Gross Yield

CEO Dashboard KPI Excel Template

Our CEO Dashboard Excel Template provides a comprehensive overview of…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

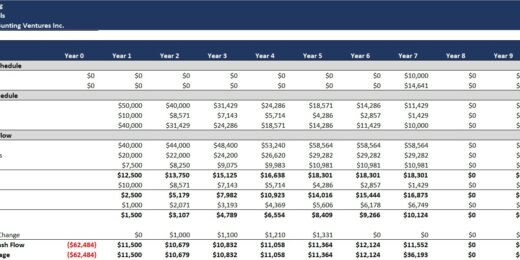

Self-Storage Park Development Model

This Self-Storage Park development model will produce 20 years of…

Badminton Court and Club Dynamic Financial Model 10-years

Introducing the Badminton Court and Club Forecasting Model, a visionary…

Beverage Trailer (Self-Pour or Manual) 10-year Financial Model

This beverage trailer financial model will provide you with 10…

Solar Farm (PV) Tax Equity – Fixed Partnership US

PV farm Tax Equity partnership in the US is designed…

PICKLEBALL Court and Club Development – Dynamic Financial Model (10 years)

Introducing our Pickleball and Club Financial Forecasting Model – your…

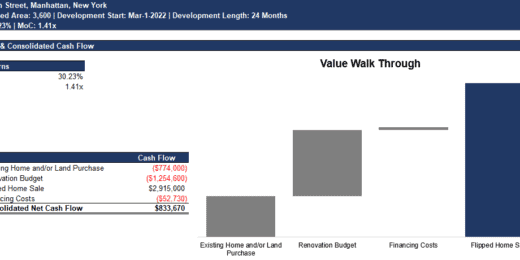

Discounted Big Bundle Real Estate Valuation and Financial Models

One Excel file for this bundle of Valuation and Financial…

Core Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Software as a Service (SaaS) Monthly 3-Statement Business Plan with Return Calculations

Pro Forma Models created this model to prepare and analyze…

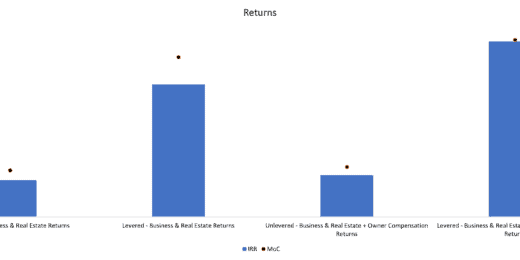

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

Capital Budgeting Model with NPV, IRR, & RoC Calculation

This model was developed to complete capital budgeting and analysis…

Dynamic Franchise Business Plan – 3 Statement Model with DCF & Returns

Pro Forma Models created this model to analyze the financial…

Hotel Real Estate Investment Model Template

Pro Forma Models created this financial model to calculate and…

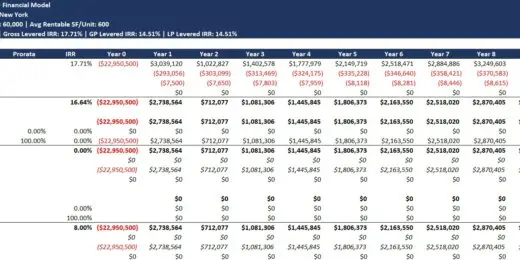

Core Multi-Family (Apartment) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

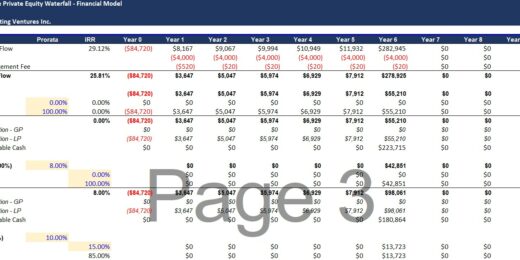

10 Year Annual Private Equity Waterfall Cash Flow Distribution Financial Model

Pro Forma Models created this model for private equity professionals…

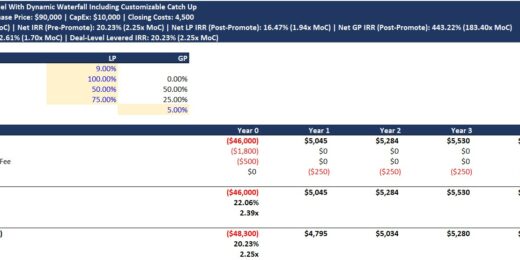

Real Estate Investment Model Template with Waterfall & Catch Up

The waterfall model includes a dynamic catch up. This model…

Grocery Store plus Deli/Bakery 10 year Financial and Business Model

This Grocery Store 10-year Financial and Business Model also contains…

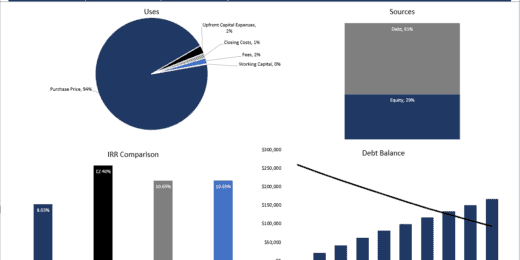

Acquisition Model for Commercial Property

This is the Quintessential Commercial Property Acquisition Model that allows…

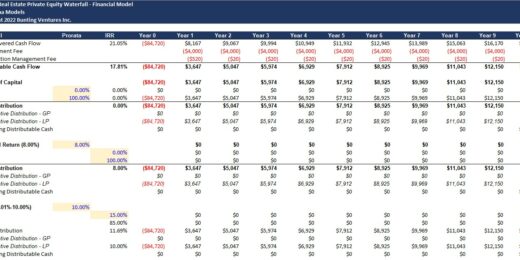

Dynamic Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity…

10 Year Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity…

Residential Investment Property Acquisition Model Template

Residential Investment Property Acquisition Model provides detailed monthly Cash Flow…

Service Provider APP (Uber-like) Business, Financial And Develop Tips Model 10 years

This Financial & Business Model is specific to the Service…

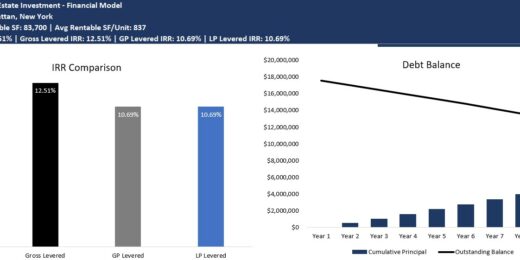

Real Estate Private Equity (REPE) Financial Model

Financing Model presenting a Real Estate Private Equity Fund scenario.

START-UP Business Financial Model & Plan – 10 years Three Statement Analysis

This Start-up Business Financial Model and Planning template is suitable…

Crop Farm Financial Model – Dynamic 10 Year Forecast

Financial model presenting a Crop Farm business scenario.

Hotel/Guesthouse/Resort Development Model and Valuation – 20 year Three Statement Analysis

This Hotel / Holiday Resort Development Model will take you…

Franchisor Business – 3 Statement Model with Return Calculations & DCF

This model can be used to analyze the financial return…

Real Estate Portfolio Template – Excel Spreadsheet

The Real Estate Portfolio Template forecasts the financial performance when…

Wholesale Business 3 Statement Model with Returns Calculation

This model can be used to analyze the financial return…

Retail Business 3 Statement Model with Returns Calculation

This model can be used to analyze the financial return…

Distribution Business 3 Statement Model with Returns Calculation

This model can be used to analyze the financial return…

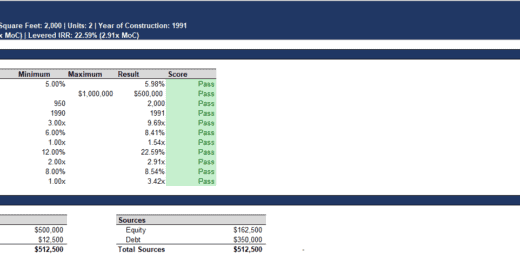

Real Estate Investment Screening Model – Levered IRR, Unlevered IRR, Cap Rate, DSCR, and More

This model can be used to quickly (5 minutes if…

Condo Development & Sales Model w/ 3 Tier Phasing, Waterfall, & S-Curve

This model can be used to analyze the financial return…

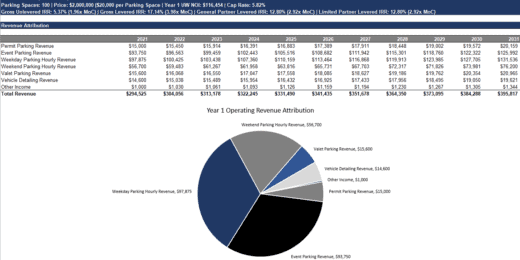

Parking Lot Investment Financial Model Template

This model can be used to analyze the financial/investment return…

AirBnB, Boutique Hotel, and Bed and Breakfast Investment Model

This investment model can be used to analyze a potential…

Property Practitioners Quintessential Bundle of Financial and Valuation Models

The Property Practitioners' essential bundle of Models will serve to…

Project Management Financial Evaluation Model

Project Management - Financial Viability, Comparisons, and Evaluation using XNPV,…

Pecan Tree Growing Financial Model

“Is Pecan Farming Profitable?” In our Pecan Tree Growing Financial…

Financial Managers Base Performance KPI Formulae Plus Real Estate Valuation Technique

Automated Financial Ratios, Liquidity Ratios, Leverage Ratios, Efficiency Ratios, Profitability…

Catering and or Catering Equipment for HIRE 10 – year Business Model

This Catering and or Catering Equipment for HIRE Business and…

Plant & Equipment Hire Business Model – Three Statement Analysis

Analyse the Start or Expansion of a Building Equipment Hire…

The Development Property Valuation Calculator incorporating XIRR and XNPV

The Development Property Valuation calculator is suitable for accurately analysing…

Multi Family Development REIT Financial Model Excel Template

Download Multi Family Development REFM Financial Plan. Excel Template for…

Hotel Development REIT Financial Model Excel Template

Get the Best Hotel Development REIT Financial Model. Excel Template…

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns…

Real Estate Multi-Family Development Excel Model

Real Estate Financial Model to evaluate a development project, with…

Real Estate Financial Model Templates Package

This is a collection of ready-made Excel financial model templates…

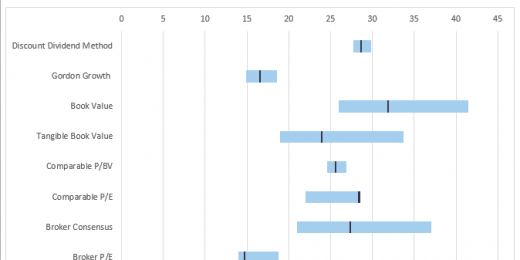

Commercial Real Estate Valuation Model Template

A commercial real estate valuation model template assists in running…

Commercial Real Estate Investment Model

The Commercial Real Estate Investment Model allows calculating the investor…

Rental Property Financial Model

The rental property financial model calculates the homeowner's IRR and…