Startup Financial Models

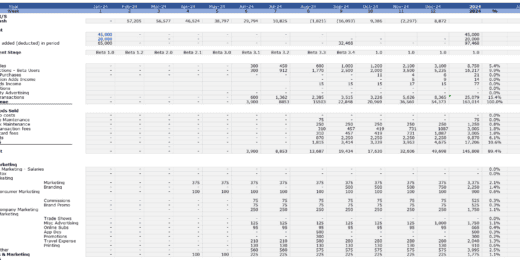

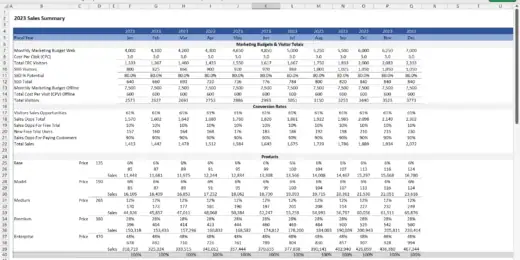

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

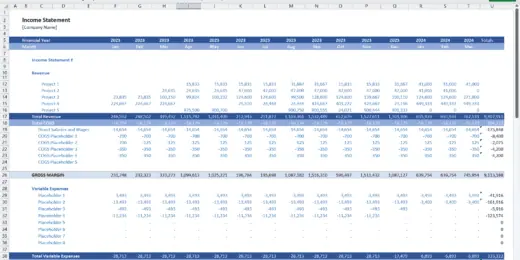

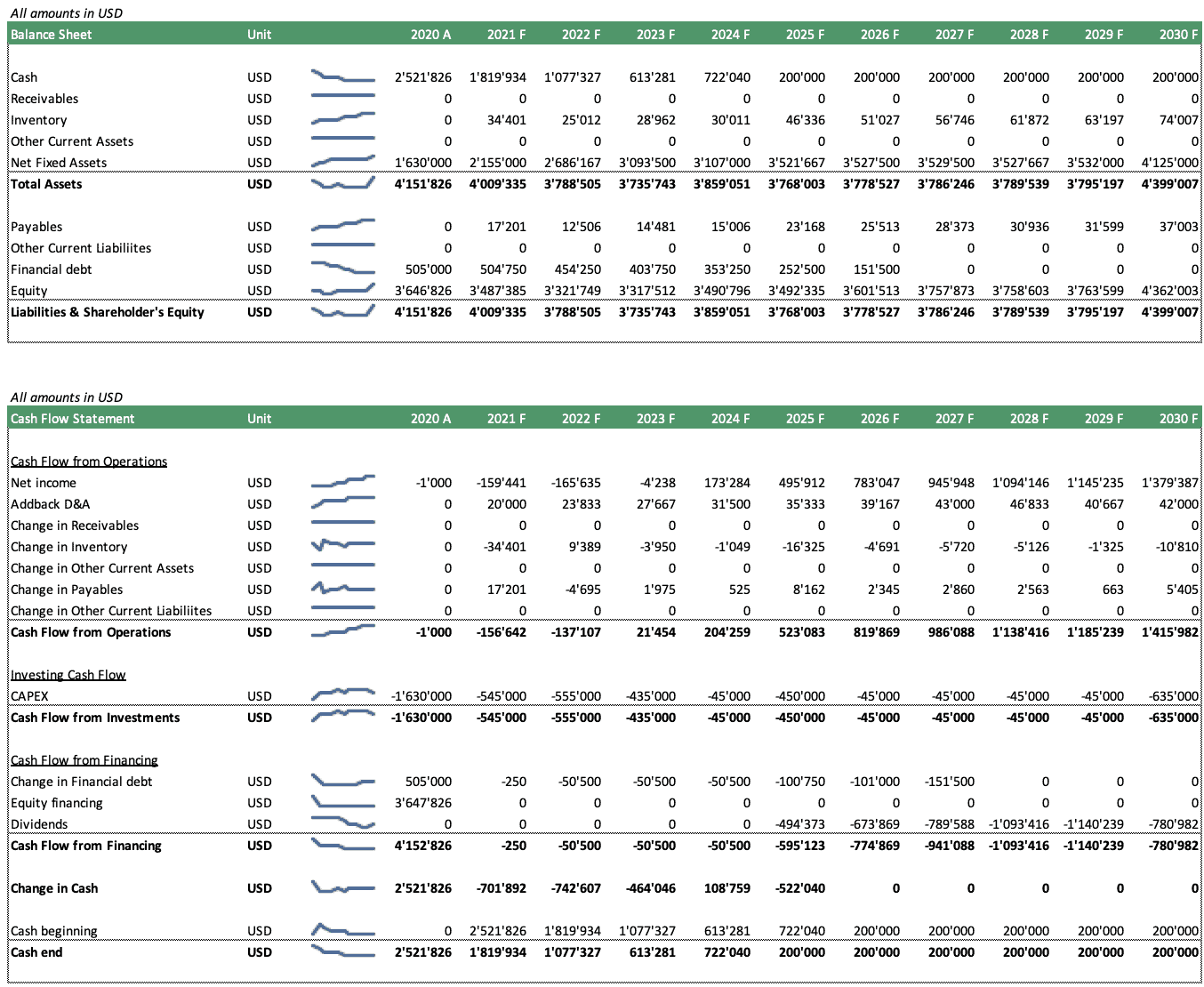

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Diagnostic Collection Center Financial Model

It is financial model for diagnostic collection center whose phlebotomists…

Mobile Imaging Center Financial Model

This Excel model facilitates mobile imaging services by providing equipment…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

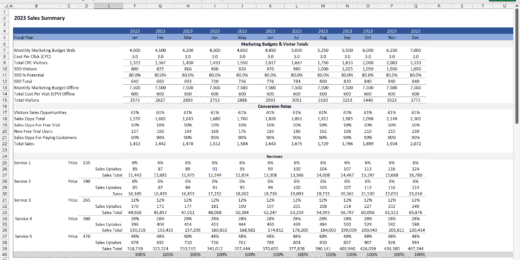

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

5 Year 3 Statement Virtualization Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Virtualization Software…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Real Estate Joint Venture Financial Model

The Real Estate JV Model analyses an equity joint venture…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

Fruit Processing Facility – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Business Valuation Spreadsheet

This file enables you to effortlessly compute the Estimated Business…

Auto Parts Store – 5 Year Financial Model

This Financial Model Template provides an advanced 5-year financial plan…

Brewery Financial Model and Budget Control

This Excel model is an advanced, user-friendly financial planning tool…

Surfboard Rental Business Financial Model

Surfing is not just a sport—it's a lifestyle booming globally.…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

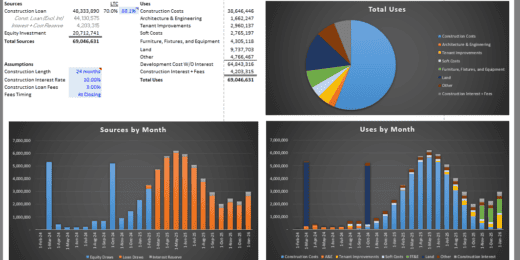

Construction Draw Schedule & Gantt (New Development Cost/Sources & Uses Model)

Elevate your construction project planning with our Construction Draw Schedule…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Trucking Company – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Pet Grooming Business Dynamic Financial Model 2024

Tailored for pet grooming businesses, this dynamic financial model streamlines…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Ship Management Business 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a startup…

Online Tutoring Services Financial Model (10+ Yrs DCF and Valuation)

The Online Tutoring Services Financial Model is a comprehensive tool…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Industrial Warehouse Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Cleaning Service Pro Forma Template (Commercial / Residential)

A pro forma template for any home service or general…

Oil & Gas Financial Model – DCF and NAV Valuation (5+ Yrs.)

The Oil and Gas financial model with DCF (Discounted Cash…

Cocktail Bar – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Self Storage Business 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a startup…

Truck Rental Company Financial Model

This detailed 10-year monthly Excel template is specifically designed to…

Private Aircraft Rental Company Financial Model

Embark on a journey to financial mastery with our Private…

Webinar Organizer Business Plan Template

Discover the key to financial success in your webinar ventures…

Party Planning Business Financial Model

Introducing the Party Planning Business Financial Model – Your Ultimate…

Culinary Arts Academy – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Dog Grooming Services Financial Model (10+ Yrs DCF and Valuation)

The Dog Grooming Services financial model is a comprehensive tool…

Ship-to-Ship Fuel Bunkering 5-Year 3 Statement Financial Projection Model

5-year rolling 3 statement financial projection with a monthly timeline…

Why Does a Startup Need a Financial Model?

How to Make a Financial Model for a Startup?

Startup Financial Models or Startup Finance models are financial models which are specially prepared for Startups and address typical questions Startup businesses face:

• Is my business plan financially viable?

• What is the optimal business model?

• How can growth be maximized?

• How does my monthly budget look like in the first years?

• What sales volume is needed to reach break even?

• When does the company plan to reach break-even?

• How much cash will be burnt per month (burn rate)?

• How much financing is needed from which sources?

• From where and how do I get funding for my startup?

• What kind of returns investors in the Startup eventually can obtain?

What is a Startup Business?

A startup business is a new business venture founded to solve a specific problem in the market and offer a solution by servicing customers who are demanding a unique solution. Startups fill gaps in the market by addressing unmet needs. As Startups involve many risks, they are entrepreneurs who are personally willing to take that risk because they exactly know what they are doing. Startups start small and usually seek to maximize the growth of their business so they can become profitable soon and stabilize the business.

