Asset Management

Whether you're evaluating investment opportunities, analyzing portfolio performance, or planning for future growth, our templates provide a structured and intuitive framework for all your asset management needs. They are tailored to streamline the financial analysis process, offering customizable features that adapt to your unique business scenarios.

Our templates are more than just a tool; they're a strategic partner in your journey towards financial excellence. Embrace the power of informed decision-making and elevate your asset management strategies with our state-of-the-art Excel financial model templates.

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

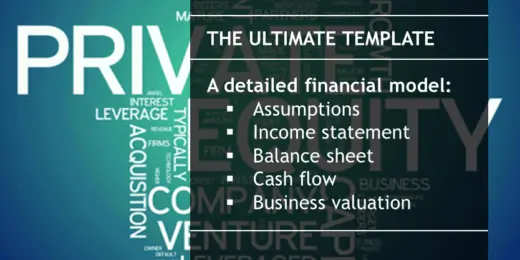

Private Equity Fund Financial Projection Model with Distribution Waterfall

Highly versatile private equity fund financial projection model with calculations…

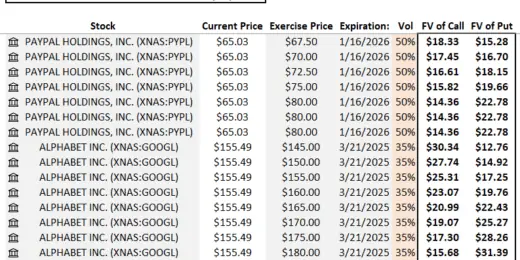

Equity Options Fair Value Calculator (Black-Scholes)

The Equity Options Fair Value Calculator (Black-Scholes) is your go-to…

Crypto Token Valuation Model

A cutting-edge crypto token valuation model, designed to provide comprehensive…

Stock Option Plan for Managers

Common practice stock options plan for companies and company managers.…

Financial Advisor / Financial Planner Financial Projection Model

5-Year 3-Statement Excel projection model for Financial Advisor / Financial…

Merger & Acquisition (M&A) Simple Financial Model

The model is great financial tool used to evaluate the…

Financial Feasibility Study – Investment Funds

This model is Financial Feasibility Study for investment funds or…

Investment Holding Company 3 Statement Financial Projection Model

3 statement 5 or 8 year rolling financial projection Excel…

Leasing Company Financial Model – 5 Year Forecast

Financial Model providing a 5-Year Financial Forecast of a Leasing…

Bundle – Business Financial Forecasting Models

The purpose of this Bundle of Business Forecasting and Financial…

Asset Management Company – Closed End Fund Model

Financial Model providing analysis of a Closed-End Fund hosted by…

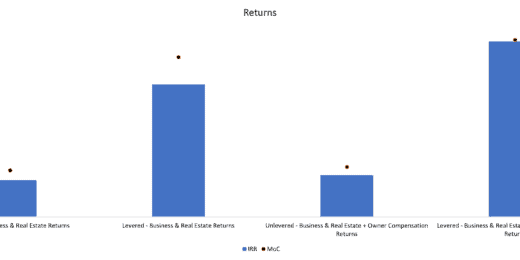

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes…

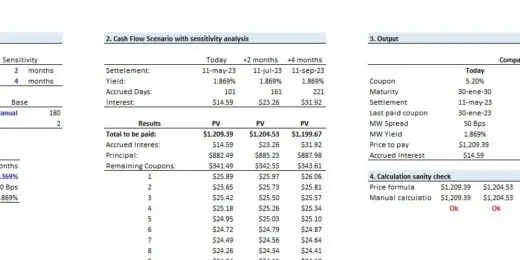

Bond, Loan or Note Make Whole Calculator

The model is designed to evaluate a make-whole calculator for…

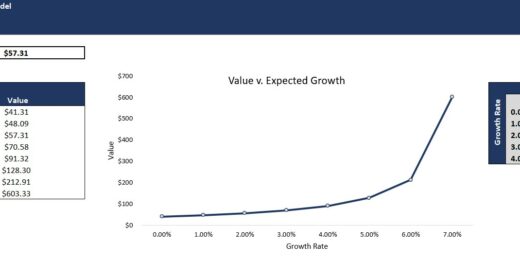

Equity Portfolio Investment Return Calculator

Excel model to calculate the expected value and return for…

Investment Fund Preferred Return Tracker: Up to 30 Members

Track preferred returns for investors in a fund with this…

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections…

Offshore Bank Financial Model Excel Template

Offshore Bank Financial Model Enhance your pitches and impress potential…

Mortgage Bank Financial Model Excel Template

Mortgage Bank Budget Template Create fully-integrated financial projection for 5…

