Cap Table

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Cleaning Service Pro Forma Template (Commercial / Residential)

A pro forma template for any home service or general…

SaaS Company Financial Model and Valuation

Discover the SaaS Company Financial Model and Valuation, an essential…

Function-as-a-Service (serverless computing) Financial Model

Create financial projections for a FaaS cloud computing services business.…

Data-as-a-Service Financial Feasibility Study

This model is built for data-as-a-service startups. If you have…

Educational Courses: Financial Feasibility and Capacity Model

Model up to 3 course types that have scaling logic…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Private Equity and Venture Capital Financial Model – BUNDLE DEAL

This is a Combo of Private Equity and Venture Capital…

Venture Capital Return Analysis Template (Cap Table, IRR, CoC)

Unlocking Potential Returns: Venture Capital Return Analysis Simplified - Financial…

Subscription Box Financial Model – Up to 72 Months

Test many variables in this financial model for a subscription…

Real Estate Private Equity GP Catchup Waterfall Analysis Model

Ultimate Real Estate Private Equity Financial Model Template: Preferred IRR…

Custom Manufacturing (Build to Order) 10-Year Financial Model

Unique logic to plan out the feasibility and cash requirements…

Real Estate PE Multiple Hurdles Waterfall Analysis Model

We proudly present our cutting-edge Real Estate Waterfall Analysis Model…

Trucking / Transportation Business: Scaling Financial Model

Build assumptions around scaling deliveries. Smart logic built for truck…

Commercial Airline Financial Model

Commercial airline financial model is for analyzing and forecasting the…

Quick Coherent HOTEL / GUESTHOUSE Valuation and Financial Model 20 years

This quick and coherent Valuation and Financial model (20 years)…

Shopping Center Valuation and Financial Model 20 years – Acquisition

This Shopping Center Valuation and Three Statement (20 years) Model…

Laundromat Financial Model – 10 Year

This template allows the user to produce financial statements based…

Real Estate Acquisition-Rent-Sell Comprehensive Analysis Model

An integrated, dynamic and ready-to-use Real Estate Acquisition-Rent-Sell Comprehensive Analysis…

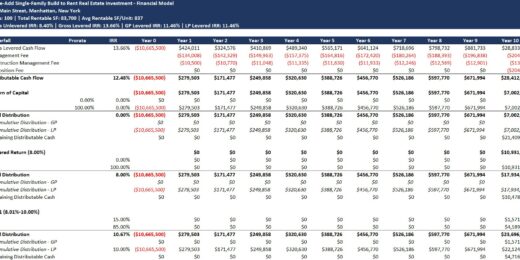

Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

A financial model to help calculate and analyze the pro…

Core Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

eCommerce Monthly 3-Statement Business Plan with Return Calculations

A model to prepare and analyze a start-up or existing…

Software as a Service (SaaS) Monthly 3-Statement Business Plan with Return Calculations

Pro Forma Models created this model to prepare and analyze…

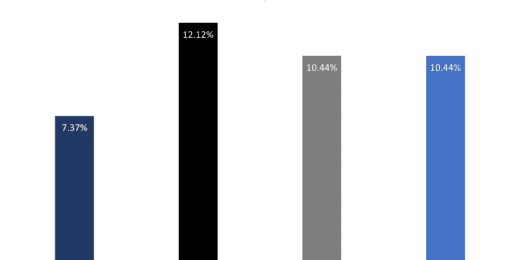

Commercial Real Estate Multi Valuations Compare Model with NPV, IRR and MIRR

This Commercial Real Estate (Multi) Valuation Model will help your…

Mobile Applications (App) Monthly 3-Statement Business Plan with Return Calculation

