Business Valuation

Each template is a testament to our commitment to excellence, offering you a reliable toolkit to decipher the true worth of businesses, assets, and ventures. With our templates, you'll embark on a journey toward informed decisions as you navigate the complex terrain of investments, mergers, and acquisitions. Whether you're a startup founder seeking investment or a seasoned business owner looking to assess your company's value, our Financial Model Templates empower you to make decisions that pave the path to success.

Join the ranks of those who understand that precision in valuation is the cornerstone of intelligent financial decisions. Explore our Business Valuation Financial Model Templates and step confidently into a world of professionalism and competence, where data-driven insights and strategic clarity back your financial choices.

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Diagnostic Collection Center Financial Model

It is financial model for diagnostic collection center whose phlebotomists…

Mobile Imaging Center Financial Model

This Excel model facilitates mobile imaging services by providing equipment…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

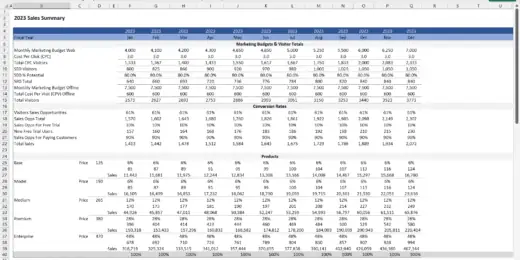

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

3 Statement Software Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking software development…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

Fruit Processing Facility – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Business Valuation Spreadsheet

This file enables you to effortlessly compute the Estimated Business…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Gym Financial Model and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Surfboard Rental Business Financial Model

Surfing is not just a sport—it's a lifestyle booming globally.…

Healthcare – Hospital – Financial Model and Valuation (10-year Forecast)

Welcome to the Healthcare (Hospital) Company Financial Model and Valuation,…

Motorboat Rental Business Financial Model

Dive into the heart of financial planning with our Motorboat…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Trucking Company – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Ship Management Business 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a startup…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

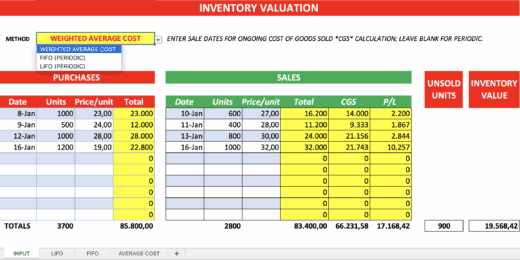

Inventory Valuation Calculator (LIFO, FIFO, AVERAGE COST)

Calculate the value of your inventory (physical items or financial…

Industrial Warehouse Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

CPG Company Financial Model and Valuation

Discover the CPG Company Financial Model and Valuation, an essential…

eCommerce | Online Retail Financial Model and Valuation

Discover the eCommerce - Online Retail Company Financial Model and…

Cocktail Bar – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Self Storage Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Truck Rental Company Financial Model

This detailed 10-year monthly Excel template is specifically designed to…

Business Valuation: Decoding Your Company's True Value

In the business world, understanding your company's true value is akin to peering into a crystal ball — a complex endeavor that can shape critical decisions. Warren Buffett noted, "The value of a business is the sum of the money it will make in the future." This profound insight lies at the heart of business valuation, a process that delves deep into financial intricacies to unveil a company's worth.

At eFinancialModels.com, we recognize that decoding your company's true value is a journey that requires precision, insight, and a deep understanding of financial intricacies. Join us in this exploration as we delve into the art and science of business valuation, uncovering the methodologies, tools, and strategies that empower entrepreneurs, startup founders, business owners, investors, lenders, and consultants to make informed decisions and unlock the doors to financial success.

What is Business Valuation?

Business valuation is a critical financial process that involves determining the fair market value of a business entity.

It is finding the fair market value of a business.

Business valuation primarily revolves around the concept of establishing the fair market value of a business. It involves assessing the company's assets, liabilities, financial performance, and various other factors to arrive at a reasonable estimate of what the business is worth in the open market. The fair market value of a business is the price that a willing buyer and a willing seller agree upon in an open and unrestricted market.

It is the process of business worth evaluation.

Indeed, business valuation is the systematic process of business worth evaluation. It's a comprehensive analysis considering tangible assets (like equipment and real estate) and intangible assets (such as intellectual property, brand reputation, and customer relationships). The business worth evaluation process typically involves various methodologies, such as asset-based, income-based, and market approaches, depending on the business's nature and the valuation's purpose.

It is more of an economic value creation.

While business valuation is primarily about assessing the current worth of a business, it also has implications for economic value creation. Understanding a business's current value can help business owners and investors make strategic decisions that enhance economic value creation over time. For example, by improving operational efficiency, expanding market reach, or introducing innovative products or services, the economic value creation of a business can command a higher price.

In summary, business valuation is a multifaceted process beyond finding the fair market value of a business. It thoroughly evaluates a company's financial health, assets, and market position. Moreover, it is crucial in strategic decision-making, enabling economic value creation among enterprises and making informed choices about their future direction,

Why Perform Business Valuation?

