Dividend Discount Model Template

This Pro Forma Model showcases the pro forma indicative return valuing an equity security using various dividend discount models including the Gordon growth model with an assumed cost of equity, CAPM, dividend capitalization, as well as a 2-stage dividend discount model.

Dividend Discount Model – Single-Stage, Two-Stage, Capital Asset Pricing Model, and Dividend Capitalization Model

Video Overview:

Overview:

This Pro Forma Model showcases the pro forma indicative return valuing equity security using various dividend discount models, including the Gordon growth model with an assumed cost of equity, CAPM, and dividend capitalization, and a 2-stage dividend discount model.

Model Highlights:

– Dynamic pro forma financial model

– Fully customizable ser defined assumptions

– Sensitivity analysis for select dividend discount valuation model

– Institutional-quality actionable reporting output to drive investment decision making

– Fully unlocked and transparent model allowing users to customize

– Support from a team of highly qualified investment and financial professionals

Key Features:

Built for anyone looking to analyze an equity investment utilizing dividend discount models accurately. The model:

– Provides institutional-quality actionable reporting output to drive investment decision making

– Calculates equity value based on a variety of user assumptions

Built by investment and finance professionals with institutional experience in private equity, real estate, investment banking, consulting, entrepreneurship, and asset management.

Similar Products

Other customers were also interested in...

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections and the insight they can provide... Read more

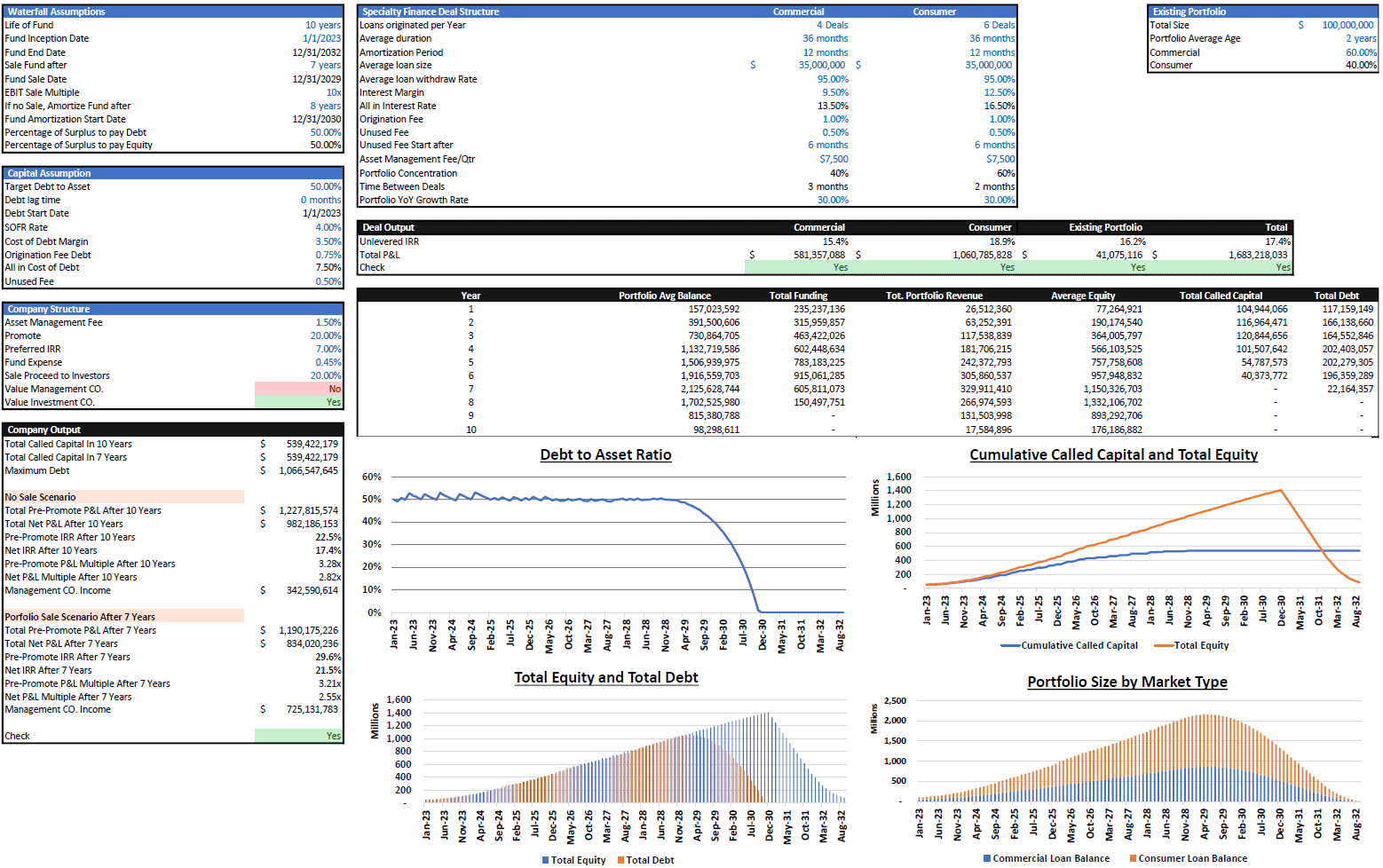

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset Management, and... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Investment Fund Preferred Return Tracker: Up to 30...

Track preferred returns for investors in a fund with this template. Premium joint venture tracking t... Read more

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Asset Management Company – Closed End Fund M...

Financial Model presenting a scenario of a Closed-End Fund managed by an Asset Management Compan... Read more

You must log in to submit a review.