Fundraising

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Pet Grooming Business Dynamic Financial Model 2024

Tailored for pet grooming businesses, this dynamic financial model streamlines…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Truck Rental Company Financial Model

This detailed 10-year monthly Excel template is specifically designed to…

Private Aircraft Rental Company Financial Model

Embark on a journey to financial mastery with our Private…

Webinar Organizer Business Plan Template

Discover the key to financial success in your webinar ventures…

Party Planning Business Financial Model

Introducing the Party Planning Business Financial Model – Your Ultimate…

Event Organizer Business Model Template

Elevate your event planning business to new heights with our…

Car Rental Business Financial Model

This Car Rental Business Financial Model Template in Excel offers…

Crowdlending (P2P) Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Merger & Acquisition (M&A) Simple Financial Model

The model is great financial tool used to evaluate the…

Business Plan – Stone Fabrication & Installation

The Business Plan is for Stone Fabrication & Installation industry,…

Food and Beverage (Restaurants, cafes, food trucks, and beverage outlets ) Financial Model Template

Elevate your food and beverage (Restaurants, cafes, food trucks, and…

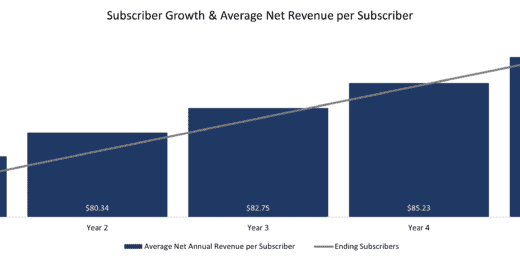

SaaS Financial Model Template – 3 Tier

This is a 3 tiered subscription model template with flexible…

PICKLEBALL Court and Club Development – Dynamic Financial Model (10 years)

Introducing our Pickleball and Club Financial Forecasting Model – your…

Corporate Finance Toolkit – 24 Financial Models Excel Templates

They are essential models to increase your productivity, plan your…

Oil & Gas Marketing and Distribution DCF Valuation Model with 5 Yrs Actual,1 Yr Budget & 5 Years Forecast

A detailed and user friend financial model that captures 5…

Asset Management Company – Closed End Fund Model

Financial Model providing analysis of a Closed-End Fund hosted by…

Market Entry Feasibility Study for Coffee Shops Industry

This model include market entry feasibility study in word format…

Mobile Applications (App) Monthly 3-Statement Business Plan with Return Calculation

