Coffee Farm Financial Feasibility Model Template

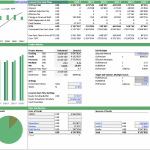

This coffee farm financial feasibility model template prepares a financial plan for your next coffee growing project! Figure out the expected incomes and cash flows for a small or a large coffee plantation project. The model uses a bottom-up approach to model up to 20 different lands under management, crop yields, planting, growing, and harvesting schedules. The model then calculates the expected monthly harvest volumes of coffee beans for each land under management. Revenues are derived by applying the respective pricing assumptions (up to 4 different coffee bean quality levels). OPEX, CAPEX and other assumptions are then used to prepare detailed profit and cash flow forecasts.

This Excel model spreadsheet template was developed to model the operations and financial results for a single-crop coffee bean farm, which plants its coffee beans on several land pieces. These lands are modeled to reflect different years’ outcomes when acquired, different tree ages, harvest yields, and cost structures. The model then calculates a monthly schedule with complete financial statements, which are then aggregated yearly. The financial feasibility can be assessed by analyzing the relevant return metrics (IRR, NPV, Payback Period) and financial ratios over the forecast period (5-10 years, depending on the model version).

The components of the Excel spreadsheet in the form of a financial feasibility model template include the following:

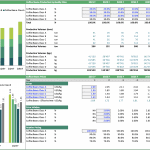

• Executive Summary with a variety of tables and charts, including

• Financial Overview

• Various Breakdowns

• Project Metrics such as Internal Rate of Return (IRR), Net Present Value (NPV), and Payback Period based on unlevered and levered cash flows

• Uses and Sources of Funds Tables

• Time to Break-Even

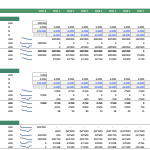

• Assumptions Section

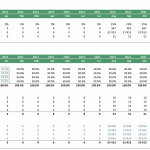

• General assumption sections which allow specifying the model’s currency, units for weight and volume to be used throughout the model, the first forecast year, applicable income tax and interest rates, applicable net working capital assumptions, and other

• Yield Assumptions, including the modeling of anticipated annual changes in yields

• Yearly price assumptions for coffee beans as per 4 different quality levels

• Direct cost assumptions for planting, tree care (growing), harvesting, and processing costs

• Labor cost assumptions, including the forecast of required annual Full-Time Equivalent (FTEs), salary levels for indirect labor, and hourly rates for direct labor.

• Assumptions for OPEX (operating cost) budget

• Assumptions CAPEX (capital expenditures) budgets

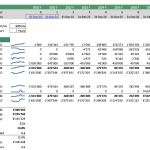

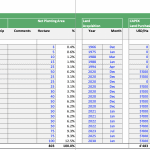

• A table that keeps inventory of the available lands under management (up to 20 different land areas)

• Year of land acquisition and type (if owned or rented)

• Land acquisition costs

• Rental expenses (if applicable)

• Planting Schedule

• Schedule when growing and tree care activities will start

• Schedule when the first harvest can be expected

• If planting will be a new planting (no revenues from that piece of land before) or a re-planting (land plot can have yields and revenues before year/month of planting)

• Yield table, which specifies what annual yield can be expected for which piece of land and in which months of the year

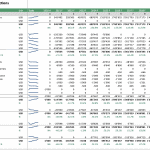

• Monthly harvest schedule

• Annual yield index

• Harvest volumes

• A growing cost table specifies the months the different costs, such as fertilizers and herbicides, will be spent, and the annual expected total costs per hectare and total cost basis. Costs can be adjusted for each piece of land under management or left to be linked to a specified general assumption.

• Exit value assumptions based on either EV/Sales, EV/EBITDA, or EV/Hectare multiples

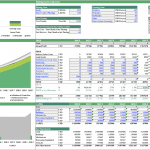

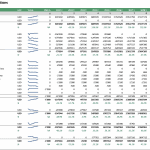

• Detailed Monthly Forecast includes tables for lands and trees under management, monthly planted areas, monthly harvested areas, monthly harvest volumes, prices, direct monthly costs, OPEX, and many other Key Performance Indicators (KPIs). The monthly sheet also includes a detailed financial statement to understand Profits, Balance Sheets, and Cash Flows.

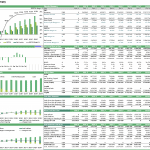

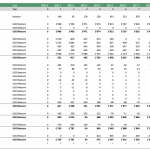

• Annual Forest, which aggregates the monthly figures into annual figures and includes the following:

• Income Statement

• Balance Sheet

• Cash Flow Statement

• Financial Ratios

• Key Performance Indicators such as Lands Under Management, Planted Area, Harvested Area, Harvest Volumes, etc.

• Fixed Asset Tables

• Debt Schedule

• Standardized Income Statement (as % of Sales)

• Profit per Hectare

• Direct Cash Flows

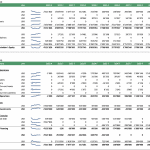

• Project Valuation

• Free Cash Flow Forecast

• Uses of Funds Calculation

• Break-Even Analysis on a per Hectare Basis (Pro Version only)

• Instructions guide on how to work with this model

• Terms & Abbreviations Table

• Model Structure Outline

In case this model (monthly forecast) is too complex or you feel requires too many details to enter, kindly check out the alternative model template – Starting or Buying a Coffee Farm (only includes annual forecast but is simpler).

This financial feasibility plan template comes in two versions, a Standard and a Pro Version both fully editable in MS Excel. The Standard version includes a 5-year forecast horizon, while the Pro version comes with a 10-year forecasting period and a break-even analysis on a per-hectare basis. Free PDF Demo Versions containing the model structure are available for download as well.

File types:

.xlsx (MS Excel)

.pdf (Adobe Acrobat Reader)

Similar Products

Other customers were also interested in...

Starting or Buying a Coffee Farm – Financial Mod...

The goal of this model is to assist you with starting or buying a coffee farm. The financial spreads... Read more

Oilseeds Crushing Plant Financial Model

Setting up an oilseed crushing plant requires a comprehensive and executed business strategy. This t... Read more

Poultry Project Financial Feasibility Model

This poultry financial model template in Excel provides a framework to determine the financial feasi... Read more

Chicken Egg Farm – Business Plan

This chicken egg farming model aims to plan the operations, financial feasibility, and profitability... Read more

Avocado Farm Financial Model

Our Excel financial model template for avocado farming is the perfect tool for investors and entrepr... Read more

Pecan Tree Growing Financial Model

“Is Pecan Farming Profitable?” In our Pecan Tree Growing Financial model, we aim to answer that ... Read more

Seaweed Farming Financial Model

The Seaweed Farm Financial Model aims to comprehensively develop a business plan of 40 years forecas... Read more

Chili Pepper Farm – Financial Feasibility St...

This financial model spreadsheet template in Excel can be used to assess the financial feasibility o... Read more

Banana Tree Farming – Investing and Growing

This banana tree plantation financial model serves as a financial planning tool for evaluating a ban... Read more

Cacao Farm Financial Model Template

The goal of this model is to assist you with starting or buying a cacao farm. The financial spreadsh... Read more

Reviews

This financial model is the one of the best , most detailed and comprehensive model in the market

265 of 505 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

To download the Coffee Farming Financial Model Template, simply add it to your cart and proceed to Checkout. You will then receive an email containing the download link of the model template(s) that you purchased. We hope this clarifies and if you have any questions or further need assistance, please do not hesitate to let us know via [email protected].

584 of 1179 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.