Property Valuation

Financial model templates specially tailored for property valuation, property appraising, real estate property valuation, and its related sectors.

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

Real Estate – Multi Family Acquisition Pro-forma

This Excel template is an intuitive and comprehensive solution tailored…

Sailboat Rental Business Financial Model

This comprehensive 10-year monthly Excel template offers an ideal basis…

Multifamily Real Estate Financial Model

The Multifamily Real Estate Financial Model allows users to evaluate…

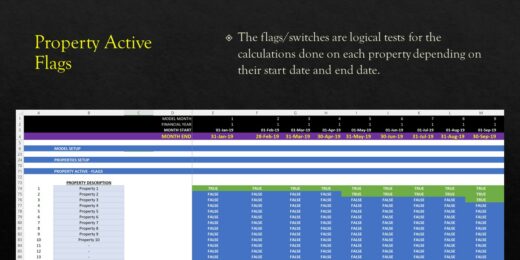

Rental Portfolio Financial Model

Introducing our Rental Portfolio Model – a comprehensive and user-friendly…

Senior Living Development – 10 Year Financial Model

Financial model presenting a development scenario for a Senior Living…

Student Accommodation / Village Development Model – 20 years

This Student Accommodation 20-year Development Model (hold and lease) will…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Self-Storage Park Development Model

This Self-Storage Park development model will produce 20 years of…

Financial Model for a Smart City Project

This is a financial model to identify various components of…

Recreation & Community Center – Dynamic 10 Year Financial Model

Financial Model presenting a development and operating scenario of a…

Yacht Marina Acquisition Financial Model

Financial model presenting an acquisition scenario of a Yacht Marina.

Public-Private Partnership (PPP) Financial Model

Financial Model presenting development and operating scenarios of various projects…

Real Estate Acquisition Financial Model (Commercial, Industrial, Residential)

Simple Real Estate Acquisition Financial Model suitable for Commercial, Industrial…

IRR Sensitivity Real Estate Model

Isolate and sensitize IRR based on changing occupancy rates, exit…

Quick Coherent HOTEL / GUESTHOUSE Valuation and Financial Model 20 years

This quick and coherent Valuation and Financial model (20 years)…

Real Estate Development Financial Model

A professional model for real estate construction (build – hold…

Discounted Big Bundle Real Estate Valuation and Financial Models

One Excel file for this bundle of Valuation and Financial…

Shopping Center Valuation and Financial Model 20 years – Acquisition

This Shopping Center Valuation and Three Statement (20 years) Model…

Self Storage Park – Valuation and Financial Model 20 years (Acquisitions)

The Self Storage Park Financial Model is a dynamic three-statement…

Multifamily Acquisition-Rent-Sell Financial & Valuation Analysis Model

We are glad to present our new integrated, dynamic and…

Real Estate Acquisition-Rent-Sell Comprehensive Analysis Model

An integrated, dynamic and ready-to-use Real Estate Acquisition-Rent-Sell Comprehensive Analysis…

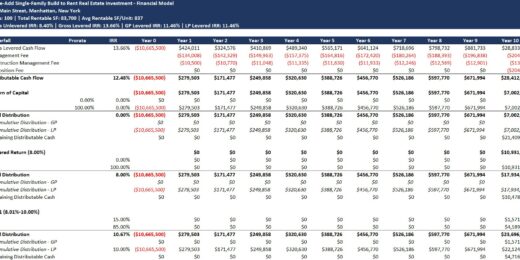

Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

A financial model to help calculate and analyze the pro…

Core Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Short-term Rental (Airbnb) Financial Model

A professional model for residential property acquisition, renovation and short-term…

Multi Sports Complex Financial Model – Dynamic 10 Year Forecast

Financial Model presenting a development and operating scenario of an…

Student Hostel Development – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Student Hostel…

Principal Residence Real Estate Investment Model

This Pro Forma Model is designed to analyze Principal Residence…

Real Estate Brokerage Business Plan with Return Calculation

Pro Forma Models created this model to analyze the financial return…

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

General Hospital Financial Model (Development, Operation, & Valuation)