Pro Forma Models created this model to prepare and analyze…

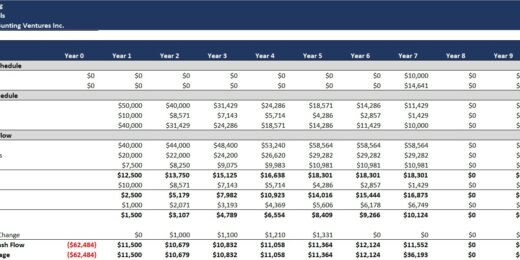

Capital Budgeting Model with NPV, IRR, & RoC Calculation

This model was developed to complete capital budgeting and analysis…

EV Charging Hub Financial Model Template – one page model

A dynamic one page EV Charging Hub financial model (up…

Food Truck Financial Model – Quick Start series

Easy to use food truck financial model with guided inputs,…

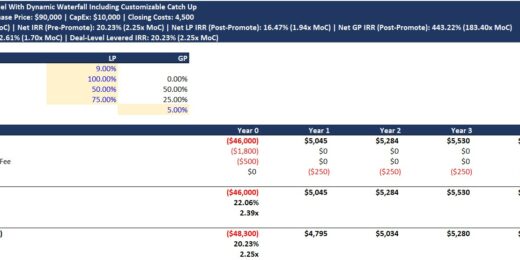

Real Estate Investment Model Template with Waterfall & Catch Up

The waterfall model includes a dynamic catch up. This model…

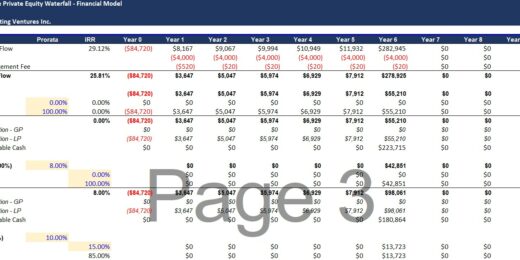

Dynamic Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity…

MARKET PLACE 3 Statement Financial Model Template – 5 Years Projections

Introducing the Future-Proof Market Place Financial Model Template: Unlock Your…

Service Provider APP (Uber-like) Business, Financial And Develop Tips Model 10 years

This Financial & Business Model is specific to the Service…

Public (Charity) Foundation Financial Model – 5 Year Forecast

Financial Model presenting an operating scenario of a Public (Charity)…

Distillery Financial Plan Template

This Distillery Financial Plan template prepares a sophisticated financial plan…

Lending Company Financial Model – 5 Year Forecast

This Financial model template presents a business scenario of a…

Real Estate Portfolio Template – Excel Spreadsheet

The Real Estate Portfolio Template forecasts the financial performance when…

Manufacturing Startup Feasibility Model

Launching a manufacturing startup can be complex, and securing financing…

Startup Business Plan – Used Oil Recycling

The report is containing full set of financial feasibility study…

Business Plan for Ethanol Manufacturing Plant

A well-planned and implemented business strategy is necessary for setting…

Online Car Rental – 3 Statement Financial Model with 5 years Monthly Projection

Online Car Rental Platform Business Plan Model is a perfect…

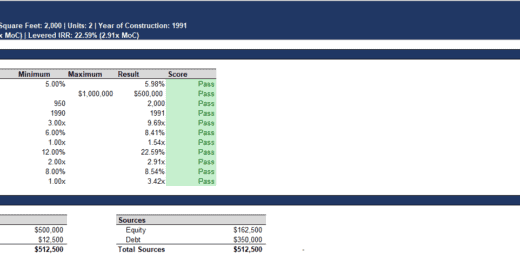

Real Estate Investment Screening Model – Levered IRR, Unlevered IRR, Cap Rate, DSCR, and More

This model can be used to quickly (5 minutes if…

Condo Development & Sales Model w/ 3 Tier Phasing, Waterfall, & S-Curve

This model can be used to analyze the financial return…

Financial Feasibility Study – General Trading

The report is containing full set of financial feasibility study…

Private Equity Oil and Gas Financial Model

The Private Equity Oil and Gas Financial Model evaluates the…

Solar (PV) Power Plant – Project Finance Model

Project Finance Model providing forecast and profitability analysis for a…

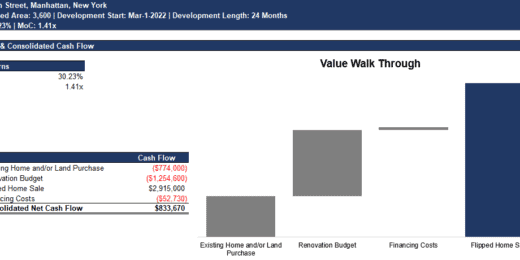

Single Family Development Model Pro-Forma Template

This is a fully functional, institutional quality, and dynamic real…

Laser Tag Business Plan Financial Model Excel Template

Get Your Laser Tag Financial Model. Investor-ready. Includes a P&L…

Financial Business Plan for Nail Salon

The Financial Business Plan Template for starting a Nail Salon…

Multi-Family Apartment Complex – Acquisition Model

Dynamic financial model presenting a potential acquisition of a Multi-family…

Chili Pepper Farm – Financial Feasibility Study

This financial model spreadsheet template in Excel can be used…

The Best Ways for Raising Funding for a Business Start-up

A start-up is not just about ideas. It is about making ideas happen. However, this journey also demands a crucial early decision: securing the best funding for a business start-up. Your chosen financial foundation can significantly influence your start-up's trajectory, affecting everything from its growth pace to operational flexibility.

