Financial Ratios Analysis and Its Importance

Dive into financial mastery with our comprehensive guide to financial ratios analysis and its importance in sculpting business success. This blog unravels the tapestry of numbers and metrics that form the backbone of any thriving enterprise, shedding light on how these crucial indicators can forecast financial health, drive strategic decision-making, and unlock the doors to profitability and sustainability.

Whether you’re a seasoned investor, a budding entrepreneur, or simply curious about the financial gears that move the corporate world, this exploration into financial ratios will equip you with the insights needed to navigate the financial landscapes confidently and fully. Join us on this enlightening journey as we decode the significance of financial ratios and transform complex data into actionable wisdom.

Financial Ratios Definition

The financial ratios definition involves quantifiable metrics derived from a company’s financial statements, such as the balance sheet, income statement, and cash flow statement. These ratios measure the relative value of two or more financial figures, providing insight into a company’s performance, financial health, and operational efficiency. They allow a better understanding of a company’s financial situation, and often, banks, investors, and management require them to understand its financial statements. Financial ratios can be calculated based on historical figures but are also widely used as input parameters when building a financial statement forecast.

Financial ratios analysis involves evaluating these ratios to make informed judgments about a company’s financial condition, operational efficiency, and future performance. This analysis helps investors, creditors, and management understand the company’s strengths and weaknesses by comparing current and past performance and benchmarking against industry averages or competitors. The financial ratios definition is a fundamental practice in financial analysis for trend analysis, strategic planning, and decision-making. It offers a comprehensive view of a company’s financial health and potential for growth and profitability.

Furthermore, the financial ratios definition also involves grouping financial ratios by their purpose as follows:

- Liquidity Ratios

- Efficiency Ratios

- Profitability Ratios

- Growth Ratios

- Leverage Ratios (Bank Ratios)

The Importance of Analyzing Financial Ratios

Analyzing financial ratios is pivotal for stakeholders across various aspects of business operations and decision-making processes. Here’s a breakdown of the importance of financial ratio analysis in different contexts:

Benchmark Financial Ratio Averages by Industry

Analyzing financial ratios against industry averages provides valuable insights into a company’s relative performance. Industries have unique operational characteristics, and financial ratio averages by industry help identify strengths, weaknesses, and competitive positioning. Understanding these nuances by analyzing financial ratios aids in evaluating a company’s efficiency, profitability, and risk management practices against its peers.

Financial Ratio Averages by Industry

Below we included the industry average for the financial ratios of comparable companies with the same industry in which our manufacturing company operates. This gives us a benchmark and allows us to assess how our company performs in comparison to its industry peers.

Funding Requisite

Financial ratios are crucial for assessing a company’s creditworthiness and financial health, which are key considerations for investors and lenders. Ratios related to liquidity, solvency, and profitability inform potential funding sources about the company’s ability to meet its short-term obligations, manage its debt levels, and generate sufficient returns. This analysis supports funding decisions, influencing the terms and availability of external financing.

Market Valuation

Ratios such as price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) are integral in determining a company’s market valuation. Financial ratio averages by industry help investors and analysts gauge whether a stock is undervalued or overvalued relative to its earnings, assets, or sales. Market valuation through financial ratios analysis is essential for making informed investment decisions and assessing the attractiveness of a company’s shares in the stock market.

Performance Management

Analyzing financial ratios internally is a tool for performance management. They enable management to track operational efficiency, financial stability, and profitability over time. By monitoring trends in critical ratios, management can identify areas needing improvement, track the impact of strategic initiatives, and adjust operations or strategy to optimize financial performance.

Strategic Decision-Making

Financial ratio analysis is instrumental in strategic decision-making. It provides a quantitative basis for evaluating strategic options, allocating resources, and pursuing growth opportunities. Ratios related to return on investment (ROI), return on equity (ROE) and return on assets (ROA) inform decisions on investments, expansions, mergers and acquisitions, and other strategic moves, ensuring that such decisions are aligned with the company’s financial goals and shareholder value creation.

Analyzing financial ratios is essential to comprehensively understanding a company’s financial condition and performance. It supports external comparisons, funding decisions, market valuation, internal performance management, and strategic decision-making and is thereby critical to business management’s operational and strategic aspects.

Financial Ratios Cheat Sheet for Financial Ratios Formulas

We have collected a comprehensive list of financial ratio formulas in the form of a financial ratios cheat sheet. These financial ratios formulas can be used as a quick reference guide whenever you need to analyze a company’s health and need the financial ratios definition at hand. Each formula is explained below.

