Best Budget Spreadsheets for Your Financing Decision

“Beware of little expenses. A small leak will sink a great ship.” – Benjamin Franklin. The quote is a powerful reminder of the importance of monitoring and controlling small expenses using budget spreadsheet templates. It may not sound like the most enjoyable task in the world to create a budget, but it’s an essential part of organizing your finances while attempting to control the funds you need to live the way you want.

Budgeting helps you track your income and manage monthly expenses such as student loans, vacations, desires, and future finances. Using an Excel spreadsheet for budgeting allows you to create an expenditure plan for your money, and it ensures you’ll always have enough money, let’s say, in your bank account, to cover all your expenses. If you are actually in debt, implementing a budget or spending plan can also keep you out of debt or help you find your way out of debt.

What is an Excel Spreadsheet Budget Template?

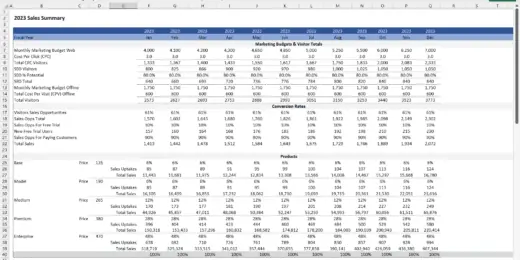

An Excel Spreadsheet Budget Template is a financial planning tool created using Microsoft Excel, a widely used spreadsheet program. It helps individuals or organizations manage their income, expenses, and overall financial goals over a specific period, such as monthly or yearly. The Excel Spreadsheet Budget Template is typically structured in a table format, allowing for the systematic organization of financial data into categories.

What to Include in an Excel Spreadsheet for Budgeting?

Creating an Excel spreadsheet for budgeting involves organizing your financial information into categories that help you track and manage your money effectively. Here’s what to include in each section:

- Income: In the income section, list all sources of money that you regularly receive. This includes your salary and any additional income streams such as bonuses, freelance work, rental income, or investments. For each source of income, note the amount and the frequency (e.g., monthly, bi-weekly). It’s essential to clearly understand your total income to set realistic budgeting goals and ensure that your spending does not exceed your earnings.

- Fixed Expenses: Fixed expenses remain relatively constant from month to month. This section should include rent or mortgage payments, insurance premiums (health, auto, life, etc.), loan payments (student loans, car loans), and any other regular payments that do not fluctuate significantly in amount. Listing these expenses helps you understand how much of your income is already committed to these unavoidable costs and what portion remains for variable expenses and savings.

- Variable Expenses: Variable expenses fluctuate based on your usage or consumption. This category includes groceries, utility bills (electricity, water, gas), transportation (gas, public transit), entertainment, and personal spending. Since these costs can vary, tracking them closely allows for adjustments in spending behaviors. By identifying patterns or areas where spending is high, you can make informed decisions to reduce costs if necessary.

- Savings: In the savings section, allocate a portion of your income towards future financial goals. It could include an emergency fund, retirement savings, or specific goals like travel, education, or home buying. Determining a fixed amount or percentage of your income to save each month can help ensure that you’re building a financial cushion and working toward long-term stability and success.

- Debt Repayment: If you have any debts, including credit card debt, personal loans, or any other type of debt, it’s crucial to include a section for debt repayment. List each debt, the total amount owed, the minimum payment required, and the interest rate. Prioritizing debt repayment is essential for financial health. You may focus on paying off high-interest debts first (the avalanche method) or start with the smallest debts for quick wins (the snowball method).

Including these sections in your Excel Spreadsheet for Budgeting gives you a comprehensive view of your financial situation. This organization helps manage your current finances and plan for future expenses and savings goals.

Budgeting Template Types

Although all budgets track finance, they can have various components depending on intent. Budgeting templates need categories that, along with other variables, are tailored to the scale and length of a project. Below are some of the most popular kinds of budgeting templates or best budget spreadsheets that you might use in your everyday life:

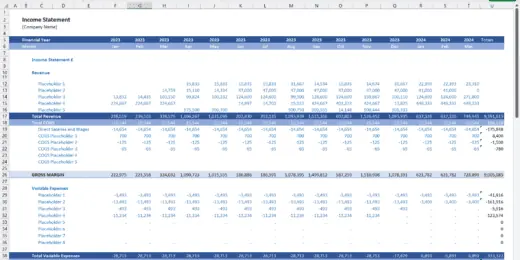

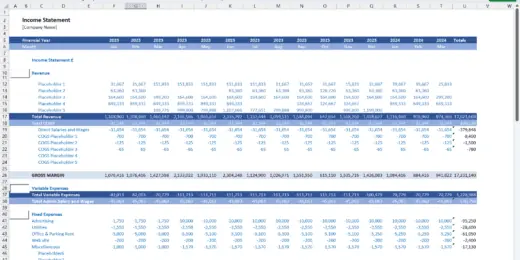

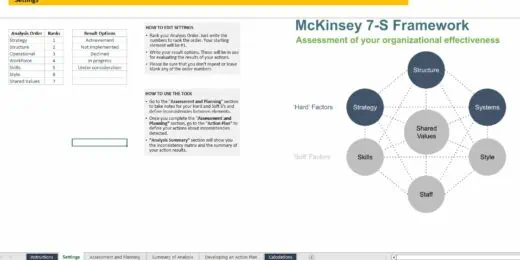

- 3 statement model budget: This model budget comprises the five most common and generally used accounting statements: Income Statement, Balance Sheet, and Cash Flow Statement. This model combines three key reports into one consolidated forecast so you can forecast your future cash position and financial health.

- Zero-based budget – Zero-based budgeting is a way to budget where the revenue minus spending equals zero. With a zero-based budget, you must ensure that your expenditures balance your monthly revenue.

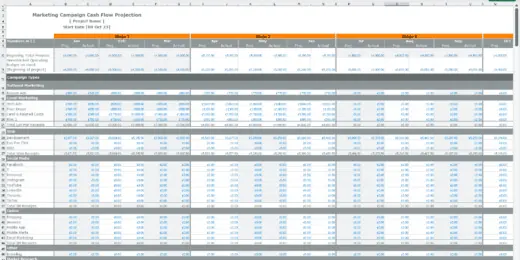

- Cash flow budget – A cash flow forecast estimates all cash revenues and expenses planned to occur for a given period. Yet cash flow budgeting looks at moving capital, not net income or profitability.

- Flexible budget: This budget adjusts or flexes with changes in volume or activity. A flexible budget is more sophisticated and valuable than a static budget.

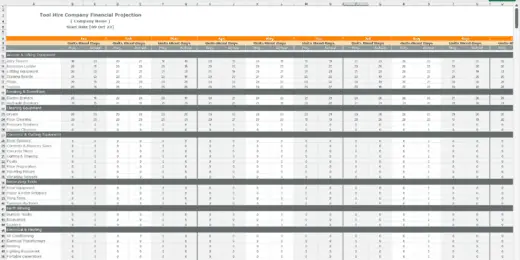

- Business budget: This outlines the financial and operational goals of your organization, so it can be considered as an action plan that helps you allocate funds, assess performance, and determine actions. When starting a new business, a budget is essential to your business plan.

- Student budget: As a student, you may earn little. The best way to hang on to the money you do have is through budgeting. While making and adhering to a budget is daunting, the process may be more straightforward than you think.

- Household budget – A personal or household budget is a detailed list of expected income and expenses that help you plan how to spend or save your money and track your actual spending habits.

How are Budget Spreadsheet Templates Used?

Budget spreadsheet templates are versatile tools for multiple financial planning and management purposes.

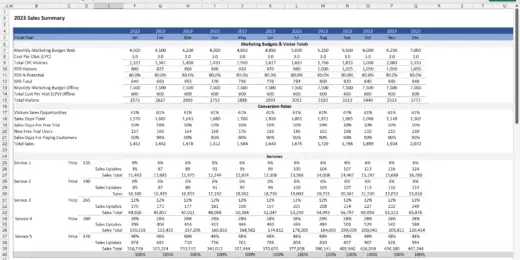

- Generate Financial Insights: Budget spreadsheet templates are designed to organize financial data to highlight spending patterns, income sources, and potential areas for savings. You can generate insights into how your money is being utilized by inputting your financial information—such as income, expenses, savings, and investments—into these templates. This analysis can reveal trends over time, showing areas where you’re overspending or underspending. It helps make informed decisions about financial planning and adjustments to meet your financial goals.

- Help Build Savings: Budgeting Spreadsheet Templates often include sections for savings goals, allowing users to allocate a portion of their income toward future savings. By visualizing your savings goals and tracking your progress, you’re more likely to stay committed and disciplined in your savings habits. The template can show how small, regular contributions to savings can grow over time, providing motivation and a clear path to achieving your savings objectives.

