Payback Period

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

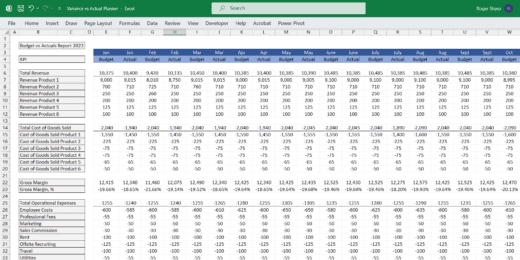

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

Aesthetics & Dermatology Clinic – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Construction Machinery Rental Company Financial Model

Discover the key to financial planning in the construction machinery…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

Fruit Processing Facility – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Auto Parts Store – 5 Year Financial Model

This Financial Model Template provides an advanced 5-year financial plan…

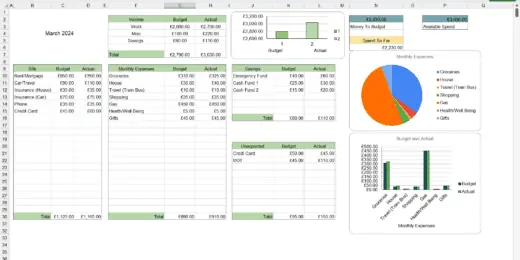

Ultimate Budget Spreadsheet, Budget Dashboard, Google Sheets, Excel

Ultimate Budget Spreadsheet, Budget Dashboard, in both Google Sheets and…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Online Tutoring Services Financial Model (10+ Yrs DCF and Valuation)

The Online Tutoring Services Financial Model is a comprehensive tool…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Oil & Gas Financial Model – DCF and NAV Valuation (5+ Yrs.)

The Oil and Gas financial model with DCF (Discounted Cash…

Cocktail Bar – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Truck Rental Company Financial Model

This detailed 10-year monthly Excel template is specifically designed to…

Private Aircraft Rental Company Financial Model

Embark on a journey to financial mastery with our Private…

Webinar Organizer Business Plan Template

Discover the key to financial success in your webinar ventures…

Party Planning Business Financial Model

Introducing the Party Planning Business Financial Model – Your Ultimate…

Culinary Arts Academy – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Dog Grooming Services Financial Model (10+ Yrs DCF and Valuation)

The Dog Grooming Services financial model is a comprehensive tool…

Event Organizer Business Model Template

Elevate your event planning business to new heights with our…

Sailboat Rental Business Financial Model

This comprehensive 10-year monthly Excel template offers an ideal basis…

Rental Property (Airbnb – Real Estate) Financial Model

Powerful Real Estate Rental Property Financial Model for Informed Decision-Making,…

Hotel Complex – Financial Model (5 Yrs. DCF and Valuation)

The Hotel Complex financial model is a comprehensive tool designed…

Sky Diving Center – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

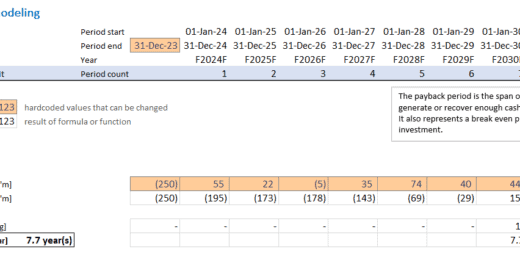

Payback period in Financial Modeling

Ideal for entrepreneurs and finance professionals, this tool offers a…

Crypto Trading Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan of a…

EV Battery Recycling Plant Financial Model (10+ Yrs DCF and Valuation)

The EV Battery Recycling Plant financial model is a comprehensive…

Events & Weddings Venue – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Microfinance Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a…

Tennis Court and Club Development – 10-year Financial Forecasting Model

Introducing our Tennis Courts and Club Financial Forecasting Model –…

Gym and Fitness Club 10 year Financial Forecasting Model

Introducing our indispensable 10-Year Excel Financial Forecasting Model, a vital…

