REIT Commercial Real Estate Valuation Approaches, Metrics, and Financial Model Templates

Real estate offers one of the most promising returns when it comes to investment simply because it appreciates over time and thus worth every penny. We have this notion that when we invest in real estate, we have to own the asset physically. However, Real Estate Investment Trust (REIT) allows investors to have exposure to commercial real estate investing without actually buying the properties. In other words, it saves the investors the need to engage in loan approval, property maintenance, finding tenants, etc. In this context, we will elaborate on REIT commercial real estate valuation and REIT valuation model templates to be used in the process.

What is REIT Commercial Real Estate?

REIT commercial real estate are chartered corporation that operates companies that own, manage, and develop commercial real estate. In other words, it’s a public vehicle of real estate ownership. The REITs run like a mutual fund in which investors contribute funds to acquire commercial properties. It allows them to participate in commercial real estate investment without buying the properties on their own.

Investment Returns for REITs

REIT commercial real estate provides several advantages to the investors as compared to any other investments. Why? Because publicly traded REITs are required to distribute 90% of their net income to their shareholders. Aside from that, the return profile for REITs exhibits returns as it has attributes of both bonds and equities.

The lease structure of commercial properties REIT provides a steady stream of income which is similar to bonds. The tenants pay monthly rentals for occupying the premises, and these rentals often include an escalation clause to increase rental payment by a certain percentage.

This allows REIT to participate in the economic cycle. For these reasons, REITs’ growth is undeniably offering superior dividend yield. However, REIT could also experience downside returns and macro-driven volatility. Like any other investments, it has risks too. There are many REIT valuation model excel templates you could use from here to help assess the potential risks and returns of this venture.

How to Invest in REIT Commercial Real Estate?

Commercial properties usually render workspace for different businesses, including office buildings, convenience stores, hotels, etc. Commercial properties tend to provide higher investment returns as compared to residential properties making them a sound investment.

An investor interested in commercial property investments can invest directly through real estate property ownership, which requires a tremendous amount of capital and significant knowledge about the industry. This investment is suitable for high net-worth individuals.

Or, an investor may prefer to invest in commercial property through shares ownership in REITs. This is the popular method of investing since it does not require too much capital and direct involvement with the property. REITs purchase commercial real estate, develop and manage the properties, and also allow investors to acquire shares in the same manner as purchasing stocks and bonds.

Thus, if you want to invest in commercial properties REITs, it is necessary to understand the basic principles, terms, and of course, the different REIT valuation approaches used by financial analysts.

REIT Commercial Real Estate Valuation Approaches

There are four common approaches used in valuing REIT.

1. Net Asset Value (NAV)

NAV represents the fair market value of the REIT’s properties minus total liabilities. The REIT can be considered attractively priced when the REIT is traded at a price lower than the NAV per share, meaning it is traded at a discount. Most often, this method is favored in valuing REIT because it is reliant on current market prices in real estate.

2. Discounted Cash Flow (DCF)

It is a valuation technique dependent on the expected future cash flows of the REIT commercial real estate properties being valued. This approach is similar to the DCF valuation method for other industries, which attempt to figure out the value of the REIT today based on the projected cash it will generate in the future.

3. Dividend Discount Model (DDM)

This approach discounts all expected future dividends to the present value at the cost of equity. DDM assumes that the current market value of the REIT equals the sum of all future dividends.

4. Replacement Cost

REIT valuation method that calculates the cost required to replace the entire property. The replacement cost can be determined by reference to comparable properties within the same vicinity or similar location. Since this data is not readily available and could be time-consuming, this technique is not popular in valuing REIT.

5. Multiples and Cap Rates

There are three common metrics used in comparing the relative valuation of REIT

– Cap Rates

– Equity Value /FFO

– Equity Value/ AFFO

Important REIT Valuation Metrics

Compared to traditional companies which are valued on EPS or book value, REITs are assessed under different scales, including FFO, AFFO, and NAV. These metrics are used because real estate is purchased in the private sector based on cash flow streams generated by the asset and not on historical book values. For this reason, there are several metrics created to evaluate REIT.

Though Generally Accepted Accounting Principles (GAAP) uses depreciation and amortization as an expense, real estate prices have historically not eroded over time because of higher land costs and replacement costs. Thus, operating income for real estate companies that uses GAAP historical cost accounting could be misleading. Since all the REIT assets are depreciable, it distorts the net income and provides significant tax benefits.

• Funds from Operation (FFO) – represents the actual cash generated from the REIT’s operation. It is a widely used ratio for valuation purposes as it becomes the primary earning metric in REIT.

