Three Statement Model | Three Financial Statements

Industry-specific financial model templates that utilize the Three Statement Model Structure in financial modeling.

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Mobile Imaging Center Financial Model

This Excel model facilitates mobile imaging services by providing equipment…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Indoor Golf Centre Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Golf…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Mobile App Development Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Mobile App…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Social Media Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Social Media…

Affiliate Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Affiliate Marketing…

Web Hosting Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking web hosting…

5 Year 3 Statement Recycling Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Recycling Centre…

5 Year 3 Statement Construction Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking construction company…

5 Year 3 Statement Solar Energy Solutions Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Solar Energy…

Digital Advertising Agency Finance Model Excel Template

A comprehensive editable 5 Year 3 Statement, MS Excel spreadsheet…

5 Year 3 Statement Virtualization Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Virtualization Software…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Graphic Design Company Finance Model Excel Spreadsheet

A comprehensive editable, MS Excel spreadsheet for tracking Graphic Design…

Private Equity Fund Financial Projection Model with Distribution Waterfall

Highly versatile private equity fund financial projection model with calculations…

5 Year 3 Statement Private Mental Health Care Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking private Mental…

5 Year 3 Statement Alpaca Farming Finance Model Excel Template

A comprehensive 3 Statement 5 Year editable, MS Excel spreadsheet…

5 Year 3 Statement Architect Company Finance Model Excel Template

A comprehensive 5 Year 3 Statement editable, MS Excel spreadsheet…

Swimming School Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Swimming School…

3 Statement 5 Year SAAS HR Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking SAAS HR…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

Pig Farming Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking pig farming…

3 Statement Indoor Rock Climbing Gym Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Rock…

3 Statement Car Hire Company Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking car hire…

Comprehensive 3 – Statement Financial Model for a Midstream Oil and Gas (Refinery with 7- Years Forecast)

This is a 6,000bpd financial model for refinery producing Diesel…

3 Statement Self Storage Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Self Storage…

3 Statement SAAS Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking SAAS Development…

3 Statement Software Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking software development…

Renewable Energy Financial Model

Comprehensive financial model designed for analyzing renewable energy projects, such…

Logistics Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking logistic company…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

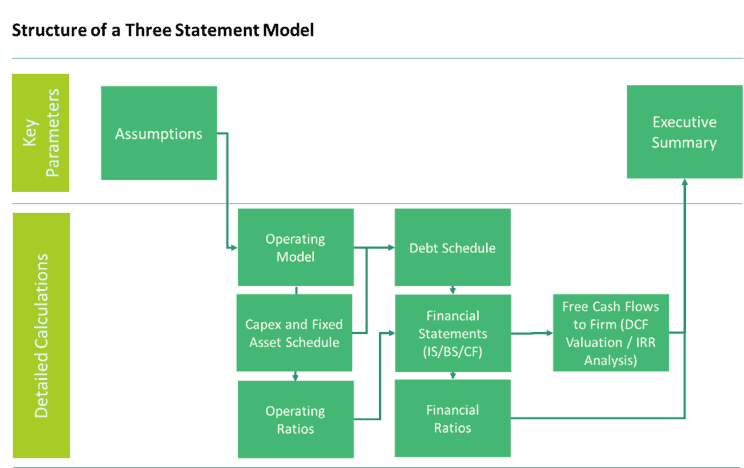

General Financial Model Structure

Creating a financial model is not that simple as it takes skill, experience, and an appropriate knowledge to be even able to complete one. There are certain structures that one must follow depending on what kind of financial model that one is planning to build. It can be simple or complex, requires a lot of details or information, and in-depth analysis.

Here is how the usual general financial model is structured:

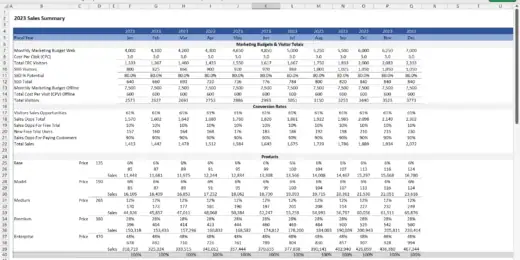

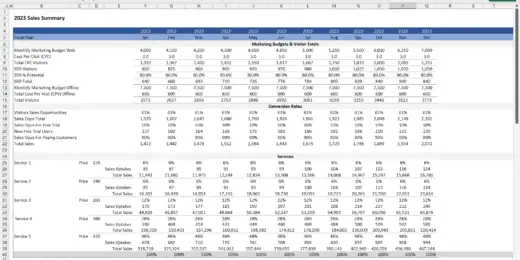

- Assumptions – are assumed scenarios/ratios that might affect the business either positively or negatively. It is usually stated in the Executive Summary where it shows the estimate to revenues, costs, schedule of payments received and issued, assumptions regarding investments either for business development or fixed assets as well as taxes, depreciation, and interest rates.