Pro Forma Models created this model to prepare and analyze…

Clinical Laboratory Financial Model

This Excel financial model forecasts the financial performance of a…

Property Management Business Financial Model

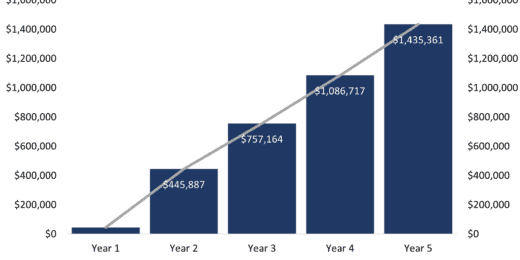

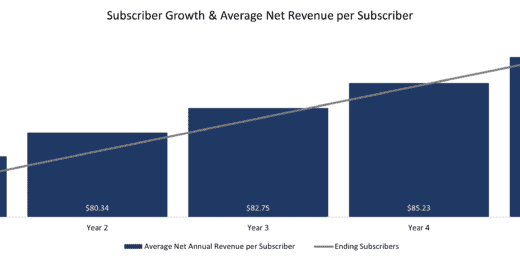

Create a wide range of scenarios for the financial forecasting…

Business Acquisition (M&A) Model with Monthly Business Plan & Returns

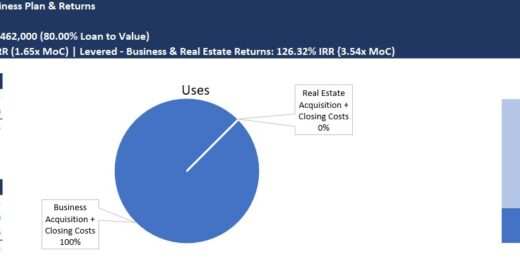

Pro Forma Models created this model to analyze the financial return…

Sports Agency Startup 3 Statement Forecasting Template

This 10-year financial forecasting template works great for any sort…

Construction Contractor Business – Cash Flow Forecast

This financial model lets the user plan out cash requirements…

Golf Course – Membership Only Model

Create a financial forecast for a members-only golf course. There…

Triple Net Lease (NNN) Real Estate Investment with Returns & Waterfall

This Pro Forma Model is used to analyze the financial…

AIRBNB Financial Model 20 years – Three Statement Analysis, and Valuations

This Airbnb acquisition and financial forecasting model will provide you…

Retail Property Acquisition Financial Model

A professional model for retail property acquisition (buy – hold…

Value-Add Multi-Family (Apartment) Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Product + Subscription Financial Model

Build a strategy for adding recurring revenues services to your…

Hotel Construction and Operation Excel Modeling Template

Granular assumptions to create a financial forecast for hotel operators…

Return Analysis Model of Real Estate with Refinancing Loan & Renovation

The objective of this model is to provide users with…

Plumbing Business Financial Model: Up to 10 Years

Bottom-up assumptions for creating up to a 10 year pro…

Assisted Living Facility: 10 Year Financial Model

Full stack financial model, including financial statement outputs, cap table,…

All My Financial Models, Spreadsheets, Templates, and Tools: 120+

Lifetime access to all future templates as well! Here is…

REIT Financial Model –NAV (Net Asset Value) & DCF Valuation Analysis Model

This is a REIT (Real Estate Investment Trust) financial model…

Small Business Playbook (Financial / Tracking Template Bundle)

This is a set of financial models, tools, and templates…

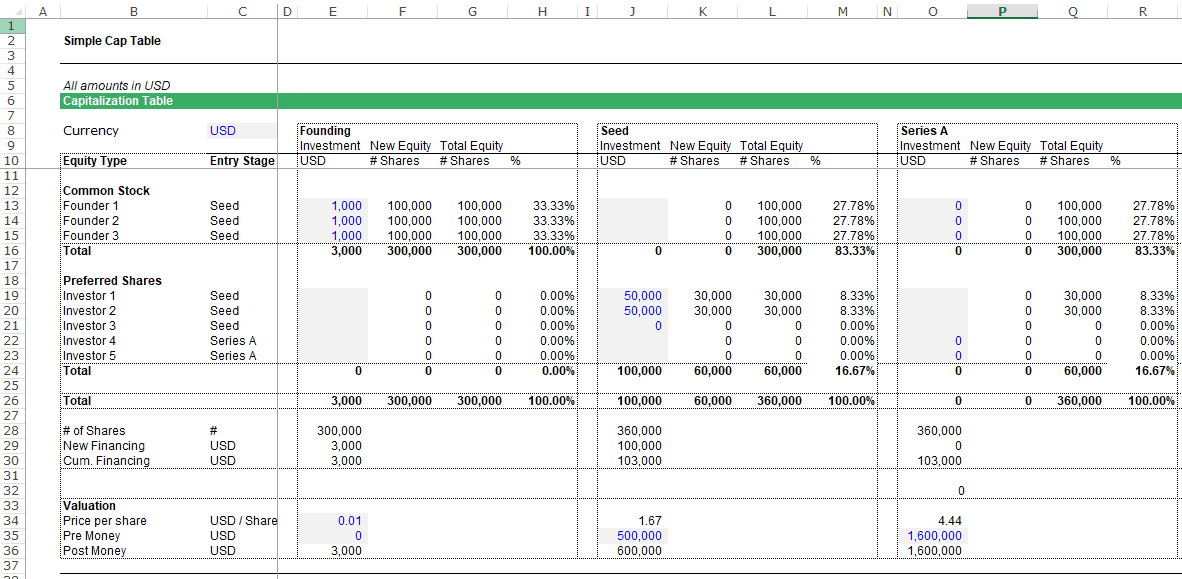

The capitalization table (or cap table) calculates the equity value of a company and the value of shareholder’s equity stakes during a series of financing rounds. It is especially important to Startup companies that require several rounds of financing.

