Finding Fair Market Value: A Quick Guide to Real Estate Valuation

“Fair value is a reality check on the market pulse; it provides the most realistic estimate of what an asset is worth today, not yesterday or tomorrow.” – Warren Buffett.

Real estate is widely known as one of the most popular industries, continuously attracting investment despite tough competition. Yet, determining the fair market value in real estate is an intricate process that entails a multidimensional analysis using real estate financial models. Unlike more liquid assets such as stocks or commodities, a real estate property is illiquid, characterized by its unique features and location, and often subject to many local and global market forces.

Read on to find out more about finding the fair market value of a real estate property. This complexity adds layers of ambiguity, often requiring specialized expertise in different real estate valuation methods.

An Overview of Different Real Estate Appraisal Values

Valuation in real estate is a complex process incorporating multiple variables, each contributing to the ultimate valuation figure. Different values in real estate appraisal can be attributed to various factors that influence this complex system. Location, market condition, physical characteristics, and preferences are key reasons.

It is also important to note that value is generally subjective and varies depending on the perspective of different individuals or entities. What might be valuable to one person due to its proximity to amenities might hold a different value to another who prioritizes a quiet environment.

Understanding the key types of value often considered in a real estate financial model is crucial for business owners, entrepreneurs, and investors engaged in buying, selling, or leveraging properties for economic gain. Here’s a quick overview of each:

Assessed Value

Business owners and investors need to be aware of assessed values as they directly affect the annual property tax burden, thereby influencing the profitability and cash flows of the property. A property’s assessed value is primarily used for tax purposes and is determined by a public tax assessor. It serves as the basis upon which property taxes are calculated and levied. Assessed value relies on mass appraisal techniques and property tax laws by jurisdiction. It may be updated periodically, often annually.

Appraised Value

Precisely appraised value is indispensable for those seeking external financing or involved in litigation processes. A certified appraiser determines the appraised value and provides a professional estimate of a property’s worth at a given point in time. It is commonly used in financing, insurance, and legal scenarios. To determine it, one must comprehensively analyze similar properties’ conditions, location, and recent sales data.

Buyer’s Value

Buyer’s Value in real estate refers to the subjective perception of the worth of a property by individual buyers. This value assessment can vary significantly among buyers based on their unique circumstances and preferences. Some buyers might be willing to pay a premium for a property due to its desirable location or specific features, especially if they perceive limited alternatives that meet their needs. On the other hand, some buyers might aim to secure a property at a price below its market value, often referred to metaphorically as “sharks.” These buyers seek to capitalize on opportunities where sellers might be motivated, or the market conditions favor negotiation in their favor.

Economic Value

Investors and business owners evaluating a property’s long-term viability or the return on investment (ROI) should focus on its economic value. Economic value is the value a property can generate over time, considering factors like rental income, tax benefits, and long-term appreciation. It may require sophisticated real estate financial modeling in Excel, incorporating cash flow projections and discount rates.

Fair Market Value

Entrepreneurs and investors often rely on market value for informed entry or exit timing decisions. Market value is a property’s most probable price in a competitive open market. In a real estate financial model, the fair market value refers to the most accurate and reasonable property price in a competitive and open market. It must meet the conditions of a fair sale. This value serves as an objective standard, helping various stakeholders, including buyers, sellers, investors, and lenders, to make informed decisions.

Sale Price

We’ve included the sale price as a value in real estate appraisal because it provides a tangible benchmark for valuing similar properties. It is the actual price at which the property is sold and is often considered the “ground truth” in valuation scenarios.

Understanding the complexities of the different types of values in real estate is vital, especially for real estate financial modeling in Excel. A nuanced grasp of these factors enables better scenario analysis, allowing clients to make more informed financial decisions.

The 4 Essential Elements of the Value of Properties

Understanding the four essential elements that contribute to the value of properties can help make well-informed financial decisions. The acronym DUST stands for “Demand, Utility, Scarcity, and Transferability.” It represents a foundational framework used to assess the value of properties.

Demand

Demand measures how many people are interested in owning a specific property type. High demand usually leads to increased property valuation. Property asset class typically influences demand — whether residential, commercial, industrial, or agricultural. Each class has its unique set of demand drivers. For example, residential properties might experience high demand due to population growth or increased employment opportunities in a particular area.

From an investor’s standpoint, understanding the asset class is vital for determining the potential return on investment (ROI) and cash flow expectations. High demand can significantly increase a property’s value and provide substantial capital gains. The challenge lies in accurately forecasting demand trends, often requiring a blend of quantitative analysis and qualitative insights into local market conditions.

Utility

Utility refers to the property’s ability to satisfy its users’ needs and requirements. A real estate property with higher utility is typically more valuable. This element is often evaluated based on the property’s improvements and location.

Improvements like buildings, infrastructures, and other permanent fixtures can add significant value. To maintain or increase property valuation, they must be aesthetically pleasing, functional, and in good condition. Moreover, the location — proximity to amenities, the quality of local schools, crime rates, and future developments can all influence property value.

