Financial Feasibility

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

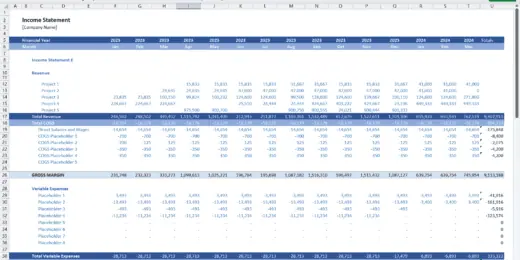

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

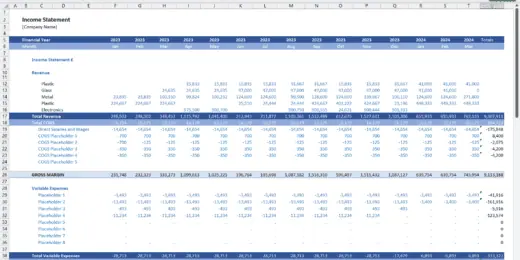

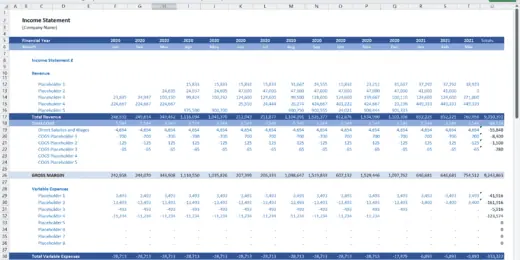

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Indoor Golf Centre Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Golf…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

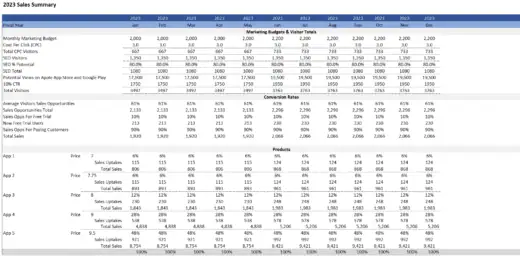

Mobile App Development Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Mobile App…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

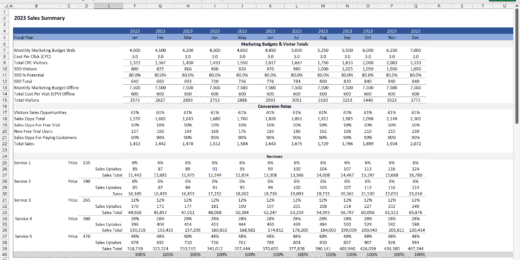

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

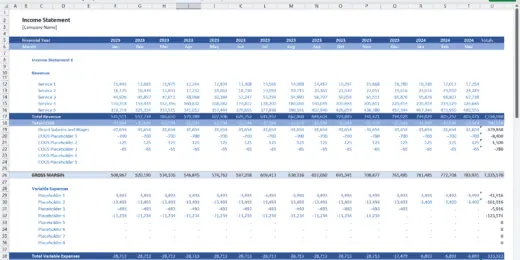

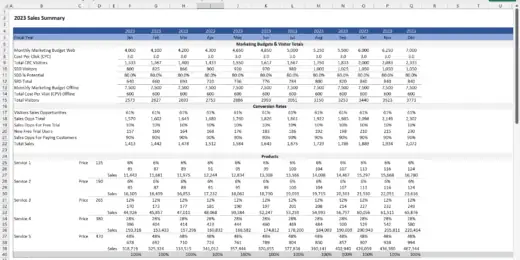

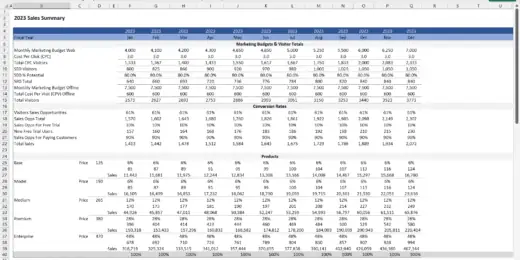

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

Social Media Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Social Media…

Web Hosting Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking web hosting…

