Examples of Result-Oriented Financial Modeling in Excel

Financial models have evolved from simple abstract spreadsheets to real-world applications. They became an important aspect of business life. They are essential in every company’s toolkit. Yet, creating a solid financial model requires in-depth understanding and financial modeling skills.

Solid financial modeling skills will help you create a trustworthy financial model. Financial models will help your business forecast your company’s financial success. They are a simplified version of your company’s portfolio. As such, you expect future profitability using a set of market hypotheses.

One must understand the following before constructing a successful financial model:

- Microsoft Excel Principles & Navigation

- Financial Modeling on Excel Capabilities

If you want to learn how to do financial modeling, read this article until the end. eFinancialModels is a reputable source of well-tailored financial model templates.

What is Financial Modeling?

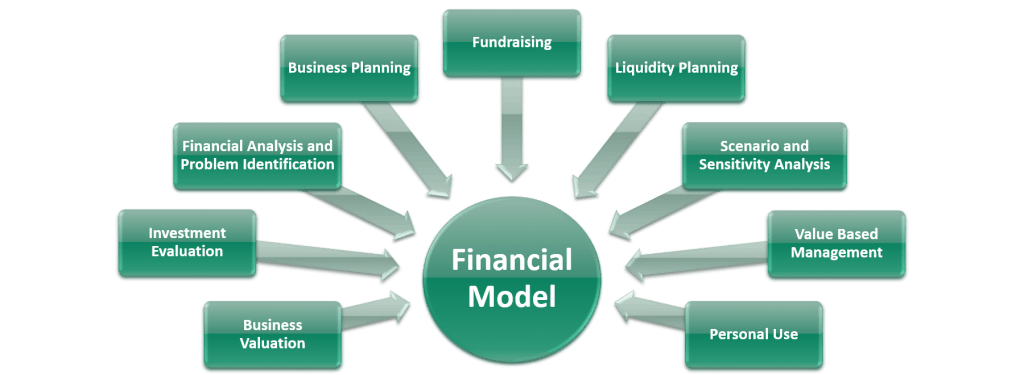

Financial modeling produces numerical representations of a company’s past, present, and future. Your firm’s financial model will be used to make decisions. Business leaders can project costs and profits for a new project using them. They help in the financial planning and analysis process flow. These include:

- Anticipating the influence of events on a company’s stock price

- Explaining internal to external factors like business model changes or strategies

Why is Financial Modeling Important?

How does financial modeling in Excel help business owners? One must understand the value drivers of business growth to succeed. As such, there’s a need to develop a sound financial model.

Below are the benefits of financial modeling in Excel:

- Get a deeper understanding of a business’s value and how key drivers influence it.

- Find potential areas for improvement. Financial modeling in Excel will help you identify synergies in M&A transactions. They identify parameters that could be more optimal compared to industry benchmarks. As such, they can help focus on areas to increase a business’ valuation.

- Develop a solid budget and financial plan by gaining future financial visibility.

- Avoid making blind decisions by getting a better basis for capital allocation. Financial modeling in Excel justifies all decisions in a traceable and rational way.

The best way to achieve your business goals is to have clear foresight in the right business areas. Spend your efforts by looking at the business as a whole. Understand both what you, as an organization, are trying to do. It then directs the purpose of the model and start-up financial projections. You must develop an optimal financial model depending on the industry and use case.

eFinancialModels aims to help entrepreneurs, key executives, and investors. It is by providing state-of-the-art examples of financial modeling. We provided industry-specific financial model templates which users can take advantage for:

- Capital raising

- Company valuations

- Creating financial plans

- Investment analysis

- Mergers & Acquisitions (M&A) transactions

A simple Excel valuation template is the best way to start something new. It better analyzes the prospects of interesting investment projects. We hope our financial modeling examples in Excel offer an excellent solution.

Where to Learn Financial Modeling?

Financial modeling is a most sought-after expertise – whether pursuing a promotion or running a firm. It may help you examine how different factors affect your income. At the same time, it forecasts future business performance. You might be wondering where’s the best place to learn financial modeling.

- Various universities or websites offer basic and advanced financial modeling courses.

- The Internet immediately displays high volumes of information and videos to teach you.

- With a click, Google or YouTube can be the best place to learn financial modeling.

- You can even try all the steps to practice financial modeling through self-study.

Another question you might ask is, “How long does it take to learn financial modeling?” There is no clear answer. Learning the theories and principles of financial modeling is challenging. It requires full attention to grasp all the knowledge. Also, it doesn’t stop you from learning; you need to master the skills and apply them to practice.

Learn Financial Modeling by using Financial Modeling Templates!

Can anyone learn financial modeling on their own? The short answer is “yes.” Anyone can learn basic or in-depth financial modeling. But learning everything from the ground takes focus, patience, and time. Many financial modeling courses are available and provided online. These high volumes of information often bombarded and confused you. First, you must determine whether the information source is credible.

If you are a Business Owner, Entrepreneur, Investor, Chief Executive Officer (CEO), Chief Financial Officer (CFO), or Finance Professional, Don’t Miss This Incredible Opportunity! Get the Best Financial Model Templates in Excel at eFinancialModels. We offer a comprehensive collection of Excel-based financial model templates for various industries to help you make clear financial decisions for your business growth.

Developing a financial model with accurate financial projections can take significant time. eFinancialModels offers a diverse range of industry-specific financial model templates in Excel. We provide the best-in-class financial modeling expertise to our users. Our highly skilled and experienced financial modeling professionals have developed financial plan templates. They create result-oriented examples of financial modeling using different techniques which users can easily understand. You can save much effort and leverage your current industry.

Moreover, eFinancialModels provides some free-to-download financial modeling Excel templates. You can also see the descriptions and screenshots of each financial model. Some even have a short video walkthrough to guide you on their capabilities and features. Better yet, take advantage of our free blogs about – financial modeling, financial modeling techniques, how to learn financial modeling, financial modeling tutorial, and the like.

Financial Modeling in Excel vs. ERP Software

The right financial program, software, or tool is critical for business owners or entrepreneurs. It can either save time and money or break the bank. There are several trade-offs between using financial modeling in Excel and ERP software. Each business necessitates different assumptions and calculations.

Excel is a well-known tool for financial modeling. It is the most customizable and flexible tool on the market. It allows you to create a completely customized model from the ground up. Excel can handle any computation, format, layout, or structure.

ERP software for financial modeling can be overly rigid. It does not allow you to comprehend each line of a company’s operations like Excel does. ERP software provides the structure and error prevention we all want in our analyses. But at the expense of being unable to handle attributes specific to a firm or asset.

eFinancialModels has professionally done almost all of its financial modeling templates in Excel. WHY do we use Excel in the first place? Because it is low-cost and simple. It can also produce an effective and solid financial model for your company. You can use Excel to customize your financial model’s structure, computations, and overall layout based on your company’s needs.

Similarly, Excel will help you understand your business better. It gives insight into every aspect of your business. Assume you used financial modeling software. Financial ratios are generated based on your company’s financial statements, projections, and capital structure. It will save you time but not teach you how to do the process.

Examples of Financial Modeling in Excel

Many types of financial models are commonly used nowadays. Below are financial modeling examples. We group them into two categories. These include the basic and advanced models often drafted by experts.

Basic Financial Models

- Three Statement Model– This covers the most basic financial modeling setups. It consists of the income statement, balance sheet, and cash flow.

- Discounted Cash Flow (DCF) Model– DCF is the most used valuation method. It is built upon the three-statement financial model. It values a business’s future cash flow based on its Net Present Value (NPV).

- Budget Model – This is a popular model for creating a budget or financial plan for personal or business use.

- Forecasting Model– This is best used in a financial plan to perform a forecast, projection, and analysis.

