. Get to know other developers, investors, contractors, and professionals who can help you with your projects.

- Develop a business plan: Once you have the necessary education, experience, and network, you can begin to develop a business plan for your real estate development company. This plan should include your goals, strategies, and financial projections.

- Secure financing: Real estate development can be a capital-intensive industry, so securing financing for your projects is important. This may involve working with investors, lenders, or government agencies.

Once you have completed these steps, you will be well on your way to becoming a successful real estate developer.

Here are some additional tips for becoming a real estate developer:

- Focus on a specific niche: There are many types of real estate development projects, such as residential, commercial, and industrial. It is helpful to focus on a specific niche to develop expertise in that area.

- Start small. Take your time tackling a large, complex project. Start with smaller projects and work up to larger ones as you gain experience.

- Be patient. Real estate development can take a lot of work. It can take years to complete a project from start to finish. Be prepared to be patient and persistent.

Becoming a real estate developer can be a rewarding career, but it is important to be prepared for the challenges involved. By following the steps above and developing the necessary skills and experience, you can increase your chances of success.

Real Estate Developer Profit

How Do They Make Money?

Real estate developers make money by buying land, developing it into something more valuable, and then selling or leasing it. However, it is important to note that real estate development is a complex and risky business. There is no guarantee of success; even experienced developers can lose money on projects.

Here is a more detailed look at some of the different ways that real estate developers can make money:

Land development is the most common way real estate developers make money. Developers purchase raw land, secure the necessary permits, and then develop it into something more valuable, such as a subdivision, shopping center, or office building. Once the development is complete, they can sell it or lease it to tenants.

However, land development is also a very capital-intensive strategy. Developers need to have a lot of money upfront to purchase the land and cover the development costs. Additionally, land development can be a slow process, and it can take several years to complete a project from start to finish.

Property flipping involves buying a property, making minor renovations, and then selling it for a profit. This can be a more hands-on strategy than land development, but it can also be more risky.

Flippers need to be able to identify properties that have the potential to be flipped at a profit. They also need to be able to make the necessary renovations on time and within budget. Additionally, flippers need to be aware of the current market conditions and be able to price their properties competitively.

Rental income can be a more stable and predictable source of income for real estate developers. Developers can purchase properties and then lease them out to tenants. This can provide a steady stream of income over time.

However, rental income can also be a lot of work. Developers need to manage their properties effectively, which includes finding tenants, collecting rent, and dealing with maintenance issues. Additionally, developers need to be aware of the local rental market and price their properties accordingly.

Joint venture real estate developers often partner with other investors or businesses to develop properties. This can help them to reduce their risk and access additional capital.

However, joint ventures can be complex, and it is important for developers to choose their partners carefully and to have a clear agreement in place before starting any project.

Other ways to make money in real estate development:

Development fees: Developers can charge development fees to other companies or investors for the right to develop their land.

Property management: Developers can provide property management services to other property owners. This can include finding tenants, collecting rent, and handling maintenance issues.

Selling development expertise: Developers can sell their development expertise to other investors. This could involve consulting on projects or providing mentorship.

There are many different ways that real estate developers can make money. However, it is important to understand the risks involved and have a solid business plan. Real estate development is a complex and challenging business, but it can also be rewarding.

How It's Made

Real estate developers obtain their profits by selling or leasing the developed property at a price higher than the project's total cost, including the cost of land purchase. The difference between the market value of fully developed real estate and all the costs is the developer's profit.

Profit = Market value of fully developed real estate - Total costs of development

For example, if a real estate developer purchases a piece of land for $1 million and spends $2 million on construction, their total costs will be $3 million. If they then sell the fully developed property for $5 million, their profit will be $2 million.

However, it is important to note that this is a simplified explanation. In reality, real estate developers need to account for a number of other factors when calculating their profits, such as:

Taxes on capital gains: In many countries, real estate developers are subject to capital gains taxes on the profits they make from selling developed property. The amount of tax paid will depend on the country in question and the specific circumstances of the sale.