- Operating Model – is a visual report of how the business delivers value in different aspects as well as checking the changes or possible changes that will happen to the business, the model also represents as a report on how the business operates in present and in the future.

- Operating Ratios – are used to determine whether the expenses or assets used to operate the business is within the limit of the business’ capability and reasonable enough to help the business grow and operate normally. The ratios will vary from model to model depending on the three financial statements of the business.

- Fixed Asset Schedule – this is when all detailed assets of the business go through depreciation or amortization where a part of the assets’ value will be expensed, hence, this section is an expense projection of assets. It also serves as a tracker of each individual asset and its related depreciation or amortization.

- Debt Schedule – is the repayment schedule of incurred debt. This is an important element to be realized in the financial model so that the user can anticipate the timing of every repayment and keep track of every cash flow in the business.

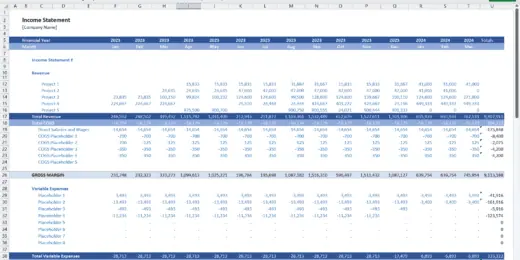

- Three Financial Statements – is a comprehensive forecast of the income statement, balance sheet, and cash flow statement.

- Financial ratios – are the estimated ratios which are very helpful components of the model. By utilizing these ratios, it allows the user to see the business from a different perspective. The usual important ratios are Financial Debt/ EBITDA, Current Ratio, ROIC, etc.

- DCF Valuation or IRR Analysis – to reach the main objective of the model, depending on its use case, an analysis or valuation is made. This is either to determine the value of the business, to determine whether it’s doing good financially or not, how much returns can be expected, etc. This section of the model will also help the interested party to better understand the business and to come up with good economic decisions in preparation for the future.

When creating a model for the three financial statements, you can either model the output in two different structures: Direct Cash Flow Statement and Three Statement Model. With the first structure, it seeks typically on projecting the direct cash flows only, but the latter, which is the three statement model, is a much more precise way to model the forecasted three financial statements. Therefore, the use of the three statement model is a better structure when creating a financial model.

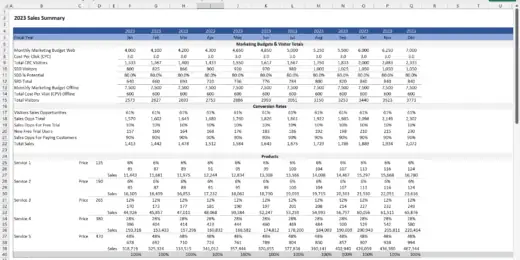

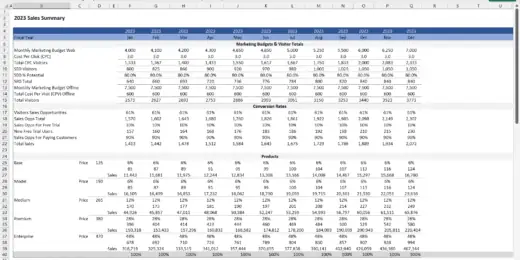

Below is the navigation structure of a financial model using the Three Statement Model which is the generally used and most preferred structure when creating a financial model.

As you can see, it is clear that the three statement model is a much more reliable structure which provides more aspects that one can explore and understand regarding the business. But of course, it has disadvantages such as it is a much more complex process thus, will definitely take a long time completing and the user will need to at least have substantial know-how about the industries and financial modeling.

