Business Consulting Services

At the crux of business consulting is the meticulous study of existing business processes, identification of areas for improvement, and formulation of actionable strategies that are both feasible and impactful. Our Excel financial model templates for business consulting services offer a robust foundation for analyzing business feasibility, preparing fundraising proposals, and developing long-term business strategies.

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Employee Retention Dashboard Excel Template

Tool for tracking and analyzing employee retention rates within your…

Recruitment Management Excel Template

Recruitment Management Excel Template, designed to streamline recruiting processes, e.g.,…

HR Expense Control Excel Template and Dashboard

Human Resources Expenses spreadsheet is a vital tool for effectively…

Human Resource Performance Metrics Template

This template offers an in-depth overview of key performance indicators…

Accounts Receivable Dashboard

Enhance Accounts Receivable Management with Excel Spreadsheet Template

Digital Hiring (Talent) Marketplace – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for an…

Consulting Industry Impact Measurement Tool

Supports the demonstration of difference made for Consultants, Accountants, advisors…

Stock Option Plan for Managers

Common practice stock options plan for companies and company managers.…

Financial Advisor / Financial Planner Financial Projection Model

5-Year 3-Statement Excel projection model for Financial Advisor / Financial…

Consortium Agreement for Professional Services Template

A Financial and Professional Services Consortium Agreement - Actual Example…

Tech/I.T. Services Company – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for an…

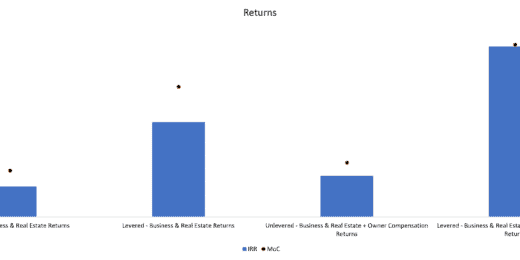

Real Estate Brokerage Business Plan with Return Calculation

Pro Forma Models created this model to analyze the financial return…

3-in-1 Templates: Accounting System in Excel

This is an easy financial statement creator based on various…

Law Firm Financial Model – Dynamic 10 Year Forecast

Financial Model providing a dynamic up to 10-year financial forecast…

Interior Design Firm Financial Model – 5 Year Financial Forecast

Financial model providing a 5-Year financial plan for an Interior…

Human Resources Company – Dynamic 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Staffing Agency Financial Model Excel Template

Staffing Agency Financial Model Allows you to start planning with…

Tax Preparation Financial Model Excel Template

Tax Preparation Financial Plan Enhance your pitches and impress potential…

Private Counseling Practice Financial Model Excel Template

Private Counseling Practice Pro Forma Template Based on years of…

Mobile Notary Financial Model Excel Template

Mobile Notary Financial Model Based on years of experience at…

Life Coaching Financial Model Excel Template

Life Coaching Pro Forma Template Based on years of experience…

Headhunter Financial Model Excel Template

Headhunter Pro Forma Template Enhance your pitches and impress potential…

Engineering Consulting Financial Model Excel Template

Engineering Consulting Budget Template There's power in Cash Flow Projections…

Fiduciary Service Business Financial Planning

The Fiduciary Service Business Financial Model aims to plan the…

Sustainability Policy for Financial Services – eBook Template

A complete example sustainability policy suite that can be adapted…

Data Entry Business Financial Model Excel Template

Data Entry Business Pro Forma Template Allows you to start…

Pricing Framework for Consulting and Wider Professional Services

Pricing Framework for Consulting, Financial Services and Wider Professional Services:…

Financial Feasibility Study – Business Consultancy

The report contains financial figures and essential literature modules such…

Impairment Test Simple Guide Model- CGU Value In Use Based

This model is extremely useful for M&A acquirers to test…

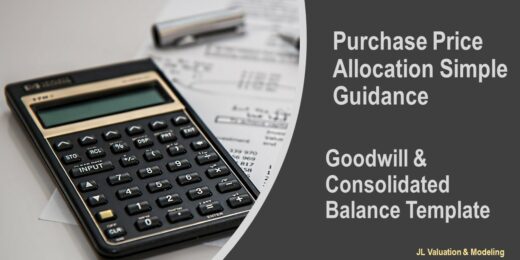

Purchase Price Allocation Simple Guidance + Goodwill & Consolidated Balance Sheet Template

