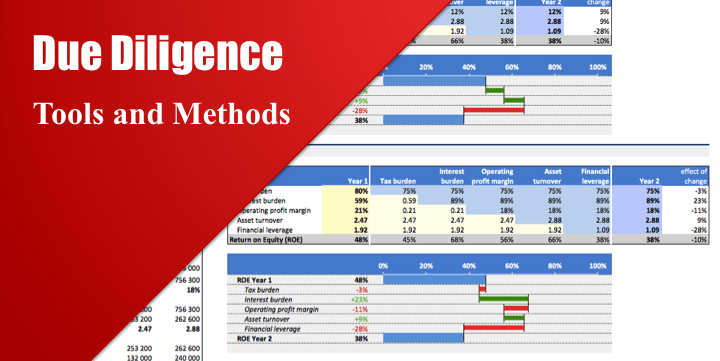

Due Diligence Tools and Methods

A suite of best practices to perform financial and commercial due diligence. Use it if you are considering a company for potential acquisition or analysing your existing company’s operations. The publication is available in two versions: 1. A free demo version with all formulas replaced with hard numbers and charts – with pictures. 2. A full version with all formulas and charts. Also includes a detailed text guide with details and explanations.

A prospective investor is concerned about the target’s:

1. Quality of earnings

2. Adequacy of working capital

3. Unrecorded or contingent liabilities.

We call upon due diligence to analyze these areas and, in a broader context, to understand the business of a company, its risks, and prospects. These objectives define the scope of due diligence and bring about a range of tools, methods, and techniques to perform the analysis.

The attached bundle includes forms and templates which I have developed during my years in buy-side private equity and investment advisory. Many of them are quite cross-functional and can be used in regular reviews of business performance. They will serve as transaction price adjustments, areas for further investigation, or a negotiation piece in your discussions with sellers. A few highlights to mention:

● Complex Financial Statement Analysis

– DuPont Analysis

– Profit Variance Analysis (Bridge Charts)

– Sources and Uses of Liquidity

● Income Statement Analysis

– Overall Sales Analysis (Quality of Earnings Schedule, Like-for-Like Analysis)

– Seasonality (creating a cycle plot chart, de-seasonalizing sales, and calculating seasonal adjustments)

– Product Analysis (Key Portfolio Statistics, Product Profitability Distribution, Profit Variance Analysis by Product, Price-Volume-Mix Analysis, Product Ramp-up)

– Customer Analysis (Attrition (Churn) Analysis, Contract Expirations, and Pipeline, Customer Concentration)

– Employee Analysis (Employee Cost Summary Schedule, Headcount and Salaries, Employee Turnover and Retention, Employee Headcount Statistics)

– Budgeting And Forecasting (Assessing Budget Accuracy, Defining Scenarios Based on Historic Volatilities, Building a Trend Forecast, Interim Budgets, Current Forecast Status by Products, Estimating Reasonableness of the Outlook)

● Balance Sheet Analysis

– Fixed Assets (Fixed Asset Roll Forward, Capex Detalization Schedule)

– Inventory (Inventory Structure, Inventory Movements, and Balances, Days Inventory Outstanding, Inventory Seasonality, Inventory Aging)

– Cash (Cash Conversion Cycle (CCC))

– Net Working Capital

– Net Debt (Debt and Debt-Like Items)

As such, you will find it useful if you are:

– considering a target for potential acquisition

– assisting your client with a potential M&A transaction

– analyzing the performance of a company you work for

– trying to understand your business better

– learning how to carry out due diligence

The Excel file is accompanied by a detailed text guide. Feel free to reach out if you have any questions about any of my products.

Similar Products

Other customers were also interested in...

Accounting Firm Financial Model – Dynamic 10...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Accou... Read more

Consulting Firm Financial Model – Dynamic 10 Yea...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Consu... Read more

Bookkeeping Agency Financial Model Excel Template

Try Bookkeeping Agency Financial Plan. Allows you to start planning with no fuss and maximum of help... Read more

Financial Advisor / Financial Planner Financial Pr...

5-Year 3-Statement Excel projection model for Financial Advisor / Financial Planner business generat... Read more

Startup Business Plan – Consulting Firm

If you dream to start a Consulting Firm Business, the template is the first step in making your drea... Read more

Financial Advisors Agency Financial Model Excel Te...

Shop Financial Advisors Agency Pro-forma Template. Creates 5-year financial projection and financial... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Law Firm Financial Model – Dynamic 10 Year Forec...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Law F... Read more

Fiduciary Service Business Financial Planning

The Fiduciary Service Business Financial Model aims to plan the financial feasibility and profitabil... Read more

Reviews

I found the model very useful and comprehensive, which helped save time.

12 of 25 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.