What exactly is a Three Statement Model

A three statement model is the general financial model structure. The term itself refers to the detailed and precise forecast of the three financial statements: Income Statement, Balance Sheet, and Cash Flow Statement, which are all required to better understand any business.

- Balance Sheet

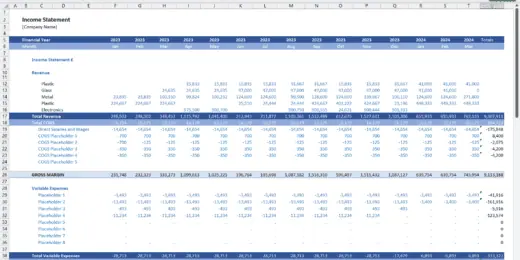

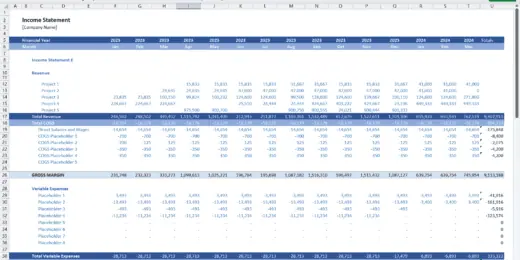

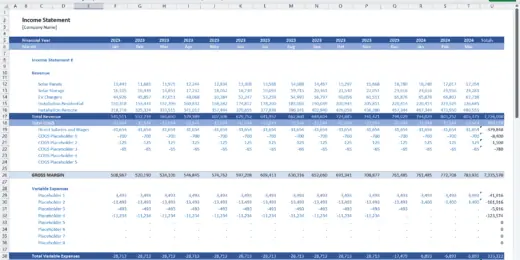

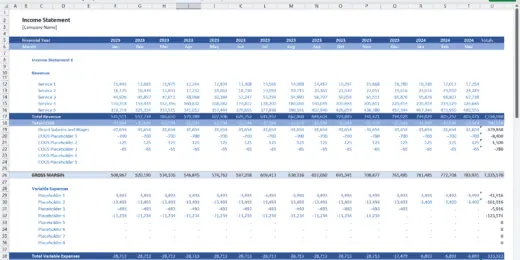

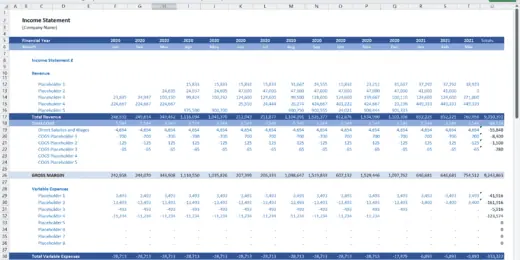

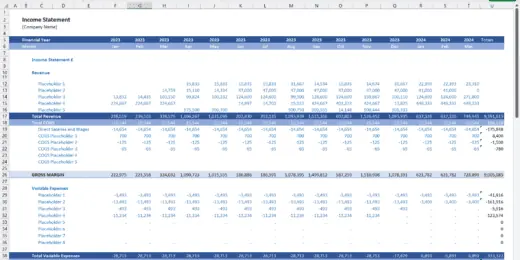

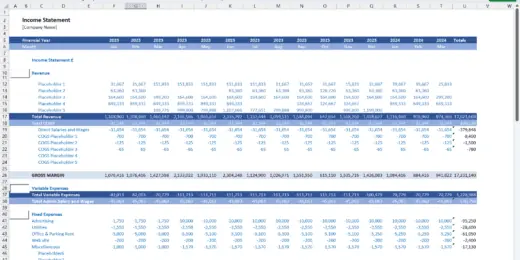

This is where you’ll see the Assets, Liabilities, and Equity of the entity as of the reporting date. Meaning, the data shown is focusing on the business’ income and expenses as of a specific point in time. The format of the report shows that all Assets will be equal to the total of all the Liabilities and Equity; this is what we know as the basic Accounting Equation. The balance sheet is considered as the second most element in a financial statement since it showcases the liquidity and capitalization of a business. - Income Statement

This is where the Revenues or Sales, Expenses, and Profits or Losses presented, which is generated during the reporting period. Others call this statement as the Profit and Loss Account, which shows how it derived the net income of the business over a stated period. Basically, it projects all the business’s operations and financial activities, which is why this is considered as the most important of the financial statements since it showcases the operating results of a business. In other words, this report provides a quick overview of what a business owns and owes, as well as the capital invested by the shareholders. - Statement of Cash Flows

This is where all the Cash inflows and outflows caused by the business’s activities during the reporting period. All the changes in the business’s cash flows will be presented here and used to provide a useful base to compare in the income statement. To check whether if it is reflected or balanced in the amount of profit or loss reported during the stated time. Cash flow statement basically answers the questions; where the money came from and where it went. Basically, this report is made to measure how well a business generates cash to fund its expenses and repay its debts. With this statement, it will help the business assess the amount, timing and predictability of cash flows which is used for budgeting and business planning.