Financial Model presenting a development and operating scenario of a…

Student Housing Real Estate Investment Model with Returns & Waterfall

Pro Forma Models created this financial model to calculate and…

Single Tenant Net Lease (NNN) – Investment & Valuation Model

Financial model presenting an investment scenario for a Single Tenant…

Triple Net Lease (NNN) Real Estate Investment with Returns & Waterfall

This Pro Forma Model is used to analyze the financial…

AIRBNB Financial Model 20 years – Three Statement Analysis, and Valuations

This Airbnb acquisition and financial forecasting model will provide you…

Hostel Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Retail Property Development Financial Model

A professional model for retail property construction (build – hold…

Value-Add Multi-Family (Apartment) Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Dynamic Annual Private Equity Waterfall Cash Flow Distribution Financial Model

Pro Forma Models created this model for private equity professionals…

Hotel Real Estate Investment Model Template

Pro Forma Models created this financial model to calculate and…

Core Multi-Family (Apartment) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Residential “Build & Sell” Financial Model

A professional model for residential property construction (build & sell)

Residential “Build-Hold-Sell” Financial Model

A professional model for residential property construction (build – hold…

Condominium Development – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Condominium Units…

Real Estate – Industrial Acquisition Model

An Excel-based analysis tool for the acquisition, operation, and ultimate…

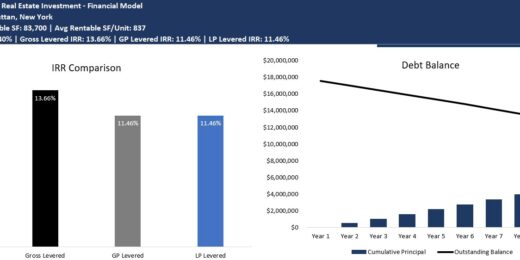

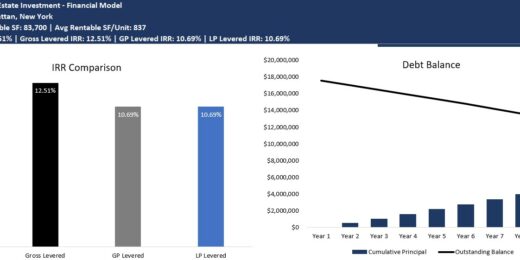

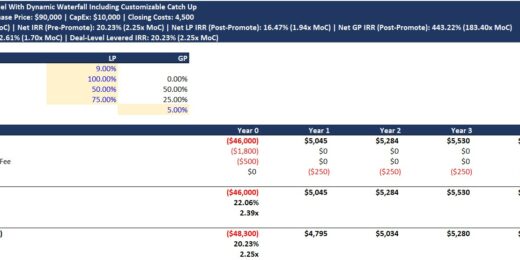

Real Estate Investment Model Template with Waterfall & Catch Up

The waterfall model includes a dynamic catch up. This model…

Acquisition Model for Commercial Property

This is the Quintessential Commercial Property Acquisition Model that allows…

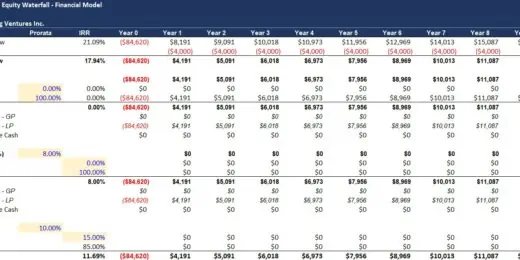

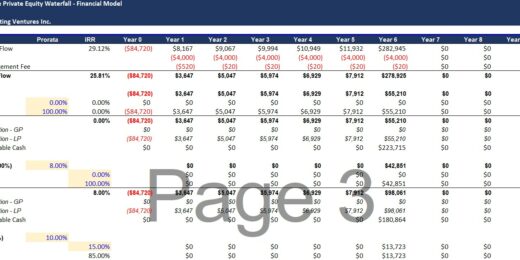

Dynamic Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity…

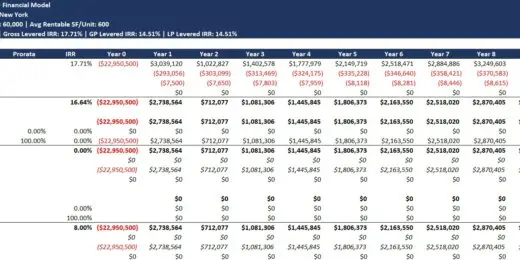

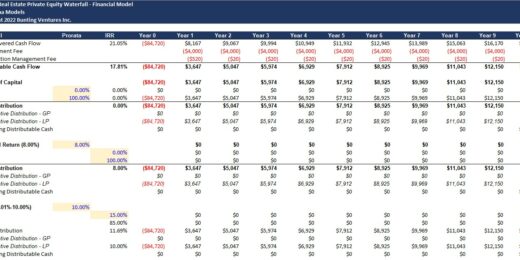

10 Year Real Estate Private Equity Waterfall

This Pro Forma Model is for real estate private equity…

Return Analysis Model of Real Estate with Refinancing Loan & Renovation

The objective of this model is to provide users with…

Industrial Real Estate Development Model

An Excel-based analysis tool for the ground-up development, operation, and…

Single Family Rental Property ROI Analysis

Analyze rental property investments with this tool. Simple assumption tab…

Apartment Block Acquisition & Valuation Model 20 years Three Statement Analysis

This Apartment Block Acquisition Model produces 20 years of Three…

Warehouse Acquisition Financial Model

A professional model for warehouse (industrial building) acquisition (buy –…

Property Valuation

Generally, a property valuation is conducted when you’re looking to buy or sell a property. Property valuation can also be considered as real estate appraisal or land valuation. Basically, it is the process of determining the value of the real estate property to arrive at an acceptable price. The location and condition of the property are usually the key factors in valuing a property. Hence, if both factors are good, then the resulting value will be affected too and most likely lean on better valuation.

There are several types of value that are commonly used for real estate appraising such as:

- Market Value – value perceived by the open market

- Liquidation Value – usually when a business goes bankrupt or undergoing liquidation and is often lower than the fair market value

- Value-in-Use – value perceived by one particular user

- Investment Value – value perceived by an investor

- Insurable Value – value covered by an insurance policy but excluding the site value

Each real estate property is unique and the market changes day by day thus, it is not that easy to determine the price of a property. Usually, an appraiser is hired to conduct a real estate property valuation to asses a property’s worth. Otherwise, creating real estate valuation models will also work as long as you have the proper tools and substantial economic know-how. Of course, there are guidelines that are expected to be followed in real estate appraising such as taking account the property’s features, structure, condition, quality, location, as well as planning restrictions. The appraiser, thus, compares to other similar properties and market conditions to finally come up with a valuation for the property. But this doesn’t mean that the price will be the same as the resulting value from the real estate property valuation since it all depends on the agreement of the involved parties.

Approaches to Value

There are three basic approaches to determining the value of a property. These are what we know as the Income Approach, Market Approach, and Cost Approach. The method used to valuation depends on the data that’s available as well as the circumstances of the property.

Income Approach

Income Approach is one of the valuation methodologies which determines the value by considering the potential profitability of the property. This approach is usually applied to commercial and investment properties which are income-producing properties. The most used valuation method that best applies the income approach is the Discounted Cash Flow (DCF) Valuation. It’s a method used to determine the value by considering the forecasted cash flows which are then discounted to the present value of the property.

Market Approach

The market approach is the next valuation approach that determines the value of a property by taking into account the value of comparable properties or historical transactions. This approach is beneficial when capturing the market sentiment while considering the peers, thus, it determines if there’s a relevance between the economic value and the potential selling price of the property. Thus, it is quite popular among appraisers. The valuation method that applies the market approach is the Relative Valuation Comparisons. It is the method to determine the value of a property by conducting a market analysis regarding the pricing of similar properties.