Shareholders normally include the founders and investors but can also include employees or even holders of convertible debt. If new equity capital is injected, it will lead to the dilution of the equity stakes of existing shareholders, and their ownership stakes change, as new investors will require an equity stake as well.

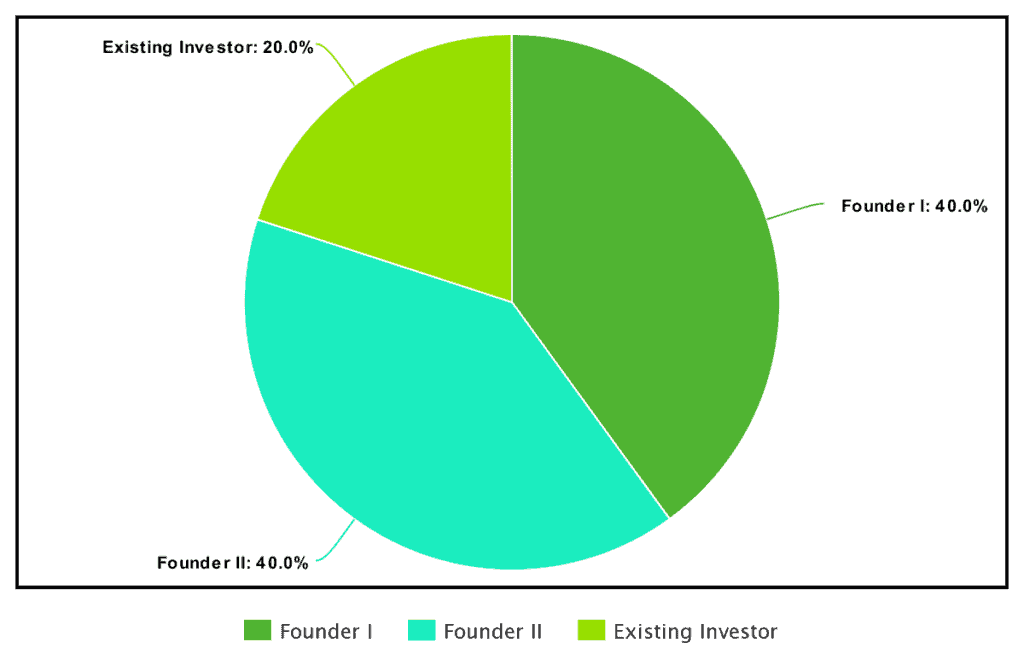

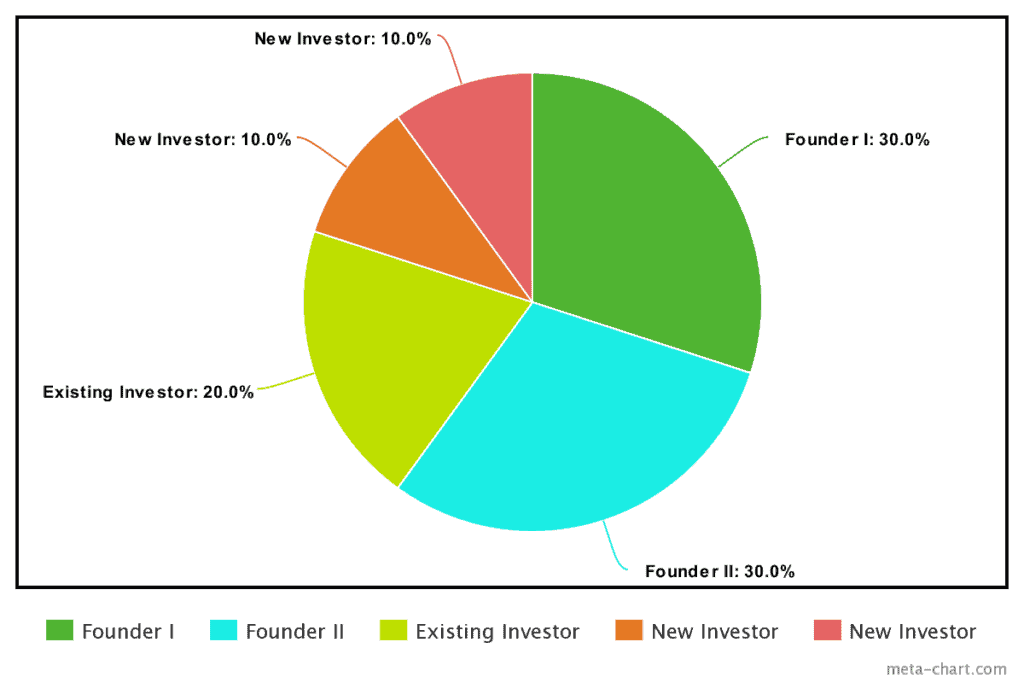

Illustrative Example: Shareholder Structure before and after a financing round

- Initial equity stakes of Founder I, Founder II, and Existing Investor.

- Accepted two new investors, causing the equity shares of existing parties to be diluted.

A capitalization table now keeps track and calculates how the issuance of new equity stakes will affect the shareholder structure at the various financing rounds. The same is true also for stock options, once exercised, they will affect the % ownership of the company's equity capital.