Uses of Financial Statements

Creating financial statements are critical for businesses, especially when gathering data and calculating numerical figures. The known common reasons, significance, and uses of financial statements are the following:

- Determining the ability of a business to yield cash, where and how they derived with the cash and how the cash will be distributed.

- Determining whether the business is capable of paying back the liabilities incurred, not just in the present but also in the upcoming years.

- Deriving financial ratios based on the financial statements that will show a business’s position and condition.

- Investigating the business’s transactions and all other projections.

- Organizing transactions and all financial projections in a readable and easy to understand way.

- Bases for decision-making when looking for potential and profitable investments and also when looking for funding from investors or getting a loan.

The three financial statements are critical components in a financial model to further prove the feasibility and validity of the projected values. Thus, by following the three statement model structure, the financial model will then be even more reliable with more details included.

The three statement model structure is a more ideal and precise way to model a business and its feasibility since it is even more detailed and complex compared to the other structure of a financial model, the Direct Cash Flow Model which is a much more simple and direct structure when creating a financial model.

Why you need a Three Statement Model

Creating a financial model can be an easy process if you proceed with the alternative of building a three statement model which would be to build a direct cash flow model. So, what is wrong with that? It isn’t really wrong so to say but, the problem with settling for a simple structure of a financial model is that you can perform your analysis only to a certain degree, especially for the tax and net working capital calculations which might not be very precise. Also, you are running the risk of creating a cash flow forecast which might simply be unrealistic as you haven't looked at the implied financial statements.

So, to ensure that you will make a better financial model, it is better to build a detailed report with all the components needed in a financial model. The main advantage of utilizing the three statement model structure is that the quality of your model increases. With more components added in the model, the report will look more complete and the resulting report will be information-driven which will greatly raise the usefulness of the model.

Another reason why you need a three statement model is to calculate more financial ratios which will help with coming up with more precise forecasted values. The model will also help better understand and validate the existing business plan. By checking the precise projected values, you will be able to determine the effectiveness of your business plan, if it needs to be improved or changed.

Basically, it is important to use a more accurate way to measure the future financial performance of a company by using a three statement model structure. The more detailed the reports and data gathered are, the more accurate and better quality the model will be.

Three Statement Model Templates

In creating a business plan, choosing the right structure for your financial model will be a determining factor if your model will be helpful for you or not. If you settle for a simple and direct financial model structure, it won’t be able to completely cover all the needed factors to reach your objective in a model. That’s why using the three statement model structure is preferable since it provides a much more complete model that will help you determine the key factors that you need to pay attention to in a business, project, or investment.

It is a good thing that nowadays, downloading ready-made three statement model templates in Excel are accessible just by simply downloading it on a financial modeling platform. These templates are made by experts and experienced finance professionals who used these templates themselves when providing financial modeling services to different companies in different industries. The best thing about using templates is, you can re-use it for related industries as long as you can customize it according to your specifications, especially the three financial statements.

Often, the reason why it takes a lot of time to prepare the three financial statement model is that some users are clueless on how to create from scratch. But learning how to create from scratch will take even more time which users most often don’t have extra to spare. The three statement model template is heaven sent to those in need of a base to start their financial report with and also to those who want to save time.

Are you planning to build a financial model which uses the three statement model structure but don’t know how to build one from scratch on your own? If you are, then you can fully take advantage of the three statement model templates listed above. The three statement model templates are ready-made by experts in financial modeling so you need not to worry about the needed industry know-how. You can simply choose according to your requirements and learn how to build a financial model on your own. No more spending too much time on building a model without the help of professionals that requires high fees, instead, you can rely on these three statement model templates which are very light on your pockets and are very useful tools for financial modeling.