Unlocking Real Estate Investment Trusts: Exploring the Benefits and Risks

What Are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are a type of collective investment fund designed to facilitate the purchase and management of properties by pooling the financial resources of many investors. REITs provide investors with a low-cost way to diversify their portfolios and invest in the real estate market without purchasing and managing individual properties. REITs are managed by professional managers who are experienced in real estate investing. By pooling resources, investors can benefit from economies of scale and access properties they may have yet to be able to purchase and manage independently.

The Benefits of Investing in REITs

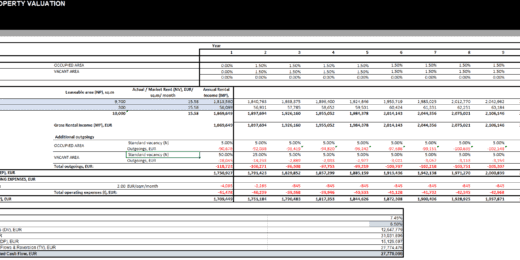

1. High Returns: REITs offer high potential returns for investors based on a portfolio of real estate assets that can generate significant profits. REITs typically pay out a portion of their earnings as dividends, providing investors a steady income stream.

2. Low Entry Costs: REITs have lower entry costs than many other investments, making them a great option for those just starting real estate investing.

3. Diversification: REITs allow investors to diversify their portfolios without purchasing multiple properties. It can reduce risk and provide a hedge against market volatility.

4. Professional Management: REITs are managed by professional managers experienced in real estate investing. It helps to reduce the risk associated with investing in individual properties.

The Risks of Investing in REITs

1. Market Volatility: REITs are subject to market volatility, as with any investment. It is important to understand the potential risks associated with investing in REITs and how to mitigate them.

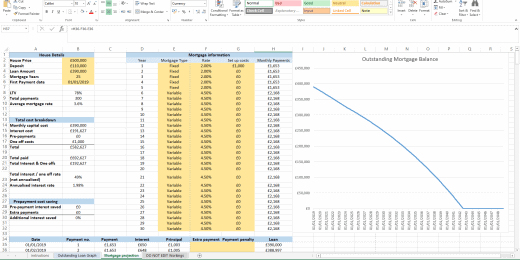

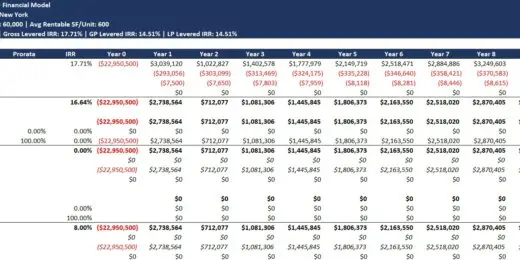

2. Leverage: REITs often use leverage to increase their returns. While this can be profitable, it can also increase the risk of losses if the market does not perform as expected.

3. Lack of Control: As professionals manage REITs, investors need more control over their investments. It can be both a benefit and a risk, as investors may need help to change their portfolios to take advantage of market conditions.

Tax Considerations for REITs

REITs are subject to certain tax considerations. Generally, REITs are treated as pass-through entities for federal income tax purposes, meaning that investors are responsible for paying taxes on their share of the REIT’s income. However, depending on the type of REIT, there may be different rules and regulations that investors must be aware of. It’s important to consult with a financial advisor or tax professional to ensure that your REIT investments comply with the applicable tax laws.

REITs vs. Other Real Estate Investment Options

REITs offer investors several advantages over other real estate investment options. For instance, investing in a REIT allows investors to access a diversified portfolio of real estate assets without purchasing and managing individual properties. Additionally, REITs have lower entry costs than many other investments, making them a great option for those just starting real estate investing.

Conclusion

Real Estate Investment Trusts (REITs) can be a great way for investors to diversify their portfolios and access a portfolio of real estate assets without having to purchase and manage individual properties. REITs offer investors high potential returns, low entry costs, diversification, and professional management. However, it’s important to understand the risks associated with investing in REITs, such as market volatility, leverage, and lack of control. Additionally, investors should be aware of the tax considerations associated with REITs and consult with a financial advisor or tax professional to ensure their investments comply with the applicable laws.

Key Questions and Answers

Q1. What are the benefits of investing in REITs?

A1. High returns, low entry costs, diversification, and professional management.

Q2. What are the risks associated with investing in REITs?

A2. Market volatility, leverage, and lack of control.

Q3. How can I reduce the risk of investing in REITs?

A3. Understand the potential risks of investing in REITs and how to mitigate them.

Q4. How can REITs provide a steady income stream?

A4. REITs typically pay out a portion of their earnings as dividends, providing investors a steady income stream.

Q5. What type of investments have lower entry costs than REITs?

A5. REITs have lower entry costs than many other types of investments.

Q6. How can REITs help to diversify an investor’s portfolio?

A6. REITs allow investors to diversify their portfolios without having to purchase multiple properties.

Q7. Who are the professional managers that manage REITs?

A7. REITs are managed by professional managers who are experienced in real estate investing.

Q8. How can leverage be used to increase returns in REITs?

A8. REITs often use leverage to increase their returns.

Q9. What level of control do investors have over their investments in REITs?

A9. As professionals manage REITs, investors have limited control over their investments.

Q10. Are there any other potential rewards of investing in REITs? A10. REITs offer high potential returns for investors based on a portfolio of real estate assets that can generate significant profits.