Infrastructure

Infrastructure financial modeling is an indispensable tool for investors, financial analysts, and policymakers, facilitating a thorough understanding of the economic viability of large-scale projects. These models serve as a crystalline lens, providing a comprehensive perspective on the financial forecast of complex initiatives.

We invite you to explore the power behind the equations through our financial models for infrastructure projects. Our projection of cash flows, assessment of financial risks, and the valuation of underlying assets are all meticulously orchestrated, where every calculation powers the pulse of progress!

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Architecture Firm Management Dashboard Excel Template (6 Month)

Our Excel dashboard and template streamline small and medium architecture…

5 Year 3 Statement Architect Company Finance Model Excel Template

A comprehensive 5 Year 3 Statement editable, MS Excel spreadsheet…

Comprehensive 3 – Statement Financial Model for a Midstream Oil and Gas (Refinery with 7- Years Forecast)

This is a 6,000bpd financial model for refinery producing Diesel…

Construction Tender and Proposal Example and Model Answer

A successful, high-quality and detailed tender and proposal document that…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Renovation Project Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking renovation project…

Network Upgrade Financial Plan

Comprehensive editable, Excel spreadsheet for tracking Network Upgrade financials in…

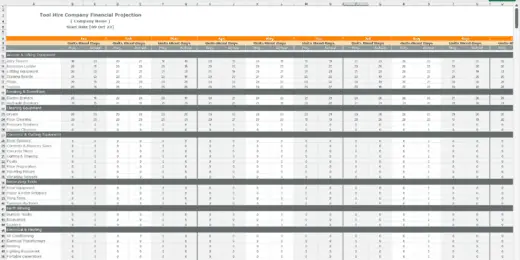

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool…

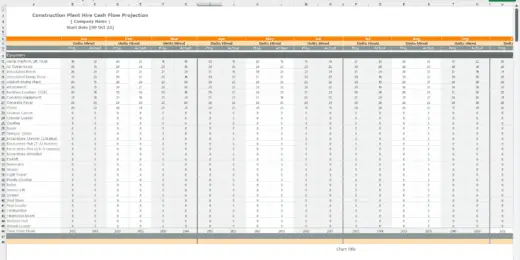

Plant Hire Business Financial Model

A comprehensive editable MS Excel spreadsheet for tracking your plant…

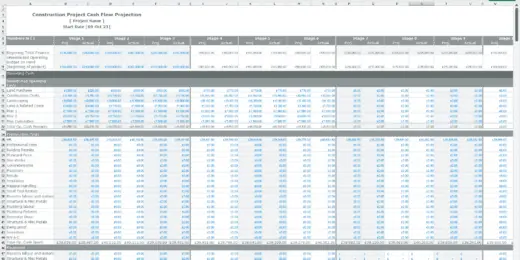

Construction Project Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking project financials…

Gas / EV Charging Station 10-year Financial Forecasting Model

This model is adaptable and useful for a Gas Station,…

Financial Model for a Smart City Project

This is a financial model to identify various components of…

Complete buy-side Telecom Tower Portfolio LBO

Complete Buy-Side Telecom Tower Portfolio LBO Model. This model allows…

Yacht Marina Acquisition Financial Model

Financial model presenting an acquisition scenario of a Yacht Marina.

Public-Private Partnership (PPP) Financial Model

Financial Model presenting development and operating scenarios of various projects…

Public Private Partnership (P3) Financial Model for Value-for-Money (VfM) Analysis

This financial model calculates the risk adjusted life cycle cost…

Technical and Financial Template for Water Wells

If you're planning to build an artesian well, try this…

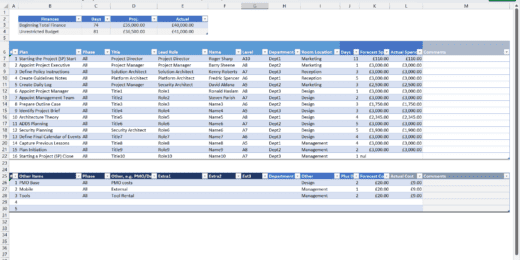

KPI Dashboard: Quote vs Actual Gross Profit Margins

This dashboard will improve the tracking of any general contracting…

Energy Project Finance (Infrastructure Model)