Other taxes: Real estate developers may also be subject to other taxes, such as income tax, corporation tax, and value-added tax (VAT). The amount of tax paid will vary depending on the country in question and the specific circumstances of the developer's business.

Financing costs: If the developer has financed the project with debt, they will need to account for the cost of interest payments in their profit calculations.

Contingency funds: Real estate developers typically set aside contingency funds to cover unexpected expenses, such as cost overruns or delays.

Once all these factors have been considered, the developer's net profit is the remaining amount.

It is also important to note that the profit margins for real estate development can vary significantly depending on the type of property being developed, the location of the property, and the current market conditions. For example, developers of luxury residential properties in major cities can expect to earn higher profit margins than developers of affordable housing in rural areas.

Real estate developers who are able to manage the risks successfully and execute their projects effectively can earn significant profits.

Real Estate Valuation Approach: How to Value Your Property

Valuing real estate is a complex process that requires a nuanced understanding of various factors, including market conditions, property characteristics, and economic indicators. Below are the three main approaches to valuing fully developed real estate, each with its own set of advantages and limitations.

1. Sales Comparison Approach

The Sales Comparison Approach is often the most straightforward and commonly used method for residential properties. It involves comparing the subject property to similar properties ("comparables" or "comps") that have recently sold in the same area.

Key Factors:

- Size (square footage)

- Location (proximity to amenities, school districts, etc.)

- Condition (age, renovations, structural integrity)

- Features (number of bedrooms, bathrooms, garage space, etc.)

Advantages:

- Easy to understand and explain to clients or stakeholders.

- Highly reliable if there are sufficient, recent, and truly comparable sales data.

Limitations:

- May not be applicable for unique or specialized properties.

- Market conditions can change rapidly, making older comps less relevant.

2. Cost Approach

The Cost Approach is based on the principle of substitution—what would it cost to replace the existing property? This approach is often used for new buildings or properties that are so unique that comparable sales data is not available.

Key Factors:

- Cost of land as if vacant

- Cost of materials and labor to construct a similar building

- Depreciation (physical, functional, and economic)

Advantages:

- Useful for new or specialized properties.

- Considers the intrinsic value of the property components.

Limitations:

- Depreciation can be subjective and difficult to measure accurately.

- May not capture the current market sentiment.

3. Income Approach

The Income Approach is primarily used for income-producing properties like commercial real estate or multi-family residential buildings. It estimates the value based on its future income-generating potential.

Key Factors:

- Net Operating Income (NOI)

- Capitalization Rate (Cap Rate)

Advantages:

- Directly related to the investment potential of the property.

- Can be highly accurate if reliable income and expense data are available.

Limitations:

- Requires specialized knowledge to calculate NOI and Cap Rate.

- Sensitive to changes in market conditions, such as interest rates and vacancy rates.

Choosing the Right Approach

The most appropriate valuation method depends on various factors, including the type of property, its use, and the availability of data. Often, a hybrid approach that combines elements from different methods provides the most accurate valuation. For instance, for a mixed-use property, applying both the Sales Comparison and Income Approach may offer a more comprehensive valuation.

By understanding these approaches in-depth, you can make more informed decisions, whether you're an investor, lender, or business owner involved in real estate. This knowledge prepares the ground for better financial decisions, aligning perfectly with your objective of providing sophisticated financial analysis and planning tools.

Property Development Finance

Navigating the financial landscape of real estate development is a critical component of success in this industry. This section aims to serve as a comprehensive guide for aspiring real estate developers, focusing on the property development finance that can make or break a project.

What Investment Strategies Should You Consider?

Investment strategies in real estate are as diverse as they are crucial. This section aims to guide you through various approaches, from the long-term 'Buy and Hold' to the quick 'Fix and Flip.' Choosing the right strategy can be the difference between a profitable investment and a costly mistake.

- Buy and Hold: This long-term strategy involves purchasing a property and holding onto it until it appreciates in value.