5 Year 3 Statement Recycling Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Recycling Centre…

5 Year 3 Statement Construction Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking construction company…

Digital Advertising Agency Finance Model Excel Template

A comprehensive editable 5 Year 3 Statement, MS Excel spreadsheet…

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Graphic Design Company Finance Model Excel Spreadsheet

A comprehensive editable, MS Excel spreadsheet for tracking Graphic Design…

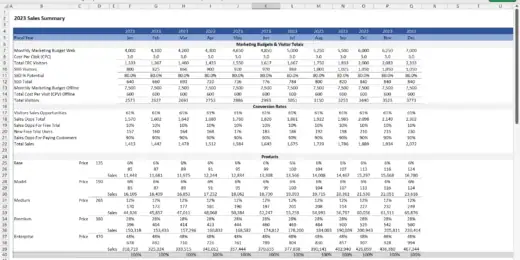

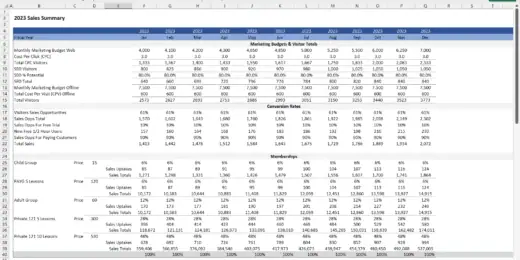

Swimming School Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Swimming School…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

Pig Farming Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking pig farming…

3 Statement Car Hire Company Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking car hire…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

3 Statement SAAS Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking SAAS Development…

3 Statement Software Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking software development…

Renewable Energy Financial Model

Comprehensive financial model designed for analyzing renewable energy projects, such…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

Fruit Processing Facility – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Auto Parts Store – 5 Year Financial Model

This Financial Model Template provides an advanced 5-year financial plan…

Brewery Financial Model and Budget Control

This Excel model is an advanced, user-friendly financial planning tool…

Real Estate – Multi Family Acquisition Pro-forma

This Excel template is an intuitive and comprehensive solution tailored…

Real Estate – Single Family Rental Pro-Forma Template

This real estate financial model is a dynamic tool designed…

Motorboat Rental Business Financial Model

Dive into the heart of financial planning with our Motorboat…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Financial Feasibility Analysis

A financial feasibility study is an assessment of the financial aspects of something, such as a project, investment, etc. It considers many factors including the startup capital, expenses, revenues, and investor income and disbursements, to contribute data to a more comprehensive feasibility study.

Financial feasibility analysis is when you study a project if it is financially viable after taking into consideration its total costs and probable revenues. For example, if the cost of developing a new product will incur $100,000 and its expected increase in revenue will be around $300,000. This entails that the project is feasible as its revenue is more than its covered costs. Basically, a financial feasibility analysis is to tests the viability of an idea where its goal is to emphasize potential risks that might occur and to ensure that after considering all important factors, the project is still a good idea.

Usually, conducting financial analysis is to allow a business to check where and how it will operate, plan about the potential risks, competitors, and the funding needed to get the business operations up and running. Thus, with the help of financial analysis, companies will be able to determine and organize all the details needed to ensure the business work, identify logistical problems or business-related problems and their corresponding solutions, developing marketing strategies to help attract investors or banks to provide funding for the project and be convinced that it is worth investing for.

It is very important to conduct a financial analysis when starting a project. Who wouldn’t want to ensure that their projects would return a bigger profit than the cost to start those projects? Aside from being able to determine if the project is financially feasible, you’ll also be able to calculate how much funding is required to start the project and where to get the funding from. If the funding came from outside sources, e.g. investors or banks, the financial analysis will also help convince those entities on why they should invest in those projects. Therefore, it is undeniable that ensuring the project is financially feasible by conducting a financial feasibility analysis, is a critical task.

Methods to Calculate Financial Feasibility

Financial Feasibility, at its core, is a function of revenues and costs. If the cost to start a particular project outweighs the expected returns, then this means that the project is not financially feasible. Most analysts tend to refer to the present value of the future cash flows or sometimes the payback period to check the financial feasibility of a project. To calculate the financial feasibility of a project, there are several methods that one can use.

