How to Value a Business Using a Discounted Cash Flow Model

A business valuation in most cases requires a sophisticated analysis of the company’s economic value, capital structure, future earnings prospects, or the market value of its assets amongst many other factors. Business owners will often turn to professional business valuation experts. These experts will rely on the Discounted Cash Flow (DCF) valuation analysis whenever they need to obtain a sophisticated estimate of the value of a business.

When valuing a company, there are three main valuation approaches used by industry practitioners:

- Income Approach – e.g. Discounted Cash Flow Valuation Method, Capitalized Earnings Valuation Method

- Market Approach – Valuations based on market comparable and precedent transactions analysis

- Cost Approach – Replacement value analysis, liquidation value

These valuation approaches are classified by their explanatory power. Every valuation method is attributable to one of these main valuation approaches. The valuation result of expected income derived from a DCF model is more precise than the value of a business calculated using replacement cost analysis.

The DCF Valuation method, an Income-based Approach, offers one of the most powerful valuation methods to truly understand where the value of a business originates. In this article, we are going to explain how to calculate the DCF valuation result using a discounted cash flow analysis example.

What is DCF Valuation?

Discounted Cash Flow Valuation is a form of intrinsic valuation and part of the income approach. Therefore, the most used and theoretical sound valuation method for determining the expected value of a based on its projected free cash flows. It requires building a DCF model spreadsheet, usually in Excel. The DCF valuation method is widely used for business valuations, real estate properties, and assets such as brands, patents, or trademarks. Important to note is that the DCF valuation method requires a business plan – which can be subjective – and at least 5 years of forward-looking financial projections.

The following listed below are the principal elements used in preparing a DCF valuation model.

- Business / Financial Plan – As a pre-requisite to a DCF valuation financial projections with at least 5 forecast years are required

- Valuation Date – for every DCF valuation, analysts estimate the value of an asset on a specific date. From the valuation date onwards, expected future cash flows are determined.

- Free Cash Flow Calculation – To calculate the discounted CF, Free Cash Flow to Firm (FCFF) is computed.

- Discount Rate – The opportunity cost of capital reflects the business risk by estimating how much return a business should generate by comparing it to the obtainable returns at the market when investing in similar risky businesses in the same industry.

- Terminal Value – Represents the value of a business generated from all the expected cash flows at the end of the forecast period (normally year 5). Various methods can be used to estimate such (which are explained later).

- Discounting – The projected future free cash flows are needed to be discounted to today’s valuation date by using the company’s discount rate. Since these cash flows are expected to be obtained in the future, they carry a risk that needs to be accounted for when calculating their present value as of today or as per a specified valuation date.

- DCF Valuation Result – Knowing how to calculate Net Present Value, also known as the Enterprise value, using DCF is important in valuing a business. This is computed simply by the summation of the discounted cash flows. When further deducting debt and adding the cash position as per the valuation date from the Enterprise value, we can also obtain the Equity Value.

How do DCF Valuation Models Work

A DCF valuation model is mostly built with a spreadsheet program such as MS Excel, which illustrates and builds solid financial projections of the company’s Free Cash Flows (to the Firm). Using this DCF spreadsheet program will allow users to smoothly understand how to calculate Enterprise Value, also known as the Net Present Value, by discounting the Free Cash Flows to their present value using the DCF discount rate. The DCF model requires an extensive amount of detail which allows the analyst to forecast value based on different scenarios and even perform a sensitivity analysis.