When conducting a valuation using the market approach there are certain basic steps that one needs to go through.

- Research the market to gather data regarding the sales of comparable properties. In other words, conduct a market analysis.

- Investigate the accuracy and reliability of the data gathered.

- Determine the relevant factors for comparison to create a comparative analysis for each.

- Start comparing the property to be sold or purchased with the sale of comparable properties while considering the factors that will bring changes to the resulting value, thus, adjust as needed.

- Find balance in regards to multiple resulting values from the adjustment. In the end, the property should be priced in the same range compared to the market in order for the pricing to make sense.

Here are the relevant factors for comparison to develop a comparative analysis:

- Price per sqm – value is determined by comparing the price per measurement of area/space (applies for commercial buildings but also for residential apartments)

- Price per room – value is determined by comparing the prices of rooms (applies best for residential apartments)

- Land prices – value is determined by considering the land prices paid in that area

- Rental rates – comparing the rental rates in that area with similar type of buildings (e.g. retail, office, production space, etc.)

- Calculation of the implied Gross Yield and Net Yields

- Gross yield is everything before expenses. To calculate the implied gross yield for the analysis, the following formula is used: Price / Gross rent of comparable buildings

- Net yield is when after you take into account the running expenses. To calculate the net yield for the analysis, the following formula is used: Price / Estimated Net Operating Income of the comparable buildings

To calculate how much rent you can achieve for a property depends on certain factors such as the type of property being offered, location and condition of the property, state of the rental market, and the supply and demand in the area. After considering these factors, you need to do a thorough look of your calculations to ensure that you didn’t make any mistake with the rental percentage then also get a clear understanding of all the expenses that will be incurred in the process such as mortgage repayments, maintenance costs, repairs, fees for caretakers, furnishings, insurance, etc.

Cost Approach

Cost Approach is the third classic approach to valuation that determines the value of the property by ensuring that the price would not exceed the cost to build an equivalent property. This approach is most appropriate for property appraising and for conducting a real estate property valuation. It is also considered as the easiest way to determine the value of a property since it refers to the data in the balance sheet and focuses on finding the value of cost to be expended rather than determining the total value of the property’s feasibility. The valuation methods that best apply the cost approach are the following:

- Replacement Cost – a method to determine the value of a property by considering the cost expended when replacing or reconstructing the property, thus, the replacement cost tend to be higher than the book value of the property since depreciation will not be accounted.

- Net Asset Value – in this method, the value is determined by calculating the net asset value of the property after taking into account the adequate depreciation of its age.

Each valuation method has its own advantages and disadvantages, but basically, each has its own focus which results in one goal, determining the value of a property. To ensure that you will get the best out of selling or purchasing properties, then you need to conduct real estate valuation by creating real estate valuation models. With real estate financial models, the whole process of valuation will be easier and a lot smoother. Since the real estate financial models are in a spreadsheet form, showing the numerical equivalent of the property, it will be easier for the users involved to arrive with a sound economic decision.

Real estate Financial Model Templates

If you’re looking to sell or purchase a property, make sure to properly research once you conduct your valuation. It is, after all, more beneficial to get the most out of the transaction and who would really say no to earning more or saving up some money? Especially nowadays when money runs the world, it is always best to have alternatives for extra income which will eventually be helpful for you and your family in the future. So, it is undeniable that the task of valuation is very critical when you’re planning to sell or buy a property. But of course, conducting a valuation will require you to have a substantial understanding of the market, thus, the need to research and help from an appraiser is also equally important.

As mentioned way above, another solution which can help you conduct a real estate valuation is to take advantage of ready-made real estate financial model templates. Creating real estate financial models can be complex, so without proper know-how and experience in financial modeling, the task will tend to take a long time to finish and might even contain mistakes. Therefore, by acquiring real estate financial model templates, the task will be a lot easier since all you have to do is to input the needed numerical data and customize the model according to your requirements. No more spending too much time and money for your property valuation, as long as you use the proper tools for creating real estate financial models.