Asset Management Business Financial Projection 3 Statement Model

3-Statement 5 year rolling financial projection Excel model with valuation…

Multi-Member Investment Fund Portfolio and Distribution Tracker

A fund management tool to track many positions over time…

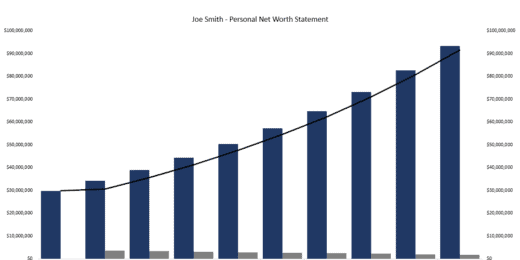

Net Worth Statement Financial Model – Up to 10 Year Projection

This model can be used to prepare, forecast, and analyze…

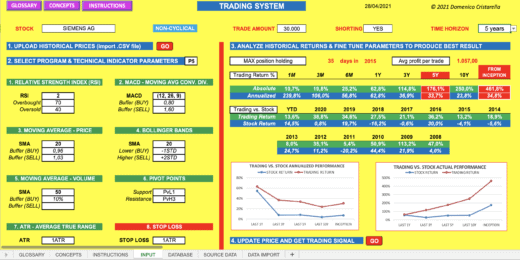

TRADING SYSTEM 2023 (fully editable, updated version)

Providing trading signals using mix of technical indicators and historical…

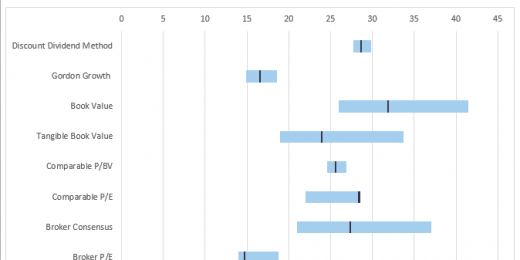

Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset…

Legal Services Financial Model Excel Template

Buy Legal Services Financial Plan. Based on years of experience…

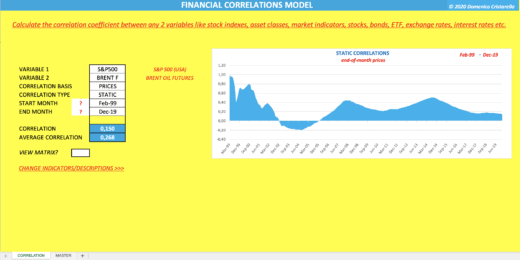

Financial Correlations Model Template in Excel

Calculate the correlation coefficient between any two variables, whether they…

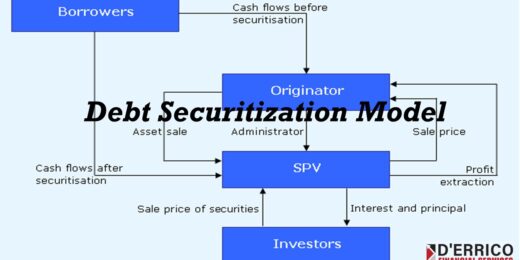

Collateralized Mortgage Obligations Model

Collateralized Mortgage Obligations Model presents a simple model where mortgage…