This is a special project vehicle (SPV) for an Energy…

Project Finance Model for a Highway SPV Project

This Project Finance Model for a Highway SPV Project is…

Port Terminal Operator – Project Finance Model

Financial Model presenting a business scenario of a Port Operator…

Airport Financial Model (Development, Operation & Valuation)

Financial Model presenting a development and operating scenario of an…

Telecom Company Financial Model – Dynamic 10 Year Forecast

Financial Model presenting a business scenario of a Telecom Company…

Toll Road Financial Model (Development, Operation & Valuation)

Financial Model providing forecast and profitability analysis for a development…

Electrical Contractor Financial Model Excel Template

Electrical Contractor Financial Model Enhance your pitches and impress potential…

Biomass to Hydrogen Gas PPP Project Model Template

Biomass to Hydrogen Gas PPP Project Model with 3 Statements,…

Hydrogen Gas Sales & Tolling Business Plan and Valuation Model

Hydrogen Gas Sales & Tolling Business Plan and Valuation Model…

Discounted Cash Flow (DCF) Valuation Excel Model (Engineering and Construction)

Detailed Financial model for DCF valuation on Engineering and Construction…

Multi Sport Complex Business Plan Financial Model Excel Template

Order Multi Sport Complex Financial Model Template. Based on years…

Self Storage Real Estate Ramping Model: Up to 15 Years

This is an equity only (joint venture capable) financial model…

6 Different Financial Modeling Assessments/Tests for Investment Banking

6 different Financial Model Tests with one coming with a…

Infrastructure Private Equity Wind Energy Modeling Test Solution (Associate level)

A self-made Modeling Test with a solution for Onshore Wind…

Green Hydrogen (Simple Electrolysis Financial Model)

The Model Incorporates data provided by different available sources to…

Freight Brokerage Financial Model Excel Template

Discover Freight Brokerage Pro Forma Projection. Impress bankers and investors…

Architecture Firm Financial Model Excel Template

Get the Best Architecture Firm Financial Model. Excel Template for…

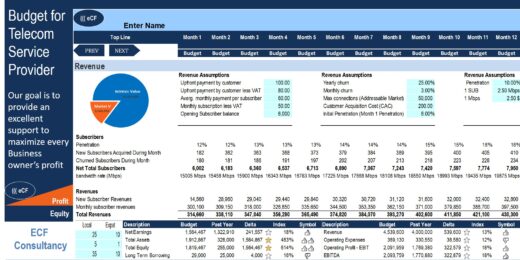

Budget Template for Telecom Service Provider

The template is a statement of estimated income and expenses…

Abacus Solar & Wind Debt Sculpting Financial Model

Abacus is a bankable, easy-to-use, debt-sculpting financial model for use…

Telecom DCF Valuation Model (3 Years Actual and 5 Years forecast)

Detailed Financial model for DCF valuation on Telecom Company

Solid Waste Treatment Plant Financial Model with Valuation

Solid Waste Treatment Plant Model is a project finance model…

Waste Water Treatment Plant Financial Model Template

Waste Water Concession Model is a Project Finance Model for…

Construction/Engineering Project Business Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model for…

Solar PV Project Finance Model Template

Financial model for a typical project finance solar project.

Project Finance – Toll Road – Build and Operate Excel Model with 3 Statements and Valuation

Toll Road Build and Operate financial model is a project…

Mobile Site & Telecom Infrastructure Builder

This is a financial model for an innovative infrastructure solutions…

Why Is Infrastructure for Development Important?