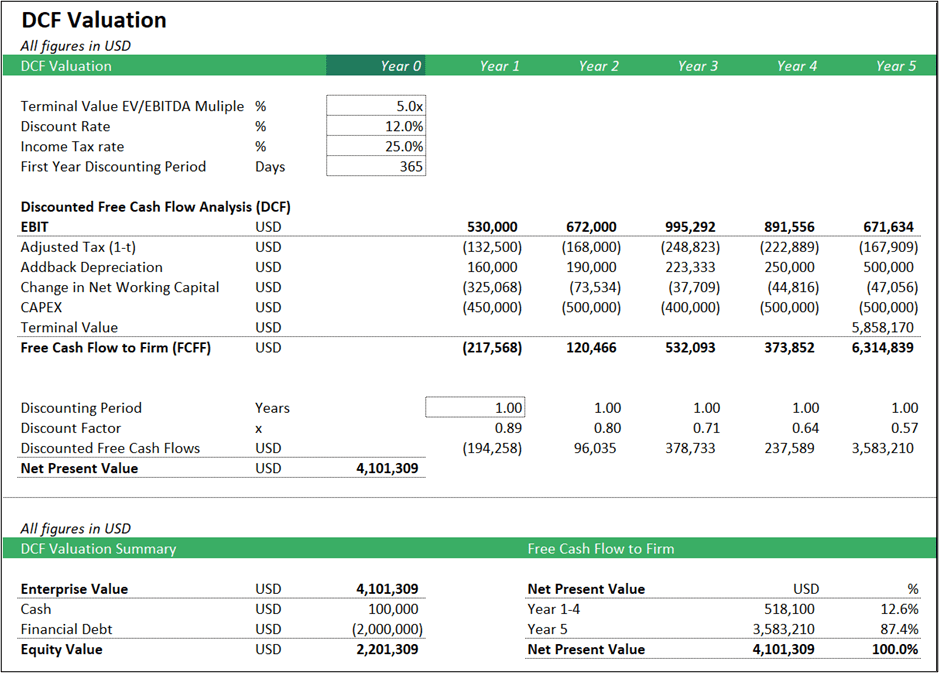

Below you will find an example of a DCF Valuation Model.

This video explains in more detail how the DCF Valuation model works.

What are Unlevered and Levered Free Cash Flows?

Each DCF valuation model is based on the projected Free Cash Flows. Free cash flows are the cash flows generated to support operations and maintain capital assets for the benefit of capital providers. There are two types of free cash flows:

- Free Cash Flow to Firm (FCFF) or Unlevered Free Cash Flows (UFCF) – These are the cash flows available to the company without considering the effect of debt financing. They are unlevered and as such belong potentially to both, debt financing providers and equity investors.

- Free Cash Flows to Equity (FCFE) or the Levered Free Cash Flows – These type of cash flows are those which are available to the Shareholders as they deduct debt financing, interest and the corresponding tax effect.

Two Main Methods to Forecast Free Cash Flows

There are two ways to develop financial free cash flow projections into the future:

- Direct Method – All required cash flow lines are forecasted directly based on a line of thinking which lists the line items of cash coming in and cash coming out. It is the quickest method to build a free cash flow forecast. However, since these cash flows only provide an excerpt into the company, this method will neglect to give you a full picture and will not allow you to calculate all future financial ratios to validate and better substantiate a financial forecast. As such, they lack a bit in quality but can give you an initial idea.

- Three Statement Model – A comprehensive forecast and projection of three main financial statements: Income Statements, Balance Sheets, and Cash Flow statements, is built for the next years. This takes a bit longer to model in MS Excel but the benefit is that we will have a more complete overview of the financial scenario and we can also better make sense of our forecast by calculating a series of relevant financial ratios. Once the forecast is built, we will extract the line items needed to calculate the projected Free Cash Flows to Firm for the company.

In this article, the following Discounted Cash Flow analysis example uses a Three Statement Model forecast.

How to Calculate a DCF Model

To further understand how to calculate DCF in an Excel spreadsheet, we have put a step-by-step guide together with the components of Discounted Cash Flow Valuation.

Step 1 – Analyzing Historic Financials for DCF Valuation

To better understand the company or asset you like to value, the first task in building a DCF model is to properly analyze at least three years of a company’s historic financials. These are critical for better substantiating and validating your business plan forecast. Past data is not subject to estimations and thus can be trusted more. Existing data is required to validate our assumptions in the future.