But it’s not always as simple as it sounds. There are many risks involved. So, it is also not uncommon that some Startups will fail. Some sources estimate up to 8 out of 10 Startups will fail within the first years of being in business, leading to a high failure rate of a startup business. Of course, several examples of successful former startups also turned into great companies, such as Amazon, Facebook, and Google. Important to remember is always: “Any business started as a Startup.”

Please see our video:

What are the Various Stages of a Business's Lifecycle?

Starting from the moment you decide to start a firm, you are part of the "business life cycle." This will take you from conception to launch and, if successful, on to the development and maturity phases of the business. An insight into each stage of business life shows a unique set of barriers to tackle and overcome. You need to be adaptable and adjust your strategy as you move along. Various techniques for market penetration are required, for instance, to accomplish expansion or maintain market share. Here are the different stages in the lifecycle of a business:

- Startup Kick-off: A business must be launched before it grows and matures. This necessitates a financial investment to get the business off the ground. However, revenue is low because the company is new and does not yet have a customer base. As a result, the launch period is the least profitable for a company. It is also widely regarded as the most dangerous of all phases. The most important aspect of the launch phase is that it should not be rushed. You build a successful business by investing time and effort in a launch. Also, keep sustainability in mind. Hiring is an excellent example. When it comes to hiring, strive for a long-term balance. If you're overstaffed, the extra payroll eats into your profits; if you're understaffed, your company is less productive.

- Growth: During this stage, the company is still creating its identity. Put another way, the business owner determines what works and what doesn't for the company. Following the launch phase's low returns, the growth phase sees revenue slowly increase. As the business progresses over the break-even point, pricing might remain constant or even fall. Now that the firm is profitable, the owner begins to search for ways to expand it. The goal is to increase revenue and, more importantly, profits. Typically, business owners concentrate their efforts on three key areas: marketing, sales, and scaling.

- Shake-out: Sales continue to rise throughout the shake-out period, although slower, either due to approaching market saturation or the introduction of new competitors. During the shake-out phase, sales are at their highest. During the shake-out phase, sales continue to rise, but profit declines. This cost increase is reflected in the increase in sales and decrease in profit. Finally, cash flow rises and surpasses profit.

- Reinvention: In this stage of business, the sales and revenue have significantly slowed. However, the company remains resilient, with consistent revenue. Increased competition is one of the key challenges that business owners face during this stage. By this point, many competitors with similar businesses are likely to have emerged. These new competitors gained an advantage by being able to reinterpret products in novel ways. The business growth cycle ends when it reaches the maturity stage. Many business owners start thinking about the next steps or an exit strategy at this point. On the other hand, many organizations extend their life cycle during this stage by reinventing themselves, investing in new technology, and expanding markets. This allows businesses to reposition themselves in their fast-paced industry and re-energize their market growth.

- Decline: The decline stage of the business life cycle model is when the company loses market share and revenues fall. Ideally, the business will recognize the onset of the decline stage and take steps to avoid it, such as investing in its current market to keep the business stable in its maturity stage, investing in new opportunities to move the business into a higher growth and expansion stage, or exiting the business in a controlled manner. After doing all the means to do expansion and reinvention and there’s no significant change in sales profits, companies admit their failure to extend their business life cycle. Companies eventually lose their competitive advantage and quit the market.

What are the Characteristics of Startups?

It is important to note that startups exhibit characteristics distinct from those of established businesses. Startups that understand these characteristics have a better chance of long-term viability without jeopardizing growth. The following are the characteristics of startups that distinguish them from established businesses.

- Startups require funding. As the term implies, startups are budding enterprises in the field. After planning all the details of your business, the next step is to execute each bullet point on your list. To turn your plans into reality, you need to secure funds to build your business and its operations.

- No financial history nor financial track record: Since startups are emerging businesses in different fields and industries to solve problems and meet market demands. Most of them don’t have a financial track record of their operations and revenues since they are just beginning to grow their business and explore their market.

- Subject Business Plan During the planning and operational stages, entrepreneurs, startup companies, and established organizations will use and require preparing the financial plan. Each element of a financial plan has a vital function to play in the strategy and management of your company. Some of these can be utilized immediately to see if your new or existing business is practical or sustainable. Others will be utilized to generate data that will help you acquire partners, investors, or financing capital, while others will continuously monitor and benchmark your business actions. However, the financial plan for startups might lean on subjective assumptions since they are still exploring and experimenting with strategies to grow their business.

- Financial Feasibility Analysis: The ability to see into the future distinguishes a successful startup from a failed one. Before ever investing a dime in a project, a goal-oriented entrepreneur conducts a financial feasibility study to confirm viability. This allows them to examine the market, estimate the potential startup costs, create a cash flow and profit plan, forecast future performance and determine the return on investment, provide intelligent statistics to the management team, identify areas for growth, and much more.

- Losses at the beginning: It is impossible to define an average time to profitability for a startup because each startup will measure profitability differently. However, we can expect that startups might not generate revenues immediately and might encounter losses at the beginning since they need to fund their businesses for them to operate and thrive in the market. The amount of startup capital required to generate the products and services and how much money is taken from the company for compensation and investor servicing determines how long it takes for the company to become profitable.

- Market Demand to be proven: People who want to buy what you sell and are willing to pay for it are essential for a successful business. In essence, that's market demand. Knowing your target market by determining their needs is a good way to get to know them. It's also a way of determining whether a market requires your goods or services. Likewise, you can reinvent, reconstruct, or innovate new items and services that could give consumers solutions to their difficulties.

- Requires Monthly Tracking: Startups are more vulnerable to risk than established businesses that have withstood the test of time because their business plans come with uncertainties. Established businesses have solid business plans in place, as well as backup plans in the event that one fails. They have the resources and connections to come up with new business ideas. However, because startups are still in the early stages of development, their business models may or may not be viable. The strategy that was effective a year ago may no longer be so. Remember that market conditions change on a regular basis, so your business plan should be revisited and updated on a regular basis.

- Negotiations with financing Investors/ Banks: A startup's financing is a major challenge for any entrepreneur or a business owner. After all the hard work of developing a business idea, an entrepreneur's next challenge is locating funding sources to get their operation off the ground. While financing a business can be difficult, it is not impossible. Founders must make an important decision when it comes to financing structures. Some people start with their life savings, while others run a crowdfunding campaign, and those who are eligible often take out a traditional loan. Equity financing and revenue-based financing are also popular financing options.

- Changes in Shareholder Structure: When a business is formed, the founders must identify who owns the business. Frequently, the founders also become the enterprise's first stockholders. The shareholder structure will almost certainly change over the course of the business's existence, and they are often based on how the company raises funds.

- Scenario Analysis: Uncertainty is the only thing that is certain in business, as in life. Scenario analysis is a powerful tool for navigating future uncertainty by analyzing the potential business consequences of future events and considering possible alternative outcomes. Companies can use scenario analysis to investigate a wide range of potential future scenarios, such as economic downturns and natural disasters, and expand a product line or open new offices. Scenario analysis does not attempt to predict any of these events outcomes. Instead, it investigates a range of potential situations and outcomes, typically ranging from best-case to worst-case scenarios. Startups can use scenario planning to better prepare for these events and their possible consequences.

Considering all these points above, preparing a financial forecast for a startup can be pretty challenging. A financial model for startups must address the typical questions in such situations and be built flexibly to run the required financial scenario. Preparing a thorough startup financial model can be a crucial tool for any entrepreneur to understand the profitability of a new venture better and prepare for an effective negotiation strategy with capital providers. Solid startup financial projections will also allow us to establish a tracking mechanism where projected results can be later compared to actual results.

Why a Startup needs a Financial Model?

There are two key points that any startup might want to prepare before actually starting a business:

• Business Plan – a document that outlines the strategy, business model, and who and how it's going to execute the plan

• Financial Plan – in most cases, an Excel spreadsheet built from a Startup Financial Model Template

Sometimes entrepreneurs ask, “Is financial modeling necessary for early-stage startup?” Preparing a solid financial plan sometimes gets forgotten. We cannot stress enough that you cannot afford not to prepare a Startup Financial Plan unless you are indifferent to the financial outcome of your venture. Many risks are involved in any new venture, and significant money can be lost. Careful financial analysis and some know-how in creating a financial plan for a startup are needed.

It can be very time-consuming to create such a startup financial model, so a good alternative is to start from a startup financial model template.

Here are why financial models for startups are needed:

• To check the profitability of the project via IRR Analysis which can be found in a startup finance model

• To validate the business model if the business is financially viable

• To know when to reach break-even

• To know how much cash will burn per month or how much the funds will last

• To know how much funding is needed to execute the business plan

• To know how much to compromise the return to shareholders via Equity Share

• To realize different scenarios and their effects, thus, the need to create dynamic models to run different simulations with different assumptions and see the results

• They will help the business manage its finances properly to avoid incurring losses through startup financial projections.

• To better understand how the business works and much more.

To build a financial model for a startup, you will need a rough business plan first. Creating a business plan usually goes hand in hand with creating a startup financial plan example to quantify the business plan's profits and returns. Once you find a profitable strategy, this will help strengthen your business plan.

Business Plan for Startups - What to include?

Due to the high possibility of not succeeding, a business or startup financial model plan became a critical factor that all startups must-have. The Financial plan template for startups helps with planning for the future and predicts some cases that will either be beneficial or not to the business. The business plan for a startup business will serve as a great tool to aid the company in lessening the failure rate of success and develop new opportunities to grow.