Funding a start-up is not a one-size-fits-all scenario. Each funding avenue paints a different future. Angel investors bring their wealth and insights, bootstrapping keeps control firmly in the hands of the entrepreneur, while crowdfunding platforms showcase the power of community support. With their emphasis on societal good, government funds can provide credibility and capital to ventures aimed at making a difference. While diluting ownership, venture capital catapults start-ups into rapid growth, placing them on the fast track to market leadership.

Choosing the funding for a business start-up is akin to selecting the right partner for a journey. It requires introspection about your venture's goals, scale, and values and understanding each option's trade-offs. The quest for start-up funding is more than just securing resources; it's about aligning your business with the right partners, ethos, and long-term vision. Let us seek the best funding choice to support your business growth, ethos, and vision for the future.

What are the Funding Stages for Start-Up?

Funding for a business start-up refers to the financial resources needed to launch, operate, and grow a new business. This capital investment is crucial for covering the initial costs associated with starting a business, such as product development, market research, equipment, and marketing, as well as ongoing expenses like salaries, rent, and utilities. Raising money for a start-up business goes through several funding rounds as it expands its operations and scales up. These funding stages are typically categorized as follows:

- Pre-Seed Funding: This is often considered the earliest stage of funding. At this point, the start-up might still need to develop a fully developed product or business model. Pre-seed funding is typically used for market research and product development. The funds may come from the founders' personal savings, friends and family, or early angel investors.

- Seed Funding: Once a start-up has a prototype or proof of concept, it may seek seed funding to begin operations and further develop its products or services. Seed funding helps a company finance its initial steps toward establishing a customer base and generating revenue. Sources of seed funding include angel investors, early-stage venture capital firms, and crowdfunding.

- Series A Funding: After a start-up has demonstrated growth potential and has a transparent business model and customer base, it may pursue Series A funding. This round is often used to optimize products/services and scale operations. Venture capital firms that specialize in early-stage investing typically lead Series A rounds.

- Series B Funding: Companies reaching this stage are well-established and seek Series B funding to expand market reach and grow their team. This round helps companies scale to meet increasing demand and expand into new markets.

- Series C, D, and Beyond: These funding rounds are aimed at companies looking for additional capital to scale their operations further, develop new products, or expand into new markets or territories. At this point, the company might be preparing for an initial public offering (IPO) or exploring acquisition opportunities. Investors in these rounds expect to see a clear path to profitability and a return on their investment.

Each funding stage is crucial for a start-up's growth and requires a solid business plan, a clear understanding of the market, and the ability to persuade investors of the potential for success. The goal of each funding round is to reach specific milestones that increase the company's value and prepare it for the next stage of growth or, ultimately, an exit strategy that provides returns to the investors.

Why is Raising Money for a Start-up Business Important?

Raising money for a start-up business is crucial for several reasons, each related to different aspects of establishing and growing a business. Understanding these aspects can help grasp why capital is fundamental for success.

- Capital Investment: This is the foundational requirement for starting a business. Capital expenditures refers to the funds used to purchase fixed assets such as buildings and land for operations, equipment necessary for production or service delivery, and inventory to start sales. These investments are essential for the start-up to begin its operations and generate revenue. Taking off or scaling operations efficiently may be challenging without raising money for a start-up business.

- Cash Buffer: A cash buffer is a reserve of funds intended to cover unexpected expenses or financial downturns. Start-ups often face unpredictable challenges, and having a cash buffer can mean the difference between staying afloat during tough times or going under. Thus, raising money for a start-up business provides financial stability and flexibility. It allows the company to navigate periods of low revenue, unexpected costs, or investment in opportunities without the immediate pressure of generating profit.

- Development and Growth: Beyond the initial setup, raising money for a start-up business is vital for development and growth. It includes expanding the product line, entering new markets, increasing production capacity, or enhancing service offerings. Funding supports research and development, which is crucial for innovation and competitiveness. With adequate capital, a start-up might find it easier to grow beyond its initial scope or adapt to market changes and demands.

