Single Airbnb Rental Unit Financial Model

If you’re considering renting your property on Airbnb, downloading a financial model can help you estimate potential profits and make informed decisions. This Single Airbnb Rental Unit Financial Model aims to comprehensively project the financial viability and profitability of renting out a rental unit over a monthly horizon of 10 years.

The rental industry is rapidly growing, and the Airbnb platform has become popular among travelers. For investors seeking to have a flexible and potentially profitable source of income, renting out a unit through Airbnb could be a great start.

With this Airbnb rental unit financial model, investors can comprehend how their business should perform financially over the following years by projecting their required startup costs and potential rental income and estimating expenses to get a thorough overview of the property’s cash flow and return on investment. Users also have the option to determine whether they will be renting out their available property or renting a unit from others.

Additionally, the model enables the determination of key performance indicators such as monthly rental yield and key relevant financial metrics, including average cash-on-cash yield, minimum funding required, and the funding period. By understanding the financial implications of the rental property, investors can optimize their pricing strategy and identify areas for cost savings.

Single Airbnb Rental Unit Template Structure

This Excel template has instructions and formulas that are simple and easy to follow, which allows users to run simulations by varying the input assumptions. The elements of this financial model template are enumerated below:

Instructions and Terms contain the cell color codes, instructions guiding the user on how to work around the workbook, and the terms and abbreviations used.

Executive Summary includes charts for a better understanding of the financial prospects of your Single Airbnb Rental Unit business model and to provide answers to the following questions:

- Is the Airbnb rental business profitable?

- What are the startup costs of an Airbnb rental unit business?

- Is Airbnb rental a good source of income?

This spreadsheet includes a 10-year summary of the following:

- Projected Financial Statements overview – Income Statement, Balance Sheet, and Cash Flows Statement.

- Levered and Unlevered Free Cash Flows calculating key financial feasibility metrics such as the Average Cash on Cash Yield, Payback Period, Net Present Value (NPV)

- Uses and Sources of Funds and Debt Financing

Detailed Summary presents in charts and tables the yearly and monthly of selected year overview of the Airbnb Rental business plan.

Assumptions that are necessary and applicable in the business plan of renting out an Airbnb unit are presented in this worksheet.

- General Settings

- Currency

- Income Tax Rate

- Discount Rate

- Investment Period

- Net Working Capital

- Cost Inflation Rate

- Airbnb Rental Business Assumptions

- Rental Unit Option – Owned or Rented

- Purchase Cost if Owned

- Monthly Rent Expense

- Rental Unit Area

- Rental Unit Income Assumptions

- Average Daily Rental Fee

- Price Inflation per annum

- Airbnb Business Time plan – Selected start year and month

- Preparation Period – Number of Months

- Operation Period – Number of Years

- Operating Days per Month

- Occupancy Rate

- Monthly Seasonal Factors

- Average Daily Rental Fee Index Factor

- Occupancy Rate Variance

- Cleaning Fee

- Average length of Stay

- Average Fee per End of Stay – Fee per Cleaning or Percentage of Rental Fee

- Cleaning Fee Type

- Payor – Operator (recognized as expense) or Guest (recognized as income)

- Other Income

- Income Source

- Utilization Rate – Percentage of Guests

- Average Fee per Guest

- Direct Costs

- Supplies Expense

- Operating Expenses

- Rental Unit Option – Owned or Rented

- Capital Expenditures (CAPEX) Assumptions

- CAPEX Items

- Depreciation Periods

- Initial CAPEX Investment Amount and Allocation

Users have the option to determine when CAPEX will be initially invested:

- First Month – In the beginning of preparation period only

- Equally Monthly – Equally throughout the preparation months

- Cash Reserve

- Debt Financing

- Debt Amount – Percentage (%) of CAPEX

- Debt Period

- Drawdown Schedule – First Month, Equally Monthly or Investment of CAPEX Basis

- Payment Term – Annually or Monthly

- Interest Rate

- Debt Repayment – Repayment starts at specified month/s after preparation period.