Financial ratio analysis is a quantitative technique of analyzing and comparing the relationship (or ratio) between two or more items of financial data contained in the firm’s balance sheet, income statement, and statement of cash flows.

This is used to assess a company’s liquidity, leverage, growth, margins, profitability, rates of return, valuation, and more, which helps investors, creditors, and internal company management understand how well a business is performing and of areas needing improvement.

It is important to analyze the key financial ratios to obtain a better understanding of the company’s financial situation.:

- Financial Debt/EBITDA – Is the company using an appropriate level of debt or is the company over-levered?

- EBIT/Interest – Is the company able to meet the interest obligation?

- Current Ratio – Does the company has sufficient liquidity to operate?

- Days Receivable, Inventory and Payable – How fast are invoices paid by the company’s customers and how long suppliers have to wait until they get paid? How much inventory does this company require? Are these metrics in line with industry benchmarks?

- EBITDA Margin and ROE – Is the company profitable and was able to produce an appropriate return for its shareholders?

- Revenue/Assets – How capital intensive is this company?

Answering questions like these before even starting to build a business plan offers the ability to obtain better insights into the company’s financial situation. A thorough understanding will also allow building a better-quality business and financial plan compared to skipping this important step.

Step 2 – Building a Financial Forecast

In building a DCF valuation model, the prerequisite in calculating Free Cash Flow to Firm (FCFF) is a 5-year financial projection/forecast of the company’s projected Income Statement, Balance Sheet, and Cash Flow Statement (using the Three Statement Model approach).

Step 3 – Projection of Future Free Cash Flows

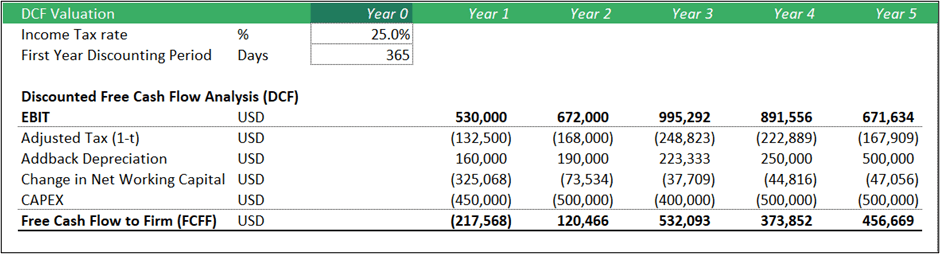

Once we have projected a three-statement model, we can now calculate the Free Cash Flows to Firm for the next 5 years and use this as a basis for our DCF model. The calculation of Free Cash Flows to Firm includes the following elements:

- EBIT (Earnings before Interest and Taxes)

- The operating profit generated by the company.

- Net Income is after tax and interest expenses, therefore changed by the company’s financing structure, therefore we cannot use it.

- T (effective expected tax rate)

- We subtract a Pro-forma tax on EBIT by multiplying EBIT x (1-T) and without deducting interest as we want to have the taxes calculated before any effects of the financing structure.

- Depreciation and Amortization (D&A)

- Are added because they are non-cash expenses.

- Changes in Net Working Capital

- The change of accounts required to perform the business such as changes in receivables, inventory, and payables which affect the cash flow statement.

- CAPEX (Capital expenditures)

- The required capital investments, such as investments in tangible and intangible assets, for the years to come. Capital expenditures are important drivers of future revenue and profitability growth

Adding these items results in a calculation like this:

Step 4 – Calculating the DCF’s Discount Rate

Forecasted unlevered free cash flow by an analyst is discounted back to the present period using the Weighted Average Cost of Capital (WACC). Each business operates with different risks and within selected industries, which therefore requires the calculations of WACC.