You can download this financial ratio cheat sheet here.

We will now use the financial ratio formulas mentioned in the cheat sheet and follow their definitions to perform our financial analysis. We systematically review the ratios in our five categories: liquidity, efficiency, profitability, growth, and leverage.

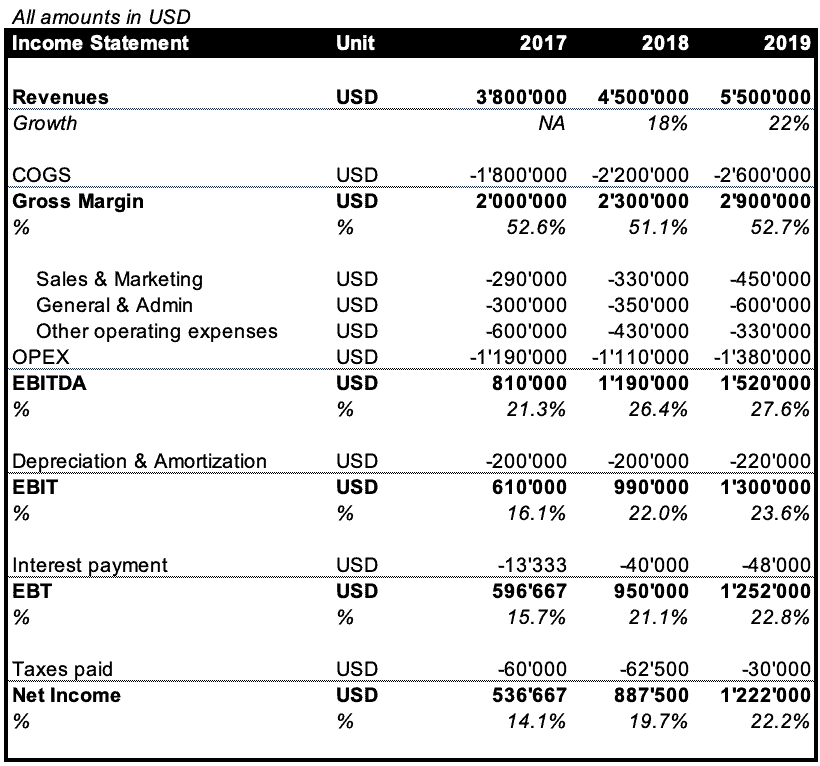

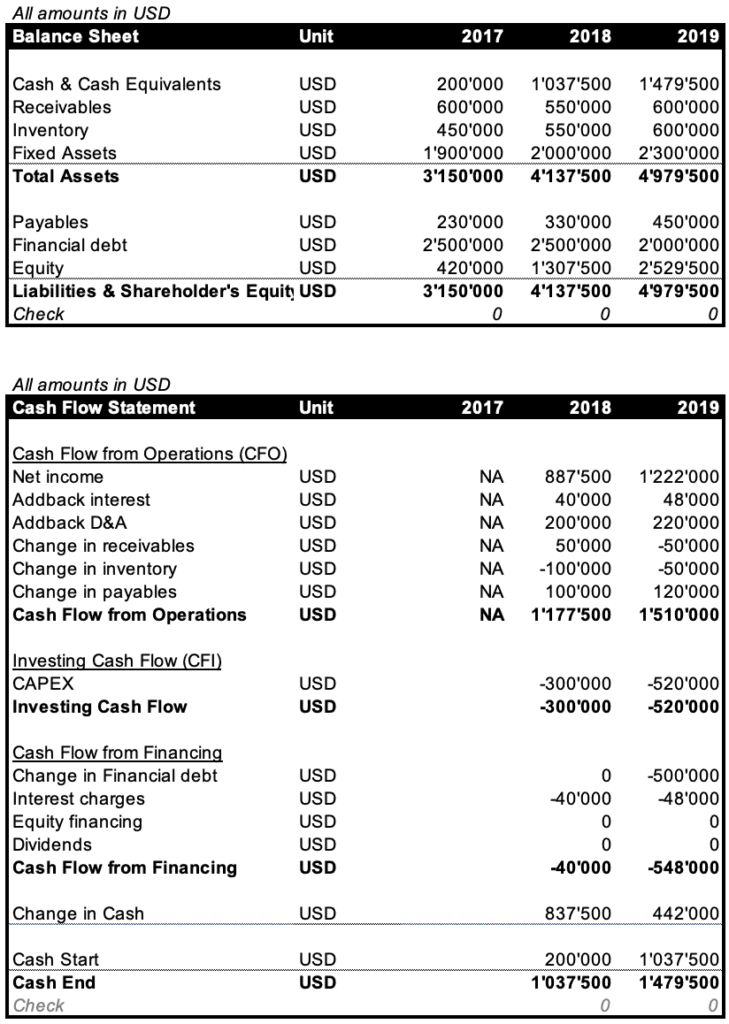

Below we present the Financial Statements – Income Statement, Balance Sheet, and Cash Flow Statement of a manufacturing company. In short, the company generates $5.5m in revenues at an EBITDA margin of 27.6%. Operating cash flow is positive while the company has to invest every year in the maintenance and upgrade of its machinery park. The company also uses Financial Debt which shows up on the Balance Sheet.