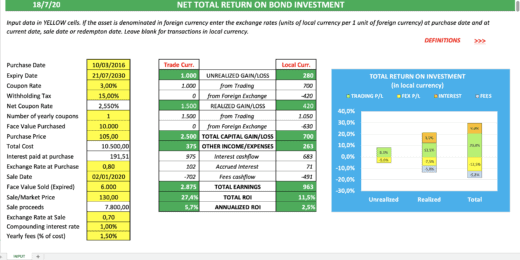

NET TOTAL RETURN ON BOND INVESTMENT CALCULATOR

CALCULATE NET TOTAL RETURN ON BOND INVESTMENT DENOMINATED IN ANY…

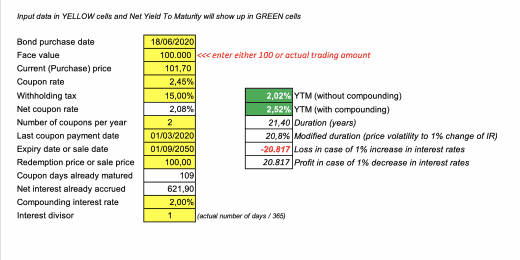

Bond Net Yield to Maturity Calculator

CALCULATE THE EFFECTIVE NET YIELD-TO-MATURITY (OR TO SALE DATE) OF…

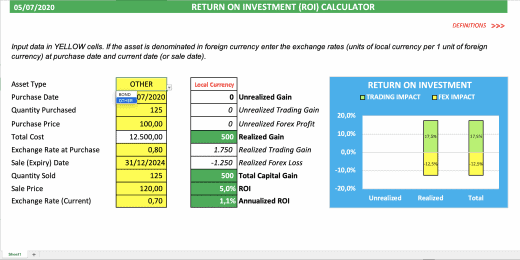

Analytical Return on Investment (ROI) Calculator

CALCULATE RETURN ON INVESTMENTS DENOMINATED IN FOREIGN CURRENCY, SPLIT BETWEEN…

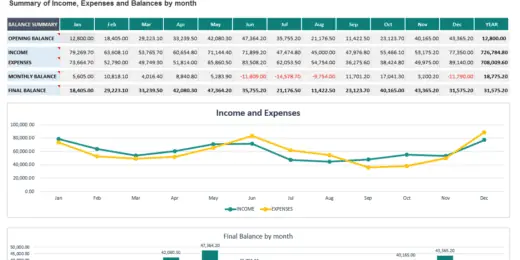

10 Year P&L, Balance Sheet, Cash Flow, and Break-even Analysis

This excel template is great for those wanting a professional-looking…

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns…

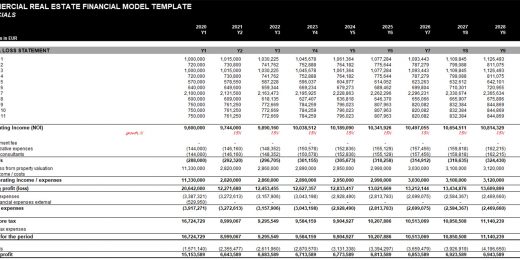

Commercial Real Estate Financial Model for Acquisitions

Commercial Real Estate Financial Model presents the case of investment…

FINANCIAL MANAGEMENT PACKAGE (2023 RELEASE)

FULLY FLEDGED FINANCIAL MANAGEMENT AND ACCOUNTING SYSTEM, DEVELOPED ENTIRELY IN…

Inventory Valuation Using FIFO – Automatically Calculate COGS Accordingly

Any accountant that needs to comply with IFRS will have…

Asset Management 101: Essentials for Success

“Do not put all your eggs in one basket” is a timeless piece of wisdom from Warren Buffet, the 20th century’s most successful investor. It perfectly encapsulates the importance of diversification in asset management. It underlines the need to spread investments to mitigate risks, ensure long-term growth, and maintain psychological comfort and adaptability in the face of market fluctuations.

Asset management serves as the cornerstone of effective financial stewardship. At its core, it encompasses a strategic approach to managing investments, optimizing asset allocation, and maximizing returns while mitigating risks. This field, blending the art of decision-making with the science of analysis, requires a comprehensive analytical framework, a firm grasp of investment strategies, and a keen understanding of market dynamics. As we delve into this intricate domain’s fundamental concepts and strategies, prepare to empower your financial journey with the knowledge and tools essential for achieving your investment objectives and elevating your financial understanding to new heights.

Understanding the Asset Management Industry

Asset management remains a critical concern for organizations globally due to the integral role assets play in driving business operations and success. In fact, the report states that in 2022, the global asset management sector brought in $376.82 billion. In today’s fast-paced and competitive business environment, physical assets — ranging from machinery and technology to infrastructure and equipment — are fundamental in ensuring efficient and effective operations. These assets represent significant financial investment and are crucial in maintaining productivity, supporting innovation, and providing a competitive edge.

Effective asset management allows organizations to optimize the use and lifespan of these assets, ensuring maximum return on investment and minimizing downtime or inefficiencies. It is essential as businesses strive to adapt to rapidly changing market demands, technological advancements, and sustainability considerations, making asset management a vital component of strategic business planning and operational excellence.

Among the five largest Asset Management Firms worldwide are:

- BlackRock, with an AUM of $9,090 Billion

- Vanguard Group, with an AUM of $7,600 Billion

- Fidelity Investments, with an AUM of $4,240 Billion

- State Street Global Advisors, with an AUM of $3,600 Billion

- Morgan Stanley, with an AUM of $3,131 Billion

In terms of total worldwide assets under management (AUM), these asset management firms are among the most significant financial organizations globally.

What Does Asset Management Mean?

Asset management is the systematic approach to guide an organization in acquiring, operating, maintaining, upgrading, and disposing of assets cost-effectively. This discipline encompasses many assets, including financial investments, real estate, infrastructure, and physical assets like equipment and technology. The primary objective of asset management is to maximize asset value and investment returns while managing risks and costs.

