Personal Finance

From short-term goals to long-term aspirations, our personal financial planning models allow you to create a roadmap for your financial future. Plan for major purchases, retirement, or fund accumulation with tools that make forecasting straightforward and realistic the way for a financially secure and prosperous future. Download now and take the first step towards a more organized and empowered financial life.

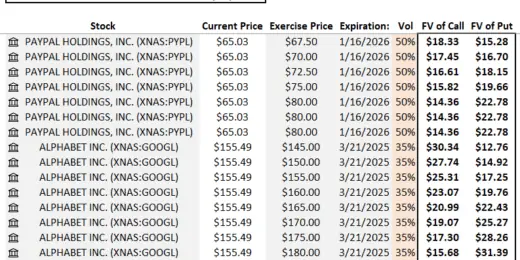

Equity Options Fair Value Calculator (Black-Scholes)

The Equity Options Fair Value Calculator (Black-Scholes) is your go-to…

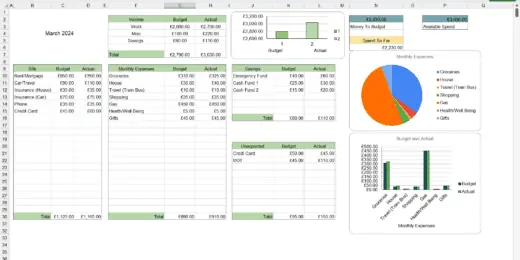

Ultimate Budget Spreadsheet, Budget Dashboard, Google Sheets, Excel

Ultimate Budget Spreadsheet, Budget Dashboard, in both Google Sheets and…

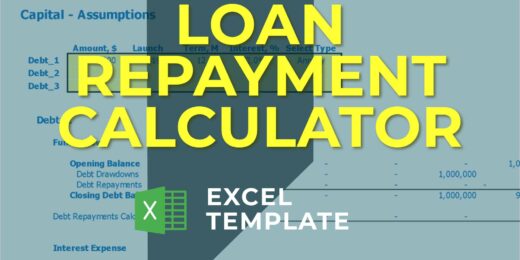

Amortization Schedules Template (Loans, Mortgages, LC, Bonds, Leases)

User friendly template including Amortization Schedules for Loans, Mortgages, Operating…

Simple Mutual Non-Disclosure Agreement Template

Protect your business secrets with ease using our Simple Mutual…

Crowdlending (P2P) Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Stock Option Plan for Managers

