Tax Assets

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Private Equity Fund Financial Projection Model with Distribution Waterfall

Highly versatile private equity fund financial projection model with calculations…

Industrial Warehouse Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Student Accommodation Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Care Home Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a multi…

Film Production 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a new…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Wellness Centre 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a wellness…

Vending Machine Business 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a vending…

Financial Advisor / Financial Planner Financial Projection Model

5-Year 3-Statement Excel projection model for Financial Advisor / Financial…

Barber Shop 5-Year Financial Projection Model

5 year rolling financial projection Excel model for a barber…

Cost Segregation Study: Estimated Benefit Summary and Supporting Data

This calculator has inputs for many different asset categories and…

IFRS 17 GMM Insurance Financial Projection Model

IFRS 17 General Measurement Model (GMM) Insurance 5 year quarterly…

Depreciation Recapture – Accounting Calculator

A simple calculator that displays the resulting tax basis for…

Apartment Building / Self-Storage / Multi-Family Acquisition Model: 15 Year

This real estate model works great for acquisitions of apartment…

Sports Club / Sports Complex 5-Year 3 Statement Financial Projection Model

3 statement 5 year rolling financial projection Excel model for…

Pharmacy Business 5-Year 3 Statement Financial Projection Model

3 statement 5 year rolling financial projection Excel model for…

Car Park Business 10-Year 3 Statement Financial Projection Model

3 statement 10 year rolling financial projection Excel model for…

Hair & Beauty Salon 5-Year 3 Statement Financial Projection Model

3 statement 5 year rolling financial projection Excel model for…

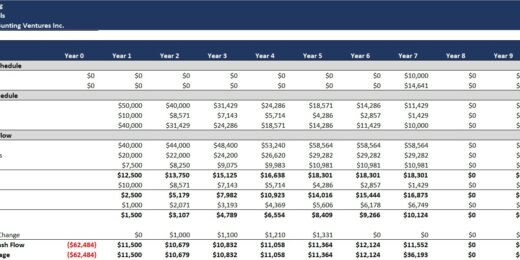

Capital Budgeting Model with NPV, IRR, & RoC Calculation

This model was developed to complete capital budgeting and analysis…

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes…

Energy Project Finance (Infrastructure Model)

This is a special project vehicle (SPV) for an Energy…

Online Travel Agent (OTA) Startup DCF Financial Model

This model provides users an integrated and fully customized OTA…

Pay-per-Visit Online Medical Marketplace All-in-one Financial Model

This model provides a financial model of a brand-new business…

Residential Investment Property Acquisition Model Template

Residential Investment Property Acquisition Model provides detailed monthly Cash Flow…

Seller Financing: Amortization and Taxable Gain Recognition

This is a tax calculator as well as an amortization…

Windfarm Investment 3 Statement Financial Projection Model

User-friendly 3 statement yearly rolling financial projection Excel model for…

Impairment Test Simple Guide Model- CGU Value In Use Based

This model is extremely useful for M&A acquirers to test…

Purchase Price Allocation Simple Guidance + Goodwill & Consolidated Balance Sheet Template

This is a simple excel explanation model of Purchase Price…

Coworking Business Financial Projection 3 Statement Model

5-year 3-statement excel model for preparation of a financial projection…

Lending Business Financial Projection 3 Statement Model

3 Statement 5 year rolling financial projection Excel model for…

General Insurance Company Financial Projection 3 Statement Model

User-friendly Excel model for the preparation a of 5-year rolling…

Franchise Business Financial Projection 3 Statement Model

3-Statement 5-year user-friendly financial projection Excel model for a new…

BRRRR Real Estate Investment Financial Projection 3 Statement Model

3 Statement 5 year financial projection Excel model for a…

Property Development & Rental Financial Projection 3 Statement Model

3-Statement 5-year rolling projection model with a valuation for new…

Wholesale Startup/Existing Business Financial Projection 3 Statement Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Solar Farm Business Financial Projection 3 Statement Model

3-Statement rolling projection model for startup or existing business developing…

BioPharma Business Financial Projection 3 Statement Model

5-year rolling 3 statement financial projection for a biopharma business…

Entertainment Venue Financial Projection 3 Statement Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Recycling Business Financial Projection 3 Statement Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Insurance Managing General Agent (MGA) Financial Projection 3 Statement Model

Insurance Managing General Agent (MGA) 3 statement 5 year rolling…

Infrastructure Private Equity Wind Energy Modeling Test Solution (Associate level)

A self-made Modeling Test with a solution for Onshore Wind…

Insurance Broker Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model for…

Digital Media Business Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model for…

Dental Practice Business Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model for…

Medical Clinic / Healthcare Business Financial Projection 3 Statement Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Online Marketplace Business (New or Existing) Financial Projection 3 Statement Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Multi-Entity Group Generic Monthly 5-Year 3 Statement Rolling Financial Projection Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Multi-Establishment Generic Startup Financial Projection 3 statement Model

User-friendly generic model for preparing a 5-year financial projection for…

Rental Business (New or Existing) Financial Projection 3 Statement Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Professional Services Startup/Existing Business Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model (with…

Marketing Startup/Existing Business Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model (with…

Education Startup/Existing Business Financial Projection 3 Statement Model

3 statement 8 year rolling financial projection Excel model for…

Generic 5-Year Monthy Rolling Financial Projection Model with Scenario Analysis

Rolling 3 statement excel projection model across 5 year period…

Delivery/Takeaway Restaurant Business Financial Projection Model

User-friendly 3 statement 5 year rolling financial projection Excel model…

Startup or Existing Subscription Business Financial Projection 3 Statement Model

3 statement 5 year rolling financial projection Excel model for…

Generic Startup/Existing Business 5-year (Monthly) Financial Projection 3 Statement Excel Model

Highly versatile and user-friendly Excel model for the preparation a…