To better understand these financial statements, we will calculate all the relevant financial ratios to get a better picture of this company’s financial and performance situation. Our financial analysis will follow the list of financial ratios mentioned in the cheat sheet. We will also need benchmark data of financial ratios by industry so that we can easily compare how our company performs compared to industry peers.

1. Liquidity Ratios

Liquidity ratios measure the capability of the business to pay its obligations, whereas we focus on the current liabilities (liabilities that are due to be paid within one year). Businesses need a certain amount of cash and other current assets to finance the business operation. They assess the company’s capacity to meet its current obligations without requiring additional capital.

Cash Ratio

The cash ratio is computed by taking the cash and cash equivalents divided by the current liabilities. It measures the capacity of the business to use the most liquid assets to pay short-term obligations. Cash and cash equivalents are the business value in a worst-case scenario in case the other current assets could be converted into cash. Cash equivalents include marketable securities and money market holdings.

In our example, the company has cash & cash equivalents of $1.48 million for the latest year with current liabilities of $0.45 million. The cash ratio computed is 3.3x, which means that the company has more than enough cash & cash equivalent to fulfill the current financial obligation. It shows that the business has excess cash not utilized in operation, which going on since 2018 (when the cash ratio exceeded 1.0x). A minimum cash ratio depends on the industry, but a cash ratio of 0.8x is a reasonable minimum target.

Quick Ratio (Acid-Test Ratio)

The Quick Ratio or the Acid-Test ratio is computed by dividing the Cash & cash equivalents + Receivables (or current assets less inventory) by the current liabilities. Inventory is taken out since it takes more time to dispose of compared to receivables where they normally can be collected quicker. The Quick Ratio is a more conservative approach than the current ratio, and a minimum ratio of 1.0x is desirable for current obligations that can be paid quickly from cash and receivables if needed. There are two financial ratio formulas that can be used:

On our Balance Sheet, the Company has cash & cash equivalent of $1.48 million in 2019, accounts receivable of $0.6 million, and an inventory amounting to $0.6 million for 2019. On the other hand, current liabilities are $0.45 million. It means that the computed Quick Ratio results in 4.6x, which implies that the business has more than enough quick assets to meet its current obligations. Having a high ratio is not a reasonable implication for the business since it does not efficiently utilize its assets and would indicate that the company lacks opportunities to find profitable investments in other ventures.

Current Ratio

The current ratio measures the company’s capacity to meet its short-term liabilities (the liabilities that are due to be paid in one year). The current assets include cash & cash equivalents, accounts receivables, and inventory. The current ratio is computed by taking the current assets divided by the current liabilities. Benchmark ratios depend on the industry, and a manufacturing company’s standard ratio would be somewhere around 2.0x. It would mean there should be around two current assets to pay for one current liability. A lower than one current ratio could mean that the business will have difficulties meeting its short-term obligations and require a cash injection (either from a bank or from shareholders). A higher than two or three current ratios suggest that the company has excess current assets that could be better invested in other ventures (since so many assets are not really needed). The financial ratio definition is as follows:

Based on the balance sheet above, the company has current assets amounting to $2.68 million and current liabilities of $0.45 million in 2019. It means that the current ratio is 6.0x, which is much higher than the desired 2.0x. The business had high current ratios for the past three years. It does not invest the excess current assets and sits idly within the company.

2. Efficiency Ratios

Efficiency ratios measure the efficiency of the business in how to run its operations. The most common efficiency ratios focus on how networking capital is managed and how efficiently assets are being used.

Days Inventory

The inventory days are derived by dividing the inventory by the costs of goods sold (COGS), then multiplied by 365 (the number of days in a year). This efficiency ratio is used to determine how long it takes for the inventory, including the works in progress, into sales. It also measures the company’s efficiency in terms of warehousing, distribution, and the timing of purchasing new inventory. The shorter the inventory days, the better since it implies that the business can produce another production cycle.

