The Development Property Valuation Calculator incorporating XIRR and XNPV

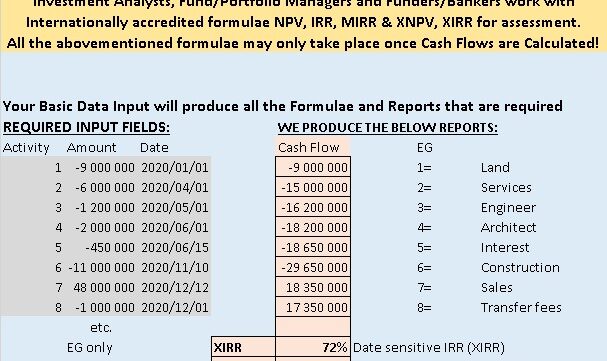

The Development Property Valuation calculator is suitable for accurately analysing development opportunities and projects. The Financial analysis makes use of XIRR and XNPV which is the date sensitive equivalent of IRR and MIRR. These formulae are essential to accurate valuations and profitability assessments of any project/development that will naturally contain irregular cash flows. The Calculator will also correctly categorise the activity cost absorption on a weighted basis EG Construction, architect, engineer cost % etc.

The Development Property Valuation calculator is suitable for accurately analyzing development opportunities and projects. The Financial analysis makes use of XIRR and XNPV which is the date sensitive equivalent of IRR and MIRR. These formulae are essential to accurate valuations and profitability assessments of any project/development that will naturally contain irregular cash flows. The Calculator will also correctly categorize the activity cost absorption on a weighted basis EG Construction, architect, engineer cost %, etc.

There are three parts to this Calculator:

a) an evaluation process automated for Developments that are for sale only

b) quick multi development projects compare and analyze returns

c) The development that is of commercial property for rental or whereby the developer retains a portion or all stock for rental purposes. Here, we will include the Commercial valuation Calculator to correctly value the retained stock and then bring this value into the project formulae at a specified date.

Here is a video guide:

https://www.youtube.com/watch?v=2qSlJTReY8o

Similar Products

Other customers were also interested in...

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to operate at a higher level. Th... Read more

Acquisition Model for Commercial Property

This is the Quintessential Commercial Property Acquisition Model that allows you to compare up to 20... Read more

Real Estate Development Bundle

This Real Estate Development Bundle is a collection of real estate calculators or tools in MS Excel ... Read more

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

Real Estate Acquisition-Rent-Sell Comprehensive An...

An integrated, dynamic and ready-to-use Real Estate Acquisition-Rent-Sell Comprehensive Analysis Mod... Read more

Single Tenant Net Lease (NNN) – Investment &...

Single-tenant property is a property that is fully occupied by a single user. Single-tenant properti... Read more

Multi-Family Housing Rental Renovation Model

The Multi-Family Housing Rental Renovation model projects monthly future cash flows from the renovat... Read more

Real Estate Multi-Family Development Excel Model

Real Estate Financial Model to evaluate a development project, with Equity Waterfall and Advanced Sc... Read more

Multi – Unit Condos Model Template

Multi-Unit Condos Model presents the business case where a property with multiple residential units ... Read more

Real Estate Private Equity – REPE Financial ...

This Template is to provide users a ready to use tool of Real estate private equity valuation and wa... Read more

You must log in to submit a review.