The business valuation discount rate usually shows a high impact on the valuation result. The higher the discount rate, the lower the net present value of the future cash flows. The reason is, higher compensation is required for this type of risk. A lower discount rate leads to a higher present value requiring lesser compensation since the risk is lower. The WACC is computed by adding the cost of equity and the cost of debt. As their weight can vary, we need to consider a weighting factor that reflects the company’s capitalization structure. The exact formula used is presented below:

Cost of Equity (COE) is estimated by using the Capital Asset Pricing Model (CAPM):

R = Rf + β (Rm – Rf)

Where,

R is Required Return/Discount Rate

Rf is equal to the risk-free rate of an investment

β equals stock’s beta

Rm equals overall stock market risk

Cost of Debt (COD) is estimated by adding a risk premium to the risk-free interest rate and deducting the tax shield from the interest (after-tax cost of debt).

Step 5 – The Terminal Value Excel Formula estimates the Value of the Business at end of the Forecast Period

The Terminal Value represents the value generated from all the expected cash flows beyond the forecasted period which normally is 5 years., based on a going concern basis. There are different ways to estimate the Terminal Value such as:

- Perpetual/Gordon Growth Model[1] – assumption is the last growth rate will apply:

- Value Driver Models based on Economic Profit

For our purposes, we keep it simple and use an EV/EBITDA multiple to estimate Terminal Value:

- Exit Multiple Method:

- Terminal value of cash flows is a multiplier of income flows measure such as EBITDA which can be observed from select trading multiples in the same industry or from recent benchmark transactions.

- EBITDA is a profit measure before considering debt/equity costs, therefore, EBITDA only makes sense when compared to the Enterprise Value (EV) and should only be used when using Unlevered Free Cash Flows.

With the given DCF example below, assuming that the EV/EBITDA Multiple is 5, the terminal value is calculated by multiplying the multiple with Year 5’s projected EBITDA.

Terminal value is included in the future cash flows at the beginning of Year 6.

Step 6 – Discounting Free Cash Flows

In this step, we should discount the projected free cash flows and the terminal value to their present values called the Net Present Value (NPV) of future cash flows, by using the discount factor.

Assuming that the business valuation discount rate is at 12%, computation for discount factors for years 1-5 are as follows:

Using the data from the three statement model illustrations, Present Value, also known as Discounted Free Cash Flows are computed as follows:

Step 7 – How to Calculate Enterprise Value and Equity Value using DCF Analysis

The Enterprise Value (also known as firm value or asset value) is the total value of the assets of a business (excluding cash). Using the discounted cash flow analysis example previously shown, Enterprise Value is simply the Net Present Value or the summation of discounted free cash flows:

The Equity Value (also known as net asset value) is the value that remains for the shareholders after any debts have been paid off. Using the DCF model, Equity Value is computed by adding back the beginning balance of cash to the enterprise value and then deducting the beginning balance of the financial debt.

Where is the DCF Valuation Method being used?

Business owners turn to professional evaluators for an objective valuation and analysis to track performance and the effectiveness of their strategic decision-making process. The following are where the DCF valuation method is commonly used:

- Business valuation – whenever we need to estimate the value of a business and there is a reliable financial forecast available

- Property valuation – same for properties

- Asset valuation – valuation of brands, patents where a future cash flow stream can be estimated.

- Performance measurement – certain methods to calculate the financial performance of a company such as Economic Value Add

- Scenario analysis – as the DCF valuation method summarizes a business plan in a single number, the NPV of various scenarios can easily be compared and used for financial decision-making.

- Investment analysis – apart from using other metrics such as the Internal Rate of Return (IRR), also the NPV offers a metrics which can be considered for financial decision-making.

Pros and Cons of using Discounted Cash Flow Valuation Models

Despite having countless advantages, a DCF valuation model also has its limitations.

Advantages

- Key Value Drivers – A DCF valuation model captures the underlying fundamental drivers of a business such as the volumes, prices, variable and fixed costs, taxes, capital expenditures and net working capital requirements, which then leads to comprehensive free cash flow forecasts.

- Intrinsic Value – Compared to other methods, the DCF method calculates the intrinsic value of a business based on a bottom-up valuation approach which results in an assessment how well a company can generate free cash flows.