FFO = Net Income + Depreciation and Amortization+ Loss on Sales of Asset – Gain on Sales of Asset+ Interest Income

- FFO per Share – Similar to Earnings per Share (EPS), simply divide the FFO to shares outstanding

- Price-to-FFO – is the substitute for (Price-to-Earnings ratio)P/E ratio for other industries. The current market price is divided by FFO per share to arrive at the P/FFO ratio.

- Payout Ratio – Divides dividend per share to FFO per share.

• Adjusted Funds from Operation (AFFO) – is another metric commonly used in REIT to measure its performance. The AFFO can be derived by adjusting the FFO to consider the recurring expenses required to keep the real property operating. The AFFO also adds back debt amortization and equity issuance costs since it is funded by external debt and equity investors.

• Debt-to-EBITDA – is the most commonly used metric to describe REIT’s debt. When evaluating REIT, this metric provides the best way to assess the debt level of REIT. Comparative analysis of similar industries can be obtained to assess the reasonableness of the ratio.

• Interest Coverage – the ratio of debt and profitability used to determine how fast the REIT could pay interest on its outstanding debt. A 5:1 ratio indicates that that the REIT is earning four times the amount it needs to pay the interest on its debt.

Formula: EBIT/Interest Expense

Normalized FFO or AFFO could render better conjectures of a company’s actual cash flow. These metrics are included in our REIT valuation model templates, which could help you evaluate prospective REITs.

REIT Valuation Model Excel Templates

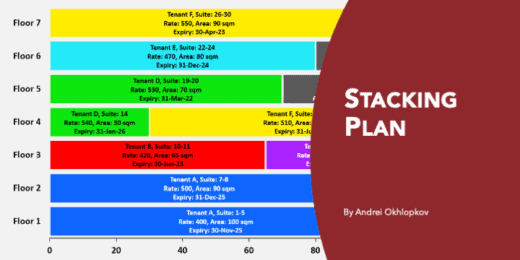

Properties are typically divided into categories where each will have different business models as well as benchmark margin, risk, and return. Initially, the costs and expenses are predicted during the process to calculate the profit when modeling a property development. The predicted cash flow will vary at different stages of development depending on the amount of risk of each property investment. Additionally, the debt and equity distribution also play a vital role in the REIT valuation.

REIT aims to invest in real estate to generate cash flow and income and distribute dividends to shareholders. Investing in REIT renders investors the edge of investing in equity assets and diversifying their portfolio from equity assets. Since the law requires publicly-traded REITs to distribute 90% of their taxable income to shareholders, it can be considered a liquid investment and provides superiority over other asset classes. Thus, an in-depth understanding of the REIT valuation model Excel templates is essential to evaluate REIT properly.