Creating a business plan is much more important and takes priority before you start anything, such as spending money on your business. The following are the elements included in a typical financial plan template for startups:

• Executive Summary

• Business Objective, Goals, Description

• Market

• Products and/or Services

• Unique Selling Proposition

• Team

• Marketing Strategy

• Financial Plan

Making a business or financial plan for a startup business has many benefits, such as better understanding your business, increasing the possibility of succeeding, being able to raise funding for the business, and also raising the probability of growth compared to those who didn’t make a solid business plan for their business.

To help you better understand the elements of a business plan, we’ll provide a brief explanation and some helpful tips to guide you as you create your own business plan or startup financial plan example.

Business Objective, Goals, and Description

Be transparent and provide a clear objective, setting a clear goal, and a proper description of the business as a whole. You can’t be ambiguous, for this will lead to uncertainties and confusion in the future. Basically, you need to point out several factors, such as:

• What kind of business? (business model)

• Where do you plan to operate? E.g. online, physical, both, local or global, etc.

• How will you operate?

• When do you plan to start operations?

• What are your reasons for going into business?

• What are your goals?

• What do you see your startup business will be in the future?

Such things need to be realized. Thus, it might seem tedious, but you don’t have to go thoroughly as you will cover the in-depth details as you write the rest of your business plan. You should always remember that this part of the business plan is just a summary of what you need to prove and cover in your business plan. So, it is best to be concise and brief, with enough information needed.

Identifying the Target Market

Before you even consider starting a business, you should research the current demand and see if there’s enough market to make it feasible. Thus, it is undisputable that one should always identify the target market for one's startup business to have a higher chance of success. Thus, you need to conduct market research to determine your target market.

Conducting market research means you will have to do thorough research about the:

• Product or Services

• Pricing

• Location

• Marketing

Determining that your business has a viable market will be a great plus. Otherwise, those kinds of businesses that fail to conduct proper market research tend to fail.

Analyzing the Competition

Another essential element is to analyze the present competition for your startup business. Aside from conducting market research, you will also need to perform a competitive analysis to implement your business plan's feasibility further. After all, it's not always that one will start up a unique business with no competition. Thus, competition for startup businesses is usually too harsh and difficult to overcome. That's why you must be ahead of the game and know the answer to the question: Is financial modeling necessary for early-stage startups?

Building up a reputation and obtaining the trust of customers takes time. Thus, as a new entrée in the industry, you are already way behind existing businesses that have survived for years. So, the competitive analysis should be conducted together with your market research. You will need the information from it to base upon your conclusions and plan out strategies for your business to stand out in the middle of countless competitions.

Creating a Budget Plan

If you want to succeed, then you must budget your funds accordingly. One known reason startups fail is running out of money to fund their operations. Creating a budget plan is critical, especially when you don’t have the current capital and planning to secure funding from other sources. You need to plan out how much you need approximately to start your business and to be able to stay operational. Creating a budget plan will help minimize the crisis of insolvency.

Setting Financial Goals

Financing is crucial for your business. Since startup businesses are new, you won’t have any historical values to compare. However, you can still make a projection based on your market research and your expected sales rate. Thus, you can determine your desired financial goal as a startup.

Financial planning is a significant factor that will help you manage all your finances, keep track of the market and expenses, and determine opportunities to be taken advantage of. This will also help make your business plan even more feasible. A financial plan can also be used to gain funding from investors, so it is clear to see how important it is to create one.

Management and Power Structure

One of the elements included in the business plan is the proper organizational structure of your startup business. It is best to sort this out as early as possible so that there won’t be any conflict arising in the future, and it will be clear who’s assigned to which tasks or who they should report to. It shouldn’t be too complex, and there should be a clear line determining the proper positions of everyone.

Marketing Strategy

Marketing is everything for a business. Without a proper marketing strategy, a business would find it hard to yield results or stay operational. Of course, your marketing strategy can’t be planned without conducting market research and competitive analysis, aligning with the budget and financial plans.

Earning your deserved position within an industry takes skill and time. Thus, planning a marketing strategy will give you an edge and a higher chance of succeeding.

Brief and Professional

It couldn’t be helped that one would think that creating a business plan is a very tedious task that will need a lot of time and effort, but you also know how important it is to have one. Though it sounds like the business plan requires a lot of details poured in, one shouldn’t get carried away and write a very long report. Yes, you want it to be detailed and thorough, but one must always be brief with what you want to show. You want to make it as clear as possible and look professional. Your business plan could be used for raising capital, so, you can’t possibly show them a very confusing report about your business. Thus, it will lead to investors not investing instead.

How to Build a Financial Model for a Startup?

“How to build a financial model for a startup?” is a frequently asked question about financial modeling. Building a financial model for a startup will help you organize and monitor the assumptions you'll be testing as you put your ideas into action. Comparing budgeted figures to facts may assist you greatly in navigating the startup stage and beyond. A good financial model can help you understand and better communicate the real potential of your business venture. A Startup financial model will also help you make better financial decisions when you better understand the financial prospects of your business plan.

Building a startup financial model template in Excel will require great and in-depth knowledge of creating a financial plan for a startup. Remember that your financial model begins with a set of assumptions before you can project future performance. Similarly, the process of making a startup's financial model is a virtual recreation of the business that evaluates the major relationships and dynamics in the business case. If a firm or organization is willing to debate and defend the dynamics factored into such a plan, this is frequently a deciding factor in closing the contract, especially if the company is in need of funding. We also refer to our step-by-step guide on building financial models.

How to get Funding for my Startup?

Many people starting a business might wonder, “How do I get funding for my startup?” Regardless of how brilliant your business idea is, one critical component of startup success is your ability to secure sufficient funding to launch and grow the company. While many people fund their new businesses with their own money or by borrowing from family or friends, there are other options. However, startup businesses must understand that raising startup funding is never easy and almost always takes longer than expected.

How does Startup Funding work?

Before examining how funding works, it is critical to identify the various individuals involved in funding a business. Some business owners are looking for funding for their ventures. A company progresses through the fundraising stages as it grows.

While investors want businesses to thrive because they encourage entrepreneurship and believe in their goals and causes, they want a return on their investment. As a result, almost every investment made at one or more stages of development funding is structured so that the investor or investing business retains a portion of the company's ownership. If the business is flourishing and profitable, the investor will be compensated in proportion to their investment.

Before any fundraising round can begin, analysts conduct a valuation of the company in question. Various factors, including management, track record, market size, and risk determine a company's value. The valuation of the business and its maturity level and development potential are among the most critical differences between investment rounds. These factors influence the types of investors who are most likely to participate. Similarly, the reasons why the company may be looking for new funding.

Putting all of your company's eggs in one basket is never a good idea. This is especially true when it comes to financing a new business. Diversifying your funding sources will not only help your startup weather potential downturns but will also increase your chances of obtaining the best financing for you. Remember that bankers are not your primary source of funding. Furthermore, demonstrating that you've sought or used alternative financing shows lenders that you're a forward-thinking entrepreneur.

What are the Funding Stages for Startups?

Regardless of its nature or scale, every company requires funding to turn its unique ideas into reality. The majority of firms fail due to an inability to raise sufficient capital. After all, money or capital is required to keep your firm afloat at all stages. If you're new to the startup sector and have no idea how to raise financing, you need first familiarize yourself with these several stages:

Idea

Beginning a business requires an idea. It must be focused on resolving a market issue. At the concept stage, you have an idea and are determining the viability of developing it into a product or service. Once a fundamental concept has been established, the attention should be on assessing whether it addresses a relevant problem and whether anyone would conceivably be interested in the answer. Your suggestion should alleviate another person's discomfort or provide them with a tangible advantage or improvement over their current position. The typical funding amount needed in this stage is from $0-$50k.

Prototype

This stage is also known as the seed investment which refers to the first round of equity capital that a startup receives. This also refers to funds used to help a startup grow and proceed to the next round of funding. During the seed funding stage, businesses lay the groundwork for a successful business by conducting market research, developing products, and determining the startup's target market. Seed finance can be obtained through various sources, including family, personal savings, and venture capital. On the other hand, Angel investors are the most prevalent, as they tend to take on riskier investments before generating income or establishing a product or market. The typical funding amount needed in this stage is from $50k-$1M.

Traction

It is also known as the Series A funding stage. This is the initial round of fundraising in the risk capital stage. At this point, the startup should have a product or service and a customer base that generates a consistent revenue stream. Capital firms, angel investors, and even equity crowdfunding provide funds during this stage. Typically, one huge investor leads this and succeeding rounds of investment, followed by the opposite investors. It is critical to have a long-term agreement in the Series A round. In this stage, fundraising requires an in-depth business strategy and evidence of the company's general momentum, such as users, revenue, or data on whatever the startup's key performance indicators are. The startup is not necessary to demonstrate that the business strategy is viable; instead, it must show interest and the possibility for rapid development. The typical funding amount needed in this stage is from $500k-$2M.

Growth

This also refers to the Series B stage. When your business generates steady revenue but has to scale up to meet demand, you're ready for Series B funding. Series B focuses on growing and expanding market reach, whereas Series A focuses on the development stage. Due to the success of the previous funding stages, Series B is used to accommodate demand. You'll need staff, company growth, advertising, increased sales, and technical support once there's a rising demand for your product or service. This will cost a significant amount of money. Regarding method and duration, Series B is similar to Series A. Your prior partners are also among your investors. You'll need a star investor with greater contacts and a proven track record to attract more investors. The typical funding amount needed in this stage is from $1M-$10M.