This is a simple excel explanation model of Purchase Price…

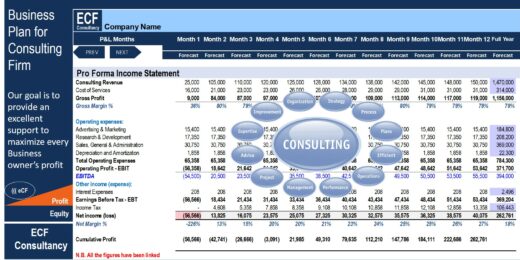

Consulting Firm Financial Model – Dynamic 10 Year Forecast

Financial Model providing a dynamic up to 10-year financial forecast…

Training Tracker – Human Resources Tool: Up to 499 Employees

A great tool for any HR manager that needs to…

Accounting Firm Financial Model – Dynamic 10 Year Forecast

Financial Model providing a dynamic up to 10-year financial forecast…

Daily Time Tracking Spreadsheet Dashboard

Free Get Daily Time Tracking Spreadsheet Dashboard for FREE for…

Human Resources Manager: Google Sheets Template

This is a stand-alone-template that is ready for data entry…

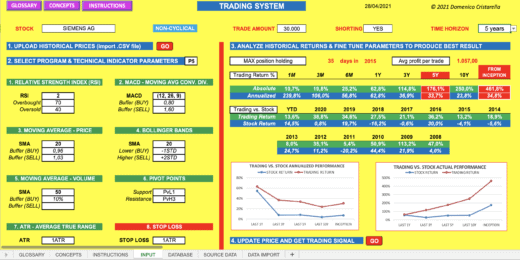

TRADING SYSTEM 2023 (fully editable, updated version)

Providing trading signals using mix of technical indicators and historical…

6 Different Financial Modeling Assessments/Tests for Investment Banking

6 different Financial Model Tests with one coming with a…

Professional Financial Modeling Services – Profit Vision

Professional Financial Modeling - Tailor Made Services and assistance for…

Custom Financial Modeling Services – Andrei

Professional financial modeling and business analysis services

Notary Financial Model Excel Template

Get Notary Budget Template. This well-tested, robust, and powerful template…

Legal Services Financial Model Excel Template

Buy Legal Services Financial Plan. Based on years of experience…

Event Planner Financial Model Excel Template

Purchase Event Planner Pro-forma Template. Create fully-integrated financial projection for…

Corporate Trainer Financial Model Excel Template

Order Corporate Trainer Financial Projection. Enhance your pitches and impress…

Business Brokerage Financial Model Excel Template

Check Business Brokerage Pro-forma Template. Includes inputs, outputs and charts…

Auditor Financial Model Excel Template

Discover Auditor Pro-forma Template. Allows you to start planning with…

Attorney Employment Agency Financial Model Excel Template

Try Attorney Employment Agency Pro Forma Projection. Fortunately, you can…

Architecture Firm Financial Model Excel Template

Get the Best Architecture Firm Financial Model. Excel Template for…

Mastering the Consulting Services Business Model: Strategies for Success

Warren Buffet's quote: "In the business world, the rearview mirror is always clearer than the windshield." Let's relate it to running a successful business where many challenges can arise. It highlights the importance of considering consulting services to help you navigate these obstacles. They are the rearview mirror in the business world.

The consulting services industry has emerged as a pivotal player, providing organizations with the expertise and guidance to navigate complex challenges and seize opportunities. "Let's delve into the heart of this multifaceted sector and comprehensively explore the strategies and principles underpinning success in the consulting world.

As businesses seek to adapt, innovate, and thrive in an increasingly competitive environment, this guide is an invaluable resource for consultants and aspiring entrepreneurs looking to excel in the art of delivering top-notch consulting services and driving transformative change for their clients.

An Overview of Business Consulting

Business consulting is a professional service provided by individuals or firms with expertise in various business management and operations aspects. The primary goal of business consulting is to help organizations improve their performance, solve problems, and achieve their strategic objectives. Business consulting services are crucial in assisting organizations to adapt to changing environments, improve their competitiveness, and achieve their goals.

Consultants can be invaluable partners in guiding businesses through complex challenges and opportunities, ultimately contributing to long-term success. They can gather and analyze data to make informed recommendations. With a keen understanding of industry trends and best practices, they can find innovative solutions to complex challenges.

Common Types of Consultants

Among the most common types of consultants are:

- Financial Consultant: These consultants offer advice on financial matters, helping individuals or organizations manage their finances, investments, and budgeting. Financial modeling consultants specialize in creating mathematical models to forecast financial outcomes.