A basic capitalization table for a startup usually lists down the names of stockholders, the percentage of every stockholder’s ownership, how much capital invested, warrants, options, and other investments in a startup. A much more complex cap table management will be needed later on as one updates their cap table after a couple of rounds of funding injected into the business.

All data is compiled in a neat list which is designed in an organized way that’s easy to read and understand. Basically, the cap table should be able to easily answer the questions: who owns which securities, for how much (price), and which securities are outstanding.

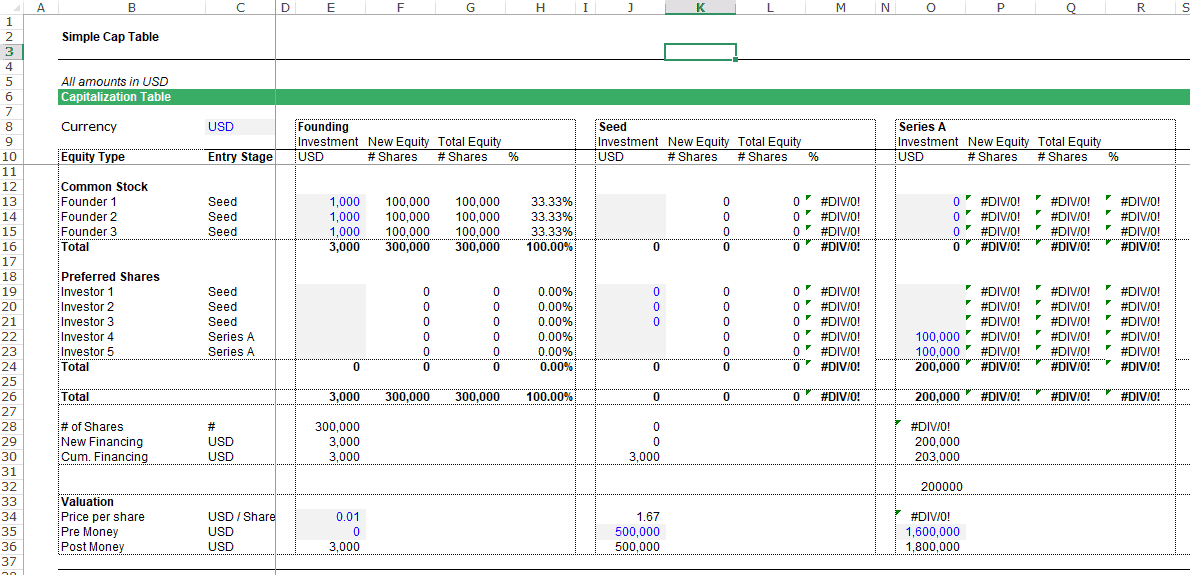

Capitalization Table Example

Here’s an example of how the equity stakes of the founders and investors change upon every addition or injection of new capital equity from third-parties.

Founding Stage – This is where the Founders are given their initial equity stakes in the business. There are no admitted investors in this stage yet.

Seeding Stage – In here, the business acquired two new investors with investments of P50,000 respectively. They received an equity stake of 8.33% each, while the equity stake of the existing Founders went down from 33.33% to 27.78%.