Expansion

Startups at the Series C investment stage or Expansion stage have achieved a degree of success where they are looking to grow into new areas, acquire other businesses, or develop new products. Startups that are currently serving a domestic market are frequently expanding their reach worldwide. Many companies have finished raising capital at this time, aiming to boost their valuation in preparation for an acquisition or preparing for an IPO. The typical funding amount needed in this stage is from $5M-$20M.

What are the Funding possibilities for Startups?

The following is a summary of seven common sources of finance for start-ups:

1. Bootstrapping

Bootstrapping or self-funding is the process of an entrepreneur starting a self-sustaining firm, marketing it, and growing it with few resources or money. This is done without the help of venture capital firms or even major angel funding.

2. Family, Friends and Fools (3F)

These individuals are frequently a person's first source of money. FFF refers to those who are close to you or believe in your idea so strongly that they are willing to risk their own money on it. In some circumstances, friends or family members may wish to invest in or purchase a stake in the company. What you should examine here is whether you want to mix personal and professional ties. Friends, family, and fools are all terms used to describe this group. The danger of financing or investing in a seed enterprise is why fools are placed in this category. These people aren't usually sophisticated investors; instead, they make rash or irrational investments. As a result, every business loan or investment should adhere to the formalities associated with a traditional lender or investment relationship. A well-drafted promissory note should secure loans, and equity investments should be based on a term sheet that has been negotiated with all relevant provisions.

3. Entrepreneurial incubators

Business incubators are organizations that are specifically geared to assist emerging firms in innovating and growing. They often provide new companies and lone entrepreneurs with workspace, mentorship, education, and investor access. These resources enable businesses and ideas to develop while maintaining a low cost of operation throughout the early stages of business incubation. Joining an incubation is like enrolling in a college program wherein you must apply, be approved, and then stick to a schedule to accomplish the incubator's goals. You'll also need to commit to becoming a part of the incubator for a set period, usually one to two years.

Below are varied types of business incubators:

• Corporate Incubators: The goal of corporate incubators is to improve entrepreneurial abilities while also assisting startups in keeping up with other industries and competing companies. Corporate incubators are designed to support both internal and external ventures connected to the company's operations. Corporate incubators' most prevalent difficulty is the dispute between top-level executives and committees over objectives and management-related decision-making processes.

• Local Economic Development Incubators: They contribute to economic development by assisting SMEs and specialized groups in their efforts to improve society's overall well-being. Small firms, handicraft-related businesses, and companies that use locally obtained materials are examples of these types of organizations. Governance risk, management quality volatility, long negotiation hours, and disagreements are all common characteristics of incubators of this type.

• Private Investors' Incubators: These organizations provide assistance to high-potential enterprises, such as technology-intensive startups, and then profit from their efforts by selling stock.

• Academic Incubators: Academic incubators provide new funding sources while encouraging entrepreneurship and emphasizing civic duty. Academic incubators focus on both external and internal projects at academic institutions.

4. Grants and subsidies

Government and private agencies provide financing such as grants and subsidies that may be available to your business. Grants and subsidies are widely recognized as one of the most essential and well-known sources of financing for businesses of all sizes. You can obtain grants by responding to specific calls issued by public or private entities for specified reasons. Grants are financial contributions made by organizations such as businesses, charities, governments, and private organizations. Whether organizations or individuals, applicants must demonstrate their eligibility by completing an application form and asserting that they meet the set of standards specified by the issuing authority in the call for applications.

5. Business Angels

Business Angel investors are typically entrepreneurs themselves or retired corporate leaders who undertake direct investments in startups. The advantage here is that they contribute with smart money: apart from providing capital, in many cases, they also can contribute with their experience, know-how, connections, and personal networks. In exchange for taking a risk with their money, investors might insist on some best practice management and reporting requirements to monitor their investment better. They also frequently take a seat on the board of directors.

6. Venture Capital

Venture capitalist investors typically are professional funds specialized in investing in a high-risk startup business. They close a gap in the market where traditional investors usually refuse to provide any form of financing. Risks are actively managed with extensive due diligence, and the people employed by Ventura Capital firms typically are industry veterans, financial analysts, or former entrepreneurs. In exchange for taking on such high risk, they expect a high return through equity participation. Venture Capital firms typically limit their scope of activities to specific industries and stages of the startup funding cycle. Startups should ensure they seek Venture Capital investors with relevant experience and understanding of their business, as this will more likely lead to success.

7. Bank Loans

In general, you should understand that banks are looking for businesses with a proven track record and outstanding credit ratings to fund. A startup does typically not have any of this as there is no financial track record. A good idea alone is insufficient; even a sound business plan might not be enough. Bank financing is targeted more towards established businesses, so Startups only on rare occasions will be able to get a bank loan from the start. If a startup can secure a bank loan, they might also demand the entrepreneurs provide a personal guarantee or assets as collateral.

Example Financial Model Templates for Startups

A financial model startup template is crucial for budding businesses as it provides rough guidelines for what constitutes an economically viable business. Financial model startup templates are also important during the fundraising process because the financers will most likely want to gauge your business expectations and see how much you need to succeed. Likewise, it can project your cash balance; if financial metrics are not good, you should reconsider your strategy. Another major reason for using a financial model template is to inform yourself and your shareholders about how the company is performing. Below are some examples of financial model templates for startups:

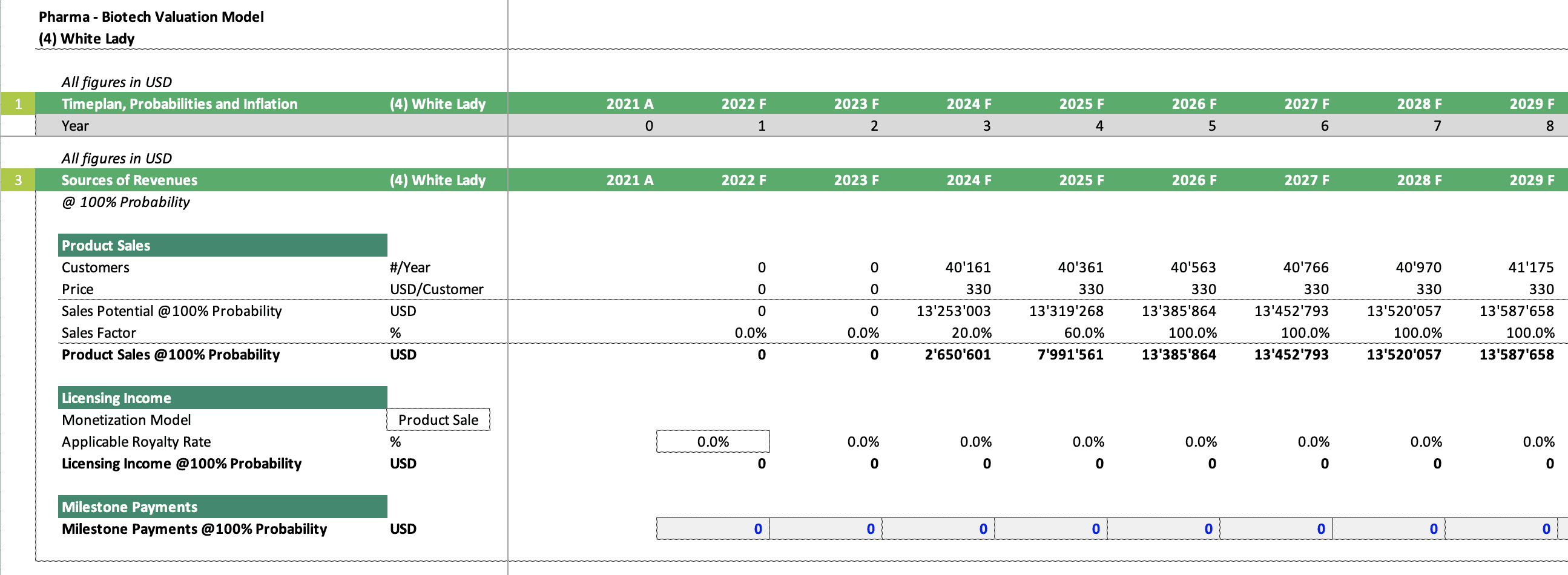

Pharma Biotech

It is undeniable that the era of biotechnology has come. It is in its "golden age" nowadays. Scientific breakthroughs pave the path for previously unimaginable new ways to treat and prevent diseases. Investors can find plenty of chances in the biotech sector. Many of the most successful biotech firms have both robust drug candidate pipelines and successful medications on the market. The COVID-19 pandemic has also opened up enormous prospects for biotechnology businesses working on virus treatments and vaccinations. If you plan to start a business in the Biotechnology industry, you have better understand your pharmaceutical firm's value composition. To do that, you need a financial model to help your decision-making and assessment. Here is an example of a Pharma Biotech Valuation Model Template:

In this template, you can assess each product's financial prospects and returns and integrate them into a single projection. Adding or removing items from the consolidated projection and altering their probability, timing, revenue, cost, and investment assumptions are all possible with this financial model template.

