Gold Mine Investment Model

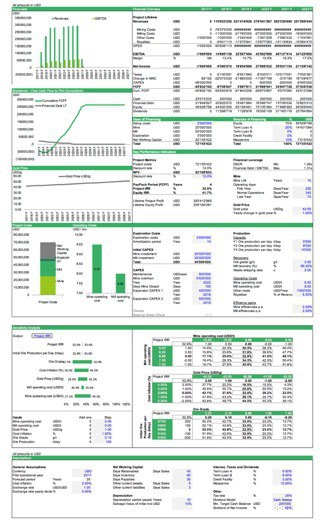

The Gold Mine Investment Model is used to determine the financial feasibility of a proposed Gold Mine Investment. The Financial Model outputs IRR and NPV based on the Mine Life expectation.

| Financial Model, Mining Industry |

| Amortization, DCF Model, Excel, Financial Feasibility, Financial Projections, IRR (Internal Rate of Return), Mine Life, NPV (Net Present Value), Valuation |

The Gold Mine Investment Model is used to determine the financial feasibility of a proposed Gold Mine Investment. The Financial Model outputs IRR and NPV based on Key Performance Indicators (KPI)s such as ore grade, ore processed, cost per ton and other relevant variables to the mining sector.

The highlights of the Gold Mine Financial Investment Model are:

- Forecast of the operational Days Per Year

- Forecast of the gold content in the ore

- Forecast of processing capacity per day for ore and material

- Mine and mill cost based on a per ton estimate

- Estimation of ore and materials to be processed

- Amortization of exploration costs

- Fixed asset schedule with depreciation and CAPEX

- Debt schedule for various layers of debt

- Forecast of gold prices in USD and conversion into local currency

- 20 Year Financial Projections whereas the Mine Life can easy set to be shorter

- Financial Statements include Income Statement, Balance Sheet and Cash Flow Statement

- Free Cash Flow to Firm and to Equity investors used for Discounted Free Cash Flow (DCF) analysis, Internal Rate of Return (IRR) analysis and calculation of Payback period

- Net Working Capital Estimation

- Sources and Uses of Proceeds Table

- Sensitivity Analysis to determine the impact of key value drivers on Project IRR and Equity IRR

The model is suitable if you need a financial model template for a thorough analysis of a gold mine investment. The model outputs the projected financials in a readable and printable format.

See also the article here for more information or the video below:

The model is available in two versions, a PDF Demo Version and the model in Excel with all cells editable (Normal). Current model version is 6.2.

Filetypes:

.pdf PDF Acrobat Reader

.xlsx Microsoft Excel

Screenshots of Executive Summary of the Gold Mine Financial Model

Similar Products

Other customers were also interested in...

Upstream Oil & Gas Project Analysis

The Upstream Oil & Gas Project Financial Model Template in Excel empowers you to project and dissect... Read more

Private Equity Oil and Gas Financial Model

The Private Equity Oil and Gas Financial Model evaluates the financial feasibility and investor retu... Read more

Gold Mining Company DCF Valuation Model Template

This is a detailed and user-friend financial model with the three financial statements, i.e., Income... Read more

Discounted Cash Flow DCF Valuation Model Template ...

This is a detailed and user-friendly financial model with the three financial statements i.e. Income... Read more

Oil & Gas Financial Model – DCF and NAV Valu...

The Oil and Gas financial model with DCF (Discounted Cash Flow) and NAV (Net Asset Value) Valuation ... Read more

Industry Based Financial Models (Variety Bundle)

There are currently 52 unique financial models included in this bundle. Nearly all of that include a... Read more

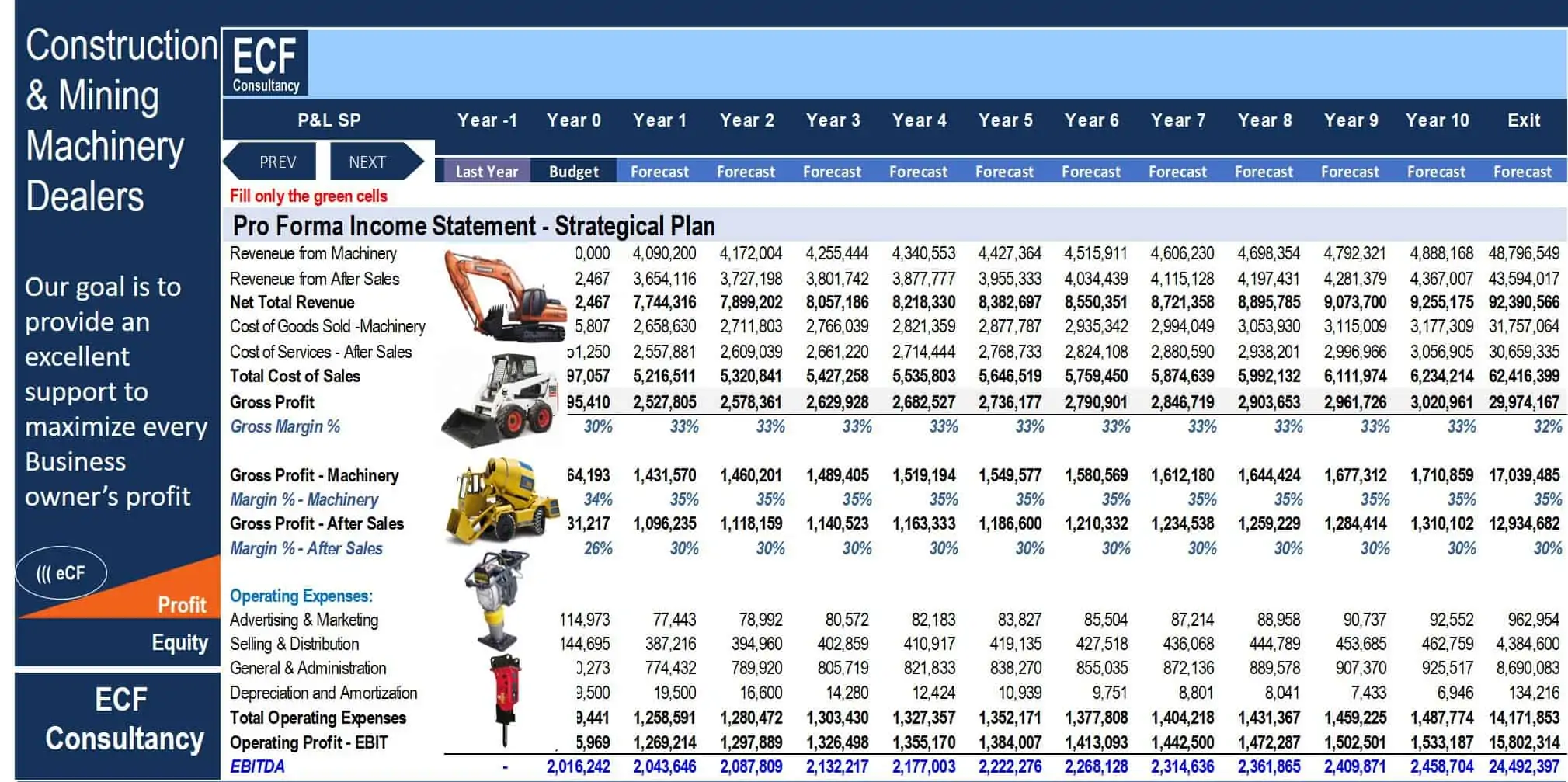

Business Plan – Construction & Mining Ma...

If you dream to start or develop a construction & mining machinery dealership business, the temp... Read more

Gold Mining Investment Project – 10 year Fin...

Financial Model providing forecast and valuation analysis of a Gold Mining Project. The... Read more

Economic Model for Oil and Gas Extraction Feasibil...

This model runs for 20 years and makes it easy to create a financial plan and feasibility study for ... Read more

Oil & Gas Marketing and Distribution DCF Valu...

A detailed and user friend financial model that captures 5 years of Historical + 1 Year of Budget + ... Read more

Reviews

Hi,

Great post.

Any chance you also have for a gold and silver refinery a financial model?

Thanks

423 of 810 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Hi Samuel, Many thanks for leaving a review! Regarding your inquiry, at the moment, we do not have a model template for Gold and Silver Refinery financial model. However, we will add this to our list of projects to be picked up by our consultants in the future. – eFinancialModels

415 of 841 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Accurate data, Industry analysis reports help a lot.

399 of 815 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Appreciate for the spreadsheet in pdf, although will have been beneficial to have the excel version.

427 of 859 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Thank you for giving a review of this product. Actually, there is an Excel version of this product. Simply choose the Excel Financial Model version here: https://www.efinancialmodels.com/downloads/gold-mine-investment-model/

415 of 822 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.