- Equity Financing

- Injection Schedule – First Month, Equally Monthly or Investment of CAPEX Basis

Financials worksheet contains a comprehensive and detailed monthly 10-year forecast of the Single Airbnb Rental Unit:

- Airbnb Financial Statements – Income Statement, Balance Sheet, Cash Flow Statement

- Forecasted Property Valuation

- Unlevered and Levered Free Cash Flow

- Funding Required

- CAPEX Schedule

- Debt Schedule

- Rental Income

- Cleaning Fee

- Other Income

- Direct Costs

- Operating Expenses

- Key Performance Indicators

- Average Income StatementRental Income Drivers

- Rental Yield (Rent per sqm)

- Financial Metrics

Generate Profit from your Rental Unit!

This Single Airbnb Rental Unit financial template offers potential investors features that help them analyze the effects of various scenarios on the feasibility of the business plan. Potential business owners will be able to decide whether investing in an Airbnb Rental will be successful with the help of financial analysis and key KPIs.

Advance your financial planning and forecasting for your Airbnb rental unit business. Get your copy today and begin making data-driven decisions with ease.

This financial model template comes pre-filled with an example forecast of an Airbnb rental business. The forecast can be easily changed by altering the assumptions indicated in blue and light blue.

The models, current version 1.2, are available in three files:

- Excel Version – pre-filled with an example forecast.

- Excel Null Version – no values in the assumption sheet.

- PDF Version – which outlines the details of the model structure.

File types:

.xlsx (MS Excel)

.pdf (Adobe Acrobat Reader)

Multiple Airbnb Rental Units Financial Model

If you are looking to model a portfolio of up to 100 rental units, consider using our comprehensive Airbnb Rental Units Financial Model.

Similar Products

Other customers were also interested in...

Airbnb Rental Units Business Plan

Owning an Airbnb rental business can be a passive income stream, as the platform handles most of the... Read more

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

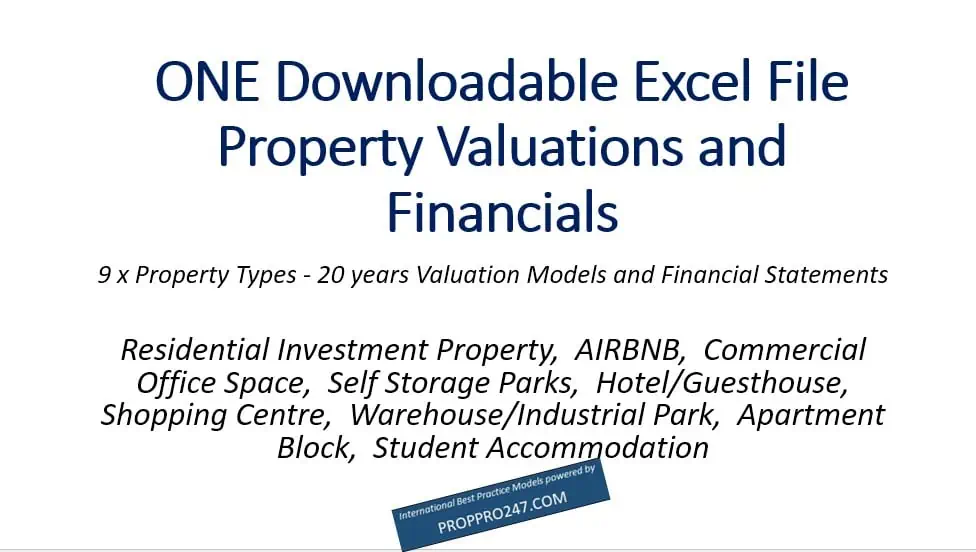

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

Airbnb Financial Model

Air BnB Financial Model Template presents the business case of the purchase of up to 5 properties wi... Read more

Bed And Breakfast Financial Model Excel Template

Buy Bed And Breakfast Financial Projection Template. This well-tested, robust, and powerful template... Read more

Short Term Rentals (Airbnb) Financial Model –...

A short-term rental is a furnished living space available for short periods of time, from a few days... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Property Development & Rental Financial Proje...

3-Statement 5-year rolling projection model with a valuation for new or existing business developing... Read more

Multi (20) AIRBNB Acquisition and/or Portfolio Mod...

This AIRBNB 20 model will assist you in evaluating up to 20 x propositions simultaneously and compar... Read more

Rental Property Financial Model

The Rental Property financial model template, forecasts a rental property's expected financials 30 y... Read more

Reviews

Very professional, complete. Excellent model with 99% of what you need.

18 of 40 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.