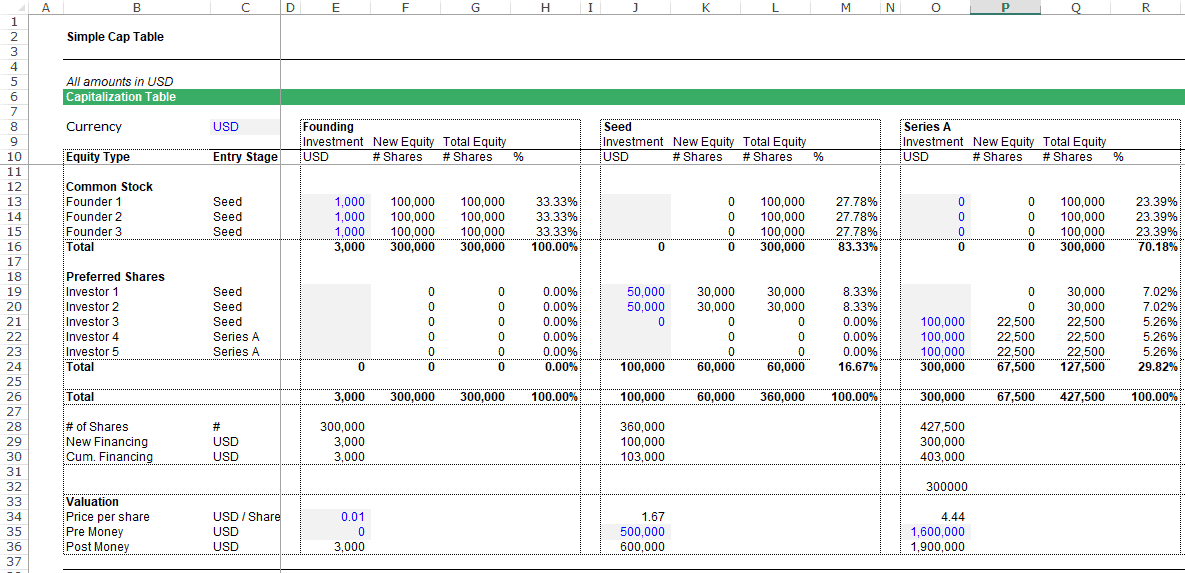

Series A – In the next stage, the business acquires 3 additional investors each with P100,000 investment bringing their equity stake to 5.26% each. This causes another dilution to the founders' equity stakes bringing them lower to 23.39% each.

This event may go on as long as your entity decides to accept new investors or partners to invest. The Capitalization Table for startup plays an important role on this since you can easily keep track and observe what is happening with your own shares, as a founder, as well as if you can still able to sell equity shares but still having the major control on the entity, preventing your shares to be totally diluted.

Top Events that affect your Capitalization Table

So how does our Capitalization Table evolve over time? The following events are important for you to know how and when are you going to use your Capitalization Table.

- Raising new financing

- Selling new shares of a new or existing security

- Establishing and increasing the size of the option pool

- Issuing a restricted share award or an option grant

- Exercising the restricted share award or an option grant given

- Transfer of shares between an individual and another entity

- IPO

- Merger

There are tons of events that you want to do or may occur that cause changes and adjustments on your capitalization table. Make sure to always list them down so you won’t lose track of events that contribute to your capitalization table and to always ensure the quality and effectiveness of your capitalization table analysis.

That is why the capitalization table for a startup is always used in making financial decisions that can impact the shareholder structure of an entity. So it is always important to maintain the capitalization table accurately based on most current information for decision making.

Why using a Capitalization Table Template

Capitalization tables can be demanded by investors as they also want to anticipate future financing rounds and have a clear view of what their equity stake will be at the time of their planned exit. Startups, therefore, should prepare a cap table to answer those questions.

- Capitalization tables are essential for the financial decision-making of a company that affects its equity ownership structure. As these decisions require shareholder approvals, cap table management help to answer questions of investors with respect to their equity stakes pre and post financing rounds. Sometimes a cap table also helps them to understand if it is better to become diluted or if they should inject additional capital.

- Founders who seek to keep control of a company by securing a 51% equity stake or a large minority stake with a target percentage ownership need to understand how a series of financing rounds will affect their equity stakes and under what conditions they will fall short of their target equity stake.

- Cap tables examples are also important to estimate the exit value of an investment in venture capital where the company is subject to several more financing rounds.

- A cap table management allows you to calculate pre-and post-money valuations for new financing rounds.

- Potential investors can evaluate how much control and leverage could be maintained during negotiations. Also, employees with options or equity stakes can see their real-time value.