- Manage Budgets Efficiently: The primary function of budget spreadsheet templates is to help individuals and businesses manage their budgets more efficiently. They allow for the categorization of income and expenses, making it easier to see where your money goes each month or year. This clarity helps identify areas where expenses can be reduced, ensuring that spending aligns with priorities and financial goals. Effective budget management leads to better financial health and stability.

- Prepare for Sudden Changes: Financial stability requires preparedness for unexpected events, such as job loss, medical emergencies, or urgent home repairs. Budgeting spreadsheet templates can help you plan for these unforeseen changes by setting aside emergency funds or adjusting your budget to accommodate new financial realities. By regularly updating your budget template to reflect current financial situations, you can quickly adapt your spending and savings plan to mitigate the impact of these sudden changes.

- Schedule Debt Repayment: For individuals dealing with debt, budget spreadsheet templates can be invaluable in planning and tracking debt repayment. These templates can outline a strategy for paying off debts, from credit cards to loans, by prioritizing them based on interest rates or balances. By having a clear repayment schedule and tracking progress, you can stay motivated and on track to becoming debt-free, potentially saving money on interest payments in the long run.

- Track Income & Expenses: At its core, a budget spreadsheet template is a tool for tracking all sources of income and expenses. This comprehensive tracking gives users a complete picture of their financial situation. By understanding exactly where every dollar is coming from and going to, individuals can make precise adjustments to their financial habits, ensuring that their spending aligns with their financial goals and priorities.

In summary, budgeting spreadsheet templates are multifaceted tools that help organize and manage financial data and empower users to make informed decisions regarding their financial well-being. Whether building savings, managing debts, or preparing for unforeseen circumstances, these templates provide a structured approach to achieving financial stability and goals.

Financial Forecasting Through Budget Spreadsheet Templates

A budget is also needed when estimating future funding requirements and figuring out if they can be funded internally or require external sources of financing. Internal financing uses the cash generated from the business’s standard operating activities. On the other hand, external funding refers to the capital provided by parties external to the company, such as banks or investors. Therefore, you need to use your budget to analyze how much external financing you will require.

You can chart your spending plan or budget for six months to a year after you make your first budget and keep your finances on track. Doing so lets you easily predict which months your finances could be complicated and which ones you’ll get additional revenue. Steady growth in the industry will not only happen overnight. It is also prepared with caution and needs careful planning, thorough observations, and experience in financial forecasting. By analyzing your financial affairs’ past and current state, a good management accountant creates accurate and meaningful financial forecasts. These act as a real-time benchmark for your business’s growth and financial health.

Financial forecasting, an essential element of business planning, is commonly used as the basis for budgeting activities. The forecast puts forward a scenario the management believes is realistic. As per the definition, a budget is always wrong, and only an educated person can best guess how the financial results will turn out. However, preparing a budget is very helpful in itself as it helps management anticipate the company’s problems and requires them to find solutions in time. Therefore, financial forecasting will be very helpful for decision-making.

Budgeting Tools for Financing Decisions

If you manage the finances at work or home, an essential first step is to have a budget in place. A budget is needed to learn where you are currently spending, decide where you can save, and determine where you want your money to be spent.

A comprehensive budget plan is a formal statement of the management’s expectations regarding an organization’s sales, expenses, volume, and other financial transactions for the coming period. Basically, a budget is a set of projected financial statements. These include the forecasts of:

- Income Statement

- Balance Sheet

- Cash Flow Statement

While forecasting an Income Statement, more clarity on future revenues, costs, and profits might be obtained. However, for many businesses, liquidity planning is even more critical. Therefore, one needs to forecast a company’s cash flow statement. It also requires to forecast the Balance Sheet.

A budget is not only a tool for planning but also for taking control of finances. At the beginning of the period, building a budget plan is standard. At the end of the period, it will serve as a controlling tool to help the management measure the performance of the actual result against the forecasted budget plan so that in the future performance, it can be further improved.

It is critical to note that with the aid of today’s technology, budgeting can be used as a very effective tool for evaluating “what-if” scenarios. This way, the company can better develop the best plan or strategy against different scenarios through multiple simulations. It can be done by financial forecasting, which helps provide the necessary data to analyze the business financing.