Internal Rate of Return: also known as the IRR which is used to estimate the profitability of potential investments by calculating the rate of return that an investment or project is expected to provide. It is a financial metric used to discount capital budgeting and to turn the NPV of all expected cash flows equal to zero. As you can see, it has a resemblance and often used alongside the Discounted Cash Flow Valuation or DCF. There are different types of IRRs depending on the types of cash flows provided:

- Unlevered IRR – Free to Cash Flow to Firm

- Levered IRR – Free Cash Flow to Equity

- Investor IRR – Cash in / Cash out to Investor

Project Profit: analysis which is particularly done to a startup of a project or in the initial years. It is to study the various trends which could impact the overall operating conditions on revenues and profit of the project. Basically, project profit analysis is to analyze the movement of all profit and loss to be in line with the projected costs. Thus, any deviations and corrections to the projection will be determined beforehand. The following parameters are the factors to used to analyze the project profit:

- Period / Duration of Project or Coverage of work

- Escalation clause in Project

- Cost-Benefit Analysis

- Projected profit based on Project Progress

- Projected profit based on the tendency to recur at intervals

Investment Multiple: also known as the Total Value to Paid-In (TVPI) multiple. One of the important ratios used in private equity. To calculate the TVPI, you need to add the reported value and the distributions received and then subsequently dividing that amount by the total capital contributed. Basically, you take all the total proceeds and then divided it by the total investment provided to the project. It gives the investor insight into the fund’s performance by showing the fund’s total value as a multiple of its cost basis. One thing to note down is that the investment multiple doesn’t take into account the time value of money. The formula to calculate the investment multiple is the following:

Investment Multiple = Total Proceeds / Total Investment

Or

Investment Multiple = (Cumulative Distributions + Residual Value) / Paid - Capital

Cost Estimates: a forecast of all costs for a project, plan, activity, etc., which comes in different types such as:

- Analogous – Basing a cost estimate on the historical costs incurred by similar projects which are only applicable when the costs are predictable.

- Bottom-Up – The cost estimates involve analysis to identify the materials, equipment, etc., to be purchased and certain tasks that need to be completed which will be estimated separately according to its appropriate specialist workforce, e.g. hiring a particular engineer to finish/estimate a task. This type of estimate also includes price quotations from suppliers.

- Parametric Estimates – The estimates are calculated based on the parameters provided, e.g. making use of required metrics to act as reference points.

- Reference Class Forecasting – To create or validate estimates based on a database of similar projects, e.g. looking up comparable buildings estimates or actual costs within the last fives years to validate bottom-up estimates.

Return on Investment: another way of calculating the financial feasibility of a project by estimating both the cost and returns. ROI stands as the gain or expected gain which is often expressed as a percentage of the investment cost. It is also a very common financial metric used to compare and evaluate strategies. The formula is the following:

ROI = [(gain from investment – cost of investment) / cost of investment] x 100

For example: If you invest $80 in a campaign that has the potential to earn you $400 in net revenue, the ROI is [(400-80)/80]x100 = 400%

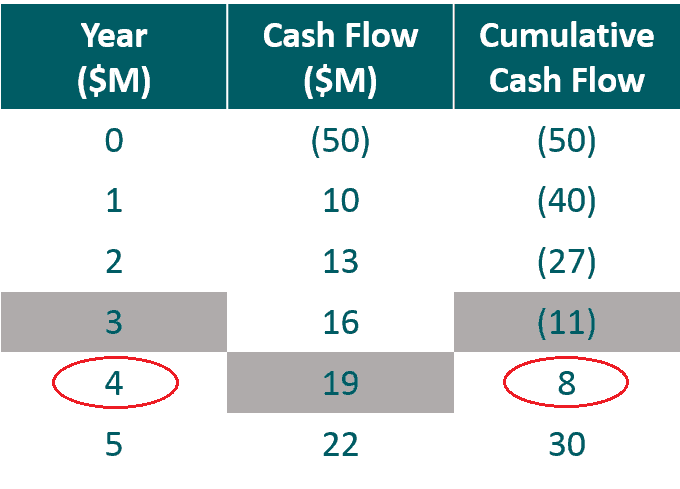

Payback Period: building a model on how long it’ll take to reach break-even. The payback period is often calculated as the period for which the future cash flows are discounted to net present value equal cost. Basically, it is the length of time it takes a project to reach break-even which can be used to compare strategies and investments based on its corresponding projected returns. The formula to calculate the Payback Period is the following:

When Even Cash Flows: PP = Initial Investment / Cash Inflow per Period

For Uneven Cash Flows: PP = A + (B / C)

Where:

A = The last period with a negative cumulative cash flow;

B = The absolute value of cumulative cash flow at the end of period A;

C = The total cash during the period after A

For example:

Payback Period

= 3 + (|- $11M| ÷ $19M)

= 3 + ($11M ÷ $19M)

≈ 3 + 0.58

≈ 3.58 years

So, the payback period will be completed approximately almost 4 years with $8M, a positive amount of Cumulative Cash Flow.

Though the payback period is very simple to calculate, it does not take into account the time value of money which is critical and can be detrimental when making wise decisions.

Net Present Value: The sum of projected cash flows that will be generated by a project which is then discounted to their present value. Unlike the payback period, the net present value is a way to evaluate the project by considering the time value of money. The formula to calculate the net present value depends on the consistency of the generated returns.

If each period generates returns in equal amounts:

NPV = C x {(1 - (1 + R)-T) / R} − Initial Investment

If many projects generate returns at varying rates over time:

NPV = (C for Period 1 / (1 + R)1) + (C for Period 2 / (1 + R)2) ... (C for Period x / (1 + R)x) - Initial Investment

Where:

C = Expected Cash Flows

R = Required Rate of Return (used as a discount rate for future cash flows)

T = Number of Periods over which a project is expected to generate an income

For example:

An investor is considering funding a project and in order to understand it, the investor will then calculate the present value of cash flows that includes all the future cash flows, e.g. expenses.

Financial Ratios: standard ratios used to evaluate the overall financial position of a company or other organizations. The financial ratios are also used to compare the strengths and weaknesses of a business. Usually, it can be expressed as a decimal value or an equivalent percent value. Most often it is used as a percentage for cases that some ratios are sometimes less than 1. To determine the financial ratios, all the values needed will be referred from the financial statements (income statement, balance sheet, and statement of cash flows). The financial ratios are an essential part of the financial feasibility analysis. Once you calculate the financial ratios, these are then compared to industry standards to check if the investment is desirable or not for lenders, banks, investors, etc.

Sensitivity Analysis: a critical part of any financial feasibility analysis to ensure that all areas of risks or opportunities will be covered. Basically, you run multiple simulations to test the financial feasibility of a business through different scenarios which will create an impact, good or bad, on the business. Therefore, the sensitivity analysis is conducted to better understand the risks and benefits of the project.

Impact Evaluation: Applicable to projects that tend to have financial costs but non-financial returns, e.g. non-profit organizations. Impact evaluation is more of an assessment of the actual results of the changes. Basically, a project may achieve its goal but overall have a negative impact.

Usually, for cases such as banks, as long as there is enough cash flow, collateral, a solid business plan with substance, and a guarantor if it’s a startup business, then it shouldn’t be a problem for banks to provide funding. As for investors, they consider first if there’s enough return, the risk is as minimum as possible, and there’s also no misalignment between the founders and investors since the project or investment is more believable if the founders themselves invest more wealth than the investors. Overall, in order to determine the financial feasibility of a project or investment, you need to get a good grasp of the project’s financial metrics, calculate the financial ratios (Debt/EBITDA, Debt/Equity, Profit Margins, etc.), determining the financial returns, etc. If all of these factors work, then the investors, banks, etc., will willingly help with providing funds, otherwise, the project won’t be funded at all.

Feasibility Analysis Examples

To better understand how to determine the financial feasibility of a business or projects, you can create a financial model which usually comes in Excel. A financial model is a great tool that covers all the aspects needed to evaluate a business’ or project's financial feasibility. So, you can start building your very own either from scratch or the easier and more convenient way, using financial model templates. Above is our list of feasibility analysis examples which you can use as a reference or as your base to start your financial model with. The listed feasibility analysis examples are made by financial modeling experts with substantial experience and industry know-how so, you’ll have an idea of what professional-made financial models are. Just simply choose from the list of feasibility analysis examples according to your preference and start building a financial model to test a project’s financial feasibility or simply building a financial feasibility analysis for your own use.