Common practice stock options plan for companies and company managers.…

Discounted Big Bundle Real Estate Valuation and Financial Models

One Excel file for this bundle of Valuation and Financial…

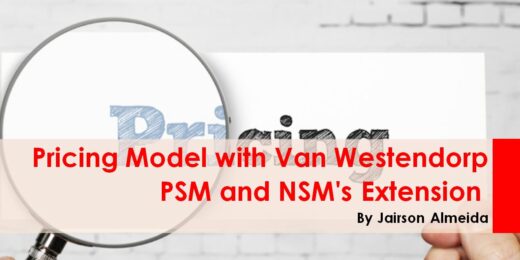

Pricing Excel Model – Van Westendorp Price Sensitivity Meter

The Van Westendorp Price Sensitivity Meter (PSM) is a market…

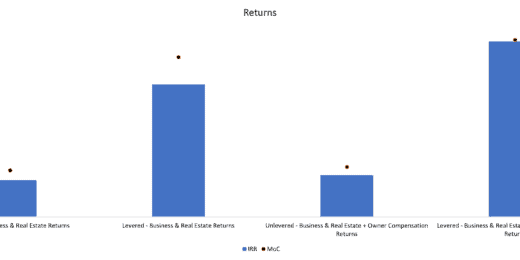

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

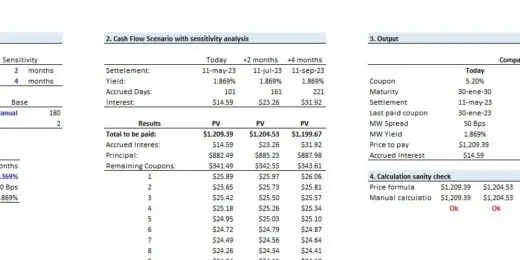

Bond, Loan or Note Make Whole Calculator

The model is designed to evaluate a make-whole calculator for…

8 Budget Templates to Manage Your Marketing Spend

A template to help with creating a budget plan for…

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections…

Lending Company Financial Model – 5 Year Forecast

This Financial model template presents a business scenario of a…

Multi-Member Investment Fund Portfolio and Distribution Tracker

A fund management tool to track many positions over time…

Buy Now Pay Later ALL IN ONE Integrated Financial Model + Market Insights

This is a real cased based ALL IN ONE integrated…

Moneylending Model – FINANCIER 20 year Business Model Three Statement Analysis

This Moneylending ( FINANCIERS) 20-year Business Model will allow for…

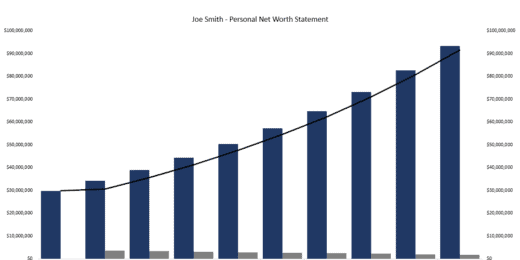

Net Worth Statement Financial Model – Up to 10 Year Projection

This model can be used to prepare, forecast, and analyze…

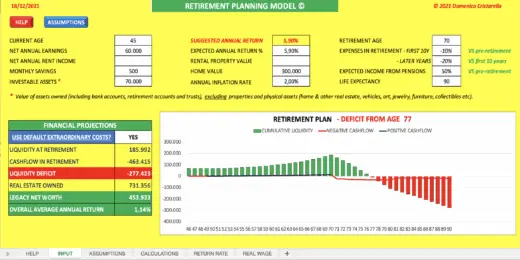

Retirement Planning Model **Inflation Adjusted**

This Retirement Planning model estimates the evolution of your investable…

Personal and Family Budget Dashboard

Download a simple and smart personal budget template. Plan the…

3-statement interlinked Financial Model for Students

This is a learning financial Model for students and beginners.…

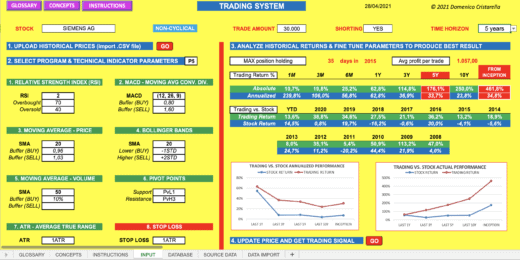

TRADING SYSTEM 2023 (fully editable, updated version)

Providing trading signals using mix of technical indicators and historical…

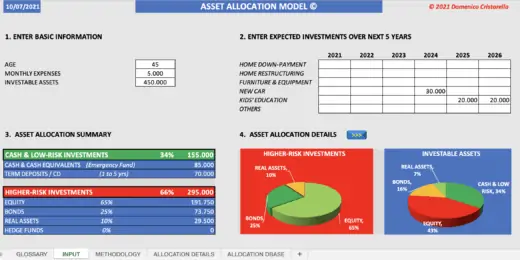

ASSET PORTFOLIO REBALANCING TOOL (2023 RELEASE)

This template makes it easy to perform portfolio rebalancing calculations…

Personal / Family Net Worth Projection Model

User-friendly excel model for projecting family or personal net worth…

Condominium Development REFM Financial Model Excel Template

Purchase Condominium Development REFM Pro-forma Template. Creates a financial summary…

Auditor Financial Model Excel Template

Discover Auditor Pro-forma Template. Allows you to start planning with…

Financial Advisors Agency Financial Model Excel Template

Shop Financial Advisors Agency Pro-forma Template. Creates 5-year financial projection…

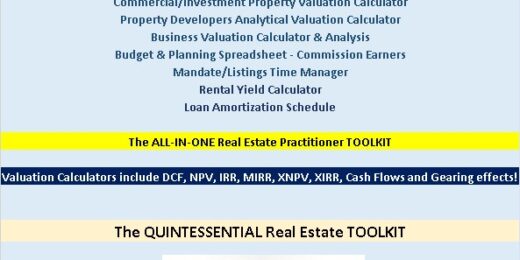

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to…

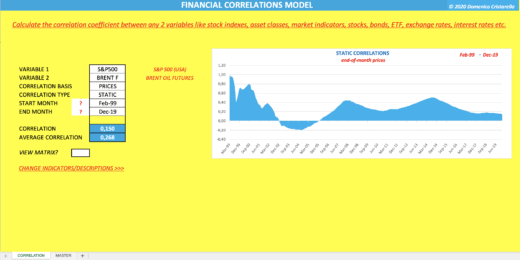

Financial Correlations Model Template in Excel

Calculate the correlation coefficient between any two variables, whether they…

Projections Plan Template

Take control of your businesses, financial with this contracting, manufacturing…

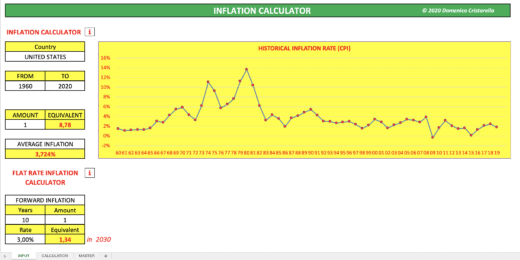

INFLATION CALCULATOR 2023 VERSION (50 COUNTRIES)

INFLATION CALCULATOR NEW FULLY EDITABLE VERSION (COVERING 50 COUNTRIES). A…

Crowdfunding Platform/Marketplace Financial Model – 5 years Monthly Projection

This Crowdfunding Platform Business Plan Model is a perfect tool…

Prepaid Expense and Unearned Income Calculator

Prepaid Expense and Unearned Income amortization calculator with accounting entries

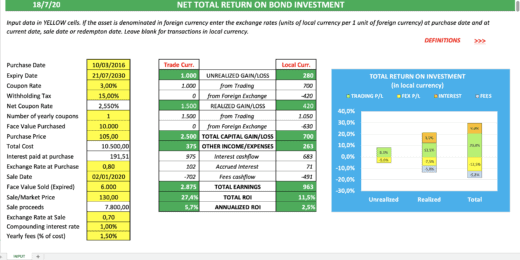

NET TOTAL RETURN ON BOND INVESTMENT CALCULATOR

CALCULATE NET TOTAL RETURN ON BOND INVESTMENT DENOMINATED IN ANY…

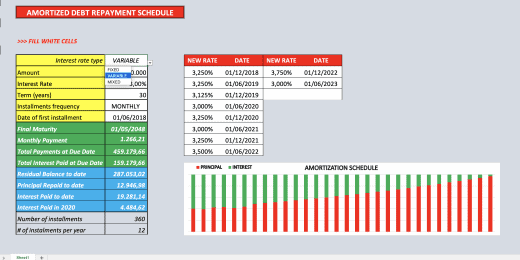

Amortized Debt Repayment Schedule Calculator

CALCULATE THE AMORTISATION SCHEDULE OF A MORTGAGE OR CONSUMER LOAN,…

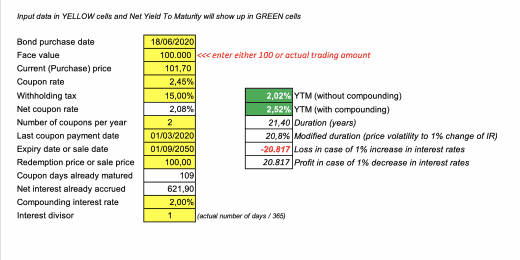

Bond Net Yield to Maturity Calculator

CALCULATE THE EFFECTIVE NET YIELD-TO-MATURITY (OR TO SALE DATE) OF…

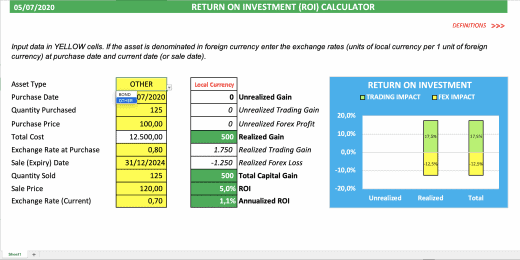

Analytical Return on Investment (ROI) Calculator

CALCULATE RETURN ON INVESTMENTS DENOMINATED IN FOREIGN CURRENCY, SPLIT BETWEEN…

PERSONAL FINANCES MANAGEMENT (2 VERSIONS-2021 RELEASE)

A useful tool to help you take control of your…

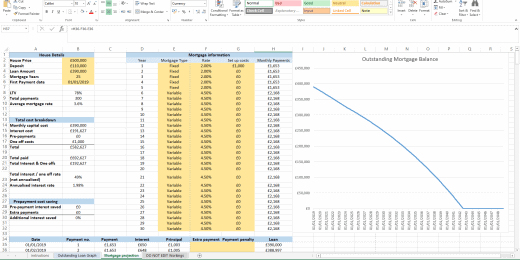

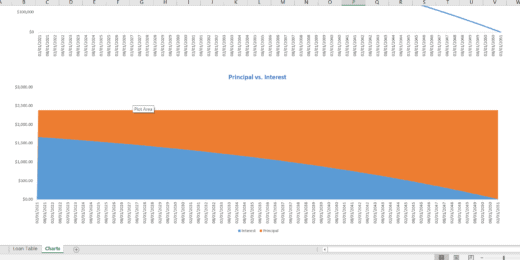

Mortgage Calculator in Excel

The mortgage calculator helps you understand your mortgage costs, different…

Personal Finance Budgeting and Net Worth Tracking Tool

A easy to use and intuitive tool to track your…

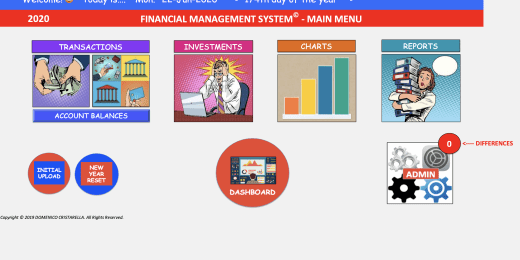

FINANCIAL MANAGEMENT PACKAGE (2023 RELEASE)

FULLY FLEDGED FINANCIAL MANAGEMENT AND ACCOUNTING SYSTEM, DEVELOPED ENTIRELY IN…

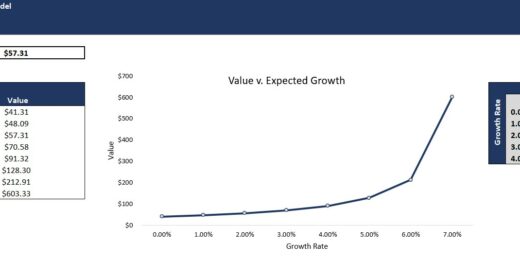

Investment Return Monte Carlo Simulation Excel Model Template

User-friendly Excel tool to calculate the expected value and return…

How to Choose the Right Personal Finance Plan

Once one reaches adulthood and starts raising one's income and savings, choosing the right personal finance plan is crucial. It begins when one considers what to do with one's money now and for one's future benefit. It covers budgeting, banking, insurance, investments, mortgages, retirement, and tax planning. To help with the complicated processes that one needs to go through, an entire industry exists to help provide financial services to individuals and households, advising them about different financial and investment opportunities they can do..

What is Personal Financial Planning?

There are three ways to answer the question best, "What is Personal Financial Planning?"

First, personal financial planning is a comprehensive process that helps individuals manage their financial resources to achieve their future goals and ensure financial security. It involves analyzing one's financial situation, setting short-term and long-term financial objectives, and developing a coherent strategy to achieve these goals. The process is dynamic and using a personal finance model requires constant updating..

Second, personal financial planning is a skill for entrepreneurs, business owners, and finance professionals. It helps them achieve financial stability and make informed decisions with broader implications for business ventures and investments. As experts in developing personal finance models and templates, personal financial planners can integrate the principles of personal financial planning into the services they offer clients, providing them with a holistic approach to managing their financial resources.

Third, personal finance is everything about achieving your personal financial goals. It can be saving up ahead of time in case of emergencies, vacations, or times when short in funds. Some also invest in different ventures for better returns and earn a substantial amount later on once retirement comes or to have a better lifestyle for their family. Creating a personal finance plan for your needs or wants is to make the most of your income or savings and also, just like in running a business, to be able to determine good or bad decisions on what to do with your money.

The 5 Areas of a Personal Finance Plan

Creating a personal finance plan is crucial to achieving financial stability and growth. It entails handling all facets of one's financial life using an all-encompassing approach to money management. Let's explore each of the following five areas:

- Income: This is the foundation of your personal finance plan. It includes all sources of income, such as salaries, bonuses, investment returns, and any other form of earnings. Understanding your income is critical for allocating it effectively across the different areas of your financial plan.

- Spending: This area involves tracking and managing your expenditures. It's not just about cutting costs but also about spending wisely. Creating a budget helps allocate funds to necessary expenses, such as housing, utilities, groceries, and transportation, while allowing for discretionary spending. Spending control is critical to living within your means and saving and investing adequately.

- Savings: Savings are an essential safety net and a source of funds for future financial goals. They include building an emergency fund to cover unexpected expenses and saving for short-term goals like vacations or significant purchases.

- Investing: This area focuses on growing your wealth over the long term. Investing can take many forms, such as stocks, bonds, mutual funds, real estate, or retirement accounts like IRAs or 401(k)s. The key is to find the right balance between risk and reward that aligns with your financial goals and risk tolerance. Diversification and understanding the time horizon for your investments are crucial aspects of a successful investment strategy.

- Protection: Lastly, protecting your assets and income is an often overlooked but vital part of a financial plan. It covers insurance plans for property, health, life, and disability. It also includes estate planning, which guarantees the distribution of your assets according to your wishes and provides for your dependents in the event of your premature death.

By comprehensively addressing these five areas, you can build a robust personal finance plan to secure your current financial situation and pave the way for future financial success and security.

Basic Personal Finance Principles

Understanding and applying basic personal finance principles is crucial for long-term financial stability and success. Let's delve into each of these principles:

- Avoid Insurance That You Can Afford to Pay Out of Pocket: Insurance should be used to mitigate significant financial risks you cannot bear. For minor risks or expenses you can comfortably cover, self-insuring might be more cost-effective. This approach helps prioritize insurance for catastrophic events (like health issues, disability, or significant property damage) while avoiding paying premiums for more minor, manageable risks.

- Don't Spend Too Much on Depreciating Assets: Assets that lose value over time, such as cars or electronics, can be poor investments if you overspend on them. The key is to balance your desire and need for these items with their long-term financial impact. This principle encourages careful evaluation of your spending, prioritizing assets that either maintain or increase in value or at least depreciating assets that are essential for your lifestyle or business.

- Invest Instead of Just Saving for Retirement: While saving is a crucial component of financial planning, investing can offer higher returns, helping your retirement funds to grow more significantly over time. Investments can include stocks, bonds, real estate, or other vehicles. However, it's essential to recognize that investing involves risks, and it's vital to align your investment choices with your risk tolerance, financial goals, and time horizon.

- Reduce Your Taxable Income: This principle involves utilizing legal strategies to minimize the amount of income subject to taxes. It can include making contributions to retirement accounts (like 401(k)s or IRAs), using health savings accounts (HSAs), or taking advantage of tax deductions and credits. You can increase your net income and savings by reducing your taxable income.

- Save 20% of Your Income: This guideline suggests that setting aside a significant portion of your income can help build a solid financial foundation. The 20% figure is a benchmark; the exact amount can vary based on individual circumstances and goals. These savings can help build an emergency fund, prepare for major purchases, or contribute to long-term financial goals like retirement.

Applying these principles requires balancing current financial needs, lifestyle choices, and long-term financial goals. Tailoring these principles to your financial situation is always beneficial, considering income level, debts, personal and family needs, and future aspirations. Consulting with a financial advisor can also provide personalized guidance aligned with your unique circumstances.

Personal Finance Strategies

Navigating the realm of personal finance can be both exhilarating and challenging. Sound personal finance strategies pave the way for achieving financial security and realizing your dreams. By employing effective personal finance strategies, you can transform your economic landscape, turning aspirations into tangible realities. These strategies empower you with the knowledge and tools to take charge of your finances, make informed decisions, and confidently stride toward a future of financial well-being and prosperity.

To help you start personal finance plan, here are the best personal finance strategies to manage your money:

- Budget Plan

A budget plan makes a whole lot of difference on how you spend your money. It is critical when you have long-term goals and if you want to live within your means. Budget planning is easier said than done, but it is a good thing that nowadays, there are many tools that help greatly in sticking to the plan. Of course, you must also be determined and persevere, for you are the greatest factor of your plan’s success. Remember, a plan is just a plan without proper execution.

- Emergency Fund

One can’t really predict when certain difficulties arise, thus, it is better to be prepared in case of an emergency such as hospital and medical bills, unemployment, uncontrollable disasters like storms or flooding, etc. It is advisable to set aside a portion of your earnings until you reach a certain point which will serve as your ideal safety net against unexpected circumstances. Once you do reach your goal amount, you can still continue on pouring some money in, since you can simply convert the excess fund for other purposes in the future.

- Debt Limit

Basically, don’t spend beyond your means. Insolvency often happens to businesses who let their debt out of hand, the same applies to any entity. Going into debt doesn’t necessarily mean that it’s a bad thing especially when it is for the development or improvement of something that will help you gather more yield or assets. The main point is, limit your debt.