If the resulting data isn’t to the company’s liking, especially to the budgeted financial statements in terms of various financial ratios such as the liquidity, turnover, leverage, profit margin, and market value ratios, the company the budget serves as a basis to analyze where the problems are or its origin. The company can then act upon and change its previous strategy and business plan. Though quite time-consuming for executives, the need to draft a new budget plan today is standard and considered good practice for responsibly managing any business.

Top Qualities of a Good Budget Spreadsheet Template

What should we look for in an Excel Budget Spreadsheet? Before you decide which Excel budget spreadsheet template you will acquire, here is our list of top qualities that help determine good budgeting spreadsheets.

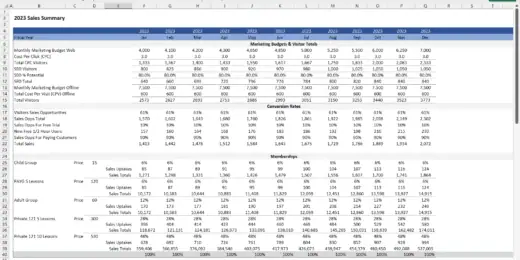

- Allows Actual vs Budget Comparisons: This process involves using financial data to assess how closely a company’s spending and generated revenue meets the financial forecasting projections included in its budget. Performing regular budget vs. actual comparisons will reveal trends in your operations that could otherwise go unnoticed.

- Better Understand Cash Flows: It’s so crucial for businesses to understand the basics of cash flow and cash flow forecasting. Owners and investors need to know how a company’s operations are running, where its money is coming from, and how money is being spent.

- Focus on Short-Term: Budget plans work best for short-term periods. It allows the business to control the funding more efficiently as well as be able to compare the Actual vs Budget plan sooner. Thus, after analyzing the results, the budget plan will be updated again to ensure that there will be more improvement in the future.

- Identify Deviations from the Budget: Using budgeting spreadsheets, your business forecast, and your P&L statements by doing a side-by-side comparison of these numbers. Afterward, you can tell where in your total operation you need to focus your attention based on the difference between expected and actual outcomes. Areas where you were below or on budget can be set aside for later.

- Track Essential KPIs: A good budget spreadsheet in Excel offers you all insights, knowledge, and especially important Key Performance Indicators (KPIs) that you would love to track and measure to develop a suitable financing decision.

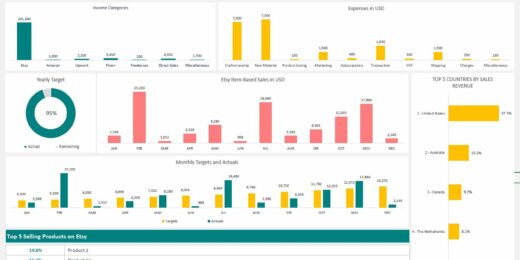

- Visual Representation: Observe your budgeting flow and variances by looking into a visual representation, such as graphs and charts, to visualize your budgeting trend carefully and precisely.

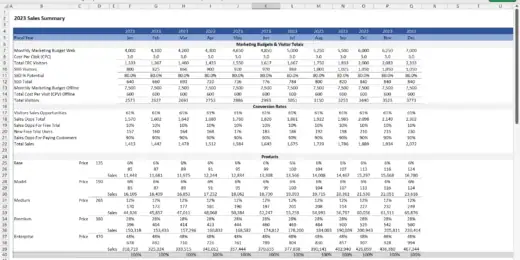

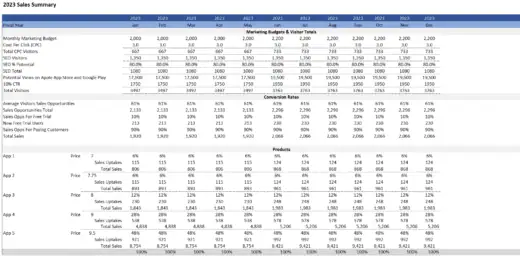

Best Budgeting Spreadsheet Templates

Need budget Excel templates? We offer a selection of budget Excel templates used by our experienced practitioners. The spreadsheets come as Excel files and provide more insights into the budgeting process and the ways to present them.

The following Excel budgeting spreadsheet templates are used by entrepreneurs, executives, and other users worldwide, such as in the US, UK, Canada, Australia, Japan, and many more countries that need help from experienced financial modelers with substantial know-how.