Infrastructure for development is essential because it facilitates economic growth, social progress, and sustainable development. Infrastructure includes physical assets such as roads, bridges, and buildings, as well as digital assets such as telecommunications networks and power grids.

Infrastructure for development can improve the efficiency of transport and communication, reduce the cost of doing business, and increase access to essential services such as healthcare and education. It, in turn, can promote economic growth and create jobs, reduce poverty, and improve the quality of life for people. Moreover, infrastructure development can also address environmental challenges by promoting renewable energy and reducing greenhouse gas emissions.

What Infrastructure Means?

The Infrastructure Industry encompasses businesses that provide fundamental facilities and systems serving a country, city, or area and services or facilities necessary for the economy's functionality. Either public or private physical improvements such as roads, bridges, tunnels, water supply, sewers, telecommunication, and electrical grids. Businesses in the infrastructure Industry cover big projects like these.

Infrastructure projects are high-cost investments and are crucial to economic development. With the constant growth of the population and the aging of the facilities and infrastructures, business in infrastructure guarantees high returns, too. So, the high potential of profitability in this industry gives rise to opportunities for those planning to start their own business in the infrastructure industry.

What are Infrastructure Projects?

Economic infrastructure projects are essential services representing a foundational tool for the economy, whether for a nation, region, city, etc. Such infrastructure for development could be physical structures, systems, institutions, services, and facilities. To further segment what are infrastructure projects, let us categorize them broadly into different types:

- Transportation: These are infrastructures built to provide convenience for transportation services such as roads, highways, rail, ports, bridges, airports, etc.

- Technology: The technological advancement developed this new type of infrastructure, which provides basic technology services such as networks and systems.

- Health and Education: These are institutions built to support a healthy and educated lifestyle, e.g., hospitals, schools, etc.

- Public Space: These are infrastructures that encourage tourism activity. Usually, these are government-funded or private parties interested in making some income from the available market. E.g., nature reserves, parks, beaches, etc.

- Energy: In this type of infrastructure, they deal with the production and delivery of energy to the masses. They are usually behind the electric grids, and some support the application of alternative sources such as solar panels, wind, etc.

- Water: One of the most basic needs is water. Thanks to the water infrastructure development, the provision of water supply, especially clean water, is existent and very convenient for everyone. The management of the water resources is also monitored in this type of infrastructure.

- Financial: This type of infrastructure focuses on the financial markets and services that help with the basic economic processes such as raising capital, investment, savings, payments, risk management, etc.

- Safety and Resilience: Safety and resilience infrastructure are institutions and systems that help avoid and endure natural disasters or certain circumstances that are uncontrollable, such as shelters, detection systems, developed sources, etc.

- Environment: The services provided in this economic infrastructure type are systems that help improve the environmental conditions, such as rain gardens and green roofs.

- Culture: In this infrastructure type, they build cultural institutions that promote tourism and corporate action, such as museums.

- Standards and Rules: In this infrastructure type are institutions that set a basic standard of lifestyle, rules, etc., that results in productive competition, protection of lifestyle preference, and management of resources.

As a whole, what are infrastructure projects have one thing in common – economic development. Economic infrastructure exists solely to serve as the foundation to build a better economy.

How to Start an Infrastructure Business?

Starting an infrastructure business involves a strategic approach and attention to various aspects. Here's a detailed breakdown of steps you might consider:

- Create a Business Plan: Define your business goals, target market, services you'll offer (e.g., construction, transportation, energy), and your unique value proposition. Conduct market research to understand industry trends, competition, and potential clients. Outline a detailed financial plan, including initial investment requirements, operating costs, revenue projections, and profit margins.

- Legalize the Business: Register your business and obtain the licenses and permits required in your area. The specifics of legal requirements can vary by region and the type of infrastructure business you're establishing.

- Recruit the Right Team: Assemble a skilled and experienced team, including professionals with expertise in engineering, project management, finance, legal compliance, and other relevant fields. Emphasize teamwork and a commitment to the vision of the company.