The average inventory amounts to $0.60 million, and the costs of goods sold amounted to $2.60 million in 2019. Both inventory and COGS have increased throughout the years. Given the figures above, the computed days in inventory are 84 days, which can be considered a high ratio compared to the industry average of 50 days as calculated in the financial ratios by industry. It means that the company stocked up inventory for almost three months before it disposed of it and turned it into cash. The day’s inventory needs to be improved. As the Days Inventory was already reduced from 2018 (91 days) to 2019 (84 days), most likely, efforts were initiated but not enough to meet competitors’ standards.

Days Receivables

The day’s receivables (or days sales outstanding) are the average number of days it takes for the accounts receivable to be collected. It depicts the company’s efficiency in collecting payments from its customers. The faster payment can be collected, the more cash is available for day-to-day operations. The targeted day’s receivables vary from industry to industry but should be near the average credit terms provided for the company’s customers. As per the financial ratio definition, days receivables are computed by dividing the accounts receivable over net sales, then multiplied by 365 days.

Given the accounts receivable of $0.60 million and net sales of $5.50 million for 2019, the calculated day’s sales outstanding is 40 days. The turnover has decreased in the past three years, 58 days in 2017 and 45 days in 2018, respectively, suggesting that the collection system has improved. If we compare to the industry average (50 days), the company (40 days) now actually manages receivables more efficiently than its peers. This would be a sign of good management.

Days Payables

Days Payables is computed by dividing the accounts payable by COGS, then multiplied by 365 to get the length of time it takes for the company’s bills and financial obligations to be paid. Desirable days payable depend on industry standards and good relationships with creditors. A low ratio can indicate that the business applies shorter credit terms than its competitors or that it is not fully utilizing the terms offered by creditors. On the other hand, the high ratio suggests that the company has better credit terms than its competitors or has limited ability to pay the current obligations on time. A high ratio can be beneficial, given that the company can use the cash for other activities such as investment. However, it can jeopardize the business’s credit rating and lead to higher purchasing costs when suppliers realize that their invoices do not get paid in time.

The accounts payable for 2019 are $0.45 million, and the COGS is $2.6 million, translating to 63 days of turnover. Days payable outstanding for 2017 and 2018 are 47 days and 55 days, respectively. Either the company is in a favorable position to demand longer credit terms, or, in some cases, it would indicate that the company is using payables to finance its operation. Also, our analysis of financial ratios by industry shows that the days payable are longer than the industry average of 30 days.

Cash Conversion Cycle (CCC)

The cash conversion cycle measures how fast the inventory turns into cash. It includes the working capital accounts, which are the inventory, receivables, and payables. The day’s inventory and receivables are added, and then the days payable are used to compute the cash conversion cycle. The shorter the CCC, the better since more products can be sold in a particular time and then produce another production cycle.

As computed above for the year 2019, days inventory is 84 days, days receivable is 40 days, and the days payable is 63 days. It translates to 61 CCC, which means that it takes 61 days to purchase inventory, sell products on credit, collect cash, and pay outstanding payables. It is higher than the industry benchmark of 55, which means that the cash conversion cycle should be improved.

Asset Turnover Ratio

Asset turnover is an indicator of how efficient the company is in using assets to produce sales. It is computed by taking revenues and then dividing them by the total assets. Higher ratios indicate that a company uses its assets more efficiently to generate revenues. Conversely, lower ratios than competitors need further investigation and analysis to determine how the company can utilize the assets properly to produce more output that turns into sales.

For 2019, the company recorded net sales of $5.5 million and the value of its total assets of $4.98 million. It provides an asset turnover ratio of 1.1x, which means that per dollar of assets, $1.1 in revenue can be generated. This is a good indicator that the business is appropriately utilizing its assets to generate more sales.

Effective Interest Rate

The effective interest rate is the effective interest rate paid by the company’s interest-bearing debt, taking into account all effects, including eventual compounding. It means that the more frequent the compounding period, the higher the effective interest rate. A higher effective interest rate is profitable for the lender but more interest to pay on the debtor. The interest payment is divided by the average interest-bearing financial debt to compute the effective interest rate.

In our example, the company has paid interest amounted to $48K for 2019 and financial debt of $2.5 million and $2.0 million for 2018 and 2019, respectively. With the given figures, the computed effective interest rate is 2.1%. A low-interest rate indicates that using debt financing benefits the company as much as the interest is cheap. A high-interest rate would indicate that using debt financing adds significant stress on the company and, therefore, might require de-leveraging.