- Financial Plan – A DCF valuation model requires a sophisticated financial plan with a minimum of a 5-year forecast. This process offers better insights for a company rather than just estimating next year’s budget.

- Flexible – Since forecasts are based on assumptions, any changes in assumptions will allow flexible changes and analysis of different scenarios.

- Forward-looking – DCF valuation is all about forward-looking expectations, where the only thing that matters are what will happen in the future and how much free cash flow will be generated. Historical results do not matter and should not influence the valuation.

- Excel – Complicated software is not needed to run a DCF valuation model because the model can easily be built in a spreadsheet program such as MS Excel.

- Analyzing Mergers and Acquisitions – A DFC model is used to compare the value and the asking price when purchasing another company. If the value is higher than the price, value can be created by purchasing that company. DCF analysis can also be used to quantify the impact on a company’s valuation from synergies between two companies.

- Risk – The company’s discount rate, which is normally computed by the weighted cost of capital, captures the business risk of the company. As such, the discount rate reflects the alternative of investing money in a company with similar risk. This allows to get a price for the business risk and reflect it in a DCF valuation. The higher the risk, the higher the discount rate, the lower the DCF valuation result, and vice versa.

Disadvantages

- Subjective – In building a financial forecast for a DCF valuation, free cash flows are derived from the subjective assumptions of a financial modeler. The result of the DCF valuation can differ from a financial modeler to a modeler, depending on their point of view.

- Assumptions – Building a discounted cash flow analysis example requires several assumptions, which should be substantiated by research, analysis of historic financials and the industry. The principle here is “garbage in, garbage out”. A discounted cash flow analysis is only as good as its assumptions.

- Manipulations – DCF modeling demands a set of forward-looking assumptions which can be subjective and prone to manipulation. Therefore, there is a certain likelihood that the assumptions can be manipulated, and the valuation results be fabricated.

- Complexity – In some cases, DCF valuation analysis can become overly complex to understand due to the quantity of data needed to build the free cash flow forecast.

- Valuation Date – Any DCF valuation calculates the value of a company as per a specific valuation date. Changing the valuation date alone, in some cases, can lead to a different valuation result.

- Terminal value – In a 5-year financial forecast, the expected terminal value of a business at the end of year 5 usually contributes the majority of the value of the business. Very often, around 65-75% of a business value comes from the terminal value alone. Any minor changes to the terminal value assumption will greatly impact the final valuation. A forecast from year 6 onwards is very difficult to understand from today’s point of view. It is much easier to project the next 1 to 3 years. Therefore, a careful analysis of the terminal value will be needed.

- WACC Calculation – Business valuation discount rate requires a calculation of the WACC, which is a key driver in determining the present value of the cash flows. The calculation of WACC requires a lot of technical know-how and analysis that can be difficult to accurately assess.

Despite its pros and cons, if the DCF model is done correctly with solid inputs and a working business plan, the resulting DCF model will be one of the best tools to value an investment, project, asset, business, etc.

Discounted Cash Flow Valuation is an excellent Method to Value a Business

For investors, cash is king as it is more difficult to manipulate than accounting profits, thus free cash flows are a reliable measure of a firm’s health that eliminates window dressing and subjective accounting policies. Hence, it can be said that free cash flows are really the money available to the investors. When knowing how to calculate DCF is done correctly, developing a Discounted Cash Flow model can offer quite a powerful valuation method that includes powerful elements to truly understand how the value of the business is derived.

A DCF valuation model translates a business plan into a company valuation. The model captures all the key values drivers, which can be operational in nature but also model-related, such as the WACC, growth rate. Having a DCF model ready is very useful to explain the economics of a business and discuss its impact on the valuation.

Get the Discounted Cash Flow Model Template here

Discounted Cash Flow Valuation Model: Free Excel Template

This Discounted Cash Flow (DCF) valuation calculator template projects a…

Example DCF Models

Here are some links to example DCF valuation models you can check out: