IFRS-16 Transition Model

This module allows for a transition to use IFRS-16 in both accounting records and business planning on the corporate level. This will allow measurement of the impact of IFRS-16 implementation retroactively and going forward on a company’s financials.

– When building a financial model, rent cost is one major component in your financial projections.

– With the introduction of IFRS-16, projected income statements have shown a different split in expenses between rent, depreciation, and interest costs.

– With the adaptation of the standard in financial statements, even retroactively in many cases, it has become a requirement that financial models incorporate and apply IFRS-16 in all projections.

– This module allows for a transition to use IFRS-16 in both accounting records and business planning on the corporate level. This will allow measurement of the impact of IFRS-16 implementation retroactively and going forward on a company’s financials.

TIMELINE:

Monthly Periodicity for 180 months (15 years)

Annual Summary Output

Flexibility for financial year-end

CAPACITY

Model periodicity is monthly

Model timeline spans up to 15 years (180 months)

Up to 40 properties can be incorporated

CALCULATIONS

Timeline Flags and applicable discount factors

Present Value calculations for each property

Right-of-use Assets calculation [for balance sheet]

Right-of-use Liability calculations [for balance sheet]

Split of Short-term vs. Long-term ROU liabilities

Interest component calculation [for income statement]

Rent component calculation [for income statement]

Depreciation calculation [for income statement]

Consolidated Annual Summary

AUDIT

Full amortization of ROU Assets/Liabilities over the lifespan of the property.

Similar Products

Other customers were also interested in...