Scarcity

Valuation in real estate treats scarcity as the basic economic principle of supply and demand. It could refer to a limited number of properties in a high-demand area, or it could refer to a unique property feature that sets it apart from others. In markets where available properties are scarce and demand remains constant, the property’s value often increases.

Scarcity can be real, influenced by limitations like zoning laws or geographical constraints, or perceived, driven by market sentiment. In any case, understanding the dynamics of scarcity can offer a competitive advantage. For example, investors might find it beneficial to sell during a seller’s market where scarcity is high. In contrast, in a buyer’s market, purchasing undervalued properties can provide excellent long-term value.

The scarcity of desirable locations is also a key factor that drives up the value of real estate. Some investors only want to buy real estate in a country’s top 3, 5, or 7 cities. So, it’s important to consider both macro and micro perspectives.

- At a macro level, the overall region or city where a property is located greatly influences its value. Economic factors, such as job opportunities, economic growth, and infrastructure development, play a significant role. Major cities usually offer better employment prospects, access to cultural and recreational amenities, and better educational and healthcare facilities. These factors attract people to these areas, increasing demand for real estate and driving up property values.

- Zooming in, the micro view considers the specific neighborhood within a city or town. Factors like proximity to public transportation, shopping centers, schools, parks, and safety are vital. Exclusive or well-established neighborhoods often have limited available properties, which increases demand and subsequently raises property values.

If a location has limited available properties and a high demand from potential buyers, the competition among buyers increases. This competition can lead to bidding wars and higher sale prices.

Transferability

Transferability is the ease with which property rights can be transferred from one party to another. Legal clarity, ease of transaction, availability of financing options, and title authenticity all contribute to transferability.

Better transferability usually enhances a property’s value. If encumbrances or legal issues are associated with the property, its value diminishes because the ability to sell or transfer the asset becomes complicated. Investors and consultants should perform rigorous due diligence to ensure that the property has clear titles and that all statutory payments and taxes are up-to-date, facilitating a smoother transaction process that preserves value.

In summary, a deep understanding of Demand, Utility, Scarcity, and Transferability is imperative for making well-informed, strategic decisions in property investment. Their interplay defines the value of properties, offering an indispensable framework for financial analysis, due diligence, and, ultimately, for making sensible investment choices.

Why Perform Valuation in Real Estate?

Real estate valuation is pivotal in the economic ecosystem, impacting various stakeholders, from investors to business owners and policymakers. Understanding a property’s intrinsic and market value through a real estate financial model fuels informed decision-making and forms the backbone of a robust financial strategy.

Here are the most common reasons for performing real estate valuation:

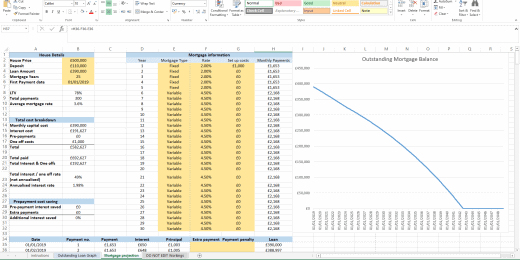

Financing: When securing a loan, particularly mortgage loans, lenders look at the property’s value to ascertain its worth as collateral. Valuation is fundamental in defining the Loan-to-Value (LTV) ratio, which in turn influences interest rates and financing options. From an institutional perspective, proper valuation can mitigate credit risk and ensure a more stable financial system. The lending process would be fraught with risks and inefficiencies without a fair valuation.

Investment Analysis: Valuation is indispensable for investors and fund managers considering real estate as a primary or alternative investment. It offers quantitative data that can be integrated into various investment models, allowing stakeholders to conduct risk assessments, yield calculations, and asset diversification strategies. Accurate valuation prepares investors to make strategic moves, such as entry and exit timing, thereby maximizing returns and enhancing portfolio performance.

Property Insurance: Valuation is essential for defining the property’s insured value. This quantifiable metric allows insurers to set premium rates and define the terms of coverage. Inaccurate valuation can lead to over-insurance or under-insurance, each with financial repercussions. An optimal valuation ensures that the insurance coverage is commensurate with the property’s worth, safeguarding the insured and the insurer against unforeseen contingencies.

Sales Listing: In a marketplace that is ever-fluctuating due to factors like economic cycles, legislation, and supply-demand dynamics, determining a property’s market value is crucial for a fair sale. Valuation empowers sellers with data-driven insights, lending credibility to listing prices. For buyers, this serves as a cornerstone for negotiation and purchase decisions. Overall, it lends transparency and rationality to the sales process.

Taxation: Property valuation directly influences tax obligations, including but not limited to property taxes, capital gains tax, and inheritance taxes. Governments often rely on property valuations for equitable taxation, contributing to public services and infrastructure. Accurate valuations ensure that tax burdens are fairly allocated, leading to a more effective and balanced fiscal policy.