Tennis Club Financial Model – 5 Year Forecast

Financial Model providing an advanced 5-year financial plan for a…

Catering Services Business Financial Model (10+ Yrs DCF and Valuation)

The catering services business financial model is a comprehensive tool…

Moving Services Business Financial Model (10+ Yrs DCF and Valuation)

The moving services business financial model is a comprehensive tool…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Car Rental Business Financial Model

This Car Rental Business Financial Model Template in Excel offers…

Self-Storage Park Development Model

This Self-Storage Park development model will produce 20 years of…

Digital Hiring (Talent) Marketplace – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for an…

Online Payments Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

VOD/OTT Streaming Platform – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup…

Subscription Box Financial Model – Up to 72 Months

Test many variables in this financial model for a subscription…

Subscription Business – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup…

Crowdlending (P2P) Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Financial Feasibility Study – Excavation Contractor

The report is containing full set of financial feasibility study…

Car Repair Shop Financial Model (10+ Yrs DCF and Valuation)

The Car Repair Shop Fin. Model (DCF and Valuation) is…

Payback Period - The time it takes to recover the cost of the Initial Investment

The Payback Period is the time period required to recover the cost of a project. In other words, it is the length of time needed to know when a project's cumulated cash flow will be able to pay back for its initial investment. Also, it is a question of risk where the shorter the money is invested in a risky project, the less risky the investment is. But the main advantage of this ratio is that it is easy to calculate and also can be easily understood by anybody.

The attractiveness of an investment is proportional to its payback period. Shorter paybacks make investments more appealing. The payback period is a valuable metric in financial and capital budgeting, but it also has applications in other industries. It can be used by individuals and companies to measure the return on investment in energy-efficient technology such as solar panels and insulation, as well as the costs of repairs and upgrades.

Capital budgeting is at the heart of corporate finance. One of the most important principles for any corporate financial analyst to grasp is how to value various investments or operating ventures in order to choose the most profitable project or investment. The payback period is one way corporate financial analysts do this.

The payback period is calculated by dividing the investment expense by the annual cash flow. The investment is more appealing if the payback period is short.

Payback Period Purpose

Once you are ready to make a decision as to the profitability of a project, how to calculate payback in Excel is a very useful tool. The payback period is usually expressed in years or months and a very important factor if you want to measure the feasibility of a project or investment and its risk. By calculating the payback period, you will be able to answer the question, “How long will it take to recoup the initial investment?”. If the answer is less than or equal to the maximum allowable period, the project is considered to be acceptable. If the payback period is longer than is acceptable, then the project is rejected. Note that the payback period serves as a kind of break-even period, and thus provides some information regarding the liquidity of the project under analysis.

On the other hand, the limitation of this ratio is that in the simple form, it is not considering the time value of money and only focuses on short-term benefits. Basically, the cash flows at the beginning have the same weight as cash flows coming in the future. Also, the cash flows, after the project has paid back its investment, are excluded from the analysis.

In other words, a payback period has very clear advantages and disadvantages such as:

+ Simple financial metric easy to calculate

+ Easy to explain

- Focuses on Short-Term gains (excludes longer-term benefits from the analysis)

- Cash Flows in the near and distant future have the same weight

Despite its clear disadvantage, overall, how to calculate payback in Excel is a great and simple financial ratio to check whenever you consider an investment. Below, you can see an example of a simple calculation of the payback period.