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

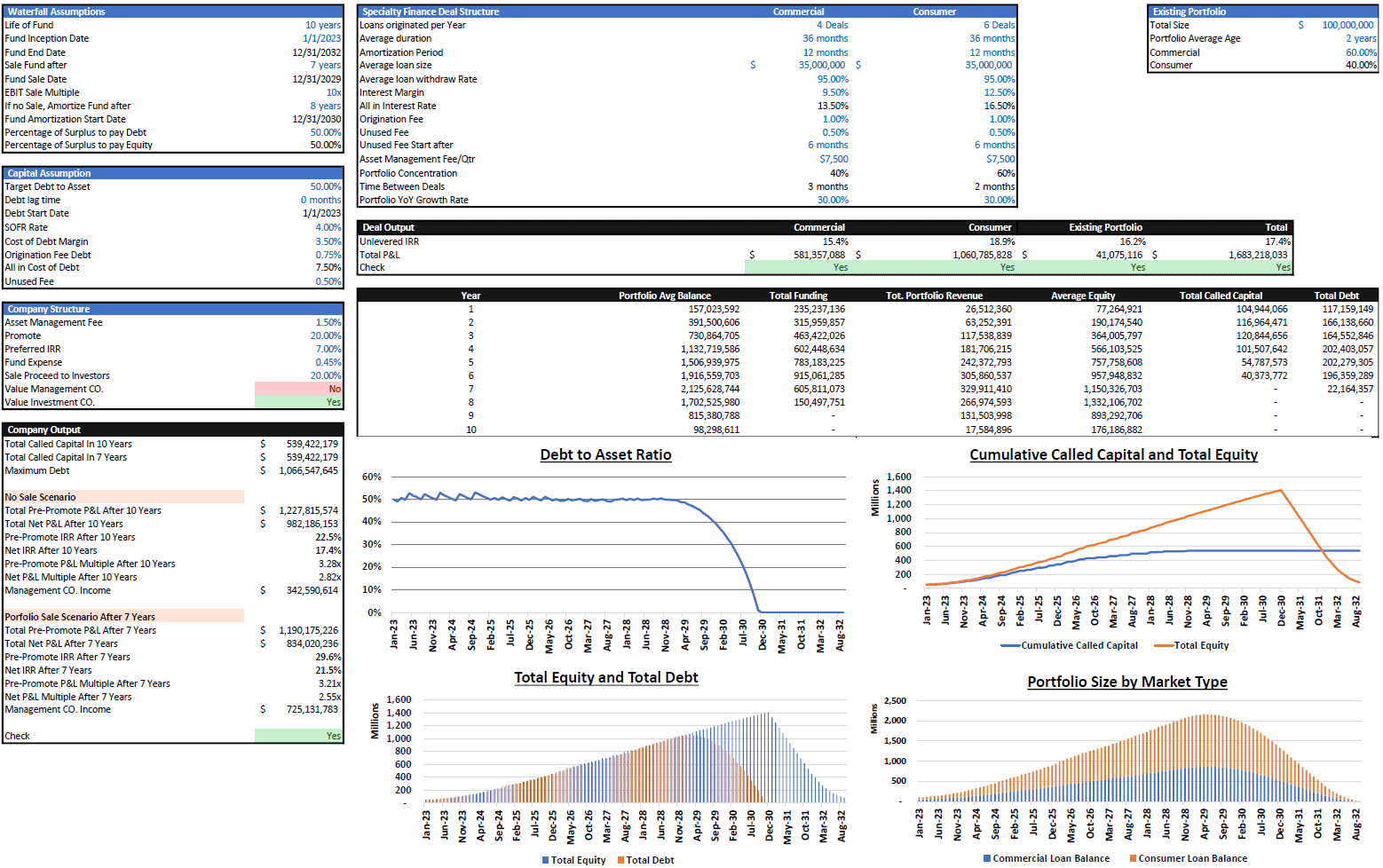

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Investment Fund Preferred Return Tracker: Up to 30...

Track preferred returns for investors in a fund with this template. Premium joint venture tracking t... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

Asset Management Company – Closed End Fund M...

Financial Model presenting a scenario of a Closed-End Fund managed by an Asset Management Compan... Read more

Mergers and Acquisition (M&A) Financial Projec...

User-friendly financial model to project and analyze the financial outcomes and feasibility of an Me... Read more

Bundle – Business Financial Forecasting Mode...

The purpose of this Bundle of Business Forecasting and Financial Models is to assist Business Owners... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

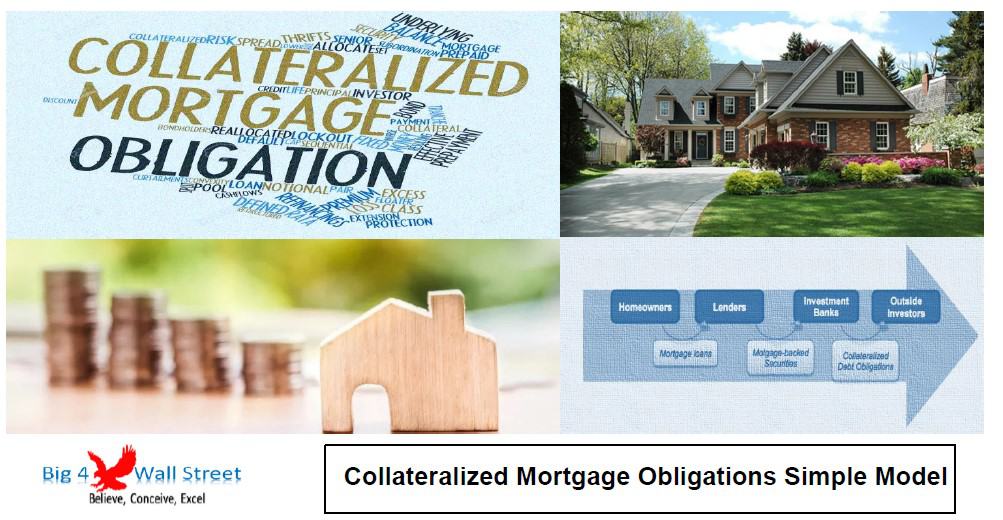

Collateralized Mortgage Obligations Model

Collateralized Mortgage Obligations Model presents a simple model where mortgage backed securities a... Read more

You must log in to submit a review.