Mobile App

With a billion mobile users, mobile app development is in the mainstream. Mobile app applications have become a vital part of everyone's life recently. Everything is literally at your fingertips, from shopping to arranging a doctor's appointment, taking exercise courses, ordering groceries, and booking a restaurant table. Thousands of applications are currently available on the market, and the number is expected to continue to grow. Therefore, if you're considering investing in mobile application development, you might consider this mobile app financial model:

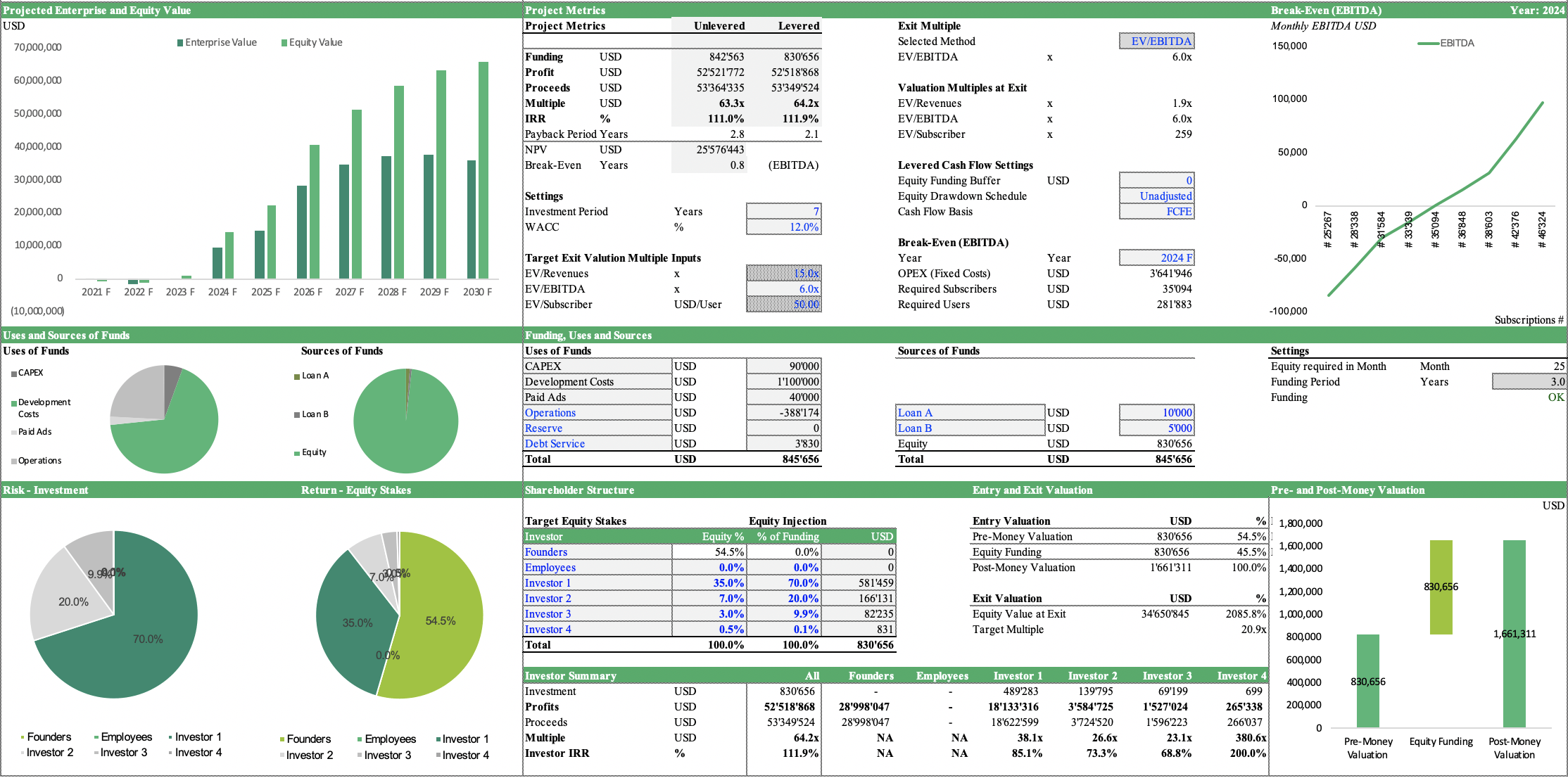

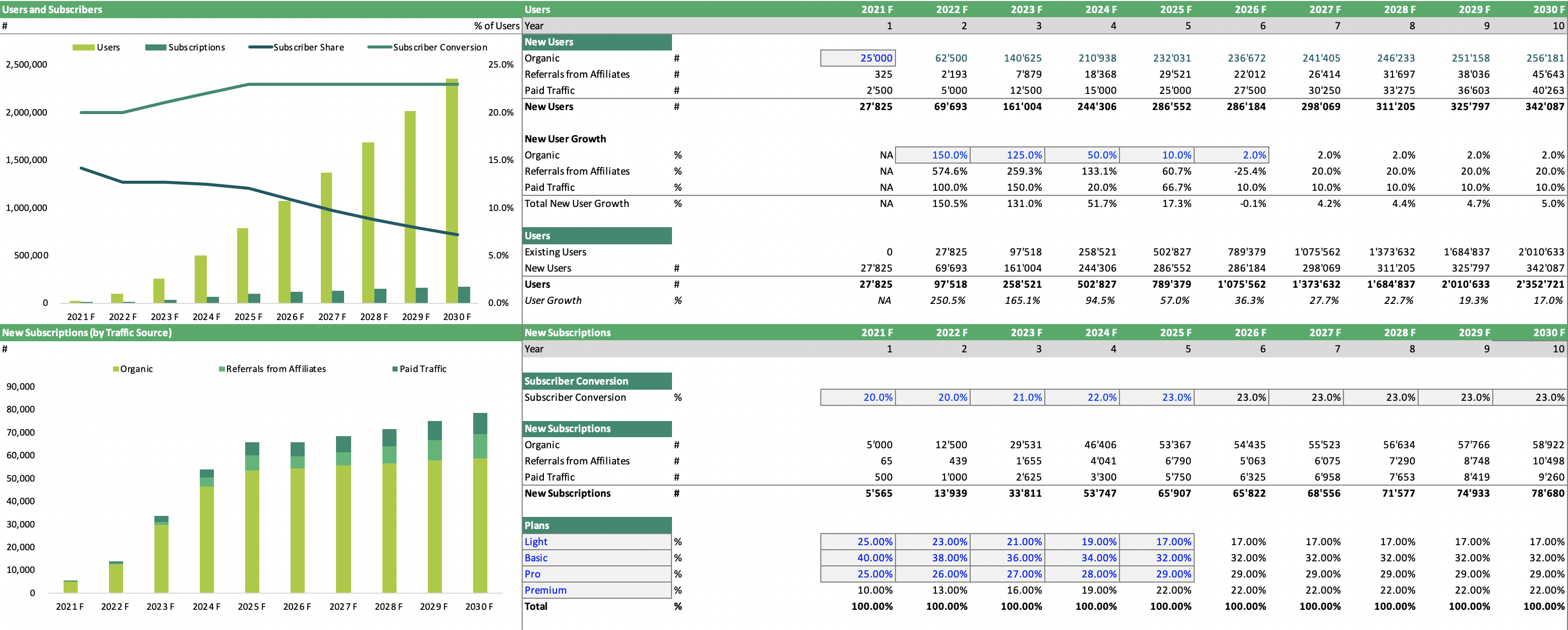

This financial model template detailed the financial strategy for a mobile app firm or similar software development project. It is a thorough Startup Model that can also be applied to an existing App business. The model template emphasizes five primary revenue streams: revenue from paid app downloads, revenue from in-app purchases, revenue from subscriptions, and advertisement revenue from pay-per-click or pay-per-impression campaigns. All of these revenue streams are contingent upon future growth in app installs and active users.

Software as a Service (SaaS) Startup

Software as a Service has become a popular topic among Startups since instead of selling software one time, the software is sold as a service and secures monthly income for the Startup. The beauty of this Startup business model is that once customers are on board, they will get used to the service and normally, will not leave that easily. Therefore, the key upfront cost lies in the development of the software, the marketing, and the carrying of the operating costs until the number of subscribers can be stabilized and

One check to perform to know if the Startup Model works is to focus on the customer lifetime value (CLV). To calculate the customer lifetime value, one needs to estimate the average subscription, which a typical customer will pay, and for how long. The CLV can be adjusted by also considering the operating costs required to deliver the service so that we are talking about a Customer Lifetime Gross Profit (CLGP). The CLGP can then be compared to customer acquisition costs, e.g., Google ad campaign costs. If the CLGP is higher than the acquisition costs, the Startup should be able to make profits in the long term.