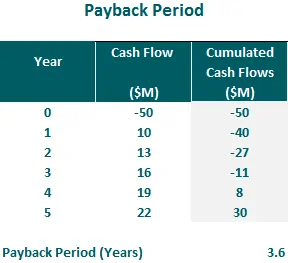

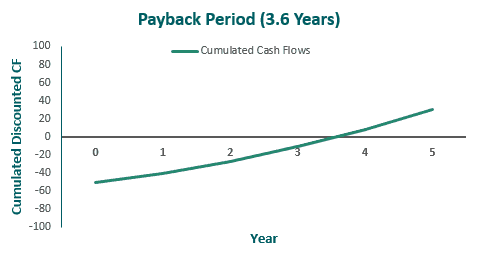

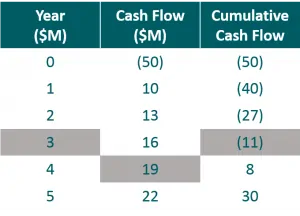

With the given initial investment of $50M and projected cash flows for 5-yrs, the period calculated where the business will be able to pay back the initial investment as well as start accumulating income or basically, the payback period, is determined as 3.6 years just like how it is shown in the table above and the graph below.

How to Calculate Payback Period? - Examples

Though it sounds easy to determine the payback period, we will discuss in detail how to calculate the payback period from here on.

The cash flows or projected cash flows are critical elements in determining the payback period of a business. But it is not always the case where it is constant or even at certain periods. Hence, the way to calculate the payback period will differ. Basically, to determine a much more precise result, there are two ways on how to calculate the payback period. The first one applies to cases when cash flows are even and the other is when the cash flows are uneven.

Since the payback period is usually expressed in years, the steps for calculating the Payback Period is as follows:

- Even Cash Flows – simply divide the initial investment by the cash inflow per period

- Uneven Cash Flows – simply subtract the cash flows from the initial investment until the initial investment is covered

To put it in simpler terms and an easier way to understand, the following formulas are used:

When Even Cash Flows: PP = Initial Investment / Cash Inflow per Period

For Uneven Cash Flows: PP = A + (B / C)

Where:

A = The last period with negative cumulative cash flow;

B = The absolute value of the last negative cumulative cash flow at the end of period A;

C = The total cash flow received during the period after A

Calculation of Payback Period Example with Even Cash Flows using the formula:

Assuming that the expected cash flows of a certain business with a $50M initial investment is constantly $20.5M for every period. We will then calculate the payback period by dividing $50M to $20.5M, resulting in 2.45 years.

Calculation of Payback Period Example with Uneven Cash Flows using the Table shown below and applying the formula:

If we take the initial investment in the example above of $50M, you will see that in year 4 the cumulated cash flows become positive ($8M). This means the project's payback period is between year 3 and year 4. If we want to calculate it precisely, we need to divide the missing cash flow by end of year 3 (-$11M) by the cash flow received in year 4 ($19M).

Therefore, the payback period for this project is 3.6 (3 + 11/19) years.

Although the payback period makes a great deal of sense intuitively, it is not without its problems. As mentioned before, the principal problem is that the payback method ignores the time value of money. It should be obvious that most investments become increasingly attractive as the firm’s required return (WACC) falls and less attractive when the required return rises. However, the payback period doesn’t change when the WACC changes. A second difficulty with the payback period is that it does not take all of the cash flows into account. Because it ignores all cash flows beyond the payback period, it can lead to less than optimal decisions.

You don’t have to fret and think that maybe you shouldn’t waste your time with the methods in calculating the payback period. There is, of course, a way to fix the issue regarding the time value of money and that is by using the discounted payback period or also known as the dynamic payback period method which we will discuss further below.

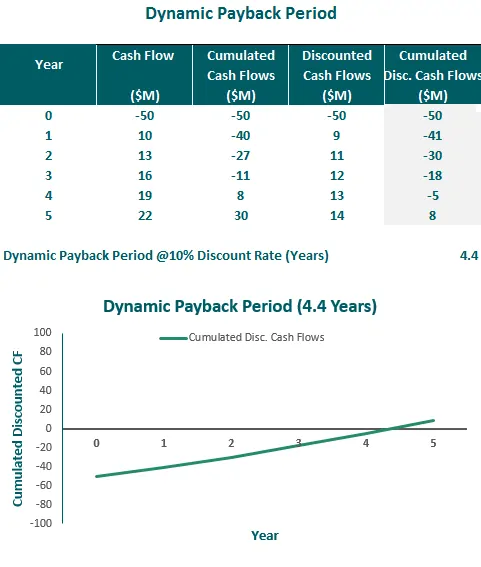

Dynamic Payback Period Method | Discounted Payback Period Formula

Another variation in calculating the payback period is the dynamic payback period method or also known as the discounted payback period (DPP). In this method, you check when the discounted free cash flows pay back for its investment. Basically, a dynamic payback period is the period after which the capital invested has been recovered after considering the discounted net cash inflows from the project.