- Marketing: Marketing and advertising are critical for establishing a brand presence and attracting customers. Funds allocated to marketing enable the start-up to implement effective strategies to reach its target audience, from digital marketing campaigns to traditional advertising and promotional events. Marketing is not just about creating awareness; it's also about building brand loyalty and driving sales. With sufficient investment in marketing, even the best products or services may be known to potential customers.

- Working Capital: Working capital refers to the funds available to cover the day-to-day operational expenses of a business, such as salaries, rent, utilities, and supplier payments. Adequate working capital ensures that a start-up can maintain operations without interruption, even when there are delays in revenue generation or fluctuations in sales. It supports the smooth running of the business by ensuring that operational costs are covered while waiting for income to materialize.

In summary, raising money for a star-up is essential across various dimensions — initial capital investment for setup, creating a cash buffer for financial health, funding development, and growth to innovate and expand, investing in marketing to build a brand and drive sales, and securing working capital for ongoing operations. Each aspect is crucial in the start-up's journey from inception to growth and sustainability.

Options for Funding a Business

Funding a business is crucial for entrepreneurs, providing the financial resources needed to start, sustain, or expand operations. Various options for funding a business are available, each with its own set of advantages and drawbacks.

- Angel Investors are affluent individuals who provide capital for start-ups, usually in exchange for ownership equity or convertible debt. The main advantage is the access to funds combined with the investors' business experience and networks. However, entrepreneurs might have to give up a significant equity stake, and finding the right angel investor can be challenging.

- Banks offer traditional loans, secured or unsecured, depending on the business's creditworthiness and the availability of collateral. Bank financing benefit from clear, fixed repayment terms, but they require a strong credit history, often demand collateral, and have a rigorous application process that can be time-consuming.

- Bootstrapping refers to funding the business through personal finances and revenue generated by the company itself. This approach allows entrepreneurs to maintain complete control over their business but can limit growth due to financial constraints and places personal assets at risk.

- Crowdfunding platforms allow businesses to raise small amounts of money from many people, typically via the internet. This method can validate the business idea through market interest but involves significant marketing efforts and, often, the provision of rewards or equity to backers.

- Environmental, Social, and Governance (ESG) Funding is provided by investors looking to support businesses that meet specific ethical, ecological, and social criteria. The advantage is access to a growing pool of funds focused on sustainability, but it requires companies to meet and maintain specific ESG criteria, which can be stringent.

- Equipment Leasing allows businesses to get the necessary equipment without purchasing it outright, preserving cash flow. However, over the long term, leasing can be more expensive than purchasing, and the business does not own the equipment.

- Friends, Family, and Fools (3Fs) involve getting funding from personal contacts. It can be one of the quickest options for funding a business without formal approval processes. The downside is the potential for strained relationships if the company does not perform as expected.

- Private Equity Firms invest in companies to exit at a profit, typically through a sale or IPO. Private Equity funding can provide significant capital and expertise but often require a substantial share of the business and may push for aggressive growth strategies.

- Start-up Grants are non-repayable options for funding a business provided by governments, foundations, or corporations to support new businesses. While they do not require repayment or equity, grants are highly competitive and often have specific requirements that must be met.

- Venture Capital is a form of private equity provided to start-ups and early-stage companies with high growth potential in exchange for equity. Venture capital can provide substantial funding and valuable guidance. Still, it requires giving up a portion of ownership and control, and the focus is often on rapid growth and exit strategies.

Each of the options for funding a business has unique criteria, benefits, and challenges, and the choice depends on the business's and its founders' specific needs, goals, and situations.

How to Raise Money for a Business

Starting a business can be an exhilarating journey, but securing the necessary funding often presents a significant challenge. Understanding how to raise money for a business is crucial for realizing your entrepreneurial dreams. This guide on how to raise money for a business will explore effective strategies and practical tips to attract investors, secure loans, and leverage grants, ensuring you have the financial foundation to launch and grow your venture successfully.

- Analyze the Right Funding Source: The first step on how to raise money for a business is to identify the most appropriate funding source. It could range from self-financing, seeking venture capital or angel investors, applying for loans, or exploring government grants. Each source comes with its own set of expectations, requirements, and implications for your business. For example, venture capital might offer significant funding but will likely require equity in return, while loans need to be repaid with interest. It's crucial to analyze which option aligns best with your business goals, growth stage, and the level of control you wish to maintain.

- Draft a Business Plan with Financials: A well-crafted business plan is essential for attracting investors or lenders. This document should outline your business model, market analysis, operational strategy, and, most importantly, detailed financial projections. Financial business statements such as income statements, balance sheets, and cash flow statements provide a quantitative foundation for your business plan. They demonstrate the company's potential profitability, financial health, and cash management strategy. These financials help investors understand the business's revenue streams, cost structure, and long-term financial viability.

- Perform a Financial Evaluation: This step on how to raise money for a business involves a deep dive into financial health using various financial metrics and ratios. Key financial ratios like return on investment (ROI), debt-to-equity ratio, and profitability margins offer insights into the business's financial performance and stability. Evaluating these metrics helps identify strengths, weaknesses, and areas that require improvement before approaching investors. It also equips you with the knowledge to answer potential questions from investors regarding the company's financial status.

- Prepare a Proposal and Term Sheet: The next step is to prepare a detailed funding proposal once the financial evaluation is complete. This proposal should include an executive summary, business description, market analysis, financial projections, and the amount of funding requested. Including charts and graphs can visually communicate the business's potential growth and financial forecasts, making the proposal more compelling. A term sheet, which outlines the terms and conditions of the investment, including the company's valuation, the amount of funding, and the equity offered in return, should also be prepared. This document serves as a basis for negotiations between the business owner and potential investors.

- Submit Documents for Approval: The final step involves submitting your business plan, financial statements, funding proposal, and term sheet to the chosen funding sources for approval. It may require presenting your proposal to investors, banks, or grant committees. The submission should accompany a well-prepared presentation highlighting the key points of your business plan and funding request. Effective communication and a clear understanding of your financials are crucial to address any concerns and negotiate terms favorable to both parties.

Each of these steps requires thorough preparation, analysis, and strategic planning to secure funding for your business successfully. Tailoring your approach to your potential funding sources' specific requirements and interests can significantly increase your chances of approval.

Financial Business Statements: Key to Successful Business Fundraising

A meticulous financial analysis is paramount to secure the best funding for a business start-up. This process thoroughly examines the business's financial needs, potential revenue streams, and cost structures. By accurately projecting financial outcomes, entrepreneurs can determine the capital required to sustain business operations until they become profitable.

Additionally, a comprehensive financial analysis helps identify the most suitable funding options, whether equity financing, debt financing, or alternative funding sources. It also positions the start-up to present a compelling case to potential investors or lenders, showcasing the business's viability and the entrepreneur's understanding of the financial challenges and opportunities ahead. Through this rigorous financial scrutiny, start-ups are better equipped to secure funding that aligns with their strategic goals, ensuring they don't over-leverage or dilute ownership unnecessarily.

Financial business statements are the cornerstone of successful business fundraising. These documents provide a snapshot of the company's financial health and operational efficiency. They are crucial for investors and lenders, who rely on this information to make informed decisions regarding allocating resources. A well-prepared set of financial business statements demonstrates the company's ability to generate profit, manage expenses, and sustain operations. It also highlights the business's fiscal responsibility and strategic planning capabilities.

For start-ups, presenting accurate and detailed financial business statements can significantly enhance credibility with potential funders, illustrating a clear path to profitability and long-term growth. In essence, these financial documents are not just reports of past and present financial performance but are also a strategic tool for securing the future financial support necessary to fuel business growth.