- Initial Public Offering (IPO) Model – Investment bankers and corporate development professionals commonly use the IPO model to do a valuation of their business before going public

- Merger Model (M&A) – Advanced financial modelers use this model to evaluate mergers and acquisitions.

- Leveraged Buyout (LBO) Model– This is another advanced financial model for creating a sound debt schedule.

- The Sum of the Parts Model – This is usually built by summing up several DCF models.

- Consolidation Model – Instead of just one business, multiple businesses will be added to one model.

- Option Pricing Model – You can create this kind of model in two ways. But basically, this is usually presented purely as mathematical. It acts more as a calculator.

Advanced Financial Models

- Initial Public Offering (IPO) Model – commonly used by investment bankers and corporate development professionals to do a valuation of their business before going public

- Merger Model (M&A) – usually used by advanced financial modelers to conduct a merger and acquisition

- Leveraged Buyout (LBO) Model – another advanced financial model for creating a sound debt schedule

- Sum of the Parts Model – this kind of model is usually built by taking several DCF models and summing them up together

- Consolidation Model – in this model, instead of just one business, there will be multiple businesses added to one single model

- Option Pricing Model – there are actually two ways you can create this kind of model, but basically, this is usually presented purely as mathematical and acts as a calculator rather than subjective

Excel Valuation Templates and More

There are several ways to earn money. These include:

- Having a job

- Starting a business

- Investing in businesses, projects, and other potential ventures

Investing is one way to earn the most out of one’s money. Thus, it became popular among business executives and entrepreneurs. The questions are:

- How to know if the investment is worth it?

- How to decide which investment venture is the best choice?

- How to know the expected returns of the investment?

The best answer would be to conduct a business valuation and create a Valuation model. It will help you determine the financial value of the business you plan to invest in. There are many valuation methods you can apply to your model. The most common are:

- Income Approach – valuation method used for income-producing properties where it calculates the value based on the entity’s past, current, and forecasted cash flowto determine the intrinsic value. Under this approach are the commonly used and popular methods like the Discounted Cash Flow (DCF), Capitalization of Earnings (CoE), and Economic Value Added (EVA).

- Market Approach – used to determine an entity’s value by considering the market prices of comparable entities. Three known methods utilize this approach: the Precedent Transaction Analysis, Stock Market Multiples Analysis, and Relative Valuation Comparisons.

- Cost Approach – the value is determined by basing it on the balance sheet, generally used to value entities based on the market value of assets, cost to build, replacement cost, and liquidation value of the assets.

Each approach has advantages and disadvantages, but depending on how you use it, you can count on these approaches as a basic guide to valuing a business or an asset. After deciding which approach best suits your needs, the next thing to do is to create a valuation model. It will need you to spend time researching, calculating, and analyzing. Sometimes you need experts to assist or guide you. Another way would be to acquire an Excel valuation template. Using an Excel valuation template will help you save time, learn more about financing, and even give you choices on which valuation method you want to focus on.

The Unique Value Proposition of eFinancialModels

Financial modeling requires financial modeling know-how and can be very time-consuming. The way to approach this is to work very structured and apply stringent logic. Using a financial model template in Excel provides such a structure and an example of how to do such a task.

eFinancialModels offers a wide range of industry-specific financial model templates. It helps save time and provides a structured way to analyze a company or an investment opportunity. Important financial analysis know-how is inbuilt with the financial modeling examples in Excel. We constantly update our model inventory for new industries and use cases as we gather more projects and new vendors.

eFinancialModels offers financial modeling templates for a variety of industries and use cases as follows:

- Financial Analysis: Obtaining a better understanding of the economics of your business and its value drivers

- Forecasting: Preparing a budget and 5-year business plan/financial plan

- Key Performance Metrics (KPIs): Forecasting key metrics such as break-even point, payback period, etc.

- Scenarios: Analyzing the effects of different growth and financing scenarios on your business

- Valuation: Valuing a company or an asset

- M&A: Buying/selling a company or an asset

- Investment and Capital Allocation Decisions: Making enhanced and rationale investment-decision based on solid financial analysis

- Fundraising: Bank financing, equity, etc.