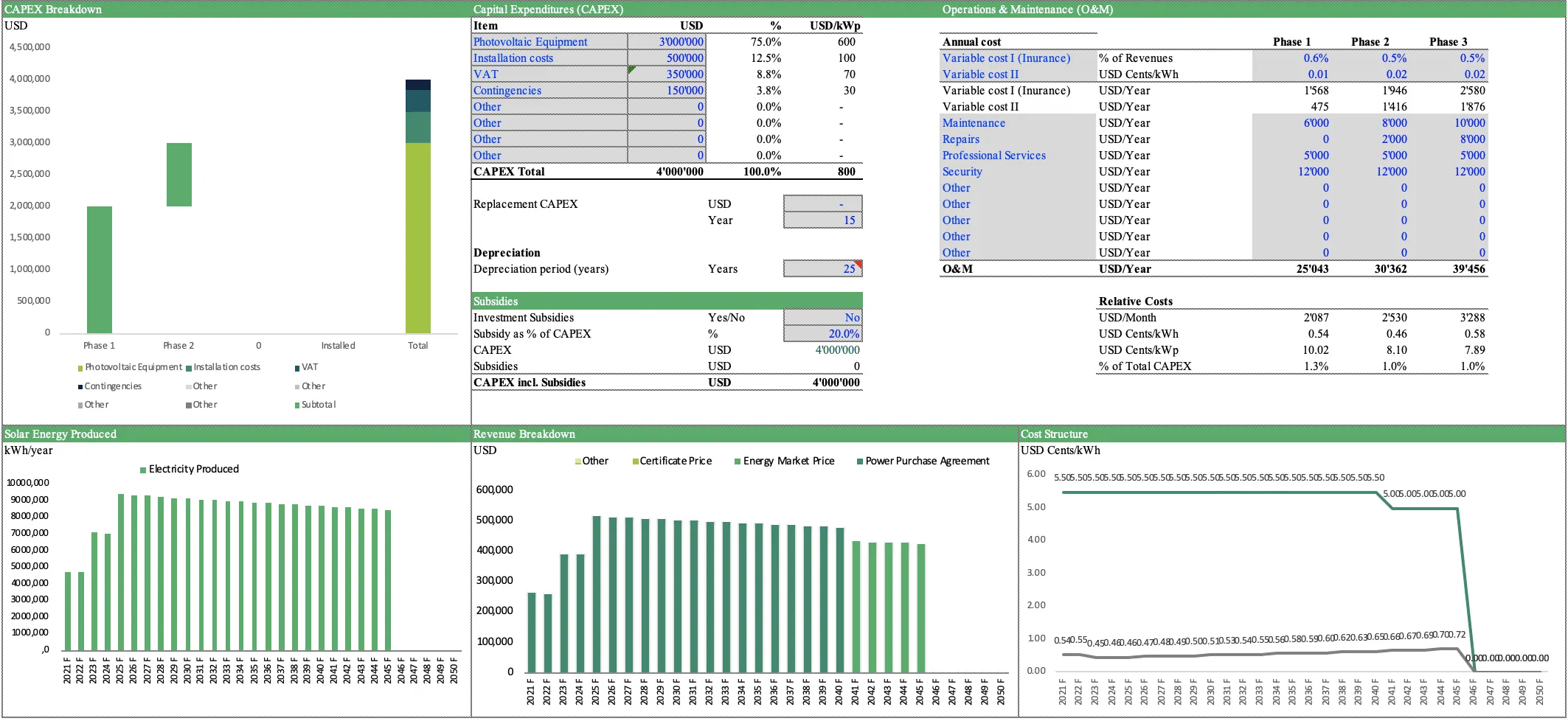

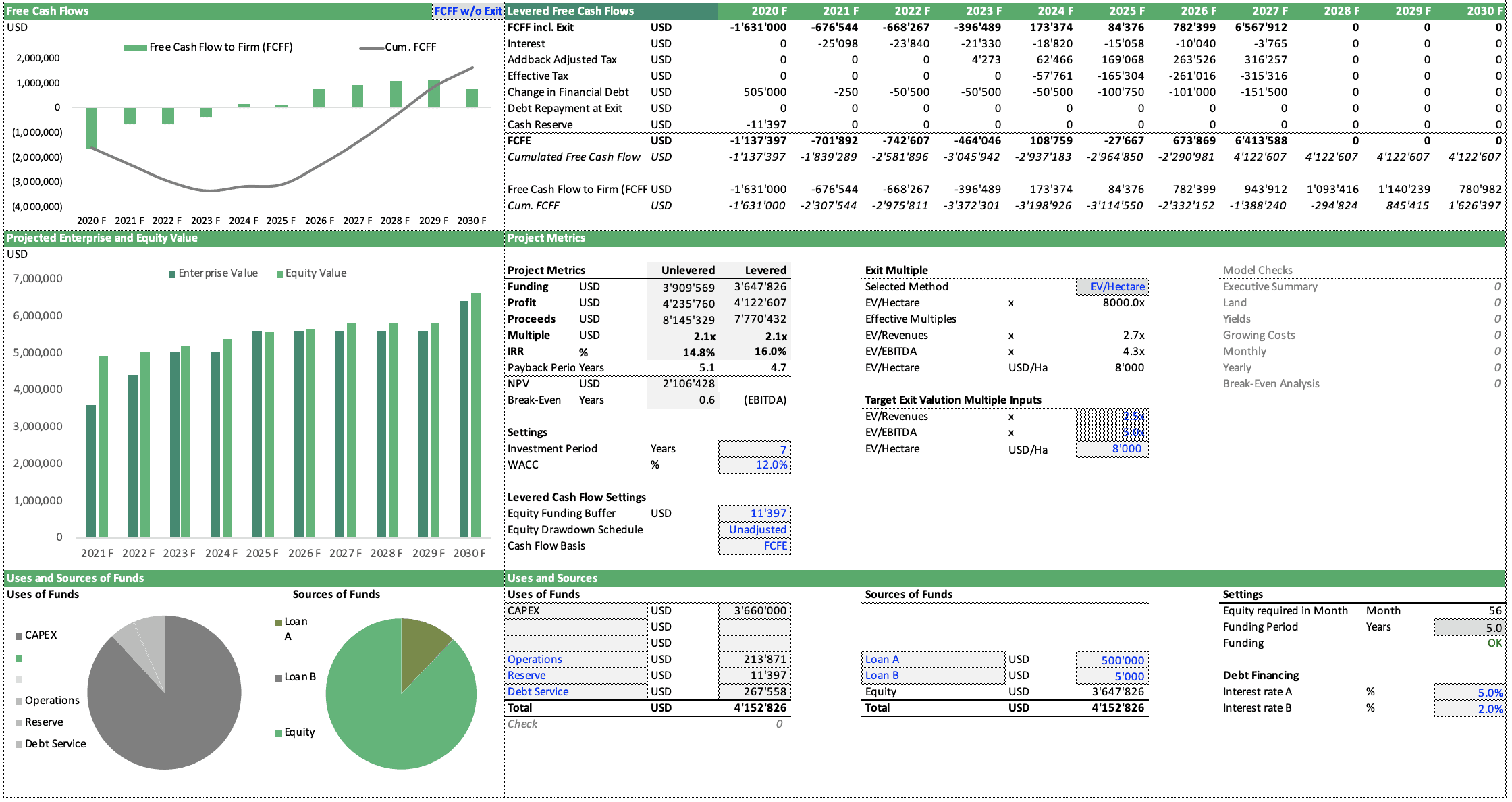

Solar Energy Financial Model

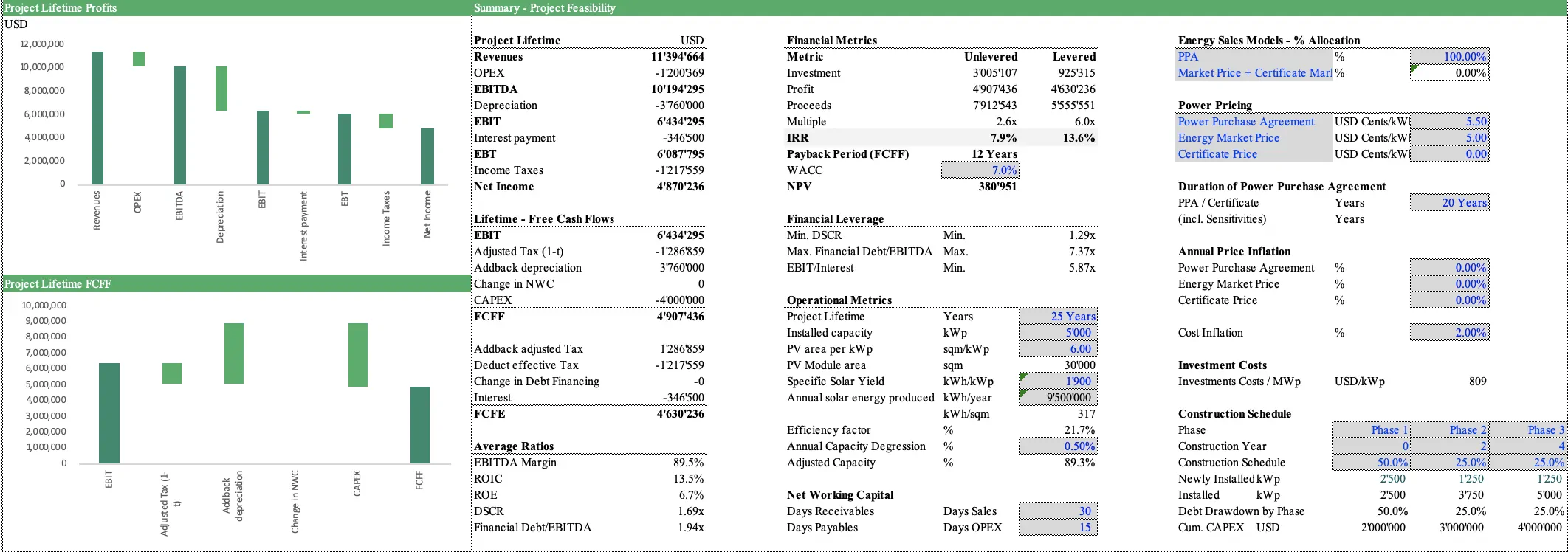

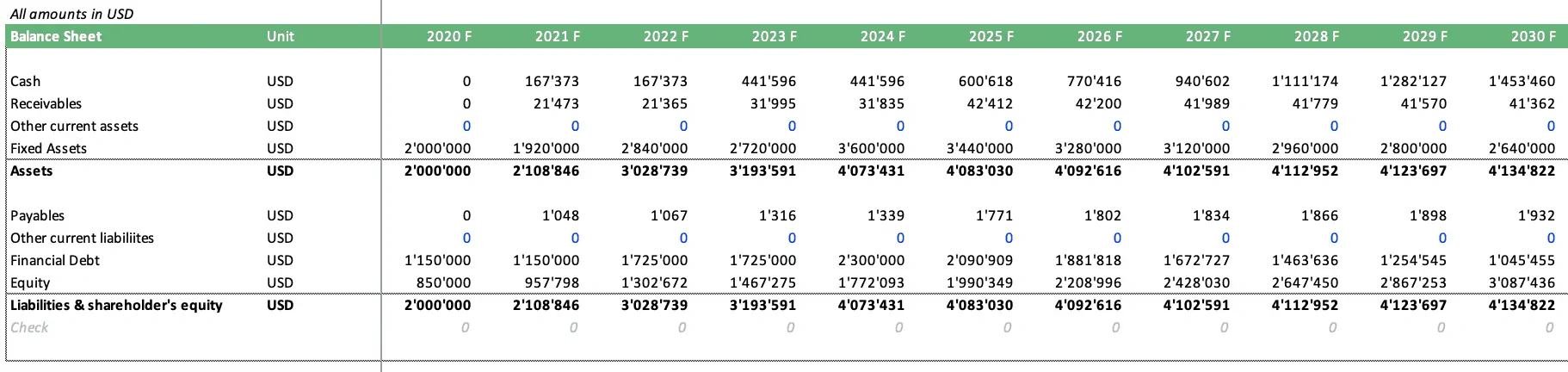

As the world's population grows, the reality of finite resources becomes more apparent. The world cannot rely on fossil fuels indefinitely to meet people’s energy needs. Advances in technology have allowed people to tap into previously unreachable sources. It has prompted consumers, investors, corporations, and governments to adopt a solution which is to use renewable energy. Industries are now promoting the use of Solar Energy. Here is an example of a startup financial model template for solar energy:

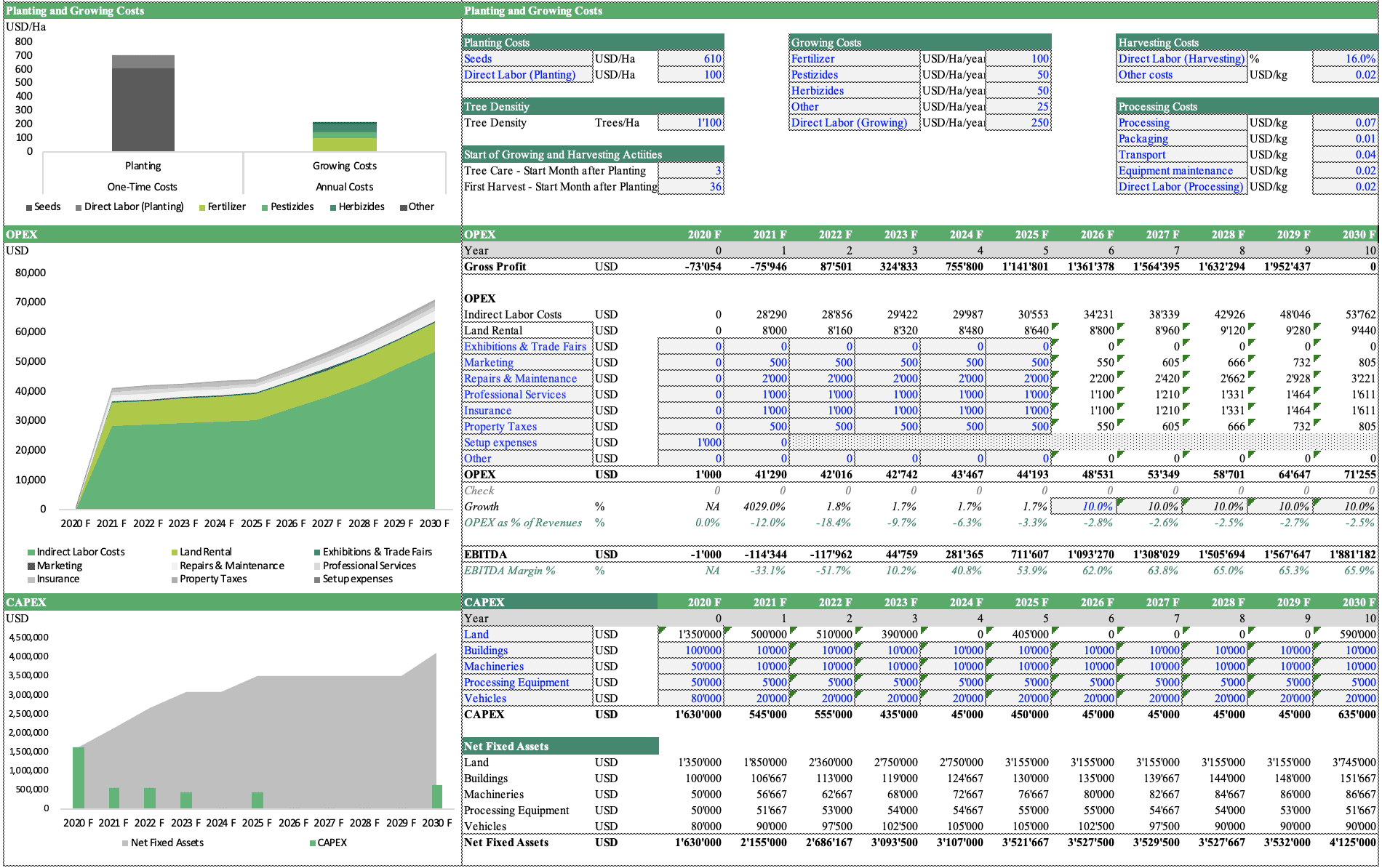

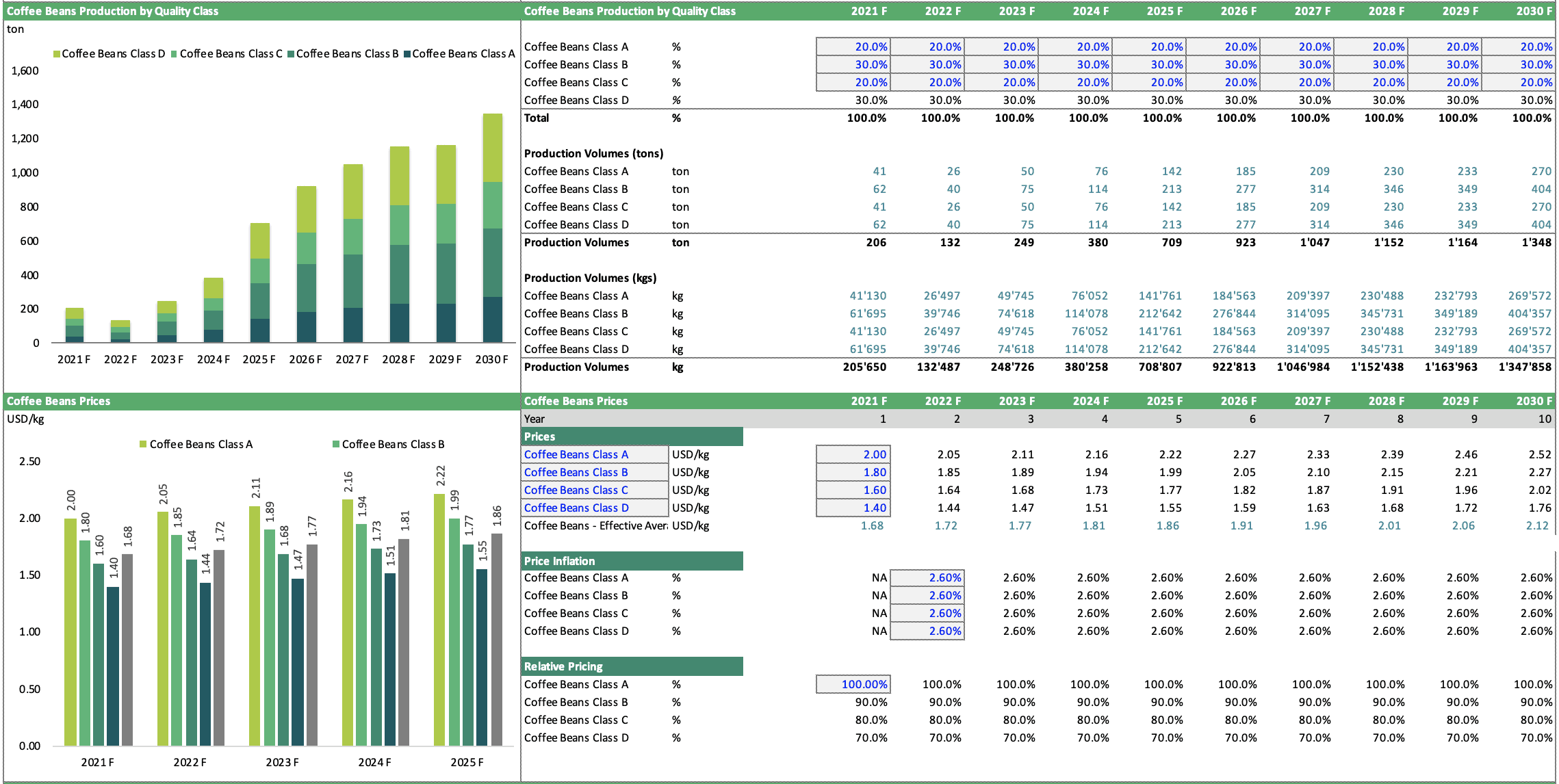

Coffee Farming Financial Feasibility Model

It's no secret that starting a business from the ground up is difficult. However, if you want to operate a coffee farm, you can achieve your goal with hard effort, good expertise, analytical abilities, and a well-designed business strategy. Understanding the financial aspects of running a coffee business is critical to realizing your ambition. Most significantly, you must consider the business's initial, fixed, and variable costs and its ergonomics. This tried-and-tested, robust, and potent startup coffee farming financial feasibility model serves as a solid foundation for starting your coffee farming business:

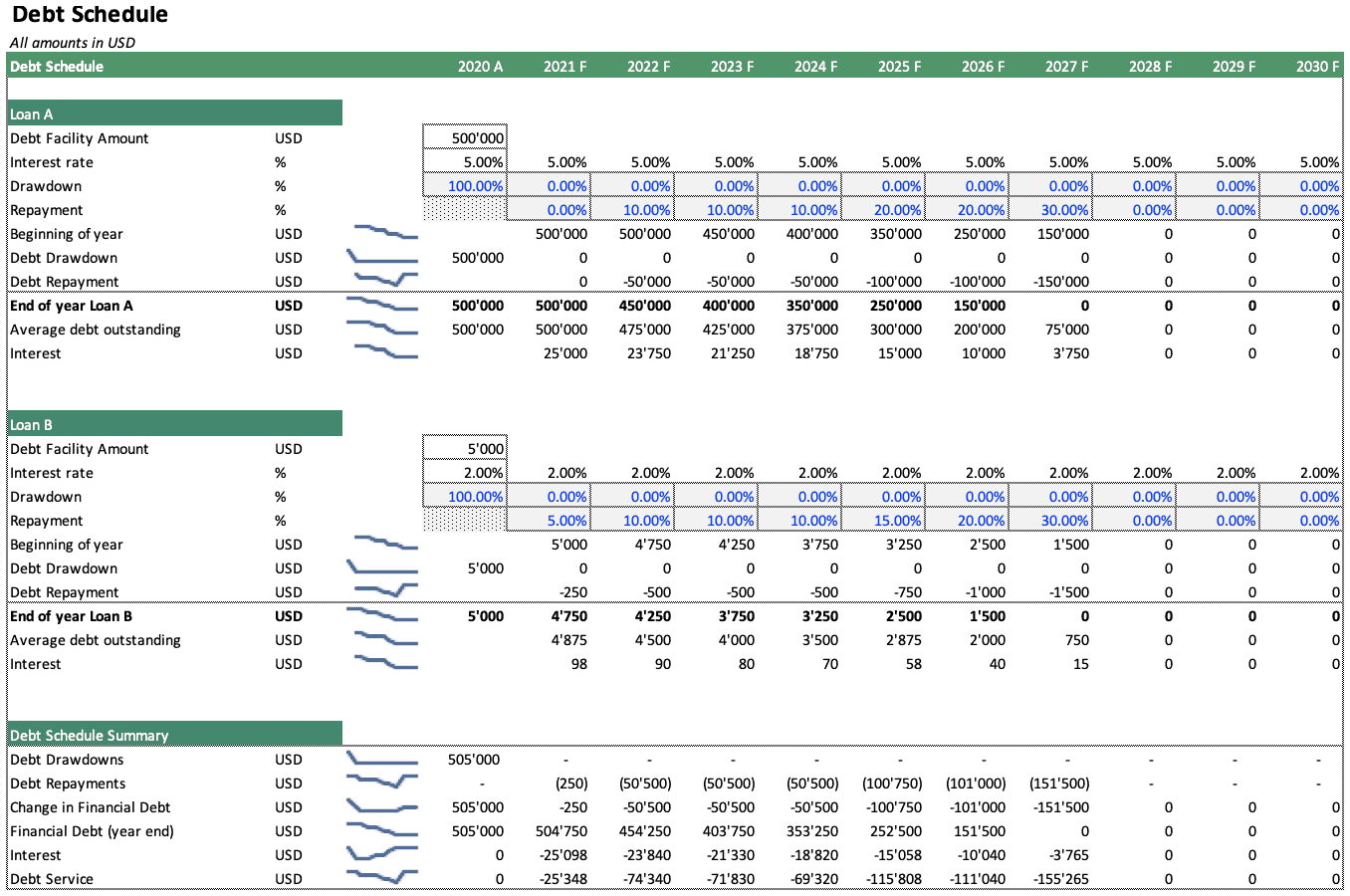

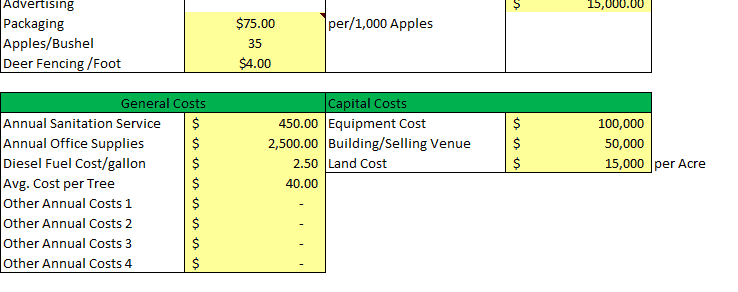

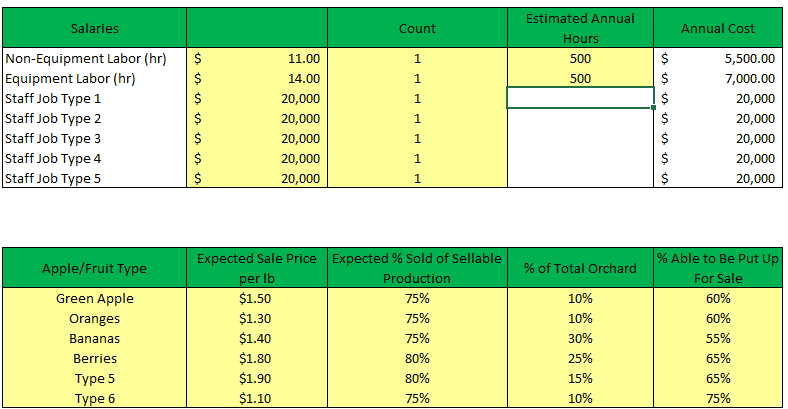

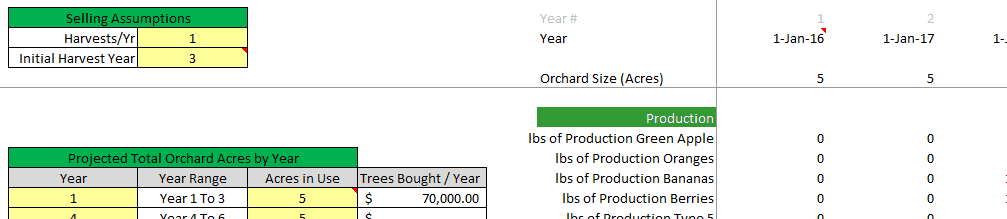

Apple Orchard Financial Model

Growing apples at a profit necessitates meticulous attention to detail, from selection to planting, training, pest control, thinning fruit, harvesting, handling, and selling. You'll need to learn about apple growing in more detail if you want to. Remember that patience and strategy are required before any profit can be made from fruit trees. Dwarf fruit trees take time to bear fruit and reach maturity. In this type of startup, a detailed financial report can help you monitor the financial metrics of your startup business. Here is an example of a financial model template for an apple orchard farm:

These are just some of the many startup financial model templates. If you need financial plan templates for startups, you can check out our list and see which ones fit your criteria and needs. You don’t have to worry about the credibility of the startup financial model template since experts make them in financial modeling with vast experience and knowledge of industry know-how.

Startup Financial Model: Key Takeaways

It is undeniable that the prospect of starting a business that you believe will be successful in the future excites you. It's easy to get carried away with just imagining what it could be, but the sad truth is that it won't be easy. If you truly desire the things you want in the future, you must first set things straight and plan out everything, not just thinking about it but writing it down in a structure that will guide you as you complete your plan.

It is also worth noting that financial models are excellent tools for managing the overall operations of your business, whether it is a startup or not. You can make sound financial decisions for your company with the help of your financial model. Remember that if you want to build a startup financial model, you must plan thoroughly and organize all of your business ideas. Financial models are essential because they allow you to determine whether your planned business will be profitable in the long run. Make a point of only pursuing profitable ventures to avoid the risk of losing money. The foundation of a promising startup is innovative goods and business methods. However, you'll need a steady stream of funding to turn those ideas into reality, especially in the early stages.

Remember that knowing when you will reach a breakeven point when starting a new business is critical. You'll learn how much revenue you'll need to cover your direct and indirect costs this way. Even companies with high sales volumes can lose money if their expenses are not covered.

So, in summary, there are several important reasons why you need a startup finance model for any Startup:

• Prepare a budget and financial plan

• Determine the profitability of your Business Plan

• Assessing the Financial Viability

• Determine how much funding is required

• To know when to reach break even

• Forecasting the Cash Balance

• Obtaining the first idea about possible Investor Returns

• Prepare for different scenarios

• Prepare for negotiations with capital providers

• To better understand your business

The process is definitely worthwhile, but if you're unsure how to create one correctly, you can always explore new ways and alternative solutions, as hiring a consultant or finance expert to make your startup financial model can be costly. With the advancement of technology today, many existing tools alleviate the burden of creating a business plan for your startup business. Suppose you are starting a business and do not yet have the funds to hire a financial expert. In that case, you can begin by reviewing the financial model templates below, specifically designed for startups. Professional financial modelers create these based on the demands and needs of various industries.