Solar Energy Financial Model

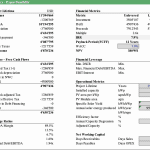

The Solar Energy Financial Model Excel template forecasts the expected financials for a Solar Park project and calculates the relevant project metrics to determine its financial feasibility. Pro and Premium model versions also include the developers’ point of view and sensitivity analysis. The solar PV model calculates the main relevant financial ratios as required by investors and banks to understand the solar energy project and offers a flexible tool to run scenarios by varying the input assumption.

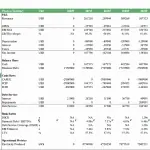

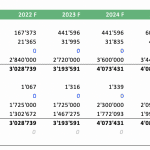

The Solar Energy Financial Model template projects the financials for a new Solar Park project and calculates profits and returns. The Excel spreadsheet model comes in three versions and is designed to obtain a better understanding of the financial feasibility of your next Photovoltaic (PV) park project. The solar PV model calculates the main relevant financial ratios as required by investors and banks to understand the solar energy project and offers a flexible tool to run scenarios by varying the input assumption. The solar project finance model includes a Three Statement Model with Income Statement, Balance Sheet, and Cash Flow statement forecast for up to 30 years.

A walkthrough of the model is provided in the following video:

The financial model template includes:

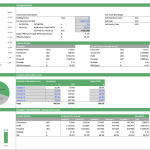

- Executive Summary section with charts, summarized key financials, and the main assumptions of the solar park

- Key assumptions to enter include:

- Installed capacities such as kiloWatt or Mega Watt

- Annual solar yield

- Yearly yield degression factor

- Lifespan years of the project

- Phasing plan to simulate a phased construction plan

- Revenue models

- Model 1: Sale of Energy via Power Purchase Agreement (PPA)

- Model 2: Sale of Energy at Market Price + Eventual Premium through the sale of Certificate

- Pricing assumptions for each revenue model, starting price as well as forecasted annual price increases/decreases

- Duration years of PPA / Certificated

- CAPEX Assumptions

- Subsidy Assumptions

- Operations and Maintenance Cost assumptions (either to be entered as fixed amounts or as % of revenues, cost per kWh) by Phase

- Debt assumptions such as loan amounts, interest rates, and debt repayment

- Weighted Average Cost of Capital (WACC) or Discount Rate

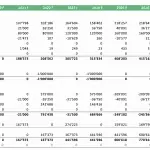

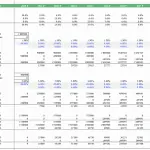

- Detailed yearly calculation for volumes, prices, etc.

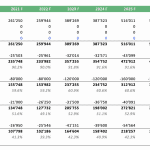

- Financial tables with projected Financial Statements (Income Statement, Balance Sheet, and Cash Flow Statement) for a period of 30 years forward

- Debt schedule which models two layers of financial debt (junior and senior debt) for drawdowns, repayments, and interest

- Fixed asset depreciation schedule

- Tables with forecasted yearly financial ratios such as of relevance to banks and investors: Debt/EBITDA, LTV, Debt Service Coverage Ratio (DSCR), Interest Coverage Ratios, etc.

- Calculation of Unlevered and Levered Free Cash Flows

- Calculation of Project Metrics of relevance to Project Finance and Financial Feasibility analysis such as total profits, investment multiples, IRRs for Unlevered and Levered Returns

- Calculation of the Net Present Value (NPV)

- Project Payback period

- Calculation of required equity funding amount

- Uses and Sources of Fund table

The BASIC model version also includes:

- Same features as the STARTER version

- Expanded Tax Model which considers effects from tax incentives and tax loss carryforwards

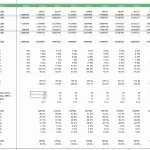

The PRO model version also includes:

- Same feature as the BASIC version

- Return calculation from the developer’s point of view (profit and IRR)

- Holding Period and Exit Valuation assumptions (either based on a mark-up to initial costs or EV/EBITDA multiple)

- Return calculation (IRR) for future Buyer at the time when developer exits

- Investor table to simulate up to 5 different investors joining at the developer level and contributing various portions of equity funding and receiving different equity stakes in the project

- Sensitivity Tables to analyze the impact of important key assumptions on the IRR

- Pricing analysis and their impact on IRRs

The PREMIUM model version also includes:

- Same feature as PRO version

- An additional worksheet that prepares data tables and charts to be included in a PowerPoint Presentation (via copy/paste)

- PowerPoint Presentation template which provides the suggested presentation slides on how to best explain the project to banks and/or investors from a project finance perspective.

The Excel model comes in a printer-friendly layout including charts and graphs. Also, there is an instructions sheet included as well as a worksheet to explain common terms and abbreviations.

The model – current version is 5.2 – is available in four versions:

- PDF – Demo Versions

- STARTER – Excel Model fully editable

- BASIC – Excel Model, fully editable (includes expanded tax model)

- PRO – Excel Model (includes expanded tax model, developer view, and sensitivity tables), fully editable

- PREMIUM – Excel Model (includes expanded tax model, developer view, sensitivity tables, graphs for PowerPoint presentation, PowerPoint presentation template), fully editable

Filetypes:

- PDF Adobe Acrobat Reader

- .xlsx (Microsoft Excel)

Similar Products

Other customers were also interested in...

Green Ammonia from Renewable Energy Financial Mode...

This comprehensive 40-year tool aid investors in evaluating potential risks and returns and assess t... Read more

Renewable Energy Financial Model Bundle

This is a collection of financial model templates for projects or ventures in the Renewable Energy I... Read more

Green Hydrogen (Electrolysis) Production Financial...

This green hydrogen financial model template builds a multi-year financial plan to analyze the finan... Read more

Yellow Hydrogen from Solar Energy Financial Model

Deciding whether to invest or not in producing yellow hydrogen from solar energy, one would require ... Read more

Solar (PV) Power Plant – Project Finance Mod...

Project Finance Model providing forecast and profitability analysis for a development and operating ... Read more

Renewable Energy Financial Model Template Bundle

Take this opportunity and get a discount by getting the Renewable Energy Bundle where you get Solar,... Read more

Solar PV Plant 3 Statements Financial Model Templa...

Solar PV Plant 3 Statements Financial Model with Flexible Timeline, NPV, IRR, Debt Covenan... Read more

Solar Farm Development Model

Solar Farm Excel Model Template is an excellent tool to assess the financial feasibility of a propos... Read more

Green Hydrogen Project Financial Model (Electrolys...

A Project-Level Financial Model to assess the financial feasibility of setting up and operating a Gr... Read more

Start Up Solar Farm Excel Model and Valuation

Start Up Solar Farm Excel Model presents the business case of an investment in the construction of a... Read more

Reviews

Very helpful model. Versatile. I’d like a hybrid version incorporating batteries and multiple projects for an aggregated asset point of view.

185 of 349 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

In my case, I have 20 projects, and I want to model them all together (according to different assumptions for each model).

419 of 798 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

After 16 years in the solar industry and having worked with 10s of financial models, this is the cleanest one I have seen.

Once you find your way around this workbook you’ll find great tools to bring transparency to a project transaction, like using it to reverse engineer a developer fee to match an accepted market return. Want to talk to a bank that’s new to solar: use this template!

Finally, 4/5 because I want to choose which investor exits when, and adjust the Final Buyer’s gearing

1426 of 2815 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You can not have a complete Solar Model in 2019 without including ITC and state incentives. Also I prefer to have all inputs on an Inputs tab and not search for them all

1435 of 2809 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

The model has been updated and now also includes a more sophisticated tax model to include the effects of tax incentives and other subsidies to address this comment.

1437 of 2871 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Thank you greatly for your feedback! As for why we didn't include the ITC and State incentives, it's because this template is not only for the USA. Plus, this is only a template which you can easily customize according to your specifications.

1451 of 2854 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Can this model be use for an off-grid solar project?

1400 of 2761 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

I had some initial difficulties with the solar model but thanks to some very prompt and helpful email support I got passed the initial issues. Thanks!

1427 of 2854 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Great Model .. is this model about : 1- photovoltaic method or 2-

concentrated solar power method ?

1533 of 3037 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Hi there, the solar energy financial model is about the photovoltaic method using solar modules to generate electricity. Normally these are installed on a field or on a rooftop of a building and the energy is fed into the energy grid.

1465 of 2859 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Is it possible to make a model for the mother method ? i.e. : concentrated solar power method ?

1431 of 2828 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Just bought this model and worked through it. It is a very clean, workable model, that I will use as a basis for my project. Easy to follow and critically, zero circular references. Excellent!

1411 of 2792 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

-

You must log in to submit a review.