Effective Tax Rate

The effective tax rate is the average tax rate paid by a company. It is computed by taking the tax paid divided by earnings before tax (EBT). Investors and analysts use this ratio to analyze business efficiency in generating income and how much is allocated from earnings to pay for tax obligations.

Considering that the company’s tax obligation for 2019 is $30K and the EBT is $1.25 million, this translates to a 2% effective tax rate for the corresponding year. It means that the tax obligation is only a small percentage of the business cash outlays and doesn’t affect the earnings.

3. Profitability Ratios

Profitability ratios evaluate the company’s capacity to generate profits relative to its revenue, assets, cash flow, and equity. These ratios are the financial ratio formulas most looked at by investors since they tell them how much they can earn by investing in the company. The higher the profitability, the better.

Gross Profit Margin

It is computed by taking the gross profit and dividing it by net sales. This ratio entails how effective the company is in earning profit after deducting the cost of goods sold or the service industry’s revenue costs. A high gross profit margin shows that the business can sufficiently cover its direct costs (direct expenses when producing goods and services).

The Company shows net sales of $5.5 million for 2019 and 2.9 million in gross profit. This results in a gross profit margin of 52.7% percent. It means that only 47.3% is spent on COGS. A 52.7% gross profit margin is considered a high margin compared to industry standards.

EBITDA Margin

EBITDA is the earnings after deducting all production costs and operating expenses, excluding interest, taxes, depreciation, and amortization. The EBITDA margin is derived by taking EBITDA and then dividing it by net sales. It is more comparable to using with competitors since it only considers the operating costs on a cash basis, which can be similar to the competitors.

The company generates an EBITDA of $1.52 million for 2019 from a $5.50 million net sale. The EBITDA margin is computed at 27.6%. It can be considered a higher return compared to the industry average of 15%, per the industry analysis. Also, many other industries show EBITDA margins between 10% – 15%.

Net Profit Margin

Production costs, general and administrative expenses, interest expenses, taxes, and depreciation are deducted to derive net income, which is then divided by net sales. Though this ratio could be a valuable tool for internal use to assess how much is left after removing all the costs, the net profit margin is not a fair comparison with competitors since businesses have different financing structures.

Considering a net income of $1.22 million for 2019 after deductions of all expenses from the net sales of $5.50 million, the company’s net profit margin translates to 22.2%. The company’s net profit margin has been increasing for the past three years, 14.1% and 19.7% for 2017 and 2018, respectively. Increasing net profit margins show the stability of business earnings.

Return on Assets

The return on assets is derived by taking the net income + interest divided by the average assets. It measures the business’s efficiency in generating profit by optimizing its assets. The return on assets is a valuable ratio in evaluating asset-intensive companies such as telecom and car manufacturers since it assesses if they are correctly utilizing their assets to generate more profit. The financial ratio definition is as follows:

In 2019, the Company had a $1.22 million net income with an interest obligation of $48K. The assets of 2019 ($4.98 million) and 2018 ($4.14 million) led to an average asset position of $4.56 million. With these figures, the return on assets is computed at 27.9%. It can be assessed that the business is appropriately utilizing its assets to produce desired earnings.

Return on Equity

The return on equity is looked at from the shareholders’ point of view and is computed by dividing the net income by the average shareholders’ equity. The higher the return, the better it is for the investors since profits can either be used to pay higher dividends or reinvested to grow the business. It also shows how effective the company is in utilizing its equity to produce earnings.

The Company’s net income was $1.22 million in 2019, while shareholders’ equity was $1.31 million and $2.53 million for 2018 and 2019, respectively. The computed return on equity is 63.7%, which means that every dollar of equity produces 64 cents. Therefore, the Company is appropriately utilizing the investors’ money to pay back dividends.

Return on Capital Employed

Return on capital employed measures how efficiently the company uses the capital employed in its operations, including net debt and equity, to produce earnings. It is computed by taking the Net Operating Profit Less Adjusted Taxes (NOPLAT), which is the same as EBIT adjusted for Pro-forma taxes, divided by the average capital employed. Capital employed is the amount of total capital invested in the business to use for the business operation and generate profit. It is calculated by adding Net Working Capital minus Cash plus Fixed Assets, which is the same as Net Debt + Equity.

The return on capital employed is a more meaningful profitability ratio to assess business performance since it considers both the capital invested by shareholders and debtors. The financial ratio formulas are the following:

Considering 2019, the company shows a NOPLAT of $1.29 million ($1.30 million EBIT—2% tax rate). Capital employed amounted to $2.77 million (2018) and $3.05 million (2019), averaging at $2.91 million. The resulting return on capital employed (ROCE) is 43.6% for 2019. This is much higher than any reasonable opportunity costs on the invested capital and shows excellent operating profitability of the company.

