Mining Industry

Comprehensive 3 – Statement Financial Model for a Midstream Oil and Gas (Refinery with 7- Years Forecast)

This is a 6,000bpd financial model for refinery producing Diesel…

Oil & Gas Financial Model – DCF and NAV Valuation (5+ Yrs.)

The Oil and Gas financial model with DCF (Discounted Cash…

Comprehensive Oil & Gas Financial Model

Comprehensive financial model for an oil & gas company. Flexible…

Gas / EV Charging Station 10-year Financial Forecasting Model

This model is adaptable and useful for a Gas Station,…

Expert Sensitivity Analysis for Upstream Petroleum Models

The main purpose of the model is to enable users…

Upstream Oil Financial Derivative Hedging Model

This model calculates financial oil derivative positions for Put Options,…

Oil & Gas Marketing and Distribution DCF Valuation Model with 5 Yrs Actual,1 Yr Budget & 5 Years Forecast

A detailed and user friend financial model that captures 5…

Economic Model for Oil and Gas Extraction Feasibility

This model runs for 20 years and makes it easy…

Metal Mining Business Financial Model Excel Template

Metal Mining Pro Forma Template Allows investors and business owners…

Gold Mining Business Financial Model Excel Template

Gold Mining Pro Forma Template Solid package of print-ready reports:…

Coal Mining Financial Model Excel Template

Coal Mining Financial Model Based on years of experience at…

Biodiesel Manufacturing Business Financial Model Excel Template

Biodiesel Manufacturing Financial Plan Enhance your pitches and impress potential…

Gold Mining Investment Project – 10 year Financial Forecast

Financial Model providing forecast and valuation analysis of a Gold…

Hydrogen Gas Sales & Tolling Business Plan and Valuation Model

Hydrogen Gas Sales & Tolling Business Plan and Valuation Model…

Oil & Gas Financial Model – Dynamic 10 Year Forecast

Financial Model providing forecast and valuation analysis of an upstream…

Private Equity Oil and Gas Financial Model

The Private Equity Oil and Gas Financial Model evaluates the…

Business Plan – Construction & Mining Machinery Dealers

If you dream to start or develop a construction &…

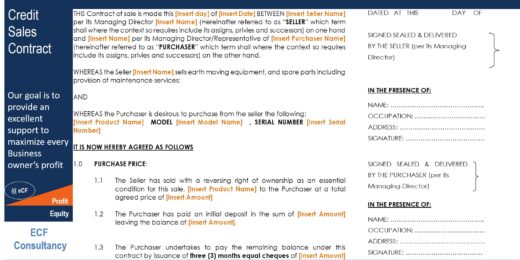

Sales Contract with Reserving the Right of Ownership

A sales agreement with reserving the right of ownership is…

Gold Mining Company DCF Valuation Model Template

A financial model that performs a DCF & Relative valuation…

Discounted Cash Flow DCF Valuation Model Template (Mining Company)

Financial model that performs a DCF & Relative valuation on…

Gas Sales & Distribution Model Template with 3 Statements and Valuation

Project Finance - Gas Distribution is a project finance model…

DCF Valuation Model with 3 Years Actual and 5 Years forecast – Oil and Gas Company

Financial model that performs a DCF valuation on Oil and…

Heavy Machinery Trading Startup Business Plan

This model has been constructed for startup heavy machinery trading…

Industry Based Financial Models (Variety Bundle)

There are currently 52 unique financial models included in this…

The mining industry has long held an allure for investors, drawing them into a world where the Earth's hidden treasures await discovery. Beneath the surface, this industry is a compelling blend of risk and reward, where the promise of mineral wealth is tantalizingly real. Yet, before one plunges into the depths of the mining sector, it's vital to understand the nuances and challenges of investing in it.

Scope of the Mining Industry

Mining encompasses a vast array of minerals and resources, each with its own unique properties and market demand. Some popular mining products include precious metals like gold and silver, base metals like copper and zinc, industrial minerals like limestone and gypsum, and energy resources like coal and uranium. The diversity within this sector provides investors with a broad range of opportunities, but it also requires a tailored approach to investment decisions.

The mining industry offers various opportunities for big and small players, each with its own advantages and challenges.

Big Mining Opportunities

- Access to Capital: Established mining companies have better access to capital markets and financing options, enabling them to fund exploration and development projects.

- Global Reach: Big mining companies often have the resources and infrastructure to operate worldwide, exploring and developing mineral deposits in multiple countries.

- Large-Scale Operations: Established mining companies can engage in large-scale mining operations, extracting valuable minerals, metals, and resources on a massive scale. It requires significant capital, equipment, and expertise.

- Technological Advancements: Big players can invest in advanced technologies such as automation, AI, and data analytics to improve efficiency, safety, and environmental sustainability in mining operations.

Small Mining Opportunities

- Local Operations: Small-scale mining operations can thrive in regions with untapped mineral resources, contributing to local economic development and employment.

- Niche Markets: Smaller mining ventures can focus on niche markets, targeting specific minerals or metals with high demand and value, such as rare earth elements or specialty metals.

It's important to note that big and small players in the mining industry must adhere to environmental regulations, engage with local communities, and address sustainability concerns. The choice between big and small operations depends on available capital, market focus, risk tolerance, and targeted mineral resources.

Process Before Starting a Mining Operation

There is a process that mining business projects have to go through before starting the operations. These steps are critical to follow, such as from the discovery of an ore body through the extraction of the ores and, finally, the restoration of the land’s natural state.

- Prospecting or Exploration: Before starting a mining project, the first step is looking for a source to mine. Prospecting or exploring will lead to the discovery of the ore body. It defines the area, location, and value of the whole ore body. Thus, by conducting a mathematical resource estimate, one can determine the size and grade of the existing deposit. The estimation result will be detrimental to identifying whether further investment and engineering studies are needed to identify critical factors that need improvement.

- Feasibility Study: A financial feasibility analysis is needed to evaluate the project’s profitability and viability. The study will be used when the mining company needs to make decisions like developing the mine or dropping the project. The financial feasibility analysis encompasses planning the mine's recoverable deposit, metallurgy, marketability of ore concentrates, risks, costs, finance and equity, and research conducted from the extraction through reclamation.

- Development: After analyzing the mine to determine its recoverable deposit, development begins to give access to the ore body. Mine buildings and processing plants are constructed, and the equipment needed is obtained.

- Reclamation: Once the operation starts, the decision to recover the extracted ore solely depends on the company. Reclamation is when all the ore that can be mined has been extracted and recovered; the company will reclaim the suitable mining area for future use

One thing that needs to be noted in a mining project to determine the proportion of a deposit that is economically recoverable depends on the enrichment factor of the existing ore in the area. So, to gain access to the deposit, one must mine through or remove waste material, which could be more beneficial for the business.

The excavation of ores and waste material are both parts of the whole mining process. Depending on the nature and location of the ore body, there might be cases where there is more waste than an ore deposit. Thus, waste removal has been one of the long-standing factors that cost mining companies a lot. So, before the start of the project, a detailed characterization of the existing waste material upon exploration is critical for the companies to take note of before mining operations start.

Capital Expenditure and Operational Mining Costs

The cost of starting a mining operation can vary significantly depending on several factors, including the type of minerals or resources being mined, the operation's location, the operation's scale, and the region's regulatory environment.

Here are some of the typical mining costs associated with a mining operation:

- Exploration Costs: Before mining can begin, exploration activities are usually conducted to assess the presence, quality, and quantity of mineral deposits. It can involve geological surveys, drilling, and sampling. Depending on the project's complexity, exploration costs can vary widely, from tens of thousands to millions of dollars.

- Land Acquisition: Acquiring the rights to mine on a specific land or mineral claim can be a significant expense. This cost depends on the property's location, size, and mineral potential.

- Permitting and Regulatory Costs: Obtaining the necessary permits and complying with environmental and safety regulations can be lengthy and costly. These costs include environmental impact assessments, permitting fees, and compliance measures, which can cost millions of dollars.

- Equipment and Infrastructure: mining operations require various equipment, such as excavators, trucks, crushers, conveyors, and processing plants. mining costs for purchasing, transporting, and maintaining this equipment can be substantial. Additionally, infrastructure like roads, power supply, and water sources may need to be established or upgraded.

- Labor and Training: Labor costs depend on the size of the workforce needed for mining, associated tasks, and local labor market conditions. You may also incur training expenses to ensure the safety and competence of workers.

- Operational Costs: Once mining begins, ongoing operating costs include fuel, maintenance, labor, and other expenses required to extract and process the minerals. These costs can vary widely depending on the type of mining (e.g., open-pit, underground), the depth of the deposit, and the method used.

- Environmental and Reclamation Costs: Mining operations often have to budget for environmental mitigation and reclamation activities, including land rehabilitation and water treatment, to ensure the site is returned to a suitable condition after mining activities cease.

- Financing and Interest Costs: Securing funding to cover initial capital expenditures can involve interest payments, which add to the overall cost of starting a mining operation.

- Market and Price Risks: The profitability of a mining operation can be influenced by market conditions and fluctuations in commodity prices. Managing these risks may require additional financial resources.

- Contingency Funds: It's common for mining projects to face unexpected challenges and cost overruns. Setting aside contingency funds is prudent to handle unforeseen issues.

The total capital expenditure and operational mining costs can range from millions to billions of dollars, depending on the project's specifics. Mining companies must conduct comprehensive feasibility studies and financial assessments before committing to a project to ensure the potential returns justify the investment.

Types of Mining Business Models

In the mining industry, there are different ways to excavate the ores. Due to the advancement in technology, there have been other methods emerging, such as:

The mining method used solely depends on the mined ore deposit, the location of the mining area, whether underground or on the surface, and if the resource is feasible enough to start a mining project in the first place.

Running a mining business should be run efficiently and responsibly, with every move appropriately managed. There are technical and economic issues in mining projects that must be revealed ahead of time by the responsible mining company. That’s why, before starting mining projects or investing in the mining business, you need to make a proper mining business model or a financial plan to ensure accurate financial feasibility analysis, financial projections, forecasting, valuation, and other representations that will prove that the mining operation is profitable.

Benefits of Investing in the Mining Industry

Potential High Returns on Investment and Case Studies of Successful Ventures

The mining industry has historically offered the potential for high returns, attributed to the cyclical nature of commodity markets and the leverage effect of operational efficiencies. Successful ventures often result from strategic site selection, technological innovation, and market timing. Case studies of prosperous mining investments highlight the importance of rigorous due diligence, expert partnerships, and adaptive management in realizing substantial profits.

Portfolio Diversification Benefits

Mining investments can significantly enhance portfolio diversification, reducing overall risk. Commodities often move inversely to other market instruments like stocks and bonds, providing a hedge against inflation and currency depreciation. This diversification benefit is particularly appealing in volatile economic environments, offering stability and protection to investors’ portfolios.

Demand-Driven Growth Fueled by Technological and Infrastructural Advancements

The ongoing demand for minerals and metals, driven by technological advancements and infrastructural development, underpins the mining industry's growth prospects. The global push towards renewable energy, electric vehicles, and sustainable technologies has spurred demand for specific commodities, presenting opportunities for forward-thinking investors to capitalize on these trends.

Challenges of Investing in the Mining Industry

Market Volatility and Price Fluctuation Risks

Commodity markets are inherently volatile, with prices influenced by a myriad of factors including economic indicators, geopolitical events, and supply-demand imbalances. This volatility can significantly impact the profitability of mining projects, making risk management and strategic planning paramount for investors.

Environmental, Social, and Governance (ESG) Issues Impacting Investment Decisions

ESG considerations are increasingly at the forefront of investment decisions, with stakeholders demanding responsible and sustainable mining practices. Navigating ESG challenges requires a commitment to ethical operations, environmental stewardship, and community engagement, aligning business objectives with societal and environmental values.

Geopolitical Risks and Operational Challenges in Different Regions

Mining investments are subject to geopolitical risks, including regulatory changes, political instability, and jurisdictional disputes. These risks can affect project viability, requiring thorough geopolitical assessment and risk mitigation strategies.

Navigating Investments in the Mining Industry

Best Practices for Investors Considering the Mining Sector

Investors should embrace a comprehensive approach, incorporating thorough research, due diligence, and diversification. Engaging with industry experts and leveraging advanced analytical tools are key to understanding market dynamics and identifying viable investment opportunities.

Importance of Thorough Research, Due Diligence, and Risk Management

In-depth research and due diligence are fundamental in uncovering potential risks and opportunities within the mining sector. Effective risk management strategies, including scenario analysis and hedging, are crucial for protecting investments against market volatility and unforeseen events.

Future Outlook and Emerging Trends in Mining Investments

The mining industry is evolving, with sustainability, technology, and innovation shaping future trends. Investors need to stay informed about these developments, adapting their strategies to leverage new opportunities and navigate the shifting landscape.

Investing in Mining & Resources – Mining Valuation Model XLS Templates

If you're interested in starting a mining & resources business or investing in a mining company, above are mining business model templates, valuation models, mining financial model templates for mining projects, and financial plan templates for mining businesses such as a Goldmine or an Open Pit mine. These Excel mining financial model templates are designed explicitly for mining projects or companies in the mining industry.

In the mining financial model for valuation, the projections of the expected metal content of ore mined are included as relevant income and cost drivers and financial projections for a business plan for a mining operation. The data is then used to determine the mining project's value, profitability, and feasibility to ensure the investment is worth it.

These mining financial model Excel templates will be helpful as your guide to completing your financial projections for a business plan or financial plan for a mining business. You can also use it to determine the value of the mining project and calculate its feasibility in the long run. Another use of the mining financial model could be as a basis for seeing the profitability of the investment.

Also included as part of the complete mining financial model for valuation are charts and other things you'd need for swift editing and application of figures to complete your financial statements and projections, as well as the valuation, giving you a complete view and presentation of the business's financial feasibility and profitability.

Besides our mining valuation model XLS, you can also check out our other valuation model templates modeled for other projects, businesses, industries, and entities. These templates are also downloaded and used by different users such as analysts, managers, senior managers, associate directors, CFOs, entrepreneurs, and others from all over the globe, such as in the USA, UK, Germany, Japan, Australia, Switzerland, and many more who need know-how as well as assistance with their financial modeling tasks.

If you are looking for a specific financial model template and can't find it in our inventory, feel free to comment here: Missing Financial Model Templates, so that our vendors will pick up that project and soon add it to our still-growing inventory.

If you found the template but need help with customization of your preference, we also offer financial modeling services, which you can avail of here: Custom Financial Modeling Service.

We would be grateful if you also rate our products and leave a review, comments, suggestions, or any feedback about our financial model templates; this will significantly help us shape our templates to be even better.

Do you need guidance on how to build your own financial models but can't afford to hire an expert to help with your financial modeling tasks? Then why do it yourself and save money from high professional fees by learning financial modeling today?