- Managing and Tracking: Keeping track of data metrics and helping with business management.

- Fundraising: Bank financing, equity

- Managing and Tracking: Keeping track of data metrics and helping with business management.

Having the right financial model in Excel is important when it comes down to making better financial decisions. The model will give you the relevant financial metrics, such as IRR, NPV, or yield, to base your decisions on while providing all the details to back it up. In addition, working with dynamic financial modeling examples in Excel allows you to run different scenarios and test the strength of your assumptions in detail. eFinancialModels provides the best-in-class and easy-to-use financial modeling templates in Excel, which can be applied to countless use cases.

So, what are you waiting for? If you’re looking for examples of financial models in Excel or an Excel valuation template to use and understand your business, eFinancialModels is all you need. Creating a solid financial model is one of the best things you can do for your business, and together with our templates, you won’t have to spend too much time creating from scratch.

Acquire the most suitable and ultimate financial modeling examples in Excel for your kind of business now. Our financial model templates encompass but are not limited to (excerpt):

Renewable Energy Financial Models

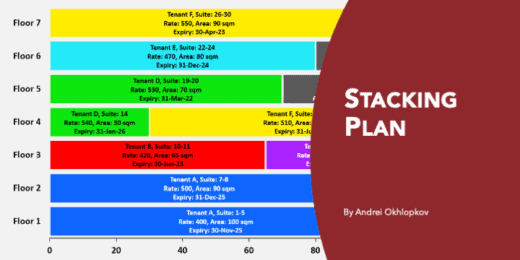

Real Estate Models

Agriculture Financial Plan Templates

Manufacturing Financial Models

Healthcare Financial Models

eCommerce Financial Plan Templates

Hotel Financial Plan Templates

Schools & Education Businesses Financial Model Templates

Private Equity & LBO Model Templates

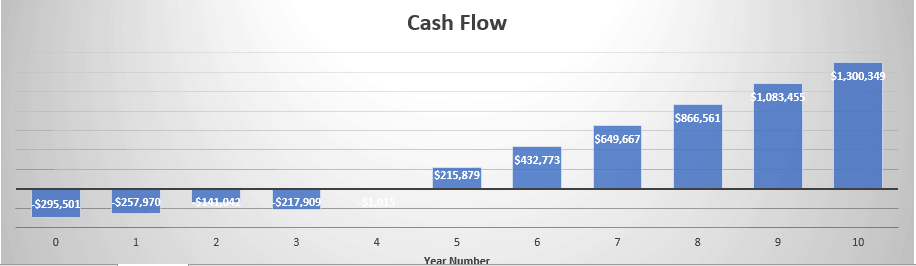

Restaurant Financial Models

Real Estate Developer Financial Plan Templates

SaaS Financial Model Templates

Serviced Office Financial Models

These are just some of the examples of what kind of financial model templates you might find on our website.

Having a solid financial model is absolutely one of the best things you can do to better understand your business and its economics. Rational decisions are based on sound financial analysis and focusing on the right questions. Login now to take full advantage of the excel valuation template models and financial analysis models provided by eFinancialModels.

Power up your financial decision-making by using high-quality and structured financial modeling examples in Excel.

Customer Feedbacks

What our customers say about our financial model templates:

“Love it, it’s a great product”

L. Kishore, App Entrepreneur

“I found them EXTREMELY useful! and by all means a quick and helpful way to get rid of excessive calculations, formulas, and waste of time. Quick, accurate, and exact way of making assessments and/or evaluations.”

G. Garza, Senior Financial Consultant

“I am always delighted with your models. Thank you. Keep delivering these Models.

J. Casabona, CFO FirmGreen Inc.

“Hi! I do not need help. Just wanted to let you know that this webpage is fantastic! Keep it going!

R. Baquerizo, Entrepreneur

“Financial Model Templates from eFinancialModels offer a great way to professionally design a Financial Model.

N. Bendarkar, Entrepreneur