4. Growth Ratios

Growth ratios typically serve as an additional metric to determine a company’s success by measuring its ongoing growth rates. Successful companies usually keep growing, while those that stagnate or do not grow end up in trouble. Therefore, as a financial analyst, you want to understand if a company keeps growing and why.

Revenue Growth

Revenue growth, a metric presented as a percentage, is used to measure if the company is growing over time. An increasing trend means that the business is continually growing, while a decreasing rate could suggest an operational problem related to the sales department or the industry it belongs to is already slowing down. On the downside, this ratio excludes costs in the computation, which means it does not present the actual picture of the company’s operations and profits. To compute the revenue growth, divide the current revenue by the revenue of the previous period, and subtract one.

In our example, the Company’s revenue growth has been increasing for the past three years, which recorded 18.4% and 22.2% for 2017-2018 and 2018-2019, respectively. It means that the company is continually growing and also clearly exceeds the 5.0% annual revenue growth as per the analysis of financial ratios by industry.

EBITDA Growth

EBITDA growth is a good measure of profitability compared to its competitors and industry average as it takes into account the operating costs or cash flows in the analysis. Increasing EBITDA shows that the effect of cost-cutting efforts done by the company is working. An interesting situation is when revenue keeps growing but not EBITDA. It means one has to analyze the costs better as it can be costly to achieve further growth. Important then is to understand if the costs spent are likely to lead to higher profits later on or not. To compute the EBITDA growth, divide the current EBITDA by the EBITDA of the previous period and subtract one.

The Company’s EBITDA Growth decreased over the last two years, from 46.9% for 2017-2018 to 27.7% for 2018-2019. Maintaining continuous high EBITDA growth is difficult. Still, management needs to identify the reasons for the high growth and seek ways to maintain it.

Net Income Growth

Net income growth measures a company’s growth using the earnings found from the income statement’s bottom level. Comparing net income to EBITDA and revenue growth rate can give indications of where a company’s problem starts. However, this is not a fully fair comparison to competitors and industry average since companies across the industry have different financial structures that impact Net Income (but not EBITDA). To compute the net income growth, divide the current Net Income by the Net Income of the previous period and subtract one.

The Company’s Net Income growth decreased from 65.4% to 37.7% in the last two years. As EBITDA already decreases according to the same pattern, we conclude that the reason must lie above the EBITDA line. The company uses debt financing, which leads to interest costs, which impact Net Income more heavily (as interest costs behave as fixed costs in this case).

Asset Growth

Asset growth is a metric used to assess how much the assets grow for the evaluated years. Increasing growth can be an indication of a company’s growth and stability. However, decreased or fluctuation needs further analysis, for it does not necessarily mean a losing business since the timing of asset sales or purchases can affect the result. To compute the asset growth, divide the current period’s Total Assets by the Total Assets of the previous period, and subtract one.

Asset Growth decreased during the past two years from 31.3% to 20.4%. The Asset Growth rate declined a bit as the Asset Turnover ratio became less efficient (1.1x instead of 1.2x). The reason lies also in the company’s cash balance which was steadily increasing over the last years and leading to a higher base to measure asset growth.

Equity Growth

Equity growth measures the growth in the company’s equity position recorded for the evaluated period. Investors use this metric to determine whether the company’s total equity is growing and whether the growth can be maintained. To compute the equity growth rate, divide the current period’s Equity value by the Equity book value of the previous period and subtract one.

The equity growth rate has decreased over the past two years. Equity growth for 2017-2018 was 211.3% but then decreased to 93.5% for 2018-2019. This is due to the fact that the equity position at the beginning was very thin, so it is easy to grow, and afterward, no Dividends are paid, leaving all income earned inside the company.

5. Leverage Financial Ratios (or Bank Ratios)

Leverage or Bank ratios are used to evaluate a business’s capacity to pay its debt. Banks and other creditors evaluate them to ensure that the company asking for a loan will meet its obligations when due.

Leverage ratios examine the company’s capital structure by assessing its total assets, liabilities, and shareholders’ equity. They also uncover how heavily a company is funded by debt. Using a high amount of leverage makes a company vulnerable to financial risks. Certain stability in the business’ cash flow generation is required to service its financial debt, as any business turmoil can put the company in severe difficulties.