- Source Funding: Explore different funding options, including government grants, private equity funding, or Public-Private Partnerships (PPPs). Prepare a comprehensive funding proposal or business plan to attract potential investors or secure loans.

- Promote Your Company: Develop a marketing strategy to showcase your services, expertise, and past successful projects. Cultivate relationships with potential clients, government agencies, and other critical stakeholders in the industry. Utilize digital marketing, networking, and participation in industry events, conferences, and trade shows to increase visibility.

Remember, starting an infrastructure business requires industry knowledge, financial acumen, and practical management skills. Adaptability and navigating challenges in a dynamic industry landscape are crucial for long-term success.

Where Does Infrastructure Funding Come From?

Infrastructure funding can come from various sources, including government budgets, private equity, and public-private partnerships (PPP).

- Government Budgets: Public infrastructure projects are often funded directly through government budgets. Governments allocate funds for infrastructure development and maintenance, including roads, bridges, schools, hospitals, public transportation, and other essential facilities. These funds come from various sources, such as taxes, bonds, or other forms of government revenue.

- Private Equity: Private investors, institutional investors, private equity firms, and infrastructure funds can contribute to infrastructure funding. These entities may invest directly in projects or infrastructure assets, either independently or in partnership with government entities or other private investors.

- Public-Private Partnership: Public-private partnerships involve collaboration between public and private entities to finance, construct, operate, and maintain infrastructure projects. This Project Finance approach combines the resources and expertise of both sectors. In a PPP, the private sector often invests in, builds, and manages the infrastructure, sometimes receiving revenue from the project (e.g., toll roads, airports) and payments from the public sector over time.

The mix of these funding sources can vary significantly depending on the specific project, the region, and the involved stakeholders. Different funding models offer various advantages and disadvantages in terms of risk allocation, cost, and efficiency, and they are often chosen based on the nature of the project and the financial capacity of the stakeholders involved.

Why Is Infrastructure Financial Modelling Important?

Infrastructure financial modelling is a cornerstone of strategic planning and investment decisions within large-scale projects that define the backbone of economies and societies. It is a vital tool that brings clarity, foresight, and precision to the financial aspects of infrastructure projects.

Here's why infrastructure financial modeling is indispensable in an infrastructure business:

- Capital Requirements and Funding Structure: These models provide detailed insights into the capital required for infrastructure projects, often requiring substantial upfront investment. They aid in structuring the funding mix between debt, equity, and grants and can be used to determine optimal leverage levels that balance risks and returns.

- Cost Management and Control: Through meticulous financial modeling, stakeholders can track and manage the costs associated with infrastructure projects. It ensures that cost overruns are minimized, and projects stay within the allocated budget.

- Decision-Making for Public-Private Partnerships (PPPs): Infrastructure financial modeling is especially crucial in PPPs, where the complexities of financing, operations, and revenue-sharing mechanisms between the public and private sectors must be clearly understood and negotiated.

- Long-Term Planning and Viability Analysis: Infrastructure projects are characteristically long-term with a lifespan that can extend over several decades. Financial models enable stakeholders to project cash flows, evaluate the financial feasibility, and assess the long-term sustainability of projects, ensuring that they are economically viable and fiscally responsible.

- Risk Assessment and Mitigation: Infrastructure financial models are sophisticated tools that help identify and quantify risks. By modeling different scenarios, stakeholders can foresee potential problems and create strategies to mitigate risks, ensuring better preparedness for uncertainties.

eFinancialModels' expertise in creating detailed, bespoke financial models ensures that all these aspects are meticulously addressed, providing clients with a robust foundation for making informed and strategic financial decisions. By offering customizable templates and services, eFinancialModels empowers its clients to navigate the complexities of infrastructure finance with confidence and precision, thus contributing to the successful planning, execution, and management of infrastructure projects.