- In the event of an audit, a well-managed cap can allow your legal team to present your company’s history and holdings with accurate and well-organized information.

- An existing shareholder can easily determine what percentage of the company to give to the new investors in exchange for the capital contributed.

It is best for startup businesses to create a cap table at their starting period to be transparent to their shareholders’ stake in the business and also to manage the securities outstanding of the business. Proper management is needed to ensure that the founder/s stake in the business the highest and to not sell away more than the business can handle.

How to Create a Cap Table Template

As you already know, a cap table is a list of who owns what in a startup business, basically, listing the business’ shareholders and their respective shares in the business. To make your own cap table for your business, you can simply make a spreadsheet and input all the data needed to be recorded in an organized manner, or you can simply follow the basic steps on how to create a cap table template.

- In a spreadsheet, list down in a column the five basic categories needed to be taken note of Name, Shares, Investment, Ownership, and Value.

- Next would be to fill out the first column by listing out all the names of the starting founders and leave a couple of empty slots for future investors. You can also group up investors if they came in waves or groups and you can name it as a “Round of Investment” where the last or most recent investor should be at the bottom of the list. If ever the same entity invested more than once, each purchase should be separated in a new row.

- Right next to the first column is the respective shares of each shareholder. Then record according to the total number of shares each entity bought.

- Then do the same for the amount of capital invested in the business, recorded under the Investment column. After that, at the bottom of the columns, total up the number of shares and dollars.

- Next would be the Ownership column, where you’ll calculate the percentage of each shareholder’s stake in the business. Just simply calculate it by dividing the number of shares each entity owns by the total number of shares held by everyone on the list.

Share % = Shareholder Share / Total Shareholders’ Shares - The last column is a bit trickier. Since the value changes every time someone invests, you will have to ensure that you will refer to the last or most recent investor. To calculate the value of the share that each investor owns, you will need to calculate how much an entity paid per share. This can be calculated by dividing the total dollars invested in the total shares purchased by the corresponding investor.

Price per Share = Dollars Invested / Shares Purchased

And that’s it! With these basic steps, you’ll be able to create the most basic cap table which represents the business’ current ownership structure. Just by looking at the report, one should be able to tell who owns the business and how much is each ownership worth in the present. But of course, this is just the most basic cap table management.

Capitalization tables can get really complex as it gets bigger and especially if there are major changes in ownership and different voting rights. You would need to extend more your cap table to ensure that you will take note of every data needed to be calculated. You will also need to continuously update the cap table too since a startup company is constantly evolving as it slowly grows. This can happen when your business will decide to issue more shares, option pools, selling existing shares, granting programmers for employees to raise benefits, investors redeeming their shares, terminating and expiring options, transfers, and selling of shares, etc., which could greatly impact the capitalization table. Thus, you must always keep it up to date to help you make informed decisions for your business.

Cap Table Financial Model Templates

Creating a cap table is simple and complex at the same time. However, it is simple enough for every startup to create their very own cap table for their business. To help you create a cap table more efficiently without having to spend too much time creating from scratch, you can take advantage of and use one of our cap table financial model templates.

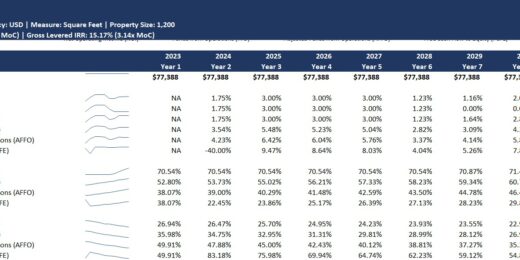

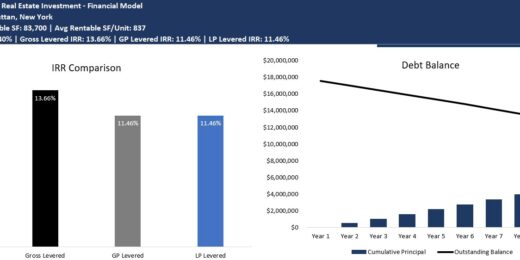

The cap table example financial models include the following:

- Capital Raisings from Seed to Series A-C until Exit

- % of share ownership and equity ownership calculation

- Stock option pool

- Pre-/Post money valuation

- IRR calculation for shares of the management and the different investors

Cap table Example

The cap table can become one of the most important tools when you plan to raise financing or make changes in your shareholder structure. The cap table allows you to stay on top of the shareholder structure and plan ahead who will control the company’s equity capital.