Leading Real Estate Valuation Methods

The right method of valuation in real estate establishes a property’s fair market value. Below are three leading approaches to real estate valuation, providing a nuanced perspective on their applications, advantages, and limitations.

Cost Approach

The Cost Approach calculates the value of properties by adding the land’s value to the depreciated value of any improvements made on the land, such as buildings or other structures. The question of “How much would it cost to replace the property with something of equivalent utility?” is answered by this. It is frequently applied to freshly constructed buildings, properties with particular purposes, and insurance values.

Key Components:

- Land Value: The market value of the unimproved land.

- Replacement Cost: The cost to build a replica of the existing property using modern construction methods and materials.

- Depreciation: The reduction in value due to physical deterioration, functional obsolescence, and economic obsolescence.

The Cost Approach is a highly reliable real estate financial model for new properties with minimal depreciation. It is also suitable for specialized or unique properties for which comparable sales data are limited. Yet, the cost approach is less effective for older properties that have experienced substantial depreciation. It may not capture market sentiment and trends.

Income Capitalization Approach

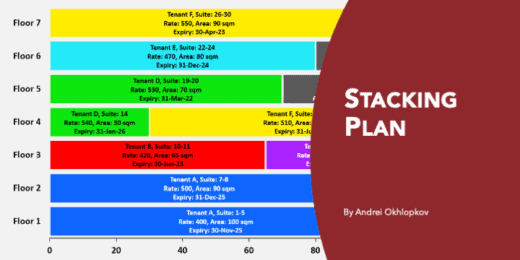

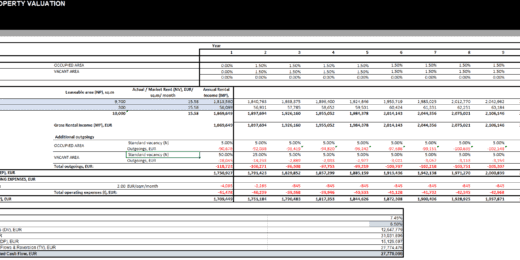

The Income Capitalization Approach, also known as the Income Approach, estimates the value of a real estate property based on the net operating income it generates, discounted to its present value. This method particularly applies to income-producing properties like apartment complexes, office buildings, and shopping centers. So, it is preferred for institutional investors, lenders, and consultants concerned with the property’s income-generating potential over time.

Key Components:

Net Operating Income (NOI): The property’s total income minus operating expenses.

Capitalization Rate: The cap rate in real estate valuation reflects the investor’s required rate of return and the property’s perceived risk.

The Income Capitalization Approach is excellent for valuing income-generating properties. It accounts for the property’s income-generating potential, often a primary concern for investors. It may only be suitable for properties with a stable income stream since it relies heavily on the accuracy of projected income and expenses.

Sales Comparison Approach

The Sales Comparison Approach estimates a property’s value by comparing it to similar properties recently sold, adjusting for differences like location, size, and condition. It is otherwise called comparable price analysis. The Sales Comparison Approach is often used for residential property valuation and is commonly employed by real estate agents, appraisers, and even homebuyers to get a sense of the market.

Key Components:

Comparables (Comps): Recently sold properties similar to the subject property in location, size, and other characteristics.

Adjustments: Modifications to account for differences between the subject property and comparables.

The Sales Comparison Approach is widely applicable to various types of real estate. It is intuitive and easy to understand. Yet, it may not be suitable for unique or specialized properties. Also, its accuracy relies on the availability and relevance of comparable sales data.

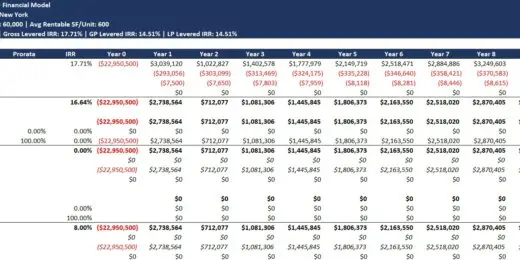

Real Estate Financial Modeling in Excel: An Easier Way to Find Fair Market Value

At its core, fair market value is the rational and unbiased real estate appraisal of a property. It aims to represent an equilibrium price — where both buyer and seller, possessing all the relevant information, are willing to engage in a transaction.

Real estate financial modeling in Excel is a cornerstone in accurately determining the fair market value of a property. Financial models often employ comparative metrics such as capitalization rates, price-per-square-foot, or gross rent multipliers derived from comparable nearby properties. Furthermore, it allows for running sensitivity analysis or multiple scenarios considering different economic conditions, occupancy rates, or rental yields.

In summary, fair market value acts as a pragmatic check on the emotional and speculative tendencies of the real estate market, offering a more reliable foundation for decision-making. Real estate financial modeling is indispensable in calculating this fair market value, providing stakeholders— entrepreneurs, investors, or finance professionals — with the analytics needed to make informed and financially sound decisions.