An Asset Management firm is a specialized financial institution that caters to the investment needs of high-net-worth individuals and organizations. It strategically manages its clients’ assets to achieve specific financial goals. These firms employ registered investment advisers bound by fiduciary duties, meaning they are legally and ethically required to act in the best interest of their clients. An asset management firm’s services range from portfolio management, including selecting and balancing various asset types like stocks, bonds, and real estate, to providing tailored financial advice and planning.

Are Asset Management and Wealth Management the Same?

Asset management and wealth management are distinct financial services, each catering to different client needs.

Approach

- Asset management requires deep knowledge of financial markets, investment strategies, and risk management. Registered investment advisers or asset managers often have strong backgrounds in finance and economics.

- Wealth management requires a broader range of expertise, including investment management, tax law, estate planning, and sometimes even lifestyle management. Wealth managers often build long-term relationships with clients, offering more personalized advice.

Clients

- An asset management firm typically caters to institutional clients like pension funds, corporations, and high-net-worth individuals. Registered investment advisers often offer more specialized and focused investment management services.

- A wealth management company generally aims at high-net-worth individuals, families, and sometimes smaller institutional clients. Wealth management is more personalized, considering each client’s unique financial situation, goals, and needs.

Service Scope

- An asset management firm’s services involve portfolio management, asset allocation, stock selection, and, sometimes, fund management. The focus is primarily on maximizing returns and managing investment risks.

- Wealth management services include comprehensive financial planning, advice on estate planning, tax strategies, insurance, and, sometimes, philanthropic planning. It often involves managing the client’s entire financial picture.

What Are the 3 Main Asset Management Types?

An asset management firm plays a pivotal role in maximizing the potential of assets, ensuring they contribute positively to the overall value and performance of an organization or individual portfolio. Three primary asset management types stand out: physical asset management, financial asset management, and digital asset management. Each type focuses on a distinct category of assets, necessitating specialized knowledge and strategies.

- Physical Asset Management manages tangible assets like buildings, machinery, and equipment. It encompasses the entire lifecycle of the physical assets, including acquisition, use, maintenance, and disposal. Effective physical asset management ensures that these assets operate at their highest efficiency, minimize downtime, and extend their lifespan, thus optimizing the return on investment.

- Financial Asset Management involves managing financial investments such as stocks, bonds, and other securities. It focuses on optimizing the returns from investments while considering the risk factors. Financial asset managers make strategic decisions about buying and selling assets, portfolio diversification, asset allocation, and managing the balance between growth and risk. Financial asset management is key to maximizing the value of their investment portfolios and achieving their financial goals.

- Digital Asset Management (DAM) is a specialized area focusing on managing, organizing, and distributing digital assets, such as digital documents, images, videos, and other media files. Unlike traditional asset management, which deals with physical assets or financial instruments, Digital asset management firms are dedicated to controlling and streamlining the access and use of a company’s digital media assets. They employ sophisticated software solutions and methodologies to ensure efficient asset retrieval, rights management, and preservation of digital assets. The primary objective is to enhance the value derived from digital media, aiding organizations in optimizing their digital asset portfolios for improved marketing, operational efficiency, and strategic use.

How Asset Management Works

Asset management is a critical process for individuals and institutions looking to maximize the value and performance of their investments over time. Here’s a detailed look at how asset management works, particularly in the context of individual clients:

Understanding the Client

- Financial Goals: The first step is understanding the client’s financial objectives. These can range from short-term goals like purchasing a home or funding education to long-term objectives such as retirement planning or wealth preservation.

- Net Worth Assessment: This involves evaluating the client’s total financial worth. It encompasses all assets (investments, property, cash, etc.) and liabilities (debts, loans, etc.). A clear understanding of net worth helps in crafting a tailored investment strategy.

- Risk Tolerance: This is crucial as it determines the investments suitable for the client. Risk tolerance can be categorized as low, medium, or high and is influenced by the client’s financial situation, investment experience, and psychological comfort with uncertainty.

Developing a Unique Asset Management Plan

- Asset Register Creation: An asset register is a comprehensive list of the client’s assets, including details like value, location, and ownership. It serves as a foundation for creating a personalized asset management plan.

- Strategy Development: The plan is tailored to align with the client’s goals and risk tolerance. It includes asset allocation (how to spread investments across different asset classes like stocks, bonds, real estate, etc.) and may also involve tax, estate, and retirement planning.

Continuous Management and Growth Strategies

- Maintenance: Regularly review and rebalance the portfolio to maintain the desired asset allocation. It ensures the portfolio stays aligned with the client’s objectives and risk profile.