Debt/EBITDA Ratio

The financial ratio formula is computed by considering the company’s interest-bearing debt (or financial debt which only includes debt with interest and financing character but not payables or provisions even despite the term debt is used) which is then divided by the EBITDA (the Earnings before Interest, Tax, Depreciation, and Amortization). The Debt/EBITDA ratio is used to measure the capability of paying financial debt out of the cash earnings available to the company. A low Debt/EBITDA ratio of less than 1.5x normally means that the company can easily cover its financial debt obligations. Based on its EBITDA, it would take only 1.5x years to repay the debt. As with any other ratio of relevance to the bank, this impacts the company’s credit score. In contrast, a high Debt/EBITDA ratio > 3.0x implies that the business, in the worst case, will require more than 3 years to repay the financial debt from EBITDA. Such high ratios normally serve as a warning sign to lenders as they might start to question the company’s ability to repay its debt. Below is the financial ratio definition:

For 2019, the company’s interest-bearing debt amounts to $2.0 million, with an EBITDA of $1.52 million, translating into a 1.3x Debt/EBITDA ratio. It portrays that the business uses only a modest amount of financial debt, which is also lower than the industry average of 2.0x.

Net Debt/EBITDA Ratio

The Net Debt/EBITDA ratio is computed by taking the interest-bearing debtless cash and dividing this number by EBITDA. It is a bank ratio that measures how many years it takes for the company to pay its debt, given that the net debt and EBITDA are constant. Having more cash, however, would render the ratio negative. A high ratio indicates that the business will not be able to pay all its financial obligations.

As mentioned above, the company’s interest-bearing debt amounts up to $2.0 million for 2019, cash & cash equivalents of $1.48 million, and EBITDA of $1.52 million. It means that the business has a net debt ratio of 0.3x. The Net Debt/EBITDA ratio normally is lower than the Debt/EBITDA ratios due to the assumption that the cash on the Balance Sheet could be used to repay some of the debt.

Interest Coverage Ratio

The interest coverage ratio measures the company’s ability to pay its interest obligation. Bankers and other creditors examine this leverage ratio to determine how much they can lend to the company. The calculation of the interest coverage ratio is derived by dividing EBIT by the interest expense.

On the income statement for 2019 above, EBIT is $1.3 million, and the interest expenses amount to $48K. The computed interest coverage ratio is 27.1x, which is significantly higher than the minimum threshold, such as 1.5x or 3.0x, that a bank could require. This ratio is consistent with the view that our example company only uses a modest amount of financial debt financing.

Debt Service Coverage Ratio

The debt service coverage ratio is computed by taking the free cash flow to the firm (FCFF) and then divided by the debt repayment + interest. FCFF is the operating cash flow after accounting for taxes, changes in working capital, and CAPEX. A high debt service ratio means there is enough available FCFF to service the loan’s interest payment and principal repayment obligations. The financial ratio formula is as follows:

Considering that FCFF available in 2019 is $0.77 million, and the debt service amounted to $0.55 million. The company has a Debt Service Coverage Ratio (DSCR) of 1.4x. This might come dangerously close to any reasonable threshold expected by a bank of 1.25x or 1.50x. However, the current year’s debt repayment component seems abnormally high, and also the company has still significant cash on the Balance Sheet. Another reason could be that the CAPEX (which impacts FCFF heavily) is influenced by one-time costs. Nevertheless, the company will have to investigate this and ensure a next year’s DSCR ratio increases either by repaying less or producing more Free Cash Flows to the Firm.

Debt Ratio

The debt ratio measures how much of the total assets are financed through debt and indicates the financial ratio’s leverage effect. It is computed by taking the total liabilities and dividing them by the total assets. A high debt ratio suggests that the business is mostly funded by debt and uses high financial leverage.

For 2019, the current liabilities are $0.45 million and non-current liabilities of $2 million, while the total assets amounted to $4.98 million. It shows that the debt ratio is only 0.5x, which depicts that the company is not highly leveraged. The debt ratios have also gradually decreased for the past three years, which portrays that total assets are financed less and less by liabilities.

Debt/Equity Ratio

The debt/equity ratio aims to determine the % of debt financing used in a company’s financing sources. It is computed by taking the interest-bearing debt and divided by the total shareholders’ equity. It is a calculation of how much the borrowed capital is for the investment. Also, it entails the capacity of the company to cover its debt through the owner’s equity. The financial ratio formula is defined as follows:

The company borrowed a total of $2.0 million for 2019, and its total equity in the same year amounted to $2.53 million. The Debt/Equity ratio for the company of 79.1% is low, and the equity can cover the debt. It can also suggest that the business is not in a capital-intensive industry since this industry can have as high as two hundred percent debt/equity ratios. Also, the company can maintain low borrowing, which should allow for avoiding adverse effects during business turmoil.