- Fix and Flip: This short-term strategy involves buying a property, making improvements, and selling it quickly for a profit.

- Wholesale: In this strategy, you contract a property and sell that contract to another buyer before the sale is complete, earning a commission.

- Commercial Investments: Investing in commercial properties often involves higher capital but can yield more stable returns.

How Can Financial Models Help You Project Earnings?

Financial models serve as the backbone of any successful real estate project. This section focuses on how these models can aid in precise budgeting, risk assessment, and valuation, thereby empowering you to make data-driven decisions. Leverage these tools to optimize your investment outcomes.

- Budgeting and Forecasting: Financial models can help you estimate the costs involved in a project and the potential revenue, aiding in effective budgeting and forecasting.

- Risk Assessment: Through scenario analysis, financial models can help you understand the various risks involved and how they could impact your ROI.

vDecision-making: Financial models provide a data-driven foundation for making investment decisions, such as whether to proceed with a project or seek alternative opportunities.

- Valuation: Financial models are crucial for determining the current or future value of a property, which is essential for both acquisition and sale.

Understanding the property development finance aspects of real estate development is crucial for success. Our specialized financial models offer you a robust foundation for budgeting, risk assessment, and valuation. Elevate your decision-making today by exploring our range of real estate development financial models: eFinancialModels Real Estate Development Financial Models.

Affordable and Sustainable Real Estate Development: How Developers Can Make It Happen

Developers are working to make real estate more affordable and sustainable in a number of ways. Here are a few examples:

Building smaller homes and apartments: This is one of the most effective ways to make housing more affordable, as smaller units are typically less expensive to construct and purchase. Developers are also building more mixed-use developments, which combine residential, commercial, and retail space in the same building. This can help to reduce transportation costs and make communities more walkable and bikeable.

Using sustainable building materials and practices: This can help to reduce the environmental impact of real estate development and make buildings more energy-efficient. Some developers are using renewable energy sources, such as solar panels, to power their buildings. Others are using recycled materials and water-saving fixtures.

Partnering with government and nonprofits: There are a number of government programs and tax incentives that can help developers to build affordable housing. Developers can also partner with nonprofits to provide affordable housing and other services to low-income residents.

Habitat for Humanity: is a nonprofit organization that builds and repairs homes for low-income families. Habitat for Humanity partners with developers to build affordable housing communities.

Enterprise Community Partners: is a nonprofit organization that works to create affordable housing and opportunities for low-income families. Enterprise provides financing and technical assistance to developers who are building affordable housing.

The Low-Income Housing Tax Credit: is a federal tax credit that can be used to finance affordable housing projects. Developers who build affordable housing projects can sell the tax credits to investors, which helps to reduce the cost of development.

The LEED Green Building Rating System: is a program that certifies buildings based on their environmental performance. LEED certification can help developers to attract tenants and buyers who are interested in sustainable living.

These are just a few examples of the many ways that developers are working to make real estate more affordable and sustainable. As the demand for affordable and sustainable housing continues to grow, developers are finding new and innovative ways to meet this need.

Real Estate Development Costs: A Guide to Different Categories and Cost Per Square Foot

The cost to develop real estate in USD per square foot varies depending on a number of factors, including the type of property, location, and desired finishes. However, as a general rule of thumb, the following ranges can be used as a guide:

Source: Statista

It is important to note that these are just averages, and the actual cost of development can vary significantly depending on the specific project. For example, a luxury high-rise condominium in a major metropolitan area could cost upwards of $500 per square foot to develop, while a single-family home in a rural area could cost less than $150 per square foot to develop.

How Much Does Property Development Cost for a Real Estate Business?

The property development cost can vary widely depending on several factors, including the type of property, the location, the size and scope of the project, and the current market conditions. Some of the key factors that can impact the cost of development include:

- Land cost: Land cost is typically the largest single expense associated with property development. The land cost can vary significantly depending on the location, the size of the parcel, and the zoning.