- Monitor Depreciation: For certain assets, like real estate or business investments, it’s essential to track depreciation and its impact on overall portfolio value.

- Optimize Allocation: Continuously seeking opportunities to optimize asset allocation. It might involve diversifying investments, taking advantage of market trends, or reducing exposure to underperforming assets.

In summary, effective asset management is a dynamic process that requires ongoing attention and adjustment. It’s not just about selecting investments but also about aligning them with the client’s overall financial picture, goals, and risk tolerance and adapting as these elements change over time. This approach helps safeguard and grow the client’s wealth in a manner that’s consistent with their objectives and comfort level.

Key Performance Indicators for Asset Management

Asset managers or registered investment advisers must track key performance indicators (KPIs) to effectively manage assets and monitor their health, utilization, and performance over time. Some of the most critical KPIs for asset management include:

Acquisition Cost

It is the total cost incurred to acquire an asset, including the purchase price, legal fees, transaction fees, and any other expenses directly related to the acquisition. Lower acquisition costs relative to the asset's potential to generate income or appreciate in value are generally preferable. The goal is to minimize the acquisition cost while maximizing the potential returns. So, it's essential to compare the acquisition cost against similar assets in the market to assess competitiveness. It should align with industry benchmarks and investment strategies.

Asset Management Fees

Investors pay asset management fees to asset managers for managing their investments. They are an asset managers' primary income source and key performance indicator (KPI) as they impact performance. The agreement between investors and asset managers regulates the fee structure and percentage. Typically, these fees may range from 0.10% to more than 2% of the total value of the assets under management (AUM). These fees are usually deducted from the assets' returns or value. Besides the asset manager's salary, they may or may not cover administrative costs, investor relations, and other fees.

Asset Value Appreciation

This KPI measures the increase in the value of an asset over time. Analyze historical data to identify trends in value appreciation. Compare the appreciation rate with market averages or similar assets. Consider factors like location, market conditions, and intrinsic asset qualities.

The higher the rate of appreciation, the better. However, this must be balanced with risk considerations. A stable, moderate appreciation is often preferable to increased volatility.

Cash Flow

Cash flow represents the net amount transferred into and out of an asset. It is particularly relevant for income-generating assets. Positive cash flow indicates that the asset generates more income than its expenses. Consistency in cash flow is also crucial. Seasonal variations or irregular cash flows warrant a more profound analysis. Consistent, positive cash flow is ideal. It should cover all operating expenses and ideally contribute to profit margins.

Net Operating Income (NOI)

NOI is the income generated from an asset after operating expenses are deducted before taxes and financing costs. It is critical for evaluating the asset's core profitability. It's crucial to analyze the trends in NOI over time and assess the operational efficiency of the asset. An increasing NOI over time is typically desirable. It indicates improving efficiency, increasing income, or both.

Return on Assets (ROA)

ROA measures how efficiently a company uses its assets to generate earnings. It's calculated as Net Income divided by Total Assets. ROA provides insights into how effectively a company uses its assets to produce profits. Comparing ROA with industry averages or direct competitors can provide a more contextual understanding. A higher ROA indicates more efficient use of assets. The ideal ROA varies by industry but should be higher than the cost of capital and competitive within the industry.

In practice, these KPIs should be used in conjunction to gain a comprehensive understanding of asset performance. Variations from the ideal standards can provide opportunities for strategic decision-making, either to improve asset performance or to reconsider asset portfolios. The key is to tailor the analysis to the specific context and goals of the asset or portfolio in question. Carefully monitoring these KPIs will provide insight into opportunities to improve asset management practices, reduce costs, and increase operational efficiency. Review metrics regularly and take action as needed to optimize your assets.

Optimize Your Assets with an Asset Management Plan

In conclusion, an effective asset management plan is crucial for asset management firms seeking to maximize the value and performance of their assets. They offer a strategic and structured approach to managing your investments, ensuring they align with overall financial goals and operational objectives. Asset management firms that embrace these financial model templates are better equipped to navigate complexities, mitigate risks, and capitalize on opportunities, leading to enhanced profitability and long-term success for themselves and their clients.

efinancialModels.com offers sophisticated asset management plan templates to aid in-depth financial analysis, evaluate investment opportunities, and make informed decisions. They facilitate comprehensive scenario analysis, budgeting, and valuation of companies, assets, and real estate. This detailed and strategic planning level is essential for optimizing asset portfolios, ensuring sustainable growth, and maintaining a competitive edge in the dynamic financial landscape.

Enhance Portfolio Performance Today!