Business valuation is a crucial financial process in finance and entrepreneurship for various purposes. As mentioned, what is business valuation involves assessing the fair market value of a business. Here are six significant reasons for business worth evaluation:

- Buying or Selling: One of the most common reasons for business valuation is when a business owner considers selling their company or acquiring another. Knowing the true worth of a business is essential for setting a fair selling price or making an informed purchase. It helps buyers and sellers negotiate and ensures that the transaction is based on a realistic assessment of the business's value.

- Capital Financing: Businesses often need to raise capital to fund their operations, growth, or expansion. Valuation is crucial when seeking equity investments, loans, or issuing shares. Investors and lenders need to understand the value of their business to assess the potential returns and risks associated with their investment.

- Investing: Investors, whether individuals or institutions, use business valuations to evaluate potential investments. By determining a company's fair value, investors can make informed decisions about allocating their capital. It is essential in investing in venture capital, private equity, and the stock market.

- Partnership: Business valuations are essential when there are changes in ownership structure, or new partners are brought into the business. Valuations help determine the value of each partner's ownership stake, ensuring that the distribution of ownership is fair and equitable.

- Strategic Planning: Businesses conduct valuations as part of their strategic planning process. Knowing the company's current value allows for better long-term planning, whether it involves setting financial goals, assessing the feasibility of new projects, or making decisions about mergers and acquisitions. It provides a clear understanding of where the business stands financially.

- Tax Reporting: Business valuation can be crucial for corporate tax planning. It can impact decisions related to asset depreciation, capital gains, losses, and the selection of tax-efficient strategies. Accurate valuation helps businesses optimize their tax positions while complying with tax laws.

In conclusion, business valuation is pivotal in various financial decisions and transactions. Whether buying or selling a business, raising capital, investing, managing partnerships, or engaging in strategic planning, a well-executed valuation provides a solid foundation for making informed and financially sound decisions. It is an indispensable tool for entrepreneurs, investors, and finance professionals seeking to optimize their financial strategies and outcomes.

How Business Value is Calculated

Examining the company's capital structure, management, potential for future profits, and asset market value are all possible components of a business valuation. There are several ways to achieve business worth evaluation. These include the following business valuation methods:

Asset Approach

The asset approach focuses on the company's tangible and intangible assets. It calculates the business value based on the fair market value of these assets.

- Net Asset Value (NAV): NAV is determined by subtracting a company's total liabilities from its total assets. This method is often used when the company's assets are the primary source of its value. It's essential for businesses with substantial physical assets like real estate or manufacturing equipment.

- Replacement Cost: This approach assesses the cost of replacing the company's assets with similar ones in the current market. It's particularly relevant when a business's assets are unique or have appreciated significantly in value.

Income Approach

The income approach focuses on the income generated by the business and its future earnings potential. It seeks to find the intrinsic value of the company.

- Capitalized Earnings: This method estimates the value by dividing the company's expected annual earnings by the capitalization rate (a rate of return reflecting the business's risk). It's suitable for stable, cash-generating companies.

- Discounted Cash Flow (DCF): DCF calculates the present value of the company's future cash flows. It involves forecasting future cash flows and discounting them back to their current value using a chosen discount rate. DCF is widely used for businesses with uncertain or fluctuating cash flows.

- Economic Value Added (EVA): EVA assesses the value created by the business after accounting for the cost of capital. It measures how effectively a company uses its capital to generate returns. It's a valuable tool for evaluating management's performance.

Market Approach

The market approach compares the subject company to similar businesses in the market to determine its intrinsic value.

- Comparable Company Analysis (CCA): CCA involves comparing the financial metrics (such as revenue, earnings, and growth rates) of the target company to those of publicly traded companies in the same industry. This method provides a relative valuation based on market data.

- Market Multiples: Market multiples use various financial ratios, such as Price-to-Earnings (P/E) or Price-to-Sales (P/S), from comparable companies to estimate the target company's value. It's a quick way to assess relative value.

- Precedent Transactions: This method looks at the prices paid for similar businesses in past mergers and acquisitions. It provides insights into what other buyers have paid for similar companies.

Each of these valuation methods has its strengths and weaknesses, and the choice of method depends on the specific circumstances and the nature of the business being valued. A combination of these methods is often used to arrive at a more comprehensive and reliable business valuation.

Financial Modeling: A Key to Precision in Business Valuation

Understanding what is business valuation is an essential step in making informed financial decisions. A thorough business valuation not only clarifies your company's current state but also equips you with valuable insights for future growth and strategic planning. By decoding your company's true value, you confidently empower yourself to navigate the complexities of entrepreneurship and investment, positioning your business for long-term success.

Financial modeling is critical in achieving precision and accuracy in business valuation. It empowers entrepreneurs, startup founders, business owners, investors, lenders, consultants, and finance professionals to make informed decisions by providing a structured framework for assessing the financial health and potential of a company or investment opportunity. Don't miss out on the benefits of sound valuation – leverage the power of financial models to drive your financial success.