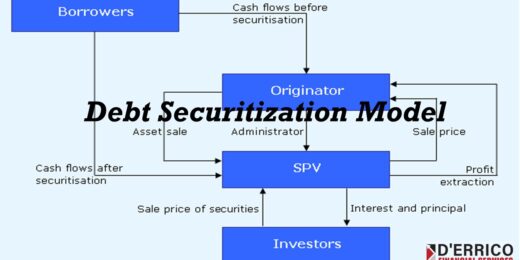

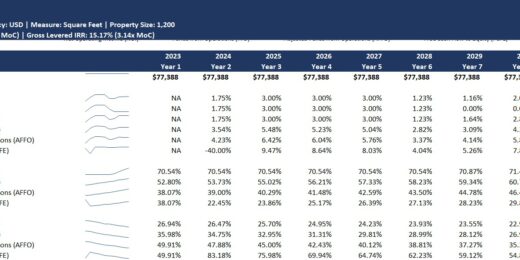

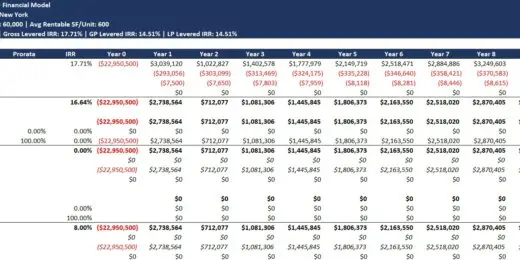

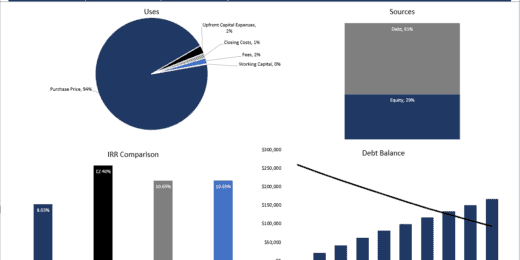

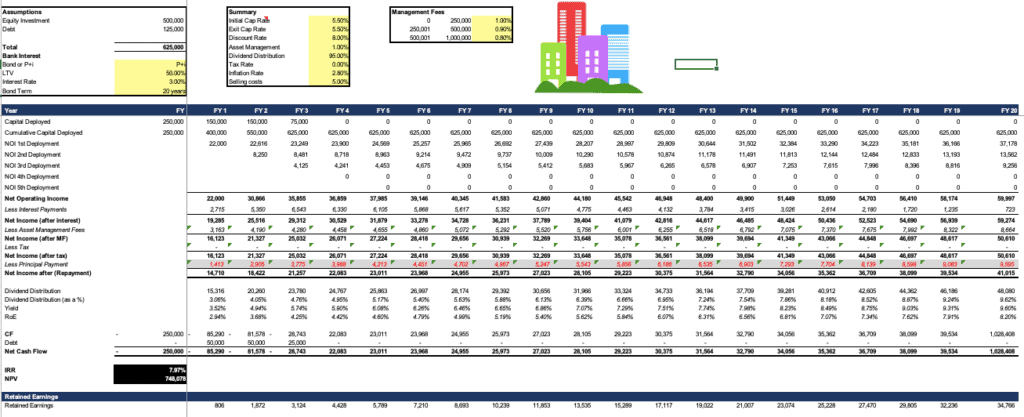

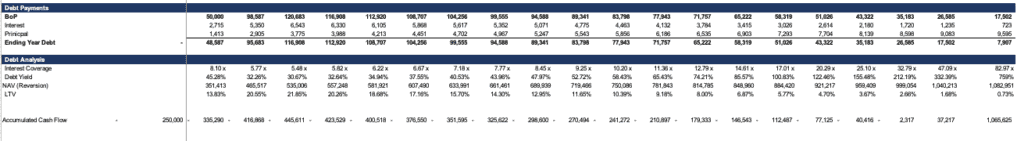

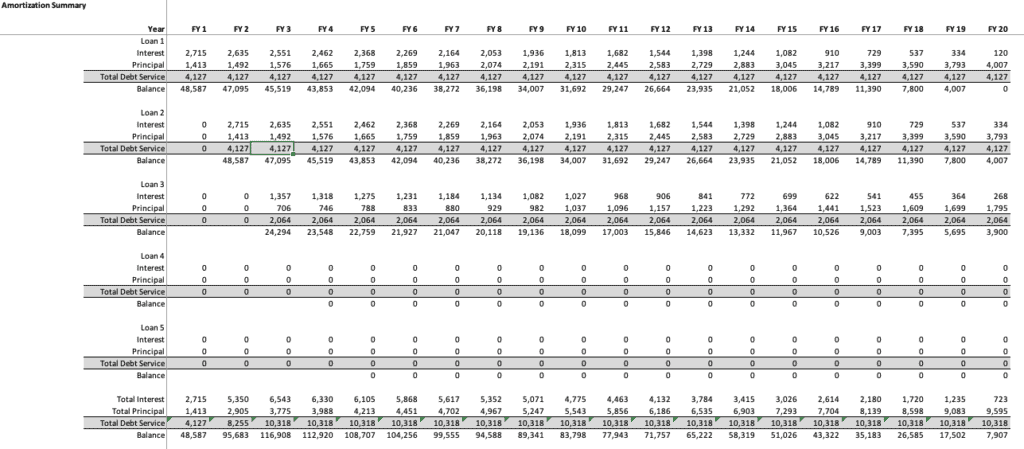

Here’s an illustration of the REIT valuation model template. Check out this link for a complete overview of this model: REIT Real Estate Investment Trust Ramping Model.

There are plenty of REIT valuation model templates available here to start your feasibility study and triumph in this business. All you have to do is read more study about the venture you’re about to take, study how the models work, and play with the numbers till you are satisfied with the potential risks and returns you’re about to make.

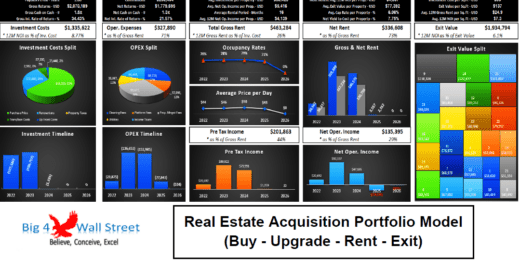

To download Real Estate Financial Model Templates, please feel free to browse our selection below: