Financial Feasibility Study – General Trading

The report is containing full set of financial feasibility study project, how much start-up capital is needed, sources of capital, use of funds, returns on investment, and other financial considerations

Report Overview

The report is containing a full set of financial feasibility study projects, how much start-up capital is needed, sources of capital, use of funds, returns on investment, and other financial considerations.

The report includes one year historical in case the business is already started, a one-year operating plan with full details, and 10 years forecast

The report is constructed based on solid experience and highly analytical skills that lead to guarantee your success

Objectives of the Model

• Startup business

• Planning to expand your business

• Investing money in potential industry

• Fundraising

• Learning how to plan

• Investment decision

• Annual operating plan

• Answers all questions to investors

Inputs

• Erase all the data in the green cells only

• Update the general info in the Front Page

• Fill the green cells only in the green tabs

Outcome

The data will dynamically flow into the following below

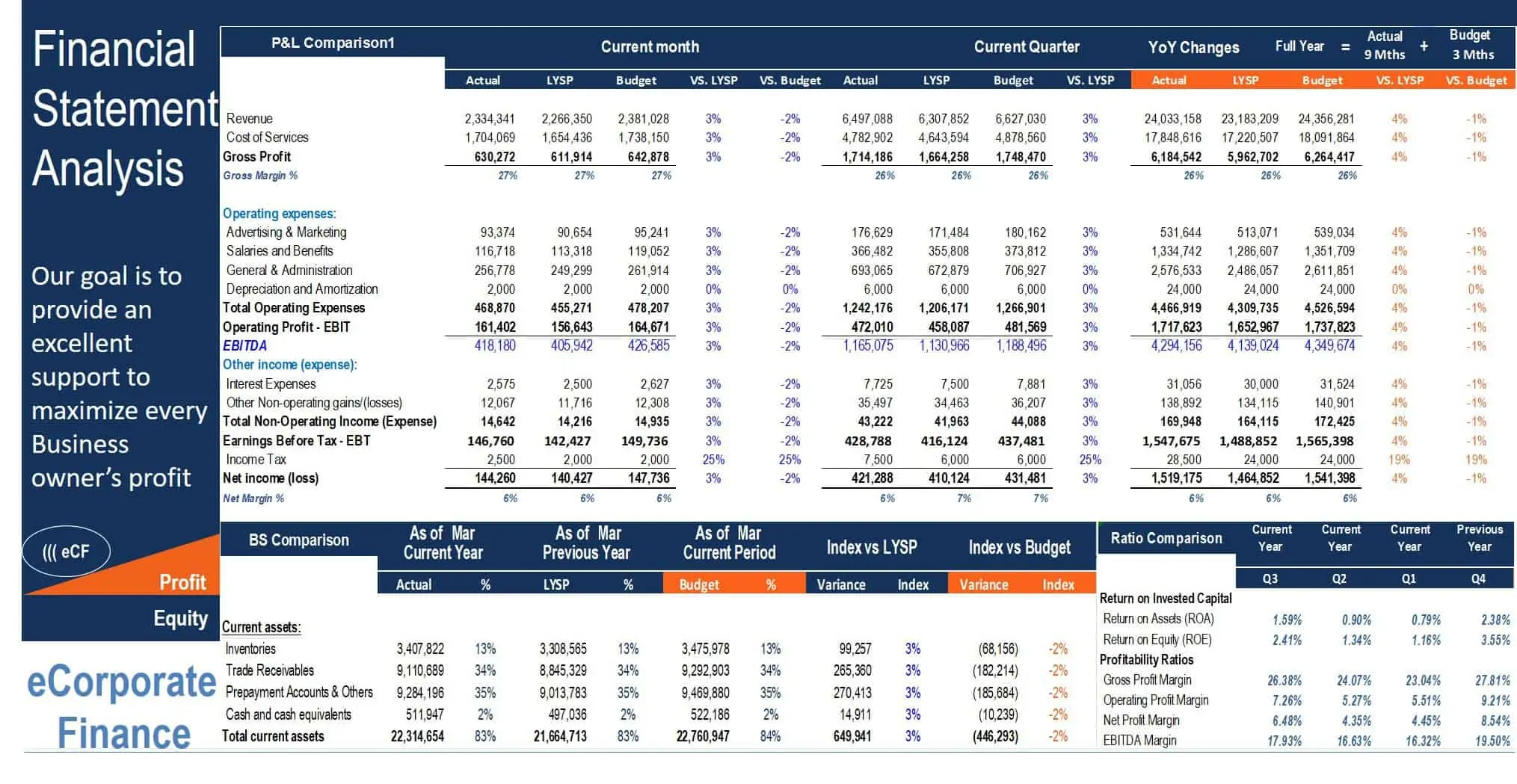

• Profit and loss statement by month including 3 major components, gross profit, EBITDA, and net profit

• Balance sheet by month including total assets, total liability, and owners’ equity

• Cash flow by month with 3 outputs such as operating cash flow, investing cash flow, and financing cash flow

• Ratios with 4 main components, such as profitability ratio, efficiency ratio, liquidity ratio, and solvency ratio

• Break-even point clearly showing the margin of safety

• Profit and loss statement for 10 years including 3 major components, gross profit, EBITDA, and net profit

• Balance sheet for 10 years including total assets, total liability, and owners’ equity

• Cash flow for 10 years with 3 outputs such as operating cash flow, investing cash flow, and financing cash flow

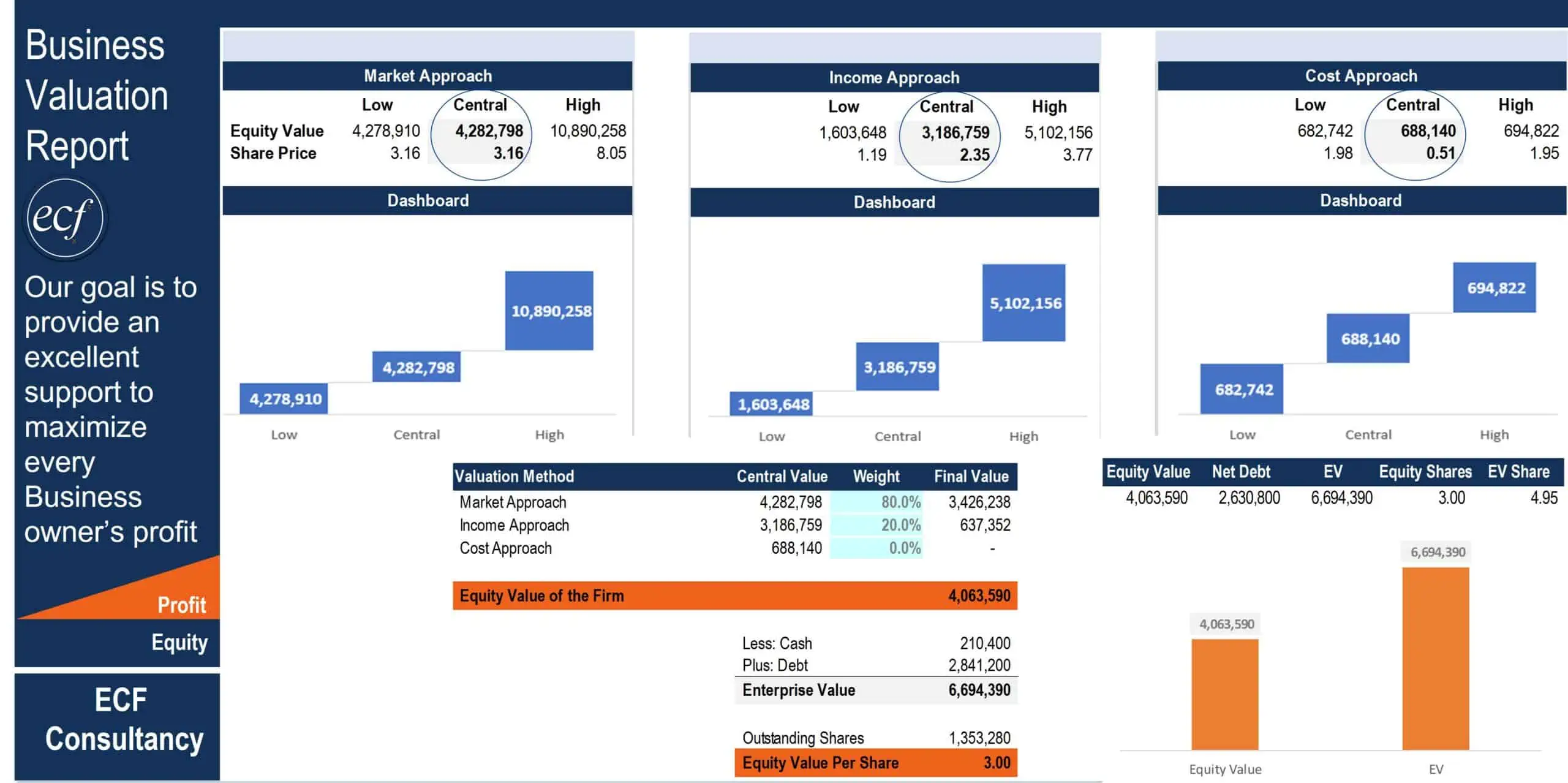

• Business valuation using discounted cash flow, with 2 main outputs such as intrinsic value and market capitalization

• Free cash flow to the firm and free cash flow to equity

• Calculation for the WACC and capital required

• Regular and discounted payback period

• Financial summary showing a full set of financial feasibility matrix

• Dashboard summary

• The model contains SWOT analysis and benchmarking sheet

Conclusion and customization

Highly versatile, very sophisticated financial template and user-friendly

If you have any inquiry, modification or to customize the model for your business please reach us through: [email protected]

File Types:

Excel Version – .xlsx

Free Version – .pdf

Similar Products

Other customers were also interested in...

Corporate Finance Toolkit – 24 Financial Mod...

They are essential models to increase your productivity, plan your future with budgeting and forecas... Read more

Financial Modeling Analysis

The main purpose of the model is to allows user to easily compare the financial performance result f... Read more

Comprehensive Business Valuation Model with Free P...

The report is detailed and easy template which allow the user to determine and monitor the value of ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

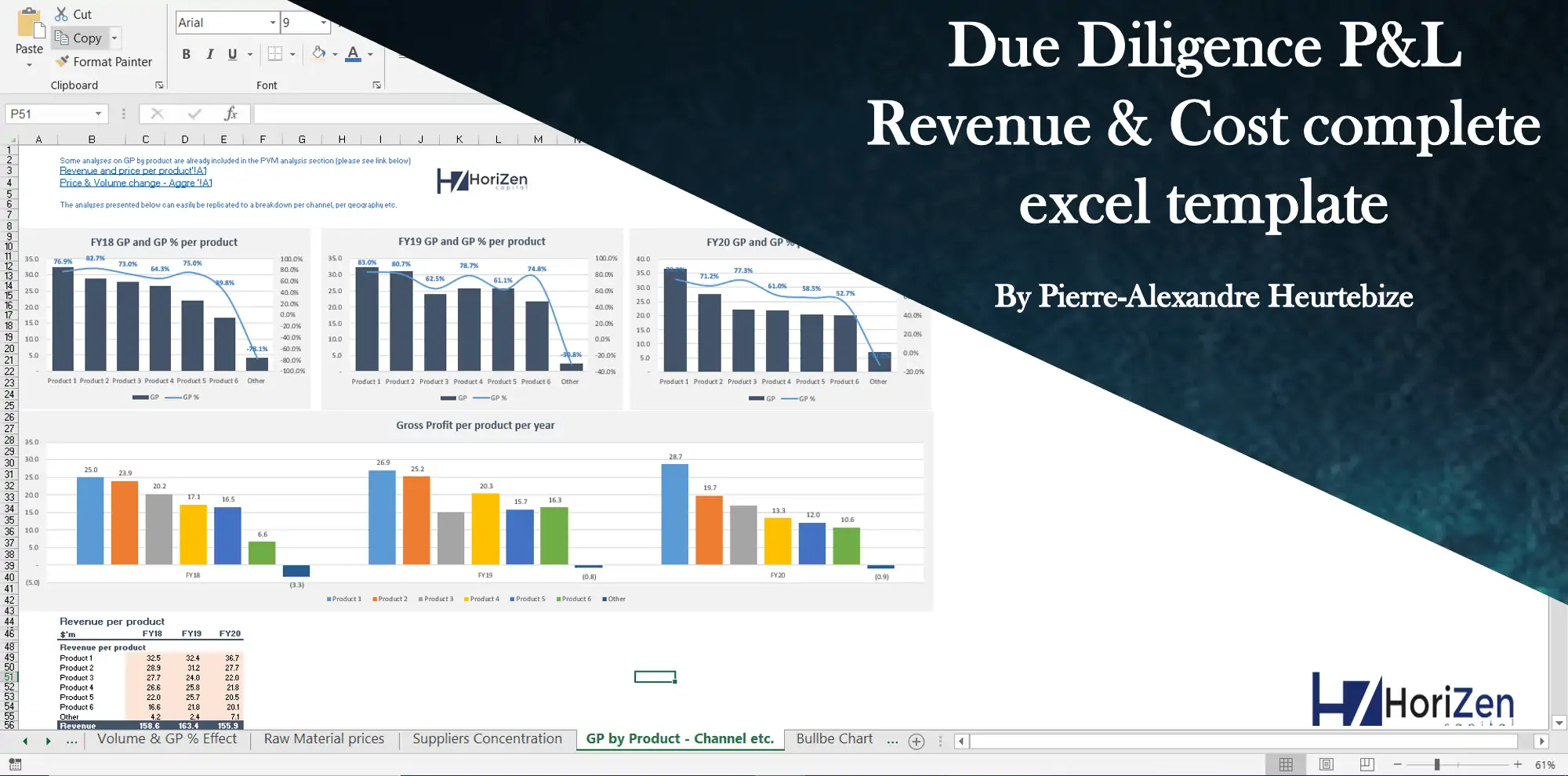

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

Small Business Playbook (Financial / Tracking Temp...

About the Template Bundle: https://youtu.be/FPj9x-Ahajs These templates were built with the ... Read more

You must log in to submit a review.