We are now all set to interpret our results using the financial ratio definitions in our cheat sheet and the industry benchmarks. This allows us to include a financial ratio comparison analysis when seeking to understand financial statements.

What Does Our Financial Ratios Analysis Tell Us?

As we worked through the financial ratios list to perform a comprehensive financial ratios analysis of our company’s situation, we now can obtain the full picture of what is going on. Here is the conclusion based on our analysis of the calculated financial ratios:

- Liquidity: For liquidity ratios, the Current Ratio (6.0x), Quick Ratio (4.6x), and Cash ratio (3.3x), all the results show that the company has more than the required current assets to cover its current liabilities. Current obligations can be easily met with the available current assets. The ratios would even indicate that there are excess funds available that could be invested outside the business to gain additional income in order to avoid sitting idle in the business.

- Efficiency: Days inventory (84 days) indicates a long period of goods that must remain in inventory. When comparing to industry benchmarks of 50 days, the company has to work things out to lower the inventory turnover to the benchmark level or near it. Days sales outstanding (40 days) seem to be close to the benchmark of 35 days, but some attention is required as the ratio exceeds the benchmark. On the other hand, days payables (63 days) increased over the last three years, which entails low turnover ratios, which can be interpreted as abusing the goodwill of the company’s suppliers and most likely will not be sustainable in the future. However, low turnover for days payables can benefit the business at the moment since the resources can still be utilized for the operation and prospective investment. Overall, there is some work to do here as our company needs to assess how to improve and lessen its working capital turnover.

- Profitability: In terms of profitability ratios, the gross profit margin is computed at 52.7%, the EBITDA margin is 27.6%, and the net profit margin is 22.2%. All these margins indicate exceptionally high profitability and strong value capture ability by the company. The company must sell something valuable as the EBITDA margins clearly outrank the available industry average of 15.0%. Also, this is reflected in other profitability ratios such as the return on assets (27.9%), return on equity (63.7%), and return on capital employed (43.6%). Important to note here is that the main reason the last three ratios are so high is the high profit margins, as clearly, the company is not operating as efficiently as its peers in terms of managing its working capital.

- Growth: Revenue growth increased from 18.4% (2018) to 22.2% (2019). However, EBITDA growth slowed down (46.9% to 27.7%), and the same is true for net income growth (65.4% to 37.7%), as it is more difficult to grow a larger starting base than a lower one. The same is true for asset growth from 31.3% (2018) to 20.4% (2019), and equity growth of 211.3 (2018) to 93.5% has a decreasing trend for the last three years. Overall, the point is that the company continues to experience strong growth and will most likely continue to grow strongly in the future, exceeding the growth rates in the industry’s average financial ratios.

- Leverage: Several financial leverage ratios, including Debt/EBITDA ratio (1.3x), Net Debt/EBITDA ratio (0.3x), interest coverage ratio (27.1x), Debt ratio (0.5x), and the Debt/Equity ratio (79.1%) would argue that the company uses a modest degree of bank financing and cannot be considered as highly leveraged. The financial ratio leverage appears modest. There is one question mark with respect to the Debt Service Coverage Ratio (1.4x), which becomes dangerously low compared to expected bank covenants, which normally lie at around 1.25x-1.50x. The reason there was a large repayment of $500,000 or eventually a large one-time investment, which led to high CAPEX in the last years. This will require further analysis with respect to the reasons why, and also, one needs to determine how the ratio will result in the next year to avoid any surprises.

It is also important to note that the financial ratios by industry are very helpful in better analyzing and interpreting the company’s financial situation. This helps to put the calculated financial ratios in perspective and allow conclusions as to where further improvements should be possible in light of the competitors’ performance.

Making good use of our financial ratios list helps us perform a comprehensive financial evaluation of the company. This allows us to identify problems better and also helps us enhance the quality of our budgets and forecasts.

Please refer also to our rich collection of financial model templates which include tons of comprehensive financial ratio analyses for countless types of businesses. The spreadsheet model templates are frequently used by entrepreneurs from many countries, including the United States, Canada, Brazil, Mexico, Colombia, United Kingdom, Germany, France, Spain, Italy, Switzerland, Belgium, Portugal, Sweden, Norway, Saudi Arabia, China, India, Indonesia, Australia, New Zealand, Japan, and many other countries. Feel free to download our financial ratios cheat sheet which can serve as a great reference when you are in need of the financial ratios’ definitions.