- Human Resource Consultant: HR consultants assist businesses with their human resource needs. They guide talent acquisition, employee relations, training and development, compensation, and HR policies to ensure efficient workforce management.

- IT Consultant: Information Technology consultants advise on technology-related issues. They help businesses implement, maintain, and optimize their IT systems, ranging from software and hardware solutions to cybersecurity and network infrastructure.

- Legal Consultant: Legal consultants provide expertise on legal matters. They may assist clients with legal research, contract review, compliance issues, and general legal advice, often failing to deliver full-scale legal representation.

- Marketing Consultant: Marketing consultants help companies develop and execute marketing strategies to promote their products or services. They may focus on market research, branding, digital marketing, and advertising campaigns.

- Project Management Consultant: Project management consultants specialize in overseeing and improving project management processes. They assist organizations in planning, executing, and monitoring projects, ensuring they are completed efficiently and within budget.

- Sales Consultant: Sales consultants offer guidance on sales strategies and techniques. They help businesses enhance their sales processes, train sales teams, and improve customer relationship management to boost revenue.

- Strategy Consultant: Strategy consultants work with organizations to formulate and execute strategic plans. They analyze market dynamics, competition, and internal capabilities to develop strategies for growth, market entry, or other key objectives.

Each consultant type brings expertise to address particular business needs and challenges. Businesses hire consultants to temporarily access specialized knowledge and skills, allowing them to benefit from external insights and experience.

Frequently-Requested Consulting Projects

Again, there are many projects that consulting firms practice, as each industry or client has their own quirks. However, there are specific consulting projects frequently requested by clients. These include the following:

Business Diagnostic

This type of project involves fast profile development to assess a company or business unit. Often, it is an excellent way for executives to get an overview of the business and understand what needs attention. Usually, the duration of projects is very fast, short-term (3 months at most), and highly analysis-driven. This project often focuses on the range rather than the profundity of a business. Also, a lot of competitor benchmarking will be conducted to understand the standing of your client compared to peers in the industry. Continuous work is possible after the project is done, e.g., follow-up works to go in-depth and more detailed analysis.

Cost Reduction

Another type of consulting project is helping clients to streamline costs. The range of the sources could be production overhead reduction, switching to better-advanced equipment or less cost raw materials, procurement expense reduction, overhead reduction, etc. Being an outside party, the consulting firm will significantly help the client make objective decisions with no bias for the client. This project will rely on the results of a Business Diagnostic to check which areas the company is overspending. The consulting firm might touch upon the Spans and Layers Analysis to help determine which costs need to be cut and how to proceed. Contract negotiations might also be encountered in cases where the client needs help with procurement cost reduction. The cost-reduction project’s duration varies since it might involve a lot of meetings, interviews, etc.

Customer Retention/Churn

The projects for Customer Retention and Customer Churn are similar. Primarily, the consulting firm will help the clients identify the current customers they are likely to retain, as well as potentially lose, and help determine the factors on how to keep more customers that clients want to keep. The consultants will analyze to understand better the state of the client's customer base, e.g., customer lifespan, annual churn rate, profitability per client, and root causes of churn. The main tasks would be conducting customer surveys and in-depth microeconomic analysis of the customers' decision-making. Then, they will help prescribe ways to convince churning customers to stick with the client. A lot of interaction with a client's customers and a fair amount of client interaction will be done in this project, which doesn't last that long, depending on the project's complexity.

Growth Strategy

It is one of the most classic types of consulting projects that most firms do for a living. This type of project often handles problems in cases like:

- What kinds of products should they be marketing?

- Which products to let go of?

- How to increase the market share?

Usually, the projects are more short-term and involve significant analysis, e.g., competitor profiling, customer surveys, interviews, SWOT analysis, etc. All in all, it depends on what kind of specific growth issue needs to be resolved, and meetings likely happen for as low as once per month.

Post-Merger Integration

The process of buying a company is more complex than it sounds. Aside from multiple chains, IT systems, customer loyalty programs, head management (positions), etc., many more processes need to be handled, hence the need for consultants. These projects are large in scope and for longer-term post-merger work. Also, when it’s a significant acquisition, multiple consulting teams will work on different areas of the Post-Merger Integration project.

Private Equity Due Diligence

Another classic consulting project is where Private Equity firms request consulting firms to assist with the due diligence of target companies. Private Equity firms can do interviews and create deal models. However, they still hire consulting firms to help them provide some input in the private equity due diligence process. In a private equity due diligence project, the consulting firm will act as an ‘extra pair of eyes’ or ‘backseat driver’ to the Private Equity firm. Projects like these usually last for almost a year and are fast-paced, with a heavy workload and client interaction.