- Construction costs: The construction cost will vary depending on the type of property being developed, the size of the project, and the materials and finishes being used. Construction costs have also risen recently due to inflation and supply chain disruptions.

- Other costs: In addition to land and construction costs, several other costs can be associated with property development, such as permitting fees, engineering fees, and legal fees.

In 2022, the typical cost to build a single-family home in the U.S. reached approximately $392,000, marking an increase of nearly $100,000 compared to 2019, as reported by Statista. The data further reveals that the most substantial portion of these costs—24%—was allocated to interior finishes. This category encompasses elements like insulation, flooring, and appliances. It's worth noting that the financial outlay for constructing multifamily or commercial properties can be considerably greater.

For example, the cost to develop a new apartment building can range from $200 to $400 per square foot, depending on the location and amenities. Developing a new office building can range from $300 to $500 per square foot.

It is important to note that these are just averages. The cost of property development can vary significantly depending on the specific factors involved. It is important to work with a qualified real estate developer to get an accurate estimate of the cost of your project.

Maximizing Project Success with Our Specialized Real Estate Financial Models

Leveraging our specialized financial models for real estate development offers a distinct advantage to developers. These Real Estate Financial Models provide a clear roadmap of projected revenues, costs, and potential profitability, ensuring that every financial decision is well-informed. More than just a tool for number-crunching, our financial models simplify the often-daunting task of financial planning, allowing developers to confidently navigate the economic intricacies of their projects and focus on delivering exceptional properties.

What Are the Latest Trends in Real Estate Development?

Real estate developers are constantly innovating to meet the changing needs of the market. Here are some of the latest trends in real estate development:

- Sustainability: Developers are increasingly focused on sustainable real estate development that is energy-efficient and environmentally friendly. This includes using sustainable materials and construction methods and incorporating features such as solar panels and green roofs.

- Mixed-use development: Mixed-use developments combine residential, commercial, and retail space in a single project. This type of development is popular in urban areas, as it offers residents a convenient and walkable lifestyle.

- Smart buildings: Smart buildings use technology to improve efficiency and sustainability. This includes features such as smart thermostats, lighting systems, and sensors that can monitor occupancy and usage.

- Affordable housing: The demand for affordable housing is growing, and developers are responding by building more affordable housing units. This is especially important in urban areas, where housing costs are rising rapidly.

- Wellness amenities: Developers are also increasingly incorporating wellness amenities into their projects. This includes features such as fitness centers, spas, and rooftop gardens.

In addition to these general trends, a number of more specific trends are emerging in real estate development. For example, a growing interest is in developing co-living spaces, senior housing, and micro-apartments.

Developers who can stay ahead of the curve and incorporate these latest trends into their projects will be well-positioned to succeed.

Your Roadmap to Real Estate Development Success

Diving into the world of Real Estate Development feels a bit like embarking on a grand adventure. It's about so much more than just putting up buildings; it's about crafting the very spaces where memories are made, families grow, and communities thrive.

Think about it: every city skyline, every neighborhood park, and every bustling street started as an idea in the mind of a developer. And as we've journeyed through this guide, we've seen just how deep and meaningful this process can be. From dreaming up sustainable and affordable homes to navigating the nitty-gritty of finances and costs, there's a story behind every brick laid.

For those just getting their feet wet, figuring out how to start in real estate development can feel overwhelming. But remember, every seasoned developer was once in your shoes, wondering about finances, costs, and the maze-like development process. And with tools like our tailored real estate financial models, you're never truly alone on this journey.

The world of real estate is always on the move, with new trends popping up now and then. Staying in the loop is essential, not just to keep up but to lead the way and shape the future.

So, as we wrap up this guide, let's take a moment to appreciate the magic of real estate development. It's not just about constructing buildings; it's about building dreams, shaping futures, and leaving a mark that lasts long after we're gone. And with the right knowledge and a sprinkle of passion, anyone can be a part of this incredible journey.