- Credit Card Control

With the advancement of today’s technology, doing transactions can be done easily by using credit cards. But it is clear to see, especially after several cases, using a credit card is like getting caught in a debt trap. Still, having one is essential for nowadays day to day basis. The problem is to control oneself on not overspending. Just like limiting your debt, eventually, every transaction will pile up into a huge sum which you need to repay on a monthly basis. You will need to track your expenses and make sure that your credit rating stays in the minimum to ensure that you’ll be able to pay on time.

- Credit Score Tracking

If you have a credit card then it is important that you monitor your credit score. Using the credit card as a tool for your transaction will slowly build up your credit score and maintained. This will be your presentation of your financial standing whenever you want to obtain something such as lease, mortgage, phone line, internet, etc. Your credit score will show your solid credit history such as information about your payment behavior, duration of your credit, credit-to-debt ratio, etc. To keep track of your credit score, you can simply utilize different tools like a financial model or an excel spreadsheet to help you have a systematic framework for tracking and fast updating.

- Plan for your Family

Once you have a family, the weight of expenses will be even greater since you need to start considering the future of your family too. You want to ensure that your family will be well-supported even after you die, so some plans need to be done first. You need to consider getting insurance not just for your assets but also for yourself and your family to prepare in the future. This will ensure the future of your family and at the same time, this will give you an opportunity to lead the young ones in your family on how to value money whether saving, investing, and spending efficiently.

- Education Expenses or Student Loan Repayment

Spending money on education can be taken as an investment to get better opportunities for achieving higher yields. Especially nowadays where getting an education is a requirement of employment and even sometimes it becomes a factor of how much your salary will be. Thus, setting aside money for education is essential, otherwise, you will have to get a student loan. Since there are a lot of loan-repayment plans and strategies available, it won’t be a trouble anymore. There are also government grants or programs that will help with student funding.

- Retirement Plan

You may think that preparing for retirement is only for those getting older and it’s too early to start one, but the truth is, you need to start as early as you can to get more benefit in the future. Slowly but surely, your savings will grow over time. This will also help you alleviate the burden of income taxes, so take advantage of this opportunity as soon as you can. There are also other ways to gather money for your retirement plan other than investing, there’s also social security benefits, permanent life insurance, etc.

- Taxes

Taxes, though sometimes it seems like a small percentage of what you earn when converted into a figure, actually amounts to a chunk of your total earnings. Without maximizing your tax savings, you’ll lose the opportunity of saving up money that could be used either for paying past loans, present expenses, or future plans. But mostly this is due to the complex taxation process, that many people seem to neglect on noticing. Some often hire professionals to help them with their taxes, while others go for available tax models to help organize and take advantage of every tax deduction and credit available.

- Personal Plans for Recreation

Personal financing may sound too strict with all the limitations and preparations that you have to deal with, but it is a fact that all are essential if you want the best for yourself and your future. But, this doesn’t mean that you’re not allowed to take a break once in a while. Ensure that you reward yourself every now and then. It doesn’t need to be too extravagant and something that will affect your budget such as an occasional night out, shopping, vacation out of town or country, etc., as long as you get to enjoy financial freedom. This, in turn, will encourage you more to stick with your plan.

In conclusion, it is undeniable that personal finance strategies open up new paths for you to take in your life. Isn't it amazing how many changes will happen once you get a hold of your finances properly? Just by simply and slowly placing your finances systematically, you will have many opportunities that you can take advantage of now and also for the future.

Personal Finance Excel Spreadsheet Templates

Personal financial planning models focus on analyzing your current financial position, predicting your future needs either short-term or long-term and executing a plan to satisfy those needs with budgeting in mind. All will depend on your goals, income, expenditures, lifestyle, desires and other simple finances.

Now the question is, how to go about financial planning, effectively applying it and figuring out beforehand if your financial plan is working? Some have knowledge on how to do their personal finance plan and make it from scratch. But a better and more efficient way is to acquire personal financial planning models that you can use for better visualization of your finances.

These personal financial planning models will be your guide to a better way of money managing and will help you calculate your personal finances easily. No more creating and researching for a money management plan from scratch. You can refer to the list below on what you need or prefer. Money Management made easy and time-saving, designed to help you with money managing.

If you are looking for a specific financial model template and couldn't find it in our inventory, feel free to comment here: Missing Financial Model Templates, so that our Vendors will pick up that project and will soon add in our still growing inventory. If you found the template but need help with customization of your preference, we also offer financial modeling services which you can avail here: Custom Financial Modeling Service.

We would be really grateful if you also rate our products and leave a review, comments, suggestions, or any kind of feedback, about our financial model templates, for this will greatly help us shape our templates to be even better in the future.