M&A Due Diligence

M&A Due Diligence, or mergers and acquisitions due diligence, is a comprehensive investigation and analysis process conducted by a buyer to evaluate a target company's financial, operational, legal, and strategic aspects before completing a merger or acquisition. An M&A due diligence process aims to assess the risks and opportunities associated with the transaction and ensure that the buyer understands the target's assets, liabilities, and overall health to make informed decisions and negotiate favorable terms. This consulting project involves analyzing a target acquired by a strategic investor, e.g., a company in the same industry. It is similar to private equity due diligence, where the company can do most of the tasks needed to acquire a company. Still, the consulting firm will significantly help the transaction process.

Organizational Design

Consulting firms work on different types of organizational projects. The first type of project is conducting a corporate re-design, e.g., region-based to global-based structure. In this project, the work will be very intensive and direct interaction with the client to finalize and decide a new Organization Chart with the right new roles. The following type of Organizational Design project is a Spans and Layers Analysis, where consultants evaluate the span of the management level at each segment in the organizational chart — helping to determine the area of opportunities to reduce headcount or reorganize positions. Another kind of project involves decision-making and culture. In this project, the consulting team will likely conduct a RASCI model or a comparable model to determine critical decisions that need to be executed, who is currently in charge of that task, and who should be in control.

Why Do Consultants Need Financial Models?

Many projects in a consulting services business involve business valuation and profiling. What works best as a tool to understand those tasks? – building a financial model. With a financial model, not just the consultants but also the client will understand faster why the consultants came about their advice. There are many other reasons why a financial model is an essential tool for consulting companies, so we listed below the standard models they build and use in their work.

Valuation Models – These are often conducted to evaluate a business targeted by the client and the client’s business standing thoroughly. A valuation model makes it easier to see whether the company is profitable and worth investing in.

Cost Models – Consulting firms do many tasks in a project, and one of them is conducting comparisons and research of the inner operations of a business. Using a cost model helps the consultants determine how different costs will develop based on the objective of their project, e.g., sales projections, restructuring, reorganization, cost-cutting measures, post-merger synergies, etc.

Pricing Models – This model will help determine how to price the products based on the chosen strategy or through competitor pricing comparison. Building this model is very convenient, for it will show the numbers needed as proof.

Sales Models / Product Line Profitability – Like cost and pricing models, sales models help determine how profit would develop as the client adds a new product or enters a new market for their business. Conducting a projection of future sales will serve as a reference to whether it is plausible and profitable for the client to add new products or enter a new market. The in-product line profitability model will help evaluate if the current product line is suitable the most after allocating resources, e.g., which ones need to be discontinued, which needs to be pushed more to expand, etc.

Distribution Models – Consultants use the models as a reference to help their clients decide in certain distribution cases, e.g., which warehouse to prioritize or close based on location and the running costs it’ll incur.

Organization Models – To evaluate the organizational structure of a business, this kind of model is built, e.g., analyzing how many subordinates and levels of hierarchy.

Full Financial Models – Though professional financial modelers usually do this, some consultants create financial models when the project demands one, e.g., restructuring financial services clients.

Listed above are just a few of the many more uses for financial models in a consulting services business. So, it is undeniable that using a financial model is a very convenient tool for this kind of business and Industry.

Creating Consulting Services Business Models

Creating consulting services business models is a time-consuming task, or it needs a lot of preparation, research, data gathering, and calculation. It’s a good thing that you can skip the tedious work of creating a consulting services business model just by downloading financial model templates that you can use as the framework of your business model.

If you need a financial plan for your consulting firm or need consulting financial model templates to designate your expenses efficiently and in a way where your firm is bound for financial stability and feasibility, listed above are Excel financial models and financial model templates to get you started in your business in any professional service firms, including consulting firm financial models that you can use.

Save your time building consulting services business models from scratch using these ready-made Excel templates, and start creating your business plan efficiently.

If you are looking for a specific financial model template and can't find it in our inventory, feel free to comment here: Missing Financial Model Templates, so that our vendors will pick up that project and will soon add to our still-growing list.

If you found the template but need help with customization of your preference, we also offer financial modeling services, which you can avail of here: Custom Financial Modeling Service. We are expert financial modeling consultants who can help you.

We would be grateful if you also rate our Excel models and leave a review, comments, suggestions, or any feedback about our financial model templates, for this will greatly help us shape our templates to be even better in the future.