This method is identical to the regular payback period, except that we use the present value of the cash flows instead of the nominal values. Because present values are always less than nominal values, the discounted payback period will always be longer than the regular payback period. Compared to the static payback period method which is a much simpler approach to calculating the payback period, the dynamic payback period method or discounted payback period formula takes into account the time value of money (and therefore the risk of the business) just like the discounted cash flow (DCF) method.

In the end, normally, the dynamic payback period leads to a longer time required to pay back for the investment compared to the normal payback calculation. This is due to the fact that the positive cash flows in the future are discounted and, therefore, are reduced.

To calculate the discounted cash flows, you need to recall how to discount the cash flows to determine their present value just like the DCF method. As shown from the example above, we assumed a 10% discount rate. After determining the discounted cash flows, we can then apply the formula for calculating the Payback Period with Uneven Cash Flows:

Discounted Payback Period Formula = A + ( B / C )

Where:

A = The last period with negative cumulative discounted cash flow;

B = The absolute value of the last negative cumulative discounted cash flow at the end of period A;

C = The total discounted cash flow received during the period after A

PP = 4 + ( 5 / 14 ) = 4.4 years

The benefit of the discounted payback period method is that the acceptability of a project will change as required returns change. If the required return should rise, the discounted payback period will rise too and then the project would be rejected. Because the regular payback period ignores the time value of money, it would still suggest that the project is acceptable, regardless of the required return. This method has similar drawbacks as the first method to calculate uneven cash flows but can be a better tool as it includes the project's risk by discounting the future cash flows for their risk as a function of time. But you still need to take note that the discounted payback period still ignores cash flows beyond the period where payback is achieved.

Capital Budgeting and Payback Period

The payback period is the selection criterion, or determining factor, that most companies use to choose between possible capital projects in capital budgeting. Small and large companies alike prefer to prioritize initiatives with a higher probability of a quicker, more lucrative payback. The payback period of a capital project is calculated by taking into account project cash flows, initial expenditure, and other variables.

These capital projects begin with a capital budget, which specifies the project's initial investment and annual cash flows. With the assumption that the project generates the required cash flows per year, the budget contains a measure to display the projected payback period.

A capital project may include the purchase of a new plant or building, as well as the purchase of new or replacement equipment. Depending on their industry, most companies set a cut-off payback period, such as three-five years. In other terms, if the payback period is less than five years, the company can buy the asset or invest in the project. It would not if the payback took six years because it beats the firm's five-year payback goal.

Payback Period Example Models

Are you looking for financial model templates that include the calculation of the payback period of an investment or a project? If you are, then download you don’t have to spend too much time on building a model from scratch. Hiring an expert to build a model for you will also be too expensive so, it is preferable to utilize ready-made templates which include the calculation of the payback period.

To help you better understand how a payback period is calculated and works in a project financial model, you can refer to the above list of Payback Period Example Models. These payback periods Excel model templates are made by financial modeling experts with vast experience and industry know-how. These payback period example models will serve as your base to start with when creating a model of a project or investment and determine if it is feasible or not. The listed payback period example models above include payback period calculations for you to use as a reference and learn how it works.

You can also get other industry-specific financial model templates on how to calculate payback in Excel available for download here at eFinancialModels. These templates are used by various kind of users such as entrepreneurs, executives, bankers, etc., from different countries such as in the USA, UK, Germany, Japan, Switzerland, Egypt, and many more who are in need of help when it comes to building financial models as well as other financial modeling tasks.