Banking

Comprehensive 3-Statement Financial Model for Banking Business

The Comprehensive financial model for Banking is an interactive, flexible,…

Crypto Token Valuation Model

A cutting-edge crypto token valuation model, designed to provide comprehensive…

Buy Now Pay Later (BNPL) Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a…

Online Payments Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

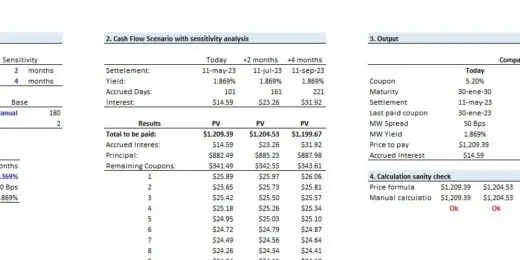

Bond, Loan or Note Make Whole Calculator

The model is designed to evaluate a make-whole calculator for…

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections…

Retail Bank Financial Model Excel Template

Retail Bank Financial Model There's power in Cash Flow Projections…

Offshore Bank Financial Model Excel Template

Offshore Bank Financial Model Enhance your pitches and impress potential…

Mortgage Bank Financial Model Excel Template

Mortgage Bank Budget Template Create fully-integrated financial projection for 5…

Lending Business Financial Projection 3 Statement Model

3 Statement 5 year rolling financial projection Excel model for…

Commercial Bank Financial Model – Dynamic 10 Year Forecast

Financial Model analyzing operations and performing valuation for a Commercial…

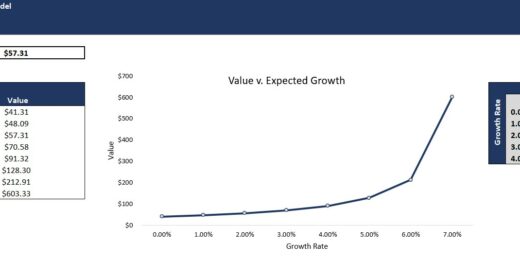

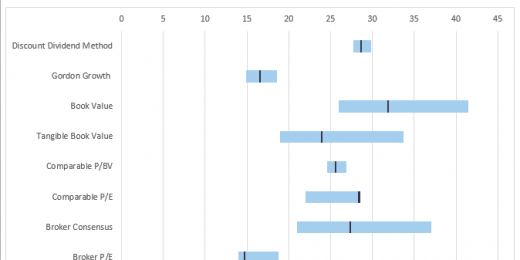

Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset…

Legal Services Financial Model Excel Template

Buy Legal Services Financial Plan. Based on years of experience…

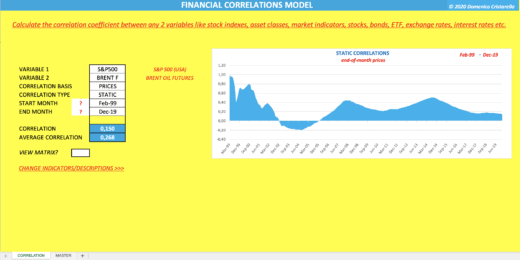

Financial Correlations Model Template in Excel

Calculate the correlation coefficient between any two variables, whether they…

Online Bank Financial Model Excel Template

Get Online Bank Financial Model. Based on years of experience…

Banking Model with 3 Statements – Dividend Discount (DDM) and Net Asset Value (NAV) based Valuation

Financial model that performs a DDM & NAV based valuation…

Prepaid Expense and Unearned Income Calculator

Prepaid Expense and Unearned Income amortization calculator with accounting entries

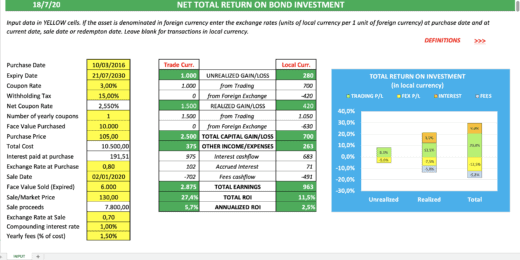

NET TOTAL RETURN ON BOND INVESTMENT CALCULATOR

CALCULATE NET TOTAL RETURN ON BOND INVESTMENT DENOMINATED IN ANY…

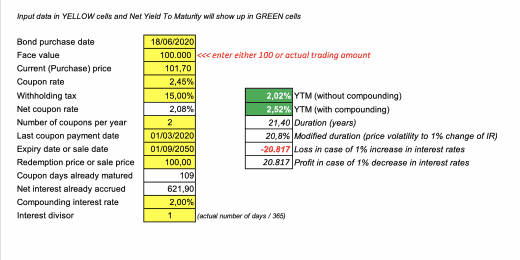

Bond Net Yield to Maturity Calculator

CALCULATE THE EFFECTIVE NET YIELD-TO-MATURITY (OR TO SALE DATE) OF…

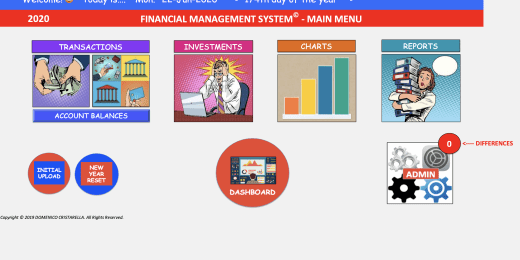

FINANCIAL MANAGEMENT PACKAGE (2023 RELEASE)

FULLY FLEDGED FINANCIAL MANAGEMENT AND ACCOUNTING SYSTEM, DEVELOPED ENTIRELY IN…

Commercial Bank Financial Model